“Ark Investment Management is “going through soul-searching” as its growth-focused funds fall out of favor amid expectations of tighter Federal Reserve policy…” – Cathie D Wood, December 9th on Bloomberg

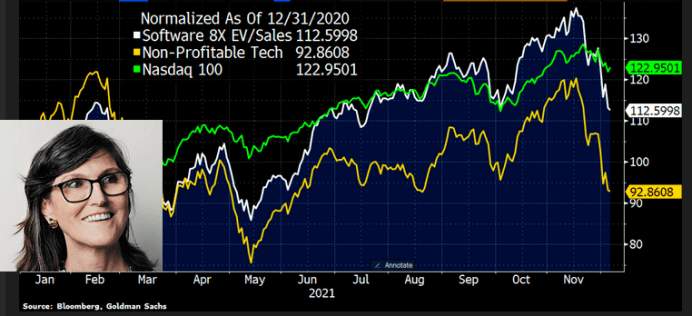

The chart above shows why all of Cathie Wood’s ETFs at ARK Funds have been hammered outright and relative to the Nasdaq. Since February 12, 2021, ARKK is now down 40.4% since hitting an all-time high on February 12, 2021. In comparison, the Nasdaq composite index is up 11.5%. The ARKK fund is not the worst performing fund in Wood’s ETF complex. The ARKG “Genomics” fund is down 46% since its all-time high close on January 20th this year. Anyone who invested in the fund after September 24, 2020 is now underwater – some have lost nearly half their investment.

When someone plays with fire, that person eventually get burned. Cathie should know this by now. She previously managed funds twice previously that went down in flames. In 1198 Ms. Wood co-founded Tupelo Capital. Under her co-stewardship, The Tupelo Capital hedge fund crash and burned 84% in just nine months in 2000. In 2001 Wood joined AllianceBernstein. The funds she oversaw there plunged 46% in 2008, and she was heavily criticized for performing worse than the overall market. But, like a dog that returns to its vomit, CDW founded ARK Invest with seed funds provided by Bill Hwang. Recall Hwang and his Archegos Capital lost $20 billion in just two days last spring.

Most of the stocks Cathie Wood puts in her ETFs are the equivalent of playing with a blow-torch near puddles gasoline. Her flagship ARKK fund was down 13% for the week; it’s down 25.6% since the beginning of November; and it’s down 40.4% since its all-time high-close of $156 on February 12, 2021. Anyone who put money into the fund on November 3, 2020 is now down on their investment. It’s even worse if they added money to their ARKK investment after 11/3/2020.

When someone plays with fire, that person eventually get burned. Most of the stocks Cathie Wood puts in her ETFs are the equivalent of playing with a blow-torch near puddles of gasoline. Her flagship ARKK fund was down 13% for the week ended 12/10; it’s down 25.6% since the beginning of November. These are stunning losses in such a short period of time. Anyone who put money into the fund on November 3, 2020 is now down on their investment. It’s even worse if they added money to their ARKK investment after 11/3/2020.

ARKK’s performance would be even worse if TSLA wasn’t 10% of the ARKK NAV (now 8). Many of her reckless bubble plays have been relentlessly hammered: Z, TDOC, ROKU, DKNG and HOOD (TDOC, I stock I recommended as a short over a year ago around the $200 level is down 69% from the $300 all-time high it hit in early February) – that’s just a few of the names. Ironically, TSLA is probably one of the best performing stocks in her fund. What happens when price-discovery engulfs Tesla?

I predicted many months ago when I started pounding the table on ARKK as a short that the fund would eventually go down in flames. Several of my short ideas this year have paid off in spades. In addition to ARKK this list includes PENN, DKNG, ROKU, Z, HOOD and OPEN. To find out more about my Short Seller’s newsletter, follow this link: Short Seller’s Journal information.