Last week, we wrote about the pending option expirations on COMEX and how this event was likely to impact prices in the short term. We even projected where prices might finish on option expiration day, Tuesday, April 25. Let's see how we did.

To start, you might go back and read or review the full post from last week. Here's the link:

It was Monday, April 17, when we discovered our first hint of where price was headed. For fun, and so that it was timestamped, I decided that this one should go on Twitter:

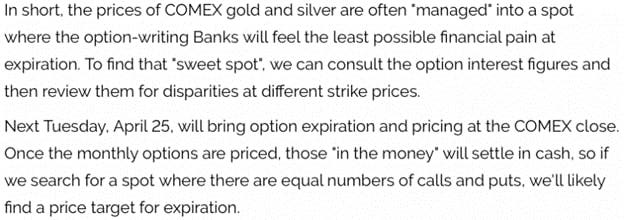

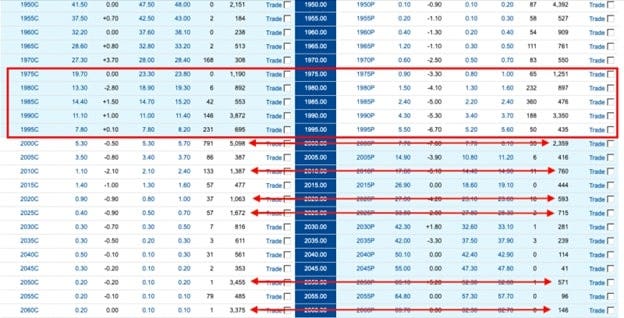

As an explanation, here's an excerpt from last week's post that is linked above:

As last week's option open interest chart shows, there was very little likelihood that The Banks would allow a $2000+ closing price at expiration. If they could get it to $1990, all the better. However, look again at the massive disparity between total calls and puts between $2000 and $2060. The chart below was updated as of Monday, the 24th:

In the end, anywhere below $2000 would qualify for a Bank "sweet spot" price for option expiration on Tuesday, the 25th. And where did price close? A late session rally on renewed concerns of a banking crisis moved price just above $2000 to near $2004.

And then, as if on cue, price began to rally sharply in the after-hours Globex session:

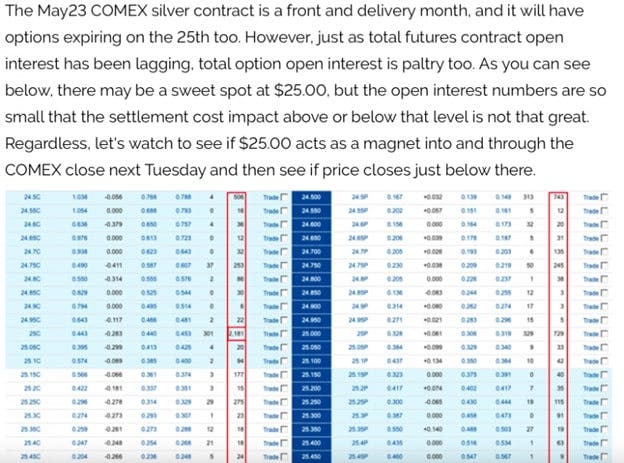

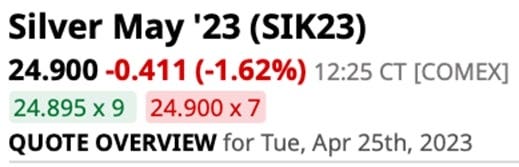

As noted last week, though the May23 contract is a front and delivery month for COMEX silver, the total option open interest was far lower and, as such, much less important to The Banks. Here's another snippet from last week's post. Again, this was written more than a week BEFORE option expiration.

And where did price actually close at option expiration? Well, after being driven sharply backward in the twelve hours preceding the April 25 COMEX close, it finished the day down 41¢ at $24.90.

So, what does this all mean and what's the point of explaining it to you?

First of all, you must realize that, even though there have now been criminal convictions for precious metals price manipulation, The Bullion Bank trading desks continue to attempt to manage price on a daily basis. Knowing this will allow you to better time your purchases of physical metal going forward.

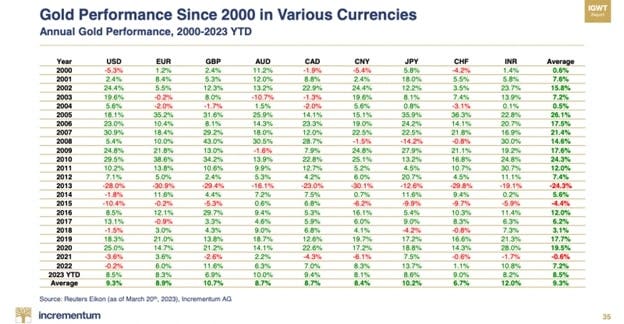

Additionally, you must understand that, even though the manipulation continues, prices can and will go higher regardless. Recall that COMEX gold was $300 in 2003 and $1100 in 2015. It's now near $2000 and the average annual gain in dollar terms this century is +9.3%.

And there are occasions when The Banks find it advantageous and profitable to manipulate price to the UPSIDE. We wrote about this several times in late 2022 when it was clear that the hedge funds had been set up for violent short squeezes in COMEX silver. Here's just one example:

So, please, DO NOT despair and go away thinking that price cannot rise simply due to the dominant position of the bullion banks in the current digital derivative and fractional reserve pricing scheme. Prices are already higher year-to-date and they will continue rising. The next rally will begin as soon as next week or next month when the Fed finally admits that they've killed the U.S. economy with their reckless policies. In January, we predicted $2300 gold and $38 silver before year end. The year is unfolding right on schedule, and nothing thus far has led me to think that we're off track.

In the end, you just need to use this information to your benefit and plan your physical metal purchases accordingly. There are periods when prices rise and there are periods when prices fall. However, the price trend in 2023 is undoubtedly higher, and regardless of the shenanigans in the futures markets, physical precious metal deserves a significant weighting in almost every diversified portfolio.