A long time ago, in a galaxy far, far away, I came up with a tagline for my comments at ZeroHedge. It stated, “the end of the great Keynesian experiment is upon us, prepare accordingly”. Well, it has taken longer than I expected, but finally, here we are.

Let's start with John Maynard Keynes. Who was he and what is this "great experiment"? In short, it was Keynes who popularized the idea of a debt-based monetary system where governments allow for unchecked growth of debt and the monetary base needed to support it.

This was all well and good, and it worked for a while. However, the end of the experiment was always scheduled for the moment when new fiat currency creation for debt monetization becomes an economic and monetary necessity. And now here we are.

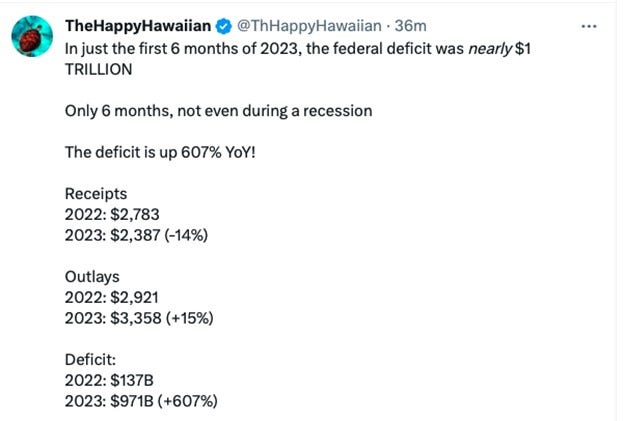

Last week, the U.S. government reported its fiscal deficit numbers for the first half of calendar year 2023. (The fiscal year actually began on October 1, 2022, and ends on September 30, 2023.) The numbers are astoundingly bad, with tax revenues sharply declining while expenditures are exploding higher. See below:

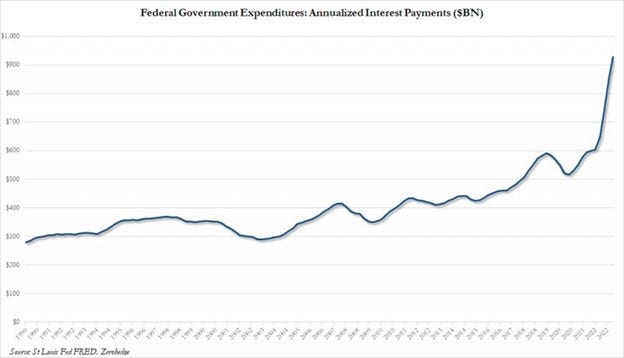

The key component to all of this deficit spending is the budget line item "interest on the national debt". One of the primary reasons for the Fed's zero interest rate policy over the period 2009-2021 was to keep U.S. debt service interest rates unusually low. The Treasury Department took advantage of the low rates by moving a majority of the existing debt onto the short end of the yield curve, where rates are typically lowest. By doing so, the annual expense of interest service remained mostly stable through the period. Why? As the total debt grew, the average interest rate on the accumulated debt fell. This created the illusion of stable interest costs.

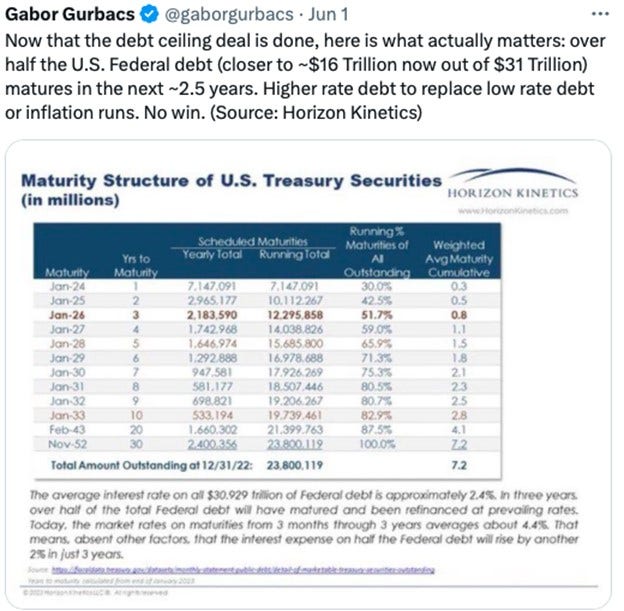

But check the end of that chart! Debt service costs are exploding higher as the impact of the Fed's current rate hike scheme takes hold. It's about to get worse, too, as nearly 75% of the current debt base is set to mature, be refunded, and rolled over in the next three years.

Already, the line item "interest on the national debt" is getting close to one trillion dollars per year, making it the third largest government expenditure behind Social Security and Medicare. By the time that $29T in debt fully rolls over in 2026—and begins paying interest at 5% instead of 2%—what will be the annual interest expense? Maybe $1,500,000,000,000? Maybe $2,000,000,000,000?

And that assumes the steady growth of tax revenue that would come with economic growth. What if the recession that the Fed seems so desperate to spark becomes a sort of extended stagflationary contraction? Look again at those year-to-date numbers shown above. Tax receipts are already down 14% this year versus last. If tax revenue continues to decline, the annual U.S. deficit may soon exceed $2T and move toward $3T. How will that exacerbate the crisis that will, by then, be exponentially worsening?

As such, the math becomes untenable, and as a wise man once said, that which is unsustainable cannot be sustained. The only solution is a rapid escalation of fiat creation and debt monetization. This will come via initiatives such as CBDC and Yield Curve Control—programs designed to camouflage the deleterious impact on fiat money supply.

Your best protection against this eventuality and the madness of the politicians and their bankers is the accumulation of physical precious metal. Prices are steady thus far in 2023 as the Fed has continued their rate hike policies. However, The End of The Great Keynesian Experiment will undoubtedly lead to lower nominal rates and negative real interest rates. Under these conditions, gold prices will soar.

Time is running short, and the math is certain, so do not delay in building or adding to your personal stack.