The Commitment of Traders Report, for positions held at the close of trading on Tuesday, August 13 was the blockbuster that both Ted and I were expecting...and then some!

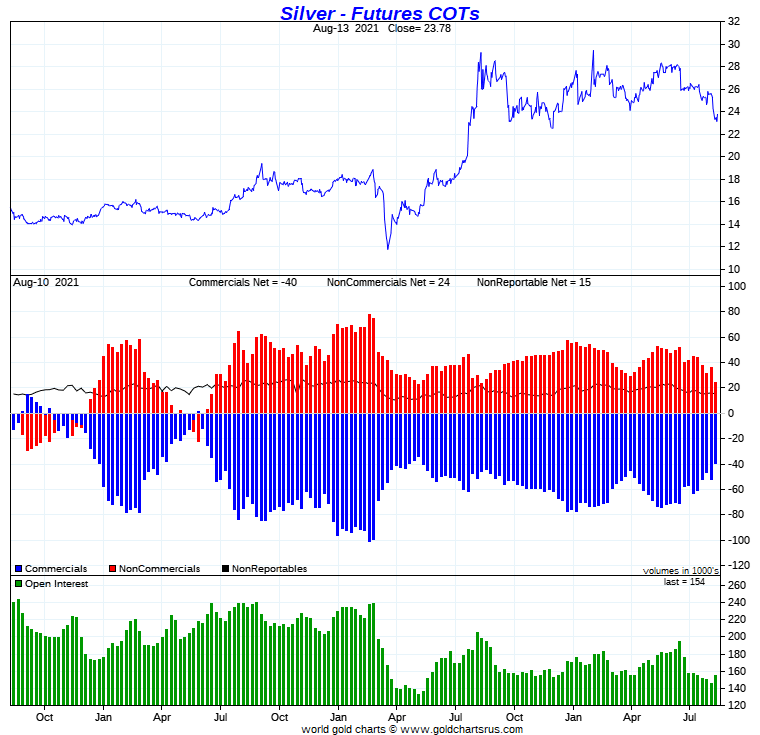

In silver, the Commercial net short position fell by 12,321 COMEX contracts, which equates to 61.6 million troy ounces.

They arrived at that number by increasing their long position by 9,166 COMEX contracts -- and also reduced their short position by 3,155 contracts. It's the sum of those two number that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was all Managed Money traders, plus a bit more, as they reduced their net long position by 13,670 COMEX contracts. Of that amount...9,423 contracts were new short positions put on. Ted wasn't overly happy about that, but I guess it should have come as no surprise.

The Nonreportable traders also decreased their net long position, them by 656 contracts. But the Other Reportables went in the other direction, as they increased their net long position by a fairly hefty 2,005 contracts.

Doing the math: 13,670 plus 656 minus 2,005 equals 12,321 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position now stands at only 199.2 million troy ounces, down from the 260.8 million troy ounces they were short in last week's COT Report.

The Big 8 are short 271.9 million troy ounces of silver in this week's COT Report, compared to the 309.9 million troy ounces they were short in last week's Report...so they improved their short position by a fairly decent amount...38.0 million troy ounces.

However, the Commercial net short position in the headline number in silver dropped by 61.6 million troy ounces during the reporting week...so where did the other 61.6-38.0=23.6 million troy ounce decrease come from?

It came from Ted's raptors, the 31-odd small commercial traders other that the Big 8...as they are all long the silver market. They bought that amount during the reporting week -- and I'll continue the discussion on this in the 'Days to Cover' commentary a bit further down.

The short position of the Big 8 traders is larger than the Commercial net short position in silver by about 136 percent, compared to the 119 percent they were short in last week's COT Report. That increase is because of all the long contracts that Ted's raptor bought, as they're in the Commercial category as well, despite the fact that they're small, as it all adds up.

Here's the 3-year COT chart for silver, courtesy of Nick Laird as always -- and the change should be duly noted. Click to enlarge.

So, are we done to the downside? One would think so, but as Ted continually points out, one can never underestimate the treachery of the Big 4 shorts.

I would suspect that yesterday's rally in silver involved big selling by Ted's raptors, the commercial traders other than the Big 8, who are mega long the COMEX silver market. They would be locking in decent profits. And since silver's current price is well below any moving average that would cause the Managed Money traders to buy, it's a given that the Big 4/8 shorts were buying every long that the small traders have been selling since the Tuesday cut-off.

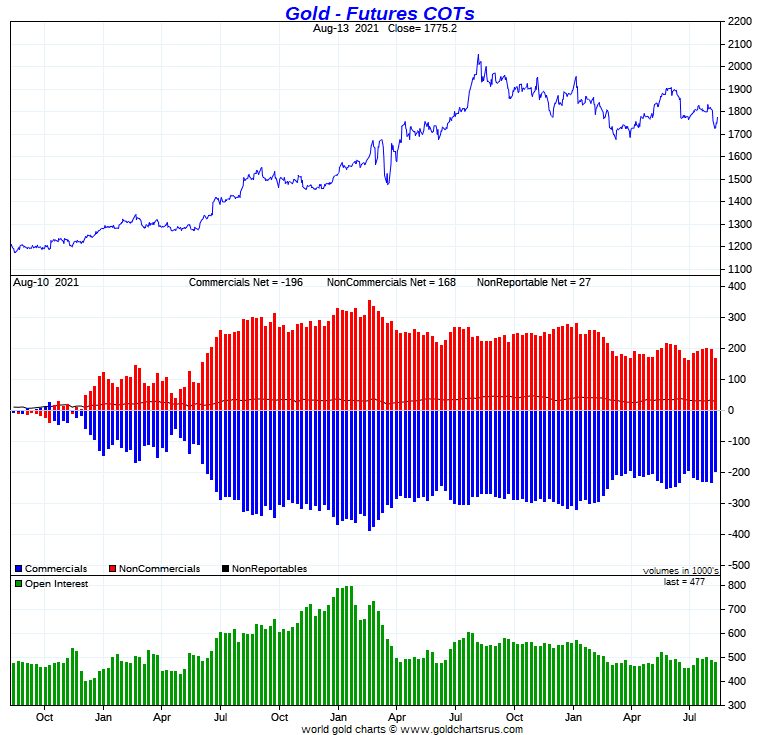

In gold, the commercial net short position fell by a chunky 35,643 COMEX contracts, or 3.56 million troy ounces.

They arrived at that number by increasing their long position by 3,371 contracts -- and also covered 32,272 short contracts. It's the sum of those two numbers that represents their change for the reporting.

And as impressive as the numbers for silver were in the Disaggregated COT Report, the changes under the hood in gold in that report were simply staggering!

The Managed Money traders reduced their net long position by an absolutely eye-watering 54,470 COMEX contracts, of which 33,442 contracts was new shorting. The Nonreportable/small traders also decreased their net long position by a huge amount...7,714 contracts. 'All of the above' means that the traders in the Other Reportables category had to go long big time -- and they did just that...to the tune of 26,541 contracts.

Doing the math: 54,470 plus 7,714 minus 26,541 equals 35,643 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold now sits at 19.57 million troy ounces, down big from the 23.13 million troy ounces they were short in last week's COT Report.

The short position of the Big 8 traders stood at 22.10 million troy ounces in this week's COT Report, compared to 22.83 million troy ounces they were short in last week's COT Report...down only 730,000 troy ounces from last week's COT Report.

What?

The headline number showed that that commercial net short position decreased by 3,560,000 troy ounces...a difference of 3,560,000-730,000=2,830,000 troy ounces from the number in the previous paragraph.

That meant that Ted's raptors, the small commercial traders other than the Big 8, were hugely aggressive buyers during the reporting week...increasing their long position by that amount...around 28,300 COMEX contracts!

The Big 8 traders are short about 113 percent of the commercial net short position in gold...up from that 99 percent that they were short in last week's report -- and that's entirely due to the monster long-buying by the small commercial traders during this reporting week.

Here's Nick Laird's 3-year COT chart for gold, updated with Friday's data -- and the weekly change should be noted. Click to enlarge.

But between these raptors and the Other Reportables, who also went mega long in gold during the reporting week, it's my opinion that all their long-buying was most likely insider trading of one type or another...friends, relative and business associates of the Big 4/8 shorts who knew these engineered price declines were coming. I brought this up with Ted -- and he thought that was most likely as well.

Of course the flip side to this is the fact that despite their huffing and puffing, the short position of the Big 4/8 traders improved by a negligible amount -- and Ted is of the opinion that this is the best they're likely to do considering how aggressively the Raptors and Other Reportables are buying longs against them.

However, as he most succinctly pointed out in his mid-week commentary on Wednesday..."Not for a moment would I underestimate the treachery and guile of the COMEX commercial shorts. But regardless of how skilled and corrupt they may be, they are still bounded by the realities that exist."

Those realities may have been reached this week.

Now, all that matters is whether these same Big 4/8 will go back on the short side when the next serious rally in the precious metals is allowed to begin.

Ted thinks not -- and so do I. But there are no guarantees.

In the other metals, the Managed Money traders in palladium increased their net long position by a fairly healthy 440 COMEX contracts during the last reporting week -- and are net long the palladium market by 2,981 COMEX contracts...around 29 percent of the total open interest...up about 5 percentage points from last week's report. In platinum, the Managed Money traders increased their net short position by a further 4,749 contracts -- and are now net short the platinum market by 8,879 COMEX contracts. In a strange twist they, along with the Big 4/8 traders, are the only categories that are short platinum right now. The other three categories are mega long, including the rest of the commercial traders. In copper, the Managed Money traders decreased their net long position by a further 7,544 COMEX contracts -- and are net long copper by only 31,102 COMEX contracts...about 778 million pounds of the stuff -- and about 16 percent of total open interest...down about 2 percentage points from last week.

![]()

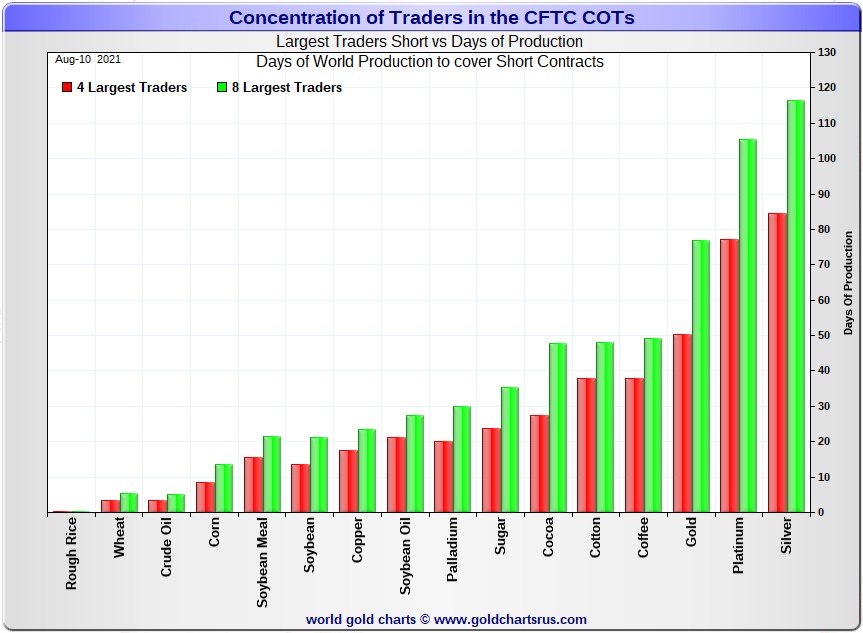

Here’s Nick Laird’s “Days to Cover” chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, August 10. It shows the days of world production that it would take to cover the short positions of the Big 4 — and Big '5 through 8' traders in each physically traded commodity on the COMEX.

I consider this to be the most important chart that shows up in the COT series -- and it deserves a minute of your time. Click to enlarge.

In it, the Big 4 traders are short about 84 days of world silver production, down about 16 days from the prior week's report. The ‘5 through 8’ large traders are short an additional 32 days of world silver production...down about 1 day from the prior COT Report for a total of about 116 days that the Big 8 are short...down a whopping 17 days from last week's COT report. [In the prior reporting period they were short 133 days of world silver production.]

That 116 days that the Big 8 are short, represents just under four months of world silver production, or 271.9 million troy ounces of paper silver held short by the Big 8.

In the COT Report above, the Commercial net short position in silver was reported by the CME Group at 199.2 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 4/8 traders is 271.9 million troy ounces. So the short position of the Big 4/8 traders is larger than the total Commercial net short position by 271.9-199.2=72.7 million troy ounces...up about 23.6 million troy ounces/4,720 COMEX contracts from last week's report.

This long buying by the small commercial traders was in direct competition with the buying by the Big 4/8 shorts.

The reason for the difference in those numbers two paragraphs ago...as it always is...is that Ted's raptors, the 31-odd small commercial traders other than the Big 8, are net long that amount...72.7 million troy ounces.

Another way of stating this [as I say every week in this spot] is that if you remove the Big 8 shorts from the commercial category, the remaining traders in the commercial category are net long the COMEX silver market. It's the Big 8 against everyone else...a situation that has existed for almost five decades in silver, platinum and palladium -- and now in gold as well.

As per the first paragraph above, the Big 4 traders in silver are short around 84 days of world silver production in total. That's about 21 days of world silver production each, on average...down 4 days from last week's COT Report. The four big traders in the '5 through 8' category are short 32 days of world silver production in total, which is 8 days of world silver production each, on average...down a bit from last week's COT Report.

I don't remember the last time that the short positions of the Big 8 was this low, but I know that Ted will have that data in his weekly review this afternoon.

And it's also obvious that the Big 4 shorts were much more aggressive in their short covering than the Big '5 through 8' shorts during this past reporting week...although much more in silver than in gold.

The Big 8 commercial traders are short 35.2 percent of the entire open interest in silver in the COMEX futures market, which is down a knee-wobbling amount from the 42.4 percent they were short in last week's COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be a bit over the 40 percent mark. In gold, it's 46.3 percent of the total COMEX open interest that the Big 8 are short, which is down only a tiny amount from the 47.0 percent they were short in last week's COT Report -- and something over the 50 percent mark once their market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 50 days of world gold production, down about 3 days from last week's COT Report. The '5 through 8' are short 27 days of world production -- up about 1 day from last week's report, if you can believe it...for a total of 77 days of world gold production held short by the Big 8 -- and down about 2 days from the prior COT Report. Based on these numbers, the Big 4 in gold hold about 65 percent of the total short position held by the Big 8...down about 2 percentage points from the prior week's COT Report.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 72, 73 and 67 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is down about 2 percentage points from last week's COT Report...platinum is also down 2 percentage points from a week ago -- and palladium is down about 1 percentage point week-over-week.

And as I keep saying month after month, despite the recent improvements in the short positions of the Big 4/8 traders...including the price bombings last Friday -- and again on Monday, they're still hugely short in all four precious metals in the COMEX futures market. But it's now mostly the Big 4...or probably just the Big 2 or 3...Citigroup, Bank America and HSBC -- and the above chart tells you all you need to know about their current plight.

They're still stuck on the short side -- and that's for the very simple reason that the Managed Money traders are no longer willing to go mega short like they used to in the past. Yes, they did increase their short positions by notable amounts during this past reporting week, but not enough to make any material difference to the short positions of the Big 8 traders...particularly in gold. And because of that, the Big 4/8 traders can't cover.

The situation regarding the Big 4/8 shorts continues to be beyond obscene, twisted and grotesque...especially the Big 2/4 -- and as Ted correctly points out, its resolution will be the sole determinant of precious metal prices going forward.

I have a very decent number of stories, articles and videos for you today.

READ THE FULL ARTICLE ON SilverSeek.com:

A Commitment of Traders Report For the Ages

August 15, 2021

By Ed Steer, Gold and Silver Digest

The Commercial net short position now stands at only 199.2 million troy ounces, down from the 260.8 million troy ounces they were short in last week's COT Report. The Big 8 are short 271.9 million troy ounces of silver in this week's COT Report..