In a previous article we discussed how a number of electrification metals are in play following Russia’s attack on Ukraine, including nickel, cobalt and palladium.

Russia is the third largest nickel producer in the world, in 2021 mining 250,000 tonnes, including 193,006 from Nornickel, the globe’s top producer of refined nickel. Nornickel’s output amounts to around 7% of global mine production, which in 2021 was 2.7 million tonnes, according to the US Geological Survey.

Note that Nornickel mines sulfide nickel, the kind best suited to lithium-ion batteries. (Sulfide nickel deposits are relatively rare, they comprise only 40% of nickel deposits found worldwide. The other 60% are nickel laterites. We can therefore say that Russia’s Nornickel mines 7% of the 40% of nickel sulfide deposits). This nickel can be processed at relatively low cost, and with minimal waste, using simple flotation, compared to the more expensive, and highly polluting techniques used to refine nickel from nickel laterites found in the world’s top nickel producer — Indonesia — the Philippines and New Caledonia.

While far behind the DRC’s 170,000 tonnes of mined cobalt produced last year, Russia’s 7,600t puts it in second place, accounting for more than 4% of the world total.

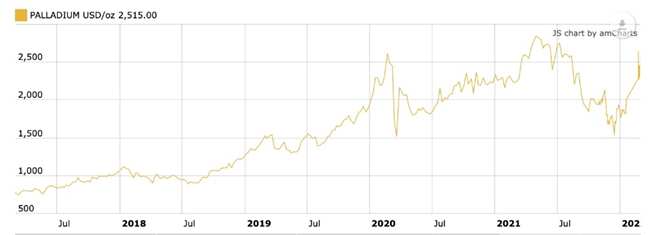

Nornickel is the largest cobalt producer in Russia, the globe’s biggest producer of palladium, and a major miner of platinum. Last year it produced 2.6 million ounces of palladium or 40% of global mine production, and 10% of world platinum production or 641,000 ounces.

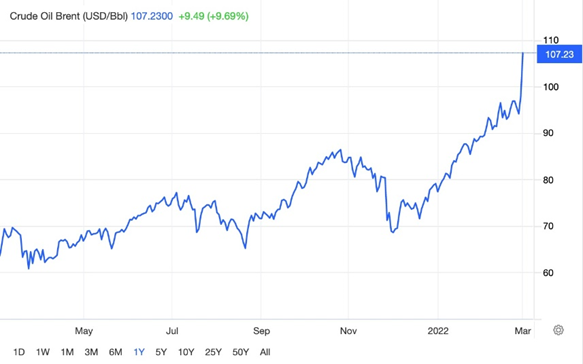

The potential for the supply of these mineral commodities to be restricted or cut off by war with Ukraine, has lit a fire under their prices. Natural gas and oil, which Russia produces in large quantities, both jumped immediately following the invasion, and have remained elevated.

The Brent crude oil benchmark rose to an eight-year high Tuesday of $106 per barrel. A year ago Brent was at $62.70, representing a 70% increase. WTI futures were also at $106/bbl, at time of writing.

Source: Trading Economics

Source: Trading Economics

Traders are becoming increasingly reluctant to buy Russian oil.

Natural gas prices in Europe, which gets a third of its supply from Russia, surged almost 30% Tuesday, to €125/MWh, as attacks on Ukraine’s capital, Kiev, and second-largest city Kharkiv intensified (watch a video showing a missile hit Kyiv’s main television tower, killing five).

Source: Trading Economics

Source: Trading Economics

Nickel scaled $11.42/lb Tuesday, with Bloomberg reporting that Russia’s industrial-metal exports are sinking:

While metals haven’t been directly targeted by sanctions, prices are surging on concern that the latest measures could snarl payments to suppliers and spur banks to rein in financing for purchases of Russian goods.

Aluminum climbed 5% to a fresh record, before slipping back to $1.54/lb, while palladium prices added 3.9%.

Rusal, the world’s top aluminum producer outside China, has reportedly halted shipments at an alumina refinery in Ukraine that feeds its smelters in Russia. Any reduction in alumina production would lead to even greater aluminum market deficits, an analyst at Wood Mackenzie said in a note. Russia produces about 6% of the world’s aluminum.

Source: Kitco

Source: Kitco

Source: Kitco

Source: Kitco

Source: Kitco

Source: Kitco

A number of agricultural commodities are also being impacted by the war. Russia and Ukraine together account for a third of the world’s wheat exports, a fifth of corn trade and almost 80% of sunflower oil production (US Department of Agriculture). Russia is also a major exporter of nitrogen, potassium, and phosphorus fertilizers and because of that, the price of urea jumped 33% within 12 hours, Farm Policy News said last Friday.

The attack led to a ban on all commercial vessels in the inland sea of Azov — which connects to the Black Sea — and the closure of Ukrainian ports. Analysts said some 90% of Ukrainian grain exports are transported by sea and the disruption is expected to wreak havoc on food supply flows.

Wheat prices have risen by almost a fifth since the start of the year to near 10-year highs; on Tuesday Chicago wheat futures broke above $9.50 per bushel for the first time since March 2008. Corn prices climbed 15%, year to date.

Source: Trading Economics

Source: Trading Economics

Limited impact of sanctions

The West’s reaction to the war with Ukraine has been to try and isolate Russia economically.

The United States, the European Union, the United Kingdom and Canada have banned certain Russian banks from SWIFT, the network that facilitates payments among financial institutions in 200 countries. The sanctions include cutting banks off from Visa and Mastercard, and consequently Apple Pay and Google Pay, affecting Russian consumers directly.

Last week, Germany halted certification of the Nord Stream 2 gas pipeline following Moscow’s actions. On Monday the United States and its allies imposed sanctions on Russia’s central bank and sovereign wealth funds, effectively freezing their assets and banning dealings with them.

The sanctions, which aim to push the Russian economy into recession, are beginning to sting. But it’s mostly ordinary Russians who are being hurt, not the government, Putin’s inner circle, or the president himself.

With the rouble down 30% against the US dollar, many are seeing their savings wiped out. Russia more than doubled its interest rate to 20% in response to the sanctions after the currency plunged to record new lows. The stock market remains closed amid fears of a massive share sell-off.

There are long line-ups at ATMs, with people worried their bank cards may stop working or that limits will be placed on cash withdrawals. The BBC said dollars and euros began running out within a couple of hours of the invasion.

However, commodities experts, and that includes us at AOTH, believe the best way to hurt Russia is to target its oil and gas exports, which account for just over a third of its national budget; so far Russian petroleum producers have escaped sanctions, mostly due to fears that export restrictions would push already soaring oil and gas prices even higher, impacting Western fossil-fuel consumers.

This is despite the fact that Ukrainians are calling for a full embargo on Russian gas and oil.

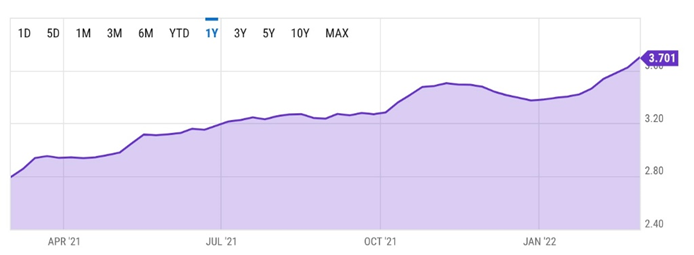

The EU relies on Russia for 35% of its natural gas, and tensions over Ukraine have worsened a European energy crisis that emerged last year due to shortages of the heating fuel. A megawatt of NG in Europe now costs nearly 10 times what it did a year ago.

Sanctions on Russian energy would definitely push European gas prices beyond current levels. Ditto for oil, of which Russia is the world’s second largest producer. US President Biden reportedly defended his decision to preserve access to Russian energy “to limit the pain the American people are feeling at the gas pump.” Retail gasoline prices have risen nearly $1 a gallon over the past year, to the current $3.70/gal.

Source: YCharts

Source: YCharts

This attitude of self-preservation, while understandable, is emboldening the Russian president who, despite being increasingly isolated by sanctions, is refusing to dial back the assault on Ukraine.

“Energy exports are the whole game,” ABC News quoted Columbia University historian Adam Tooze, an expert on finance and European politics, who went on to say that politicians in the United States and Europe chose to “carve out the one sector that might truly be decisive. I don’t think Russia is blind to what is going on and it must indicate to them that the West does not really have the stomach for a painful fight over Ukraine.”

Bullies like Putin only respond to force. But this is not what the West is offering. Led by gut-less politicians, many of whom are too young to have lived under the shadowy threat of nuclear war, are soft-pedaling economic sanctions, moving troops to Eastern Europe but not actually into Ukraine, and urging diplomacy when the time for that has long passed.

Putin clearly sensed weakness when he massed 100,000 troops on the Russia-Ukraine border and no Western power lifted a finger, citing the fact that Ukraine is not part of NATO. Earlier, the US retreat from Afghanistan was another signal to Russia that the US is losing is losing its ambition for being the world’s policeman, and likely wouldn’t challenge it on Ukraine.

US critical minerals dependence

It’s also evident that Russia, and China, are holding some powerful economic cards, that could be laid down in the event of further sanctions, say targeting its oil and gas.

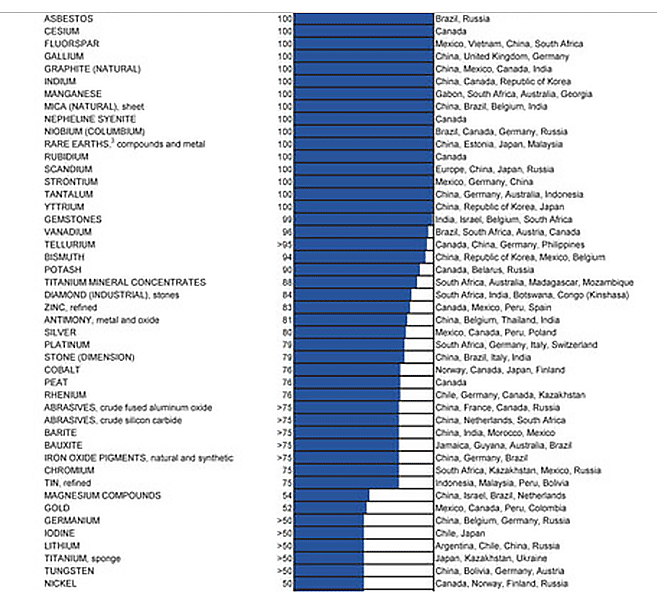

According to data collected by the UGS, the United States is reliant on totalitarian regimes with dictators installed for life for 32 of 47 minerals — an eye-watering 70%! We are of course talking about China (23) and Russia (9).

The 2022 critical minerals list below, with a brief description of each, expands upon the 2018 list that detailed 35 mineral commodities considered critical to the economic and national security of the United States.

Source: US Geological Survey

Source: US Geological Survey

Without a reliable supply chain, a country must depend on outsiders. This gives foreign suppliers incredible leverage over the United States. There is always the possibility of slowed flows or bans on strategic materials, due to politics, acts of aggression/war or trade disputes.

China’s minerals grab

Russia supplies about one-sixth of the world’s commodities, and we have seen the dramatic effects, in only one week, that the war in Ukraine and the sanctions are having on their prices.

If you thought the West was dependent on Russia for its raw materials, let’s take a look at what’s at stake in China, and what could happen if Beijing, increasingly belligerent economically, politically and militarily, were to try and expand its territory like the Kremlin is attempting to do.

China has a stranglehold on lithium and graphite processing, meaning it can use them as a cudgel in trade talks with the United States, or it could freeze shipments of them during a war.

In 2010, a decision by China to restrict exports of rare earths sent the prices of most rare earth oxides into orbit. It could easily happen again.

Think of an important mineral and chances are China controls the mining and/or refining. The list includes iron ore, copper, lithium, graphite and cobalt.

How did China end up in such a dominant position regarding the world’s supply of mined commodities?

The mining industry’s experience of China locking up the world’s mineral resources testifies to how far the Chinese will go to ensure their ever-growing demand for mined commodities is met.

While iron ore and copper were the hot targets of overseas acquisitions by Chinese firms as they sought to feed an economy that up until 2015 saw double-digit growth, the Chinese have also gone after gold, nickel, tin, coking coal and oilsands. More recently the most desired metals are those that feed into the global shift from fossil fuels to the electrification of vehicles. This has meant a hunt for lithium, cobalt, graphite, copper and rare earths — metals used in electric vehicles, of which China has become the world’s leading manufacturer.

Two large Peruvian copper mines are owned by Chinese companies. Chinese state-run Chinalco owns the Toromocho copper mine, while the La Bambas mine is a joint venture between operator MMG (62.5%), a subsidiary of Guoxin International Investment Co. Ltd (22.5%) and CITIC Metal Co. Ltd (15%). The Chinese-backed Mirador mine in Ecuador opened in 2019.

Four out of the five major copper projects in the pipeline right now either have offtake agreements in place with non-Western countries (South Korea and China), or the mines are partially owned by Japanese companies that have a say in where some of the mined copper is destined. (i.e. Japan)

China long ago put a lock on much of Africa’s vast resources.

At Ivanhoe Mines’ massive Kamoa-Kaukula copper mine in the DRC, which recently came online, 100% of initial production will be split between two Chinese companies, one of which owns 39.6% of the joint venture project.

Among China’s other recent Africa mining investments,

- Shandong Gold in 2020 offered $221 million for Ghana-focused miner Cardinal Resources;

- Zijin Mining acquired a 50.1% stake in Tibet Julong Copper for $548 million.

- Privately held Yibin Tianyi Lithium Industry completed an AUD$10.7 million investment in AVZ Minerals, which has a project in the DRC.

We know from previous articles that China has been extremely active in acquiring ownership or part-ownership of foreign lithium mines and inking offtake agreements.

China of course, has also locked up rare earths and is the main player in a number of critical mineral markets including cobalt, graphite, manganese and vanadium.

This past December, China’s Zheijang Huayou Cobalt, the world’s biggest producer of the mineral that forms part of the electric-vehicle battery cathode, said it would pay $422 million to acquire the Acadia hard-rock lithium mine in Zimbabwe.

For years the United States and Canada didn’t bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends.

China recognized opportunity knocking and answered, seizing control of almost all REE processing and magnet manufacturing, in the space of about 10 years.

Currently nearly all graphite processing takes place in China because of the ready availability of graphite there, weak environmental standards and low costs.

Over half of the world’s cobalt — a key ingredient of electric vehicle batteries — is mined as a by-product of copper production in the Democratic Republic of Congo (DRC). In a $9 billion joint venture with the DRC government, China got the rights to the vast copper and cobalt resources of the North Kivu in exchange for providing $6 billion worth of infrastructure including roads, dams, hospitals, schools and railway links.

China controls about 85% of global cobalt supply, including an offtake agreement with Glencore, the largest producer of the mineral, to sell cobalt hydroxide to Chinese chemicals firm GEM. China Molybdenum is the largest shareholder in the major DRC copper-cobalt mine Tenke Fungurume, which supplies cobalt to the Kokkola refinery in Finland. China imports 98% of its cobalt from the DRC and produces around half of the world’s refined cobalt.

Most of the metal produced under these offtake agreements will never come to the market anyplace other than in China. Those metals that do, can have their supply shut down any time the Chinese want.

Over the past few years, overt resource grabs by China in what used to be the US backyard, countries defined by ‘The Monroe Doctrine’, include:

- Shandong Gold partnered with Barrick Gold to purchase a 50% stake in the Veladero gold mine on the Chile-Argentina border for $960 million.

- Zijin Mining acquired Colombia Continental Gold and its Buritica gold project in Colombia for CAD$1.4 billion. This was followed by the purchase of Guyana Goldfields for CAD$323 million.

- Two large Peruvian copper mines are owned by Chinese companies. Chinese state-run Chinalco owns the Toromocho copper mine, while the La Bambas mine is a joint venture between operator MMG (62.5%), a subsidiary of Guoxin International Investment Co. Ltd (22.5%) and CITIC Metal Co. Ltd (15.0%).

- In 2018 China’s Tianqi Lithium purchased a 23.7% stake in Chilean state lithium miner SQM, despite concerns from regulators that the $4 billion tie-up would give Tianqi a near monopoly over the lithium market and unprecedented pricing power.

Often China’s modus operandi is to build mines in exchange for providing infrastructure that supports, and gains the favor of, the local population, such as schools, health clinics, roads and clean water systems.

A good example is what is happening in Argentina.

In 2020 Argentina defaulted on the bonds it sold to Wall Street, and it still owes tens of billions of dollars to the IMF. “Argentina’s economy is so calamitous that only adventurers like China can do business here,” Bloomberg quotes the man who ran the provincial energy and mining company, Jemse.

The province of Jujuy is home to an Australian-Japanese venture that became Argentina’s second lithium producer in 2015. Minera Exar, majority-owned by giant Chinese battery company Ganfeng, is set to become the third this year (Lithium Americas’ Cauchari-Olaroz brine lithium project).

Chinese money and technology also helped build one of Latin America’s largest solar plants in Jujuy.

And while the United States has been trying to counter China by stressing the risk of buying technology from state-controlled companies, “Dollar for dollar, the U.S. will never be able to match the deep pockets of Chinese investment banks,” saysCynthia Arnson, director of the Latin American program at Washington’s Wilson Center.

According to Bloomberg,

China has bought up so much copper, pork, and soy—and constructed so many roads, trains, power grids, and bridges—that it’s surpassed the U.S. as South America’s largest trade partner and is now the single biggest trader with Brazil, Chile, and Peru. A Chinese company is leading a group that’s building the metro in the Colombian capital of Bogotá. Energy giant State Grid Corp. owns the company that supplies electricity to more than 10 million Brazilian homes. In February, Argentina announced that China would finance about $24 billion in infrastructure projects.

China’s most recent foray into overseas minerals acquisition involves Indonesian nickel. The country is using Indonesia’s ban on raw nickel exports to monopolize the nickel market.

Tsingshan, the world’s largest stainless steel maker, plans to construct an Indonesian plant to produce nickel-cobalt salts from nickel laterite ores. Using previously uneconomic high pressure acid leaching (HPAL) technology Tsingshan says it will transform class 2 laterite deposits into class 1 metal for the electric vehicle battery market.

In April 2021, Chinese battery maker CNGR announced it will buy nickel matte, used to make EV battery chemicals, from Tsingshan’s $243 million smelting project on the Indonesian island of Sulawesi.

A month later, China’s Lygend Mining and its $1 billion nickel and cobalt smelting operation became the first project in the southeast Asian country to reach full production.

Belt and Road Initiative

The Chinese saw how successful their “mines for infrastructure” model worked in Africa and Latin America. In 2013 President Xi Jinping unveiled a new strategy that would fundamentally alter the way China looks at commodities.

China’s Belt and Road Initiative (BRI) is a “belt” of overland corridors and a “road” of shipping lanes. The grand design consists of a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics and south to Pakistan, India and southeast Asia.

So far over 100 countries have signed onto BRI.

The Belt and Road Initiative is seen by proponents as an economic driver of proportions never seen before in human history. It would not only allow Asia to relieve its “infrastructure bottleneck” i.e. an $800 billion annual shortfall on infrastructure spending but bring less-developed neighboring nations into the modern world by providing a growing market of 1.3 billion Chinese consumers.

Opponents argue that is naive and the real intent of BRI is to carve new Chinese spheres of influence in Asia that will replace the United States, in-debt poor nations to China for decades, and restore China to its former imperial glory.

China is already the world’s largest consumer of commodities. Why does it need to build a belt and road? There are a few reasons. The first as mentioned is to build infrastructure such as railways, roads and bridges. China would also construct 50 “special economic zones” modeled after the Shenzhen Special Economic Zone, first launched in 1980 under economic reformer, President Deng Xiaoping.

BRI would allow China to expand the use of the Chinese currency, the yuan, as the global influence of the US dollar as the world’s reserve currency wanes.

While the BRI satisfies a number of economic goals for China, including expanding its supply chains, accessing overseas labor, and preventing massive layoffs when companies run out of infrastructure to build, Asian geopolitical experts say the over-riding goal is regional influence.

China’s idea is for Chinese state-owned firms to build the infrastructure, paid for by participating countries. Those who can’t afford it, and that is most of them, are offered inexpensive loans and credit. It’s no different from banks offering rock-bottom interest rates to homeowners whose incomes are below that needed to support a mortgage.

In 2017, when Sri Lanka couldn’t pay off its Chinese creditors, Beijing took control of Colombo, a strategic port, through a 99-year lease. By the end of 2018, nearly a quarter of Sri Lanka’s foreign debt was owed to China — the money accepted for around $8 billion worth of ports and highways planned through BRI. Read more here

According to a Refinitiv database, more than 2,600 projects at a cost of $3.7 trillion were linked to BRI, as of mid-2020. Think about how much metal that would entail…

Taiwan, the next domino to fall

Back to the Russian invasion of Ukraine, the West’s failure to stop Putin from walking into a free and democratic country in the middle of Europe has got China thinking about how it too could fulfill its territorial ambitions. The latter fits perfectly into President Xi’s desire to revive China’s imperial glory. The fact that Taiwan is the world’s largest supplier of microchips is an obvious incentive for bringing Taiwan to heel.

The United States supplies weapons to Taiwan despite not having diplomatic relations with the island and its government. China sees Taiwan as a breakaway territory that must be re-united with the Chinese Mainland; its independence is not recognized by Beijing. A forced reunification would almost certainly cause a war between China and the US.

If you don’t think that is possible, you haven’t been paying close enough attention.

In January the South China Morning Post reported the risk of war with Taiwan is the highest since 1996 — when China intimidated the breakaway republic with missile tests in the Taiwan Strait, between the island and the Chinese mainland.

Last fall US President Joe Biden angered the Chinese leadership when he said unequivocally the US would come to Taiwan’s aid if attacked by China — considered a diplomatic faux-pas.

In February, China’s Foreign Minister reportedly criticized the Biden administration’s release of an “Indo-Pacific Strategy” that Wang Yi said “publicly listed China as the top regional challenge, and tried to include the strategy of ‘using Taiwan to contain China’ into the U.S. regional strategy, which is obviously sending a wrong signal of beleaguering and containing China.”

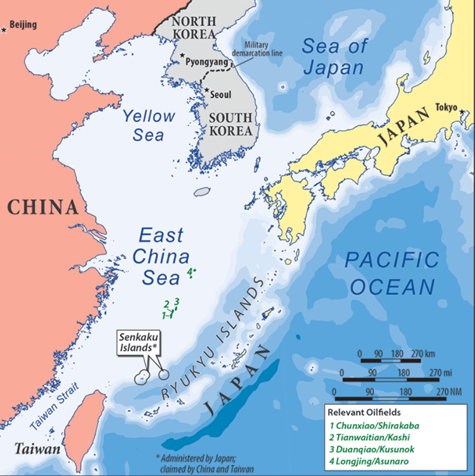

Image Encyclopædia Britannica, Inc.

Image Encyclopædia Britannica, Inc.

In the latest of many encounters in the South China Sea, in January the Chinese Military said it tracked a US warship that sailed through disputed waters, accusing it of “provocative actions” and warning of “serious consequences,” The Guardian newspaper wrote. It wouldn’t take much for two vessels to collide, or one to be fired upon, triggering an international incident that sends the US and China down a path to war.

I personally think China is going to attack Taiwan within, say, the next five years. And while the country has not reported any Chinese military maneuvers in wake of the Russian invasion of Ukraine, NBC News reported a member of Taiwan’s governing Democratic Progressive Party stating, “I think this serves as a very good wake-up call that war is a modern possibility.”

However I’m not at all confident the United States will come to Taiwan’s defense if attacked, despite what Biden says. Defending the island nation could very well result in a quagmire the country doesn’t want after Iraq and Afghanistan. Besides, the Chinese navy in that region is too strong.

China began building up its military in the mid-1990s, with the goal of keeping its enemies at bay in the waters off the Chinese coast.

Long seen to be inferior to the powerful US Navy, including the Japan-based 7th Fleet, in just over two decades the People’s Liberation Army has amassed one of the largest navies in the world. According to an in-depth Reuters feature on the Chinese military buildup,

Source: U.S. Department of State

Source: U.S. Department of State

China now rules the waves in what it calls the San Hai, or “Three Seas”: the South China Sea, East China Sea and Yellow Sea. In these waters, the United States and its allies avoid provoking the Chinese navy.

The Dongfeng-17 (DF-17) hypersonic weapon system

The Dongfeng-17 (DF-17) hypersonic weapon system

This increased Chinese firepower at sea – complemented by a missile force that in some areas now outclasses America’s – has changed the game in the Pacific. The expanding naval force is central to President Xi Jinping’s bold bid to make China the preeminent military power in the region. In raw numbers, the PLA navy now has the world’s biggest fleet.

The PLA is also reportedly building a fleet of smaller, Type 071 amphibious ships, with the ability to hold four hovercrafts, four or more helicopters and troops on long-distance deployments. Each 210-meter-long, 29,000-tonne vessel has a range of 10,000 nautical miles and can reach speeds up to 25 knots.

The amphibious ships and forces are expected to contribute to the PLA’s mounting capacity to make a landing on Taiwan, or other strategically important/ disputed territory.

Conclusion

Remember that list/ graphic of critical minerals the US is dependent on? Of 47 minerals, China supplies 23, while Russia supplies nine. This gives the Chinese incredible leverage over the United States should Washington try to sanction China over an invasion of Taiwan.

China has a monopoly on rare earths, controls lithium and graphite processing, and will require a huge percentage of the world’s copper, iron ore, zinc and other industrial metals as it continues building its Belt and Road Initiative. Beijing has poured billions into mines and upcoming projects in South America, in countries that used to be part of the US Monroe Doctrine. China and its state-run firms have also made deals in Africa, Australia, the United States and Canada — the latter including Zijin Mining’s recent takeover of Neo Lithium.

The fact that China is so dominant in commodities makes the idea of a full-scale military operation to save Taiwan very unlikely. Many raw materials essential to the functioning of a modern economy have exploded in price following Russia’s invasion of Ukraine. Russia only controls one-sixth of the world’s commodities. Imagine what would happen to prices if the United States sanctioned China over a Taiwan invasion and the Chinese responded by restricting their metal exports?

They could literally bring the West to its knees.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.