Well, the day of the U.S. election is finally here. I suppose I could write some sort of elaborate and detailed post about the stakes and the consequences, but what would be the point? The Keynesian train is headed for the cliff, regardless of who's playing engineer for the next four years.

I'll just reiterate...

Yes, I suppose there are some short-term political advantages at stake, but those shift with every election, so it's hard for me to get too worked up over the politics. Instead, all I see is this:

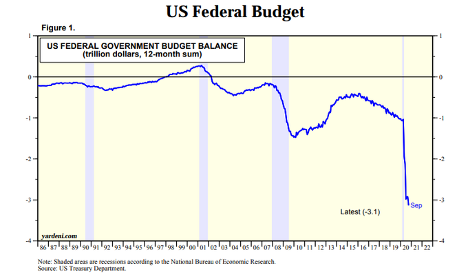

- A Trump victory with a R-republocrat Congress: $3T fiscal 2021 deficit

- A Trump victory with a D-republocrat Congress: $4T fiscal 2021 deficit

- A Biden victory with a R-republocrat Congress: $4T fiscal 2021 deficit

- A Biden victory with a D-republocrat Congress: $5T fiscal 2021 deficit

And ALL of those numbers listed above are probably conservative, given:

- Another surge in Covid and related lockdowns

- Fed pleading for more debt to monetize

- Over $8T in total treasury issuance and refunding

Perhaps the other markets are beginning to figure all of this out? The first two days of this week have brought steep dollar selling and much U.S. equity buying. Here are just two fun tweets from early Tuesday:

All I know is that I'm continuing to accumulate physical metal and mining shares on every dip. I keep my eye on The Big Picture and try not to be distracted by the day-to-day and tick-for-tick hysteria.

To that end, we wrote last week about what you should expect in terms of price as we head into the final days of 2020. Nothing has changed in that forecast, and even last week's dip has been overcome since this was first posted. If you missed it, please read it now:

For now, let's just update the charts and then get back to watching the news, building a bunker, or whatever it is you're doing today.

For COMEX Digital Gold, the key levels to watch in the days ahead will once again be the 2011 all-time highs near $1920 and then the 50-day moving average, currently found in that same area. Once price is securely back above there, we will continue to rally into year end.

And for COMEX Digital Silver, the area around $25 and the falling 50-day will continue to provide stout resistance. However, once price is back above there, $26 awaits and then it will also continue to rally into year end.

I hope the remainder of your week is safe, relaxing, and peaceful.