- Amplified Division

- Dirty Words

- Potential Thunderbolt

- Nashville, Family, and the Zeitgeist

This year’s Strategic Investment Conference is wrapped up, but it’s not over. We spent five days thinking the unthinkable. I, for one, will continue not just thinking about it but meditating on it. I believe we got some serious insight into this decade’s fin de siècle. I’ve dubbed it The Great Reset. Others have different terms. Regardless, the implications and consequences are beginning to show themselves.

Traditionally, I devote a few post-conference letters to reviewing some of the sessions. I do this for my own benefit as well as yours. I’m not just summarizing what I heard; I’m thinking out loud. If some of it seems tentative, it may be because I’m still thinking. Or, more likely, it’s because I’m connecting it to another part of the conference you didn’t see and which I haven’t mentioned otherwise. What I say here only scratches the surface.

You can still get the almost-full SIC experience. Virtual passes will still be available for a limited time, giving you access to all the videos, transcripts, downloadable audio, and slide decks. Click here to order yours.

Last week we reviewed some out-of-the-box thinking on recession, inflation, and energy. As I said before the conference, though, we can’t analyze “the economy” like some kind of independent actor. The economy co-exists and interacts with broader society, including government. Public policies—and the political processes that determine them—can change the economy in deep and lasting ways. We may not like them, but we can’t ignore them.

If I had to summarize US politics and policy in one word, it would be “paralyzed.” I know some readers will see this as a feature, not a bug. Nor are they wrong; the government often intrudes in harmful ways. However, we need it for certain things. Yet government at all levels isn’t even covering those baseline functions well. In some cases, it’s not even trying.

This paralysis is a function of our divided opinions, or perhaps our inability to make up our collective minds. To some degree this has always been the case, but to us it seems worse. (Those living in the 1850s and 1930s might disagree.)

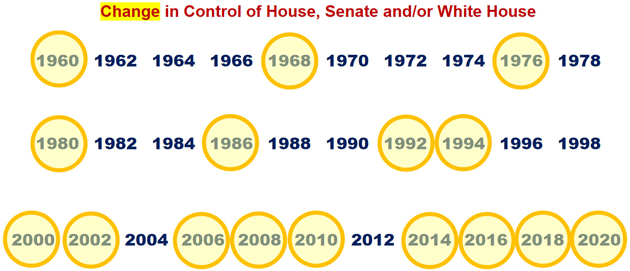

Here’s an illustration Bruce Mehlman shared at SIC. The circles are election years since 1960 in which voters handed the House, Senate, and/or White House to a different party.

Source: Bruce Mehlman

In the 20 election years from 1960‒1998, the same party kept control of all three branches in all but 7 times. But in this century, at least one branch changed control in all but two.

Constantly changing leadership means constantly changing plans and priorities. It’s no wonder nothing is getting done, but also a problem because we have important challenges. Failure to address them means they get worse, making people even more dissatisfied. This leads nowhere good.

When I interviewed Howard Marks at SIC, he pointed out some reasons we are so divided now.

“… We have problems in our country: division, inequality, lack of cooperation, high

degree of partisanship. And the parties have been pulled to the extremes because they're loud and rambunctious, and they threaten moderate leadership, and they dominate, of course, in the primaries. And these things have been exacerbated first by cable over the last 20-something years and the development of left-leaning and right-leaning cabals where the people who watch it never hear the arguments of the other side. And then it’s been made far, far worse by social media. Add anybody can say anything they want on social media, and it goes around the world in a nanosecond.”

I thought that was insightful. Division isn’t new. What’s new is having technology amplify our division and widen its impact. The same technology is the reason people don’t, as Howard put it, “hear the arguments of the other side.” And because they don’t hear the other side, they dismiss or demonize it.

Howard and I went on to talk about his work with the “No Labels” group that promotes bipartisan cooperation. It has an associated Problem Solver’s caucus in the House with 64 members from both parties. They have had some success but it’s an uphill fight. Particularly when you realize those 64 are only about 15% of the House’s total membership. The other 85% have different priorities, apparently.

It might be simpler if everyone were just bickering within their personal echo chambers while adults took care of business. That’s not the case. We have real, immediate problems and the adults are away. For instance, the federal government may be within a few weeks of hitting the statutory debt ceiling. No one is quite sure what will happen then, but none of the possibilities are good.

As regular readers know, I think the federal debt is too high and the government spends too much. I want Congress to get the budget on a sustainable path. That’s easy to say but accomplishing it requires an actual, detailed plan on which the president and a majority of Congress can agree. People must talk to each other, make tough decisions and (sorry to use a dirty word) compromise.

The same holds for many other problems. At SIC we talked a lot about the Federal Reserve and its many mistakes. I’ve written letters saying it needs reform. But guess what? Only Congress can reform the Fed. If Congress stays gridlocked, the Fed won’t change.

We also talked about technology, some of which I’ll share in a future letter. But let me note here, the economic effects of technology depend not just on what the engineers can design, but also on what the politicians allow. These aren’t easy questions, either. They involve national security, trade, consumer protection, intellectual property concerns, competition policies, and more.

These would be enormously difficult challenges even if the people in power were all thinking beyond the next election. Many are not. Bruce Mehlman pointed out how the narrow majorities in both House and Senate empower small factions. Any handful of members can stop anything cold, for whatever reasons they like, even if most of their caucus favors it.

A sticky wicket, as they say in England (and where they have their own kind of political gridlock). But the SIC consensus was that our politicians will eventually get their acts together and at least manage the most pressing problems. The process will be ugly.

Another SIC speaker, Mark Zandi of Moody’s, has been in the headlines with stark warnings about the debt ceiling. He thinks we will avoid the worst scenarios but said something else I want to highlight. Here’s Mark from the transcript.

“My own thinking here is that lawmakers will get it together, suspend the debt limit temporarily, get it lined up with the end of the fiscal year, make a decision about the debt limit and fiscal year 2024 budget funding for the government at the same time, before October 1, life goes on. I suspect there's going to be a lot of, at some point, turmoil in markets. I wouldn't be surprised if equity markets take a spin down here, just given the angst that's going to develop as we approach the X date. And in fact, I think it's almost necessary for that to occur. It's hard to imagine lawmakers are going to be able to generate the political will necessary to increase the debt limit and make other changes to policy without some push from markets. So I think I'd buckle in here a little bit with regard to what's going to go on in the equity market, the corporate bond market here in the next few days, few weeks.”

Pay attention to the sentence I placed in bold. I think Mark is right, but what does this say about our political system? Who is really in charge when leaders won’t act until financial markets force them to?

Note also, if they do what Mark thinks, the long-term debt challenge won’t change. They will at most make some cuts to 2024 spending that a future Congress could restore. This is one big part of the challenge. Fixing the debt requires more than a one-time agreement. They have to make that same politically difficult decision again the next year, and the next. And convince voters to like it.

Here we have to separate what we want to happen from what we think will happen. For me, I want a balanced budget and greatly reduced debt. But I really doubt I will get either until some kind of crisis eliminates all the other options. I don’t know what that will be but I’m pretty sure it is coming.

But long before then, we’ll have another kind of showdown.

Next year, 2024, is a presidential election year. Many experts will tell you that presidents get both too much credit and too much blame for whatever happens to the economy. Normally I would agree. This time may be different because, with Congress so divided, the White House has more latitude to act unilaterally.

So, the first question is who will be running? You might think that’s obvious. President Biden says he will seek reelection, and if so, Democrats will likely unite behind him. On the Republican side, former President Trump is polling far ahead of all others. If it’s those two, we’ll have a rerun of 2020.

Neil Howe talked about this from his Fourth Turning perspective. Elections often represent what he called “regeneracy” as new communities form and rally around a candidate symbolizing their hopes. He mentioned 1940 filling that role in the last Fourth Turning. That was the year FDR won an unprecedented third term, beating Wendell Willkie.

(Incidentally, in 1940 Europe was at war and the US economy was struggling to emerge from the Great Depression. Now? Europe is at war, albeit a smaller one, and the US economy is again in the aftermath of a severe economic downturn. Interesting parallels.)

In the current Fourth Turning, Neil again sees regeneracy as key. He talked about how 2016 mobilized both sides and voting rates skyrocketed. A race pitting two older candidates whom much of the public greatly dislikes (to put it mildly) doesn’t fit the mold. Neil has real doubts about whether Biden will actually run and whether Trump will be nominated.

For now, though, it looks like a Biden-Trump faceoff. I asked Howard Marks about the reports No Labels would back a third-party candidate. From the SIC transcript:

Howard Marks: “Now, we are faced with the possibility of having an election where the majority of Democrats don't want Biden, the majority of the Republicans don't want Trump, and the majority of Americans don't want a Biden-Trump election. And so we are, as you say, in the process of trying to get on the ballot in all 50 states so that we can offer an alternative if need be. We're not eager to do it. This is not a power grab. We're not trying to assert ourselves as a third party.”

John Mauldin: “I've sat in on some of the meetings, thank you. What I'm hearing is that if we get something besides a Trump-Biden ballot that No Labels will stick to their knitting in the House and the Senate and let the parties move on. But if we get a very divided situation where you get extremes and there's a group in the middle looking for an alternative, that's when No Labels would step in and start going through the process in 2024 of trying to find a candidate.”

Howard Marks: “I think that's a very good synthesis of the situation, John. But one other thing I might point out. So now people, since we started getting on ballots, the entrenched interests, which are the duopoly of the Democrats and Republicans who like the situation just as it is, have been beating on us that if we do this, we're going to throw the election to the other side. So lots of Democrats have complained that if we do this, we'll throw the election to Trump by draining off Biden voters. Some Republicans think we'll throw the election of Biden by draining our Trump voters.

“Obviously, they can't both be right, by the way. And we're very cognizant of this, we're not going to do this cavalierly. And we are only going to do it if we feel we'll win. Because obviously if we don't win, then we could have one of those effects, which we don't want to have. And we'll do a lot of polling, not that polling is that great anymore, but we will only do it if we think there's a road to success. And right now, we think there is one.”

Read that last part again. Howard Marks thinks a Biden-Trump race would give a third candidate a path to success. That would be a thunderbolt befitting the Fourth Turning. And depending on who it is and what kind of policy changes they would bring, it could be the exception to the “presidents don’t affect the economy” rule.

Now, this might sound similar to Ross Perot’s 1992 run. He received 18.9% of the popular vote but won no states, so zero Electoral College votes. No one is quite sure to this day what difference his presence made.

Howard says No Labels doesn’t want to be a spoiler in either direction. Bruce Mehlman addressed this, too, and noted that a third candidate winning even a few small states could send the election to the House of Representatives, at which point all kinds of weird things become possible. Bruce thinks the state delegations would still go with their own party loyalties, giving the No Labels candidate little chance.

I don’t know how any of this will sort out. I mention it because next year’s election could have market impact long before Election Day.

It almost goes without saying that each generation thinks that the elections they are currently involved in will be the most important of their lifetime. And there have been some important elections. But I think the really important elections are in our future: both 2024 and perhaps significantly more important, 2028.

The general consensus among our faculty and in much of my reading is a fiscal crisis is brewing that the monetary policy side will exacerbate and politics make more volatile. George Friedman has identified two cycles of war and business, a 50-year cycle and an 80-year one. These not so serendipitously coincide with the latter part of Neil Howe's Fourth Turning. This also fits the timing for my Great Reset.

Given the level of tumult and potential market disruptions, who is in charge during that time will be important. In one sense, it is like a very full balloon. It really doesn't matter which pin or where it touches the balloon, the result is the same: BOOM!

We're going to be going over this in some detail, but I think I got Bill White (former Chief Economist for the BIS) to explain why he thinks a deflationary depression and a hyperinflationary reaction are both possible, depending on where you start. Do we start with the kind of private debt crisis which historically led to deflationary depression? Will the Fed step in and provide liquidity? What will the government do?

What if it's a sovereign debt crisis? Not just the US, but Europe, Japan, the UK, and others would all come under pressure. We saw in 1998 how a debt/currency crisis in Asia and Russia could produce an unsettling financial crisis in the developed world. The historically typical response to a sovereign debt crisis is inflation, and eventually hyperinflation if it’s not contained.

These could be periods of great pain but they don’t have to be. There are solutions which could not only “right the ship” but set up a period of extraordinary prosperity in the 2030s. It will matter who is in charge.

John Kenneth Galbraith once said, “Politics is not the art of the possible. It consists in choosing between the disastrous and the unpalatable.”

Spending cuts affecting favorite groups will be very unpalatable. Likewise, raising taxes which will be necessary will be very unpalatable in certain circles. So will reigning in bureaucracies.

The necessary changes can only happen, unfortunately, in the midst of crisis. That’s when we can stomach distasteful and unpalatable solutions, like some of my mother’s early medicines.

We can find some comfort in the fact that the great leaders we will need are not born but actually rise to the occasion. I truly have no idea who they could be, but we are talking about the late 2020s so I think we can exclude the current octogenarians (of which I will be approaching) who will have had their moment on the stage.

That’s partly why I remain optimistic. To use Neil Howe's terminology, we always get through the Fourth Turning and into a much happier First Turning era. Add in all the new technology that will improve our lives and I get really excited about the 2030s.

We'll be here to help you survive and even thrive in this coming era, and maybe even be a part of the solution so that our children and grandchildren can experience a much better future then we imagine today.

Nashville, Family, and the Zeitgeist

I will be in Nashville May 29-June 2 for Ben Hunt’s Epsilon Theory conference. Lots of friends will be there (Grant Williams, Neil Howe, Ben, of course, Brent Donnelly and more) and of course new friends. Ben is also creating a new chair on narrative systems at Vanderbilt. I have been following this development for years and want to do a deeper dive and that means I need to be in the room.

My son Trey will be coming to Puerto Rico in a few weeks, and we will get to hang out together. I'm really looking forward to it.

Something happened at this conference that has a different qualitative feel than previous events. Olivier, Ed, and I (and our teams) can sense it. We did a great deal more polling this year than we have ever done in addition to having a faculty much broader in scope. I say each year that the conference is better than the last, but this conference was a significant leap in quality. Not so much in the speakers per se, as many have been on the stage before, but there seemed to be more consensus and a very different group mood, both among speakers and the attendees than anything we've had in the past.

We pay particular attention to attendee and reader feedback. We have a full-time person whose job is just to curate your experience and make sure that your concerns and questions are heard. We’ll be doing more polling and questioning, but we sense that something different, not marginally but qualitatively significant, is happening. It goes back to that song from my youth, “There’s something happening here... What it is ain’t exactly clear.”

I know that Olivier, Ed, and I are going to spend this summer trying to get exactly clear on what we are hearing from you. And what we learned. I'm really pretty excited about it all.

And with that, let me hit the send button and wish you a fabulous week!

Your busier than ever analyst,

|

|

John Mauldin |

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price.

Click here to learn more.