Anyone else ready for the election to be over? This uncertainty is exhausting, no matter how you want it to end. But sadly, it won’t really end. We will just transition to a different uncertainty over what will happen next. I will offer my thoughts on the election at the end of this letter, after setting the stage.

I am quite certain about one thing, though: The gargantuan federal debt will get larger still, bringing a global debt crisis ever closer. We are long past the point where even serious spending cuts or revenue increases can avert this. We should still do them, but we now need major restructuring, not possible given whatever the outcome will be in this election. We are on a one-way road to crisis. There’s no turning back. But we will get through. We always do.

This being my last letter before Election Day, I wanted to put that marker down for the record. I’m frustrated that the debt is barely an issue for either candidate. I know why; they talk about the issues they think will motivate their voters. But the harsh reality is we won’t fix all those other problems unless we get the debt under control. We just won’t. The IRS will keep collecting taxes while the Treasury sends much of it right back out the door as interest. In too few years, little will be left to actually solve our very real challenges.

That’s especially true if interest rates stay elevated. $50 trillion of debt at 4% interest rates? That’s not unthinkable. There is a nontrivial chance that we will see that outcome by the end of the decade. Massive deficit spending will simply increase inflationary pressures.

Today I’ll update you on the debt situation, talk a little about how the Harris and Trump agendas might affect it, and consider what other steps might help.

But first, the inaugural invitation to our new service, Transformative Age, will be closing soon. The response has been overwhelming and gratifying. All I can say is “wow.” Your enthusiasm for our new longevity and biotech letter, Transformative Age, has been nothing short of inspiring. To date, we’ve welcomed hundreds of new members aboard—a heartfelt thank-you for all your support. It means the world to me and the team.

We’ll be closing this opportunity very soon as attention shifts to the upcoming election, so please be sure to take a look before it ends. Get the details here.

“Highly Optimistic Numbers”

Let’s begin with a status report. Summary: The state of our fiscal union is terrible and getting worse. The Congressional Budget Office updated its Budget and Economic Outlook in June. CBO’s methodology has limitations, but I’ll stick with it for consistency, since I’ve cited it before.

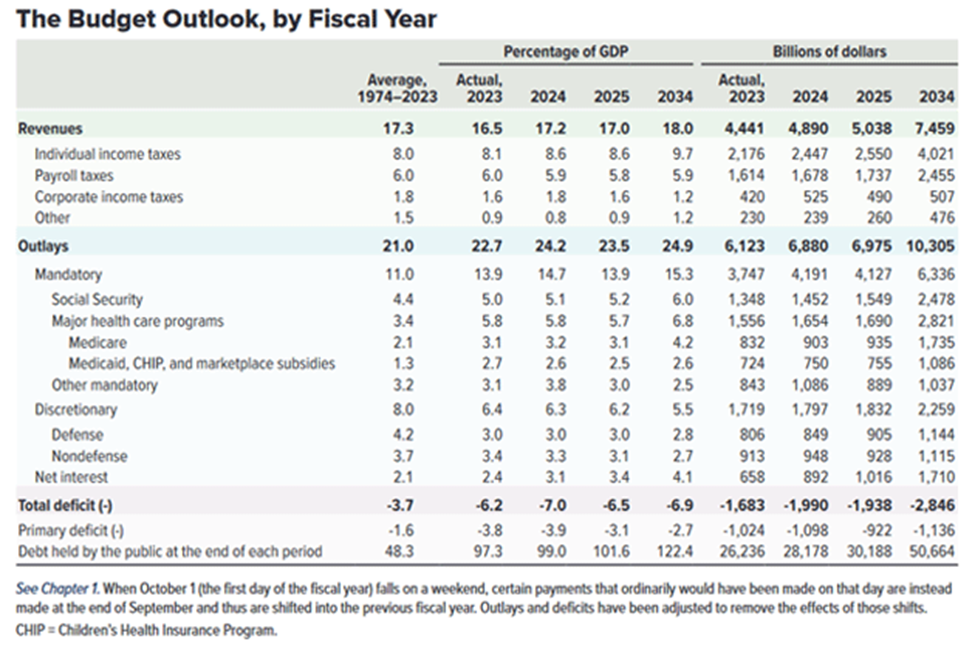

CBO expects an FY 2025 budget deficit of almost $2 trillion, of which more than half is net interest. The debt owed to the public (i.e., excluding the Social Security and Medicare trust funds) will stand at $30.2 trillion when this fiscal year ends. That will represent 99% of GDP.

(USDebtClock.org pegs the deficit close to $36 trillion and 122% of GDP.)

Source: CBO

By FY 2034, CBO’s outlook shows the debt will exceed $50 trillion, which will be 122.4% of GDP. At that point, we will be spending $1.7 trillion a year on interest alone.

These numbers are terrible but they’re actually optimistic. Start with the assumptions. CBO’s outlook is for 2.0% GDP growth in 2024 and 2025, then a steady 1.8% in 2026 and later years. By law, the agency can’t incorporate recessions into its outlook, though we all know they happen every few years. We should understand that 1.8% to be an average of recession years that are worse and boom years that are better. But the order in which those happen makes a giant difference.

Inflation matters, too. CBO assumes we have it licked, with the CPI growing 2.3% in 2025 and 2.2% thereafter. Their interest rate assumptions are similarly optimistic.

The law also requires CBO to assume spending and tax collection will continue as written in current law. This matters more than you may think; current law includes a big tax increase in 2026 when many provisions of the 2017 tax changes expire. This has the effect of making CBO’s future revenue outlook look much larger than it will probably be, assuming Congress extends those cuts.

(By the way, I’m not sure investors grasp this risk. Let me say it again to be clear. In 2026, personal tax rates will rise, and many deductions disappear, unless Congress acts first. This isn’t some “maybe” thing. It’s the law right now. If the next Congress is deadlocked, which is entirely possible, a tax shock could trigger that long-expected recession. And just the anticipation of it won’t be good for stock prices. Just saying…)

In any case, here is CBO’s bottom line on debt growth, however flawed it may be.

Source: CBO

Source: CBO

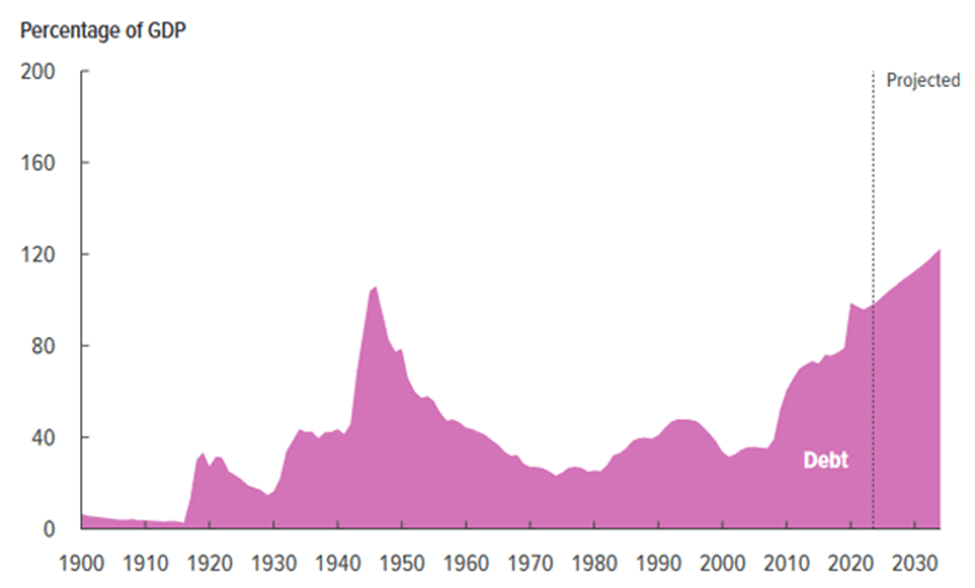

The agency’s projected debt as a percentage of GDP will soon exceed the World War II peak. In that case, debt fell pretty fast as war-related spending ended and the economy boomed. The Fed was intervening to keep long-term rates low, too.

Note also, this is again “debt held by the public” which excludes the Social Security and Medicare trust funds. But those funds are being depleted and will disappear sometimes in the early 2030s, at which point both programs will have to depend on their then-current payroll tax revenue. This will necessitate major benefit cuts unless Congress fills the gap from other revenue—which would make the debt even worse.

Wide Ranges

To the extent anyone can predict the future, I think the CBO projections are probably the best available estimate. I view their numbers as a kind of baseline from which things can get better or worse, the latter being far more likely. I will gladly offer 4-to-1 odds we have a recession in the next 10 years. Any takers? Even a garden-variety recession will push up the deficit by a minimum of $500 billion and more likely closer to $1 trillion. The hole just keeps getting bigger and we just keep digging.

CBO also can’t account for policy changes that may be brought on by new leadership. Both presidential campaigns have their own policy proposals. The new president will be able to do some things by executive authority, but most of it will require congressional approval. We don’t know what the new Congress will look like or will be able to agree on, so all this is highly speculative.

Nevertheless, the campaign promises provide a starting point. If Harris and Trump each somehow manage to get everything on their respective wish lists, how will it affect the debt outlook?

On these topics, I often cite the Committee for a Responsible Federal Budget. It is a bipartisan group that seeks to restore the kind of fiscal sanity I think we need. I’ve found CRFB’s analysis to be generally fair and rigorous. They have been monitoring the fiscal impact of both Harris and Trump proposals. You can see their recently updated report here.

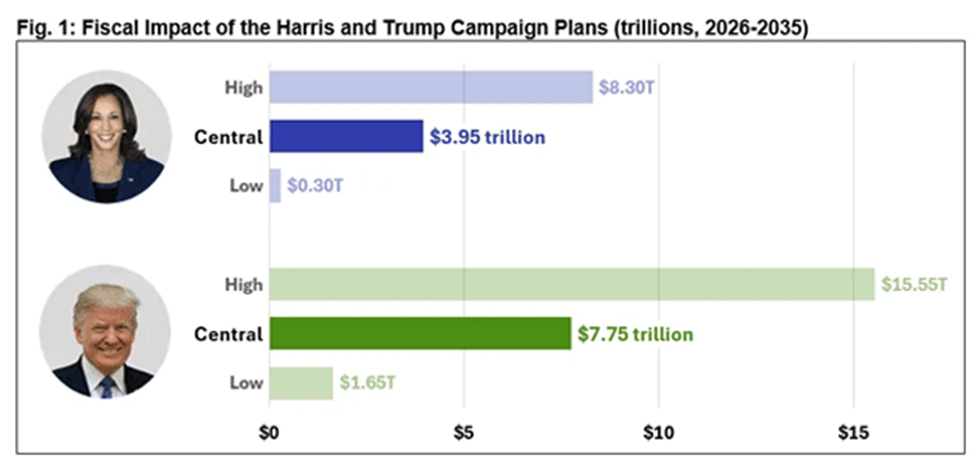

CRFB acknowledges these estimates have a wide range of uncertainty, and so expresses them as a range of possibilities. Here is the bottom line.

Source: CRFB

CRFB estimates that Harris proposals would add $3.95 trillion more to the debt in 2026–2035, on top of the current trajectory I described above. It could be as high as $8.3 trillion or as low as $0.3 trillion, depending on the assumptions and interpretations used. For Trump, the central estimate is an additional $7.75 trillion in debt, possibly as much as $15.55 trillion or as low as $1.65 trillion.

You might look at this and say Harris is better, at least from a debt standpoint. That’s not the right way to see it. The ranges overlap so it’s possible Trump would add less debt than Harris would. We can’t know.

The bigger point is that even under the most optimistic assumptions, both candidates would leave us with even more debt than currently expected, which is already bad.

Panderer in Chief

First of all, most of the tax proposals are just silly and have almost zero chance of being passed. Seriously, not taxing tips? Or Social Security? Or whatever? I mean, I would love not paying taxes on my Social Security. Maybe I will put a tip jar icon in the letter so that you can give me tax-free income. Just saying…

I am reasonably well attuned to politics. I hear almost no one talk about interest rates and deficits. The campaigns at all levels are generally politicians pandering to particular constituencies. “Vote for me and I’ll make your life better.” They promise lower taxes, more Social Security benefits, or whatever.

This is sadly consistent across the political spectrum. To the extent anyone talks about the debt, which is rare, all they would do is tap the brake and slow down a bit. No one has any serious proposal to balance the budget, much less start paying down the debt.

Yes, Trump wants to put Elon Musk in charge of cutting wasteful federal spending. And while I would never bet against a man whose company figures out how to catch a 20-story-tall rocket with chopsticks, getting significant spending cuts through Congress isn’t an engineering problem. Politics is a different kind of challenge.

I’m sure a cost-cutting commission could actually come up with $300 billion worth of cost-cutting proposals. Look at what Milei is doing in Argentina. But Argentina was a longtime basketcase where people finally said, “Let’s try something different.” The US is just not there.

Yet can we blame the politicians? They are keenly attuned to public opinion. If they thought a significant number of us cared about the debt problem, they would get more serious about solving it. They are doing what most of us want. The real problem is that we want the impossible. We differ mainly on the details of who gets what benefits and who pays which taxes.

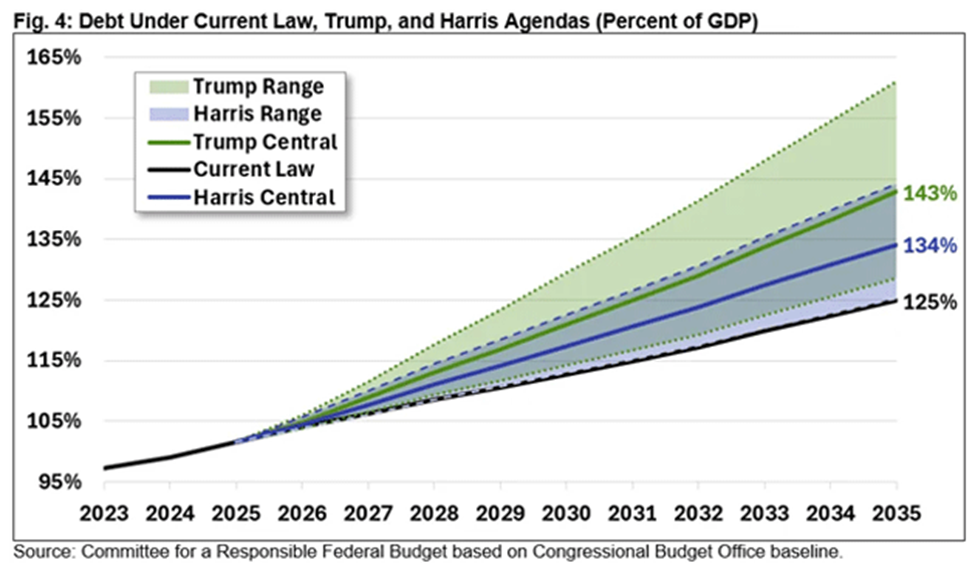

Here is another graphic showing the CRFB’s findings. The black line at the bottom is the current debt outlook, leading to 125% of GDP in 2035. Above it are the Trump and Harris ranges, which overlap in that darkest area. In all scenarios, both candidates will only add to the debt.

Source: CRFB

I don’t have room for all the details but you can see how the CRFB came to these numbers here. Again, don’t get too focused on the fine details. Once you put a pencil to these plans, it is quite obvious neither candidate sees debt reduction as a priority. The only disagreement is how much they will add to a debt that’s already growing way too fast.

Grand Bargain

One of the most frustrating things about this topic is the way people think it’s easy to solve. Twenty years ago, maybe so. We were close to a balanced budget and, at least in theory, could have kept that course and begun chipping away at the debt. Alas, we didn’t.

We have now reached a point where all the options are terribly painful. I sometimes compare it to a drug addiction. The first and hardest step is to admit you have a problem. Then what? Going cold turkey rarely works and can even make the problem worse. You have to detox slowly, methodically, with a lot of medical and family support.

When I hear well-meaning people say we can solve the debt by cutting this or that spending, or by raising taxes on the rich, I just ask them to look at the numbers. You can’t do it without producing major side effects. Yes, there are things that would help. We should do them. But make no mistake, they’re just nibbling around the edges.

As I said, the political incentives all push in the wrong direction. We can’t fix this unless both parties somehow make a grand bargain. As of now, neither seems interested, but there actually was a serious attempt not so long ago.

In 2010, Republicans and Democrats created a bipartisan “National Commission on Fiscal Responsibility and Reform.” Alan Simpson and Erskine Bowles cochaired it, hence the “Simpson-Bowles Commission” you may recall.

The original idea was that the 18 members would develop a plan for fiscal sustainability. Once 14 of the 18 members agreed, they would present it to Congress for an up or down vote.

The members could not reach that threshold. Only 11 voted for the final report. The holdouts included both Democrats who thought the spending cuts too harsh and Republicans who opposed tax increases. The report was never formally presented to Congress. A couple of years later, a bill modeled on the Simpson-Bowles plan, with some of the tax increases removed, actually did get a vote in the House. It was soundly rejected 382–38.

Simpson-Bowles was the most serious effort at fiscal reform in recent memory, since the balanced budget that was created by Clinton and Gingrich. Yet it went nowhere. While the majority of the bipartisan commission agreed on a plan, it also drew sizable opposition from both sides. This is something where a majority isn’t enough. You need a supermajority consensus. No such thing was possible in 2010, nor would it be today, in my opinion.

So where does that leave us? It leaves us on a one-way road to debt oblivion. This simply can’t continue. At some point this will be unmistakably clear. I think whoever we elect next week will be facing that fact by the end of their term.

Good luck to them. They will need it.

Thoughts on the Election Next Week

I am lucky in that I get to see some “insider” polls and reports on conversations from inside both campaigns. I am privileged to see serious analysis. What it boils down to is that this is, no surprise, likely to be a very close election. It is going to come down to turnout. The people that I think are the most serious are the ones that are the most cautious with projections.

This election is important in that it will lay down some philosophical markers. But as we noted, unless the next president has a serious change of heart it is not going to have an impact on the fiscal deficit.

Sometimes presidential elections have important results later. For example, Gerald Ford’s 1976 defeat led to Ronald Reagan’s 1980 win. Reagan was significant. I am not certain that a second Ford term would have been much different from Carter. (Though Carter did appoint Paul Volker, which was important.)

I have been saying for more than a few years that the more important election will be in 2028. By then, we will be looking at a $45 trillion debt. Interest expense alone will likely consume over 20% of tax revenue. The conversation will be about how to fix Social Security so that it is not drastically cut in a few years.

I expect a complete about-face from this year, with spending and deficits as the number-one topic. There will be competing visions of how to fix it, but certainly no consensus. Nothing approaching Simpson-Bowles. Forget about Clinton/Gingrich.

Let me lay down this marker for future discussion. The ultimate importance of 2028 will be the selection of someone to be in charge when the real debt crisis hits a few years later. The debt will not be solved until we have a crisis. Only the return of the bond vigilantes, seemingly rising from the dead, will spur the needed compromises.

It doesn’t have to be done overnight. We simply have to put ourselves on a realistic glidepath to a balanced budget. There are several ways to do that. If the bond market believes that there is a realistic path, rates will settle down and the world will go on.

Half the country is not going to be happy by the end of next week. The potential for unrest and even violence is nontrivial. But that would not be the first time in our country’s history.

I remind you the Republic will survive. It will be changed, but it will survive.

My New White Paper

Given this outlook, how do we manage our portfolios? Given the potential volatility and multiple possible directions, there are so many possible choices. For the last year, I’ve been recommending that you subscribe to David Bahnsen’s Dividend Café. His management style, which is a mixture of dividends and alternative investments combined with special situations, offers, in my opinion, one of the best ways for getting through what I think will be a bumpy ride.

I have written a white paper called Why I Am Working with the Bahnsen Group. I go step-by-step through the decision-making process I made in choosing The Bahnsen Group. You should read it not just to see if they are a potential fit for you, but to understand what you should think about when choosing your own money manager. Many readers will of course want to use someone else or a different style. I believe this paper will help your decision-making process.

You can click on this link and subscribe to the Dividend Café. You will automatically get a copy of the white paper. The Dividend Café is a short daily summary combined with pithy market wisdom and commentary, plus one weekend thought piece which will make you a better investor. I suggest you try it for a few months and join the thousands of my readers who benefit from its wisdom.

Dallas, Austin, and Newport Beach

I will be in Dallas the week of Thanksgiving for both business, meeting with old friends, and Thanksgiving dinner with my family. I need to be in New York sometime in December. I will be in Austin in early January and Newport Beach in late January.

I am really crashing through trying to finish my book on the coming crisis. It has me in a somber mood and this election isn’t helping. Surveying the geopolitical scene is not helping, either. I get a little relief by reading some fantasy or science fiction every now and then, plus thinking about some of the incredible scientific and technological advances we are making. I truly believe we will look back in the middle of the 2030s, when we are living longer and healthier, and the world has settled down, and, as my dad used to say, wonder what made us get our bowels in an uproar.

And with that, I will hit the send button. Have a great week and don’t forget to follow me on X! I can make shorter comments on topics like today’s employment numbers and refer you to other highlights.

Your hoping that we know who is president by the next weekend analyst,

John Mauldin

Co-Founder, Mauldin Economics