The Fed can easily be made to work but nobody apparently wants it to, or we’d change it. This rose bush puts out flowers that only stink and wither, but it has thorns the size of your fingers that cling to your pockets and tear at your flesh. We have three articles that were prominent in my news searches that lay out just how miserably (for all of us) the Fed is failing at its actual mission.

The first one by Joshua Glawson on GoldSeek explains what the Fed’s mission and legal requirements are. (I’ll let you go to the article in the links below to get that background if you are not fully familiar with it.) In short, however, the Federal Reserve System was created by President Woodrow Wilson in 1913 to provide “a safe, flexible, and stable monetary and financial system.”

Seriously?

Whether it has been safe may be debatable. It is still up and running more than century later, and probably hasn’t killed anyone yet. (Even that’s debatable.) It has certainly been flexible, having been adapted over the decades to become the octopus many feared it would turn into that extends its ubiquitous tentacles across the whole economy, having aggregated more powers to itself through its pocket politicians with its Johnny-come-lately addition of maintaining a strong labor market—a single innocent-sounding clause that gives it vast economic power.

One thing it has definitely not provided, however, is either a “stable monetary system” or a stable economy. Our recessions have clearly been made far worse, the more the Fed has intervened. Bubbles have been popping up and popping out in huge explosions all over the place. The Great Recession was a dollar short of being a Great Depression. And stable money, itself, now there’s a fail; yet, we’re still working through one of the Fed’s biggest fails in terms of money! Some will attempt to blame this inflation fight on Biden; some on Trump; but the full truth is that none of it could have happened without the Fed’s full-throated support to create the money that stimulus is made from in order to save the economy from wreckage created by its government.

Let me draw from Glawson to lay out some of the Fed’s abject failures:

Centralized monetary control, one of the primary reasons for the Fed's establishment, is a point of contention for concerned economists. They argue that central planning of the money supply, as conducted by the Fed, leads to artificial interest rates and misallocations of resources.

It certainly has led to constant intervention in rates to try to use them to manipulate the economy. The larger the interventions, the more obvious the misallocations became as the allocations expanded into notorious bubbles. Still, the Fed keeps its place in the center of the Garden of Evil as most citizens and politicians trust Father Fed to know best.

The Fed's ability to act as a lender of last resort is seen as promoting moral hazard, and encouraging risky behavior by financial institutions.

Again with the bubbles! They are all the proof we need of continued risky behavior since the last two massive crashes of the Great Recession and the Covidcrisis. Major crashes that require the most extraordinary “salvation” efforts by the central bank in US history seem to be happening at an alarmingly faster rate, reaching dizzying outer-atmosphere heights.

The Fed is out of touch because …

The structure of the Federal Reserve System, which includes the Board of Governors, twelve regional Federal Reserve Banks, the Federal Open Market Committee (FOMC), and member banks, is viewed as an elaborate bureaucracy that distances monetary policy from the discipline of the free market.

It has failed miserably at its prime objective:

Failure:

Despite its primary objective, the Federal Reserve has struggled with significant inflationary periods, notably in the 1970s and the post-2008 financial crisis period…. A consumer basket costing $100 in 1790 cost $2,422 in 2008. This dramatic decline largely occurred after the gold standard was abandoned in 1971, allowing the Fed unchecked control over monetary policy

The Fed has failed at creating a stable economy:

Failure:

The Federal Reserve has been criticized for its role in major economic downturns such as the Great Depression and the Great Recession. In the 1920s, it failed to prevent the stock market bubble and subsequent crash. Similarly, policies in the early 2000s, including low interest rates and inadequate regulation, are seen as contributing factors to the housing bubble and the 2008 financial crisis.

The Fed has utterly failed at creating a stable financial system. The system itself has experienced many significant breaks under the Fed:

The Fed's crisis responses, often involving bailouts, are criticized for creating moral hazard and encouraging risky behavior by financial institutions.

The Fed does far worse than engender risky behavior. That risky behavior has resulted in massive bank busts at the very core of the financial system! That is not a stable system. It resulted in numerous times where massive intervention was needed to bail out depositors whose funds would have been lost due to the risky behavior of somewhat deregulated banks or to save the bank so it didn’t crush us all.

It has failed to assure “sustainable growth and a high level of employment, production, and real income.” Income all went to the top.

Failure:

The long-term economic growth rate in the U.S. has been sluggish, especially in recent decades. Critics argue that the Fed's focus on short-term fixes, such as lowering interest rates, has failed to address structural issues like productivity stagnation and income inequality. The U.S. has experienced periods of high unemployment, particularly during economic downturns.

How do these guys even keep their jobs given how spectacular their fails have been? We have seen many periods of high unemployment during their tenure. We’re probably about to see another. If your rose bush produced flowers that stink this bad, you’d have it removed by a haz-mat team!

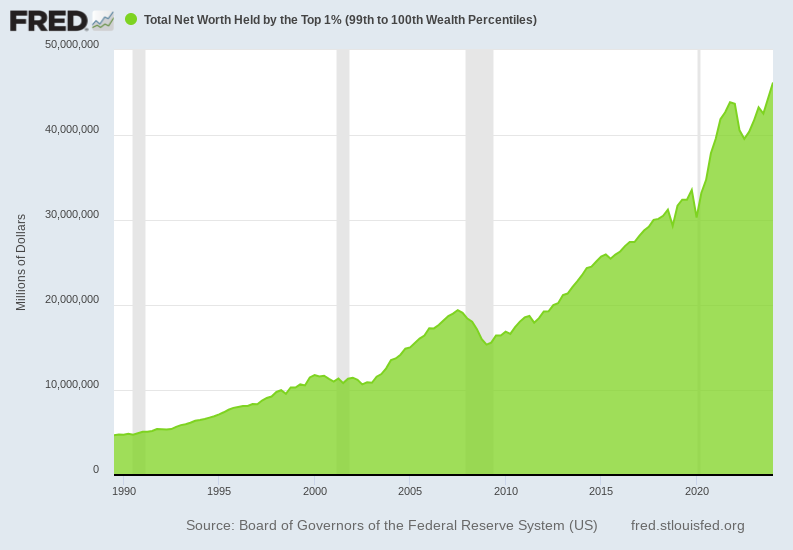

Let’s take a look at the second article highlighted in the headlines below to see how well the Fed has done with income equality. A picture is worth a thousand words:

Clearly the Fed has done a BEAUTIFUL job with income … if you’re a banker. Now, this is not entirely the Fed’s doing. US policy under Reagan gave investors a privileged tax rate that is lower than the top income-tax bracket, which assured those who can play with assets will make the most money under those effective tax caps as their income is protected. However, the Fed, by giving all of its new money to banks, also creates a lot of income disparity by making sure banksters get rich before anyone does as well as whenever anyone does. It pays to own the tree in the center of the garden that grows all the money, even if it is really a giant stinking rose bush.

Central planning has always suffered from the planners being too dumb to run anything as big as a national economy:

What should the interest rate be today? At any given moment, there is only one right answer. But the Fed’s FOMC doesn’t know what it is. And there are an infinite number of wrong answers. So, Central Banks are almost always wrong; every policy choice is an error.

The Fed tries to set interest rates to control economic growth. That needs to end. It should only be able to adjust them as much as it needs to for the sake of monetary control. If the amount of money going into the system is causing inflation, then the Fed might need to raise rates to slow the money flow that is created through loans; but it should not be trying to figure out the “neutral rate” for good economic growth. It should only be making sure the growth-rate of money supply is neutral to the value of the money, whether that is through interest rates, reserve ratios, QE, QT or whatever tools it has. It should not be using its tools to engineer economic growth or to reduce it.

Booms and busts are normal. But the feds — claiming to moderate the business cycle by countercyclical fiscal and monetary policy choices — actually make them worse…. That’s why we have $35 trillion of national debt... and Nvidia priced as though it were worth more than the entire annual output of the UK.

Look at the debt, dumb dumbs

(“Dumb dumbs” referring to the Fed and its favorite fans.) Now let’s tackle that last point with the help of our third article, which is from Ron Paul:

Last week the national debt reached 35 trillion dollars, a mere seven months after the debt reached 34 trillion dollars. To put this in perspective, the national debt first reached one trillion dollars in October of 1981, almost 200 years after the Constitution’s ratification!

The mountainous climb in debt began in the Reagan years and mostly grew worse under every administration since … even though Reagan campaigned on the promise he would reduce the perilous debt of his time, which was a hill of beans at the time, even when compared against the full scale of the US economy.

Reagan first lowered taxes too much, which caused revenue to fall. So, his budget engineer, David Stockman, implored him to immediately raise them enough to find the sweet spot where lowered taxes don’t diminish revenue and maybe even increase revenue due to the reward profile for the industrious. Stockman also implored him not to boost military spending. Reagan ignored that recommendation and stormed ahead with massive military spending that blew the deficit up into the mountaintops from where it had been. So, it’s not all the Fed’s failure, but the Fed has been the government’s handmaiden (and vice versa) through all of this.

The fact that the government was adding one trillion dollars in debt in little over half a year was not deemed worthy of comment by President Biden, Vice President Harris, and most other US politicians….

The Tea Party’s efforts to focus attention on the debt resulted in a bipartisan deal that made minuscule spending cuts. In fact, most of the cuts were not real cuts. They were just reductions in the “projected rate of spending increase,” meaning the spending still increased but just by not as much as originally planned.

That is always the way it happened. Politicians from either party would jabber about how much they had done to cut the debt, but all they had really done was reduce expenses or raise taxes far out in the future that would happen under some other government’s budget. It should have always been seen without saying that future governments would just rewrite everything to get whatever they wanted. No government would not allow itself to be hindered by dead or dying politicians of another era! So, the cuts are always a mirage that’s out ahead of us. No expense cut means a thing unless it happens in this year’s budget and maybe next year’s. The rest are fantasy cuts.

Those who pretend deficits don’t matter ignore the fact that interest on the national debt will soon be the largest item in the federal budget, consuming as much as 40 percent of federal revenue. This is unsustainable. The devaluation of the dollar resulting from the Federal Reserve’s efforts to stimulate the economy and monetize federal debt, combined with increasing resistance to US hyper-interventionist foreign policy, will lead to a rejection of the dollar’s world reserve currency status. When that occurs, there will be a major economic crisis unlike anything this country has seen since the Great Depression.

I intend to get into that aspect of things in this Friday’s Deeper Dive where I plan to take a fresh look at de-dollarization and collapse of the dollar … UNLESS more earth-shaking events happen between now and then, which, as things are going under Fed management now, is likely! The Fed’s robust failures as well as US economic policies, including those above, as well as US geo-politics, are all knocking dents in the dollar’s framework. How long can it hold up?

What should we do now that we’re Fed up with Fed fails?

My view, to be clear, is that Fed does not need to be thrown away. It needs to be dethorned and dethroned, which means two simple central changes at the core of its being: (I know, why keep a stinky rose bush at all, but keeping the reformation simple makes it easily doable, though our politicians won’t go there.)

1) Remove the Fed’s labor mandate entirely. That is what gives the Fed too much power to engineer the economy. Let labor and the economy take care of themselves. If they need help, leave that to the government to clear the obstacles or refine regulations on the playing field to be more effective and less cumbersome, etc.; but keep the Fed entirely out. Dethrone it. That would be a much bigger drop in Fed power than most realize because “maintaining a strong and stable labor market” seems so benign but it grants huge overreach into the economy to accomplish that.

2) Leave the Fed with only one job—to maintain a stable currency. And tighten that mandate up by defining “stable” as a currency that experiences 0% symmetrical inflation; i.e. the dollar’s value, as measured in prices, may waver plus or minus 0%, but the average of times up and down must equal ZERO (in other words, like a heat-seeking missile). This is where you dethorn it. The Fed may still need to adjust interest rates to govern how loans create new fiat money in the economy, but you reduce those thorns to where they do no harm when you keep its powers down to doing only what it takes to manage a stable money supply—like the towns on a raspberry bush. Money supply needs to be adjusted to keep up with the size of the population and with growing economic demand as more people consume more.

Holding money to a gold standard actually failed miserably, too, which was why Nixon gave up on that. The gold standard became what we all knew was a total illusion. First, trying to maintain the gold standard required totally rigging the price of gold. Gold prices were set by the government throughout the standard. Gold was even confiscated at one point in exchange for dollars. Even then, the gold standard also required backing the dollar by less and less gold because the US couldn’t buy up enough gold, even at those artificially lowered gold prices! (If you’re a gold-bug, the kind of government-rigged gold prices we had throughout the gold standard are not really what you want either. Let’ gold run free! It doesn’t when the government needs it not to.)

The “gold standard” deteriorated to the point prior to Nixon where the idea of a gold-backed dollar had already become preposterous because we all knew each dollar was only backed by about ten cents in gold. You could still get all of your money back in gold or silver so long as there was no major run on the dollar. There was enough gold to cover everyone 10% … or whatever the final dismal level was that we hit before Nixon gave up on maintaining the façade. I remember plenty of grumbling about how the dollar of the day was only worth about ten cents in gold before Nixon ended the gold standard.

If you mandate that the Fed maintain the Fed’s fiat money for no inflation, then clearly you end the inflation problem. The greatly diminished (therefore less stinky) Fed has one simple job left: maintaining money supply at a level that is neutral with respect to the size of the US economy and population. The Fed has several big, standard tools it uses all the time to do that. However, you also limit the reach of its thorns in terms of how much it can play with interest rates and its other tools because it can only intervene as much as necessary to keep the dollar trim.

You don’t have to be on a gold standard to limit the Fed’s room to play. (And it’s better for gold bugs if you’re not because it also keeps the government from the temptation of setting the price of gold or confiscating it, as the government did for a very long time. That also leaves gold completely separate from US money in case US money fails! You don’t want government-regulated gold prices when money fails.) You can set a zero-inflation standard with a simple stroke of the law, and make sure Team Fed knows they will be fired in the next round of appointments if they fail to achieve it. It leaves them very little room to mess with things.

If you end the Fed’s labor mandate, you strip away its power over the entire economy.

In "The Case Against The Fed," Murray Rothbard notes, "The government and the central banks are inherently inflationary. The Federal Reserve, as the monopoly issuer of currency, has persistently increased the money supply, leading to continuous devaluation of the dollar and inflation."

Then make it a constitutional mandate to achieve 0% symmetric inflation, and limit what it can do with that simple demand.

Now here it is:

The GoldSeek Radio Nugget I did over the weekend with Chris Waltzek talked about the sudden critical juncture we hit on Friday that proves we are now in recession (as close to proof as anything ever gets in economics). The new recession is, once again, thanks to the Fed failing spectacularly at evening out business cycles and amplifying them instead. We enter this recession while still fighting Fed inflation, thanks to the Fed running amok on how much money it created to Fed-feed Trump and Biden largesse during the government-created Covid financial crisis.

I had hoped to be able to link to the interview on Monday when the world fell apart for a day because everything Chris and I talked about on Saturday morning was validated by Monday’s market news. (And note that Tuesday’s “textbook turnaround” did not end the meltdown, as I wrote would likely prove to be the case. All indices tried to prove the “recovery” score by reaching for another bold recovery shot, but that failed with the Dow ending down 234 points and Nasdaq down 1%. The conversation was also validated by what Claudia Sahm said in her own interview in The Daily Doom headlines on Monday. Here it is: