“There is a growing recognition that the much-heralded V-shaped recovery is not going to happen beyond a temporary recovery following lockdowns. That being the case, the Fed is committed to unlimited monetary inflation, which is already undermining the dollar, the trade weighted version of which continues to decline.” – Alasdair Macleod, Goldmoney.com

Institutional investors have maybe 0.5% of their assets invested in the precious metals sector. At the peak of the gold/silver in 1980 institutions had 5% invested in the precious metals sector. Since then that allocation has not been above 1%. Eventually a monster move is coming in silver and the mining stocks, though no one can say when it will occur.

The catalyst for the move will be large institutional and wealthy investors reallocating cash from the stock market in general into mining stocks. I believe Buffet was a harbinger of that even though he only bought a small amount of Barrick in relation to the size of Berkshire’s assets.

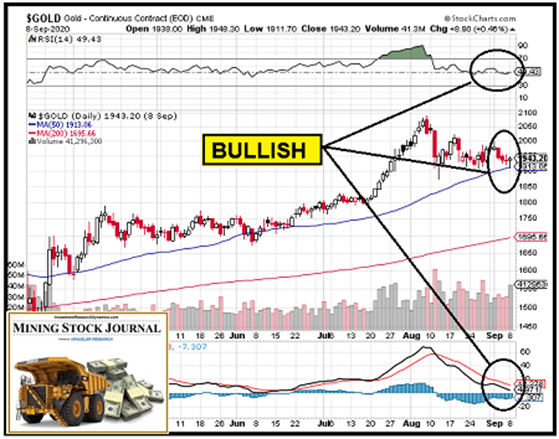

The overrbought condition that developed in July/early August is now neutral/oversold per the RSI and MACD indicators. Yesterday gold bounced off its 50 day moving average. Technically gold (and silver) is set up for a bullish move.

In addition, based on the data from India which reflects gold import activity (from John Brimelow’s Gold Jottings report), India started importing dore bars Monday and soon will be importing kilo bars. India has been absent for the last three weeks.

September through December is the seasonal period when India imports its most gold on an annual basis. This will have the effect of exacerbating the already tight supply of gold available for delivery to buyers who demand actual physical delivery rather than leaving purchased gold in bank custodial vaults. A groomsman in India dare not show up to a wedding with just a receipt for gold purchased to give to his bride.

Chris Powell (GATA.org) also pointed out several more factors that indicate the potential for a monster move in the precious metals and mining stocks:

— the smashdowns don’t work as they used to, seldom more than a couple of days;

— volatility in the metals has exploded;

— the geopolitical situation is growing more strained, not less;

— The U.S. and European economies are wrecks – the massive money printing directed at the deferral of financial and economic collapse functions as rocket fuel for gold/silver.

Furthermore, Chris points to the obvious indications that the supply of physical gold that can be delivered to entitled buyers on the Comex and the LBMA is exceptionally tight:

— The mechanics of the market: the rise and fall of EFPs, the sudden conversion of the Comex to physical off-take, the panicked dance between the LBMA and the Comex, the huge expansion of the Comex’s approved bar list, the failure of the Comex open interest to contract on falling prices, all of which suggest big underlying changes and increasingly tight supplies – whether one disagree’s or not with Andrew Maguire, he has been shouting for months that it’s impossible to get prompt delivery of metal in the LBMA system and is consistent with the unusual behavior exhibited by the CME/Comex and LBMA since April;

Finally, per the research of GATA consultant, Robert Lambourne, BIS intervention in the gold market on behalf of its member Central Banks is at its highest level in years and perhaps its highest level in history for the second month in a row (July and August). Historically BIS gold swap activity has been suspiciously correlate with visible bullion bank efforts to prevent the price of gold from rising.

While the gold price was unable to sustain its move over $2,000 – for now – the overt price intervention efforts over the last 4 weeks has had, at best, limited success. At some point this effort will fail.

Though it can’t be proved without access to the BIS records – and the BIS refuses to comment on its gold swap activities (as does the Fed) – it is thought by many who have evaluated the swap activity that the BIS uses this operation to make physical gold bars available to Central Banks for market interventions and delivery obligations. Likely it is not a coincidence that for most of August both the a.m. and p.m. London price fixings have featured heavy offerings almost daily which result in downward pricing pressure on gold.

All of the above factors lead me to conclude that there’s a high probability that the precious metals sector will stage a big move between now and the end of the year.

**************

A portion of the commentary above is from the latest issue of the Mining Stock Journal. You can learn more about this newsletter by following this link: Mining Stock Journal subscription information

Note: I do not receive any promotion or sponsor payments in any form from the mining stock companies I present in my newsletter. Furthermore, I invest in many of the ideas personally or in my fund.