There will be bear markets about twice every 10 years and recessions about twice every 10 or 12 years but nobody has been able to predict them reliably. So the best thing to do is to buy when shares are thoroughly depressed and that means when other people are selling – John Templeton

The following analysis is an excerpt from the October 20th issue of the Mining Stock Journal. It also was published by Kinesis Money

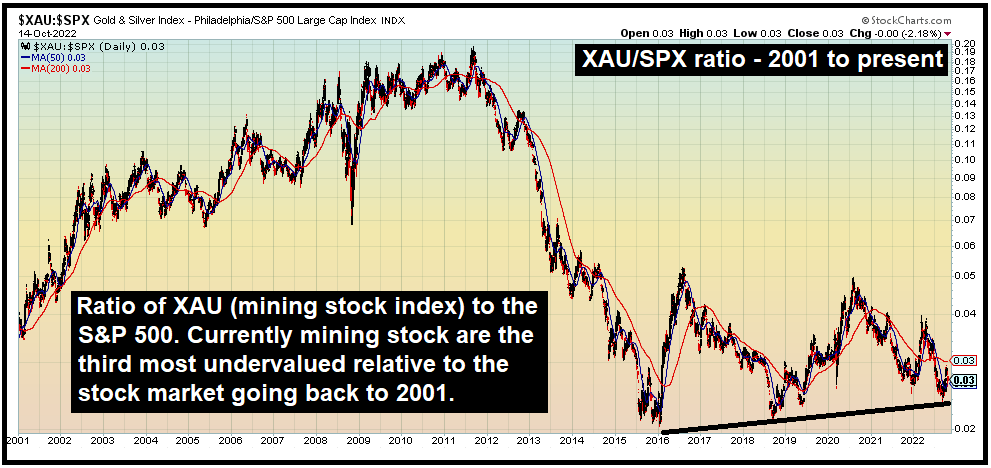

Looking for value in the stock market takes on a few different forms. The most hard core version in my opinion is that of looking for stocks that trade below tangible book value (shareholder equity on the balance sheet), where the value of assets net of intangibles minus liabilities exceeds the market cap of the company. Another flavor of “value” investing is to look for the stocks in companies with good fundamentals that, for whatever reason, the majority of investors are selling or avoiding (contrarian investing). A third version is to look for relative value. This graph is an example of the latter:

The chart above shows the ratio of XAU to the S&P 500 going back to the beginning of 2001, which is when the mining stocks bottomed from the bear market that started in 1980. The chart illustrates the value of the mining stock sector relative to the general stock market only two previous times over the last 21 years. Currently mining stocks are better value relative to the rest of the stock only two times in the last 21 years: at the beginning of 2016, after the vicious 4 1/2-year bear market that began in mid-2011, and in late 2018, when Fed monetary policy caused a big sell-off in financial assets.

Looking at the chart from a technical analysis perspective, the ratio is in an uptrend, which is potentially a bullish indicator for the sector. In 2016 the ratio reflected the fact that the general stock market was rising while the mining stock sector was declining. In 2018 and currently, the drop in the ratio is a function of the fact that mining stocks have been declining on a percentage-basis at a faster rate than the rest of the stock market. However, note that recently the ratio bounced from the trend line, indicating that mining stocks are starting to outperform the S&P 500.

Read the rest of this commentary at Kinesis Money