Most of us had been expecting gold to explode through the $2000 “barrier” and soar into the wild blue yonder. Instead, it spasmed to $2152 for a nanosecond on December 4, then crashed back down below $2000 like an anvil dropped into an elevator shaft. What happened? Gold is most certainly in a bull market, even if the ascent has been tortuous. One might think bull-market psychology would limit the extent to which bullion’s price can be manipulated, especially lower. And it has, evidently, judging from the way the last takedown attempt reversed without even getting close to a prior low at 1955. This is despite the fact that gold’s price is controlled by white-collar criminals who act with the blessings and complicity of regulators and their evil masters in the upper echelons of banking. We suggest that you Google our old friend Andy Maguire if you want to understand exactly how these slimeballs from Wharton, Sloan and Stanford operate. Their mothers actually believe they are respectable businessmen.

Use the Trendline

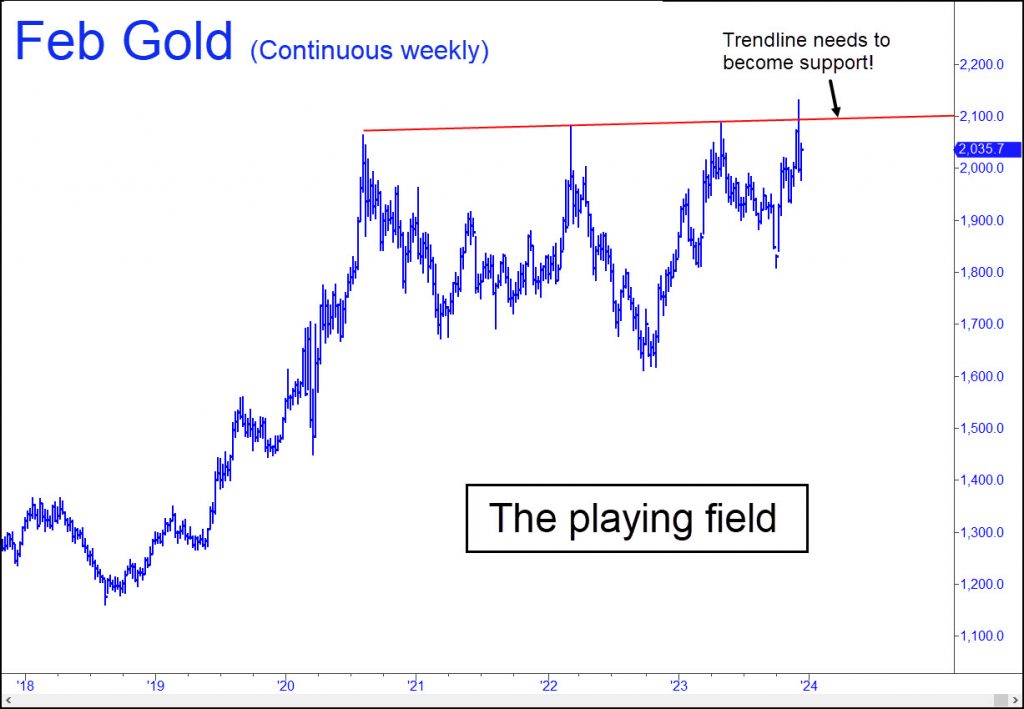

So when might we expect gold to get off the launching pad with enough firepower to turn the bad guys’ pelotas into roasted chestnuts? It is logical to think this will happen when gold has finished consolidating at the $2000 level. However, because it has spent the last year making a muddle of this idea, I’ll suggest using the trendline in the chart above to determine when COMEX futures have broken out for a run-up to at least $2500. That implies a consolidation above $2100 rather than at the ponderously symbolic $2000. A second, decisive poke above $2100 this month or next would hasten the process, especially if the futures can settle above the trendline for two or more consecutive weeks. Bulls can afford to be patient, since anyone with half a brain can see that a global financial crisis is brewing that will become a source of urgent demand for gold (and, yes, for dollars).