FedChair Powell’s “Friday Thunder” echoingly careened throughout the cascading heights of Wyoming’s Grand Tetons, across the nation and ’round the world. “The time has come” rate cut quip resulted in a decided Dollar dip, Gold in turn getting the bid for a gradual grip to barely record a winning week in settling yesterday at 2549, (a scant +3 points above the prior Friday settle of 2546). For ‘twould now appear the Federal Reserve’s Open Market Committee shall — come their 18 September Policy Statement — vote to reduce the Bank’s Funds Rate a pip. Some surmise two. Either way, “hip-hip”.

We say “decided“ for the Dollar, which from mid-year already has been selling off, Friday being the second-worst (on both a points and percentage basis) of the 163 trading days year-to-date for the Dollar Index. And “gradual” for Gold as the post-Powell push wasn’t enough to make yet another yellow metal All-Time High, the most recent having been established this past Tuesday at 2570, (basis December futures).

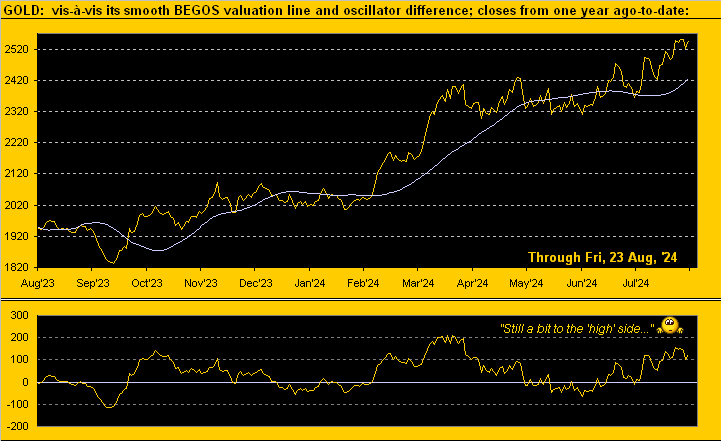

Indeed — as detailed in last week’s missive — we remain sensitive to Gold this year having habitually sold off following marginal All-Time Highs. To wit, after achieving Tuesday’s 2570 level, price within two days plopped to Thursday’s low of 2506. Such -64 points (-2.5%) of price erosion still pales in comparison to every year-to-date post-All-Time High three-figure drop per our prior piece’s table. And in looking at Gold vis-à-vis our BEGOS Markets Value measure (that gauges Gold’s price changes relative to those of the four other primary markets which comprise BEGOS, namely the Bond / Euro / Gold / Oil / S&P 500), we below see that price today at 2549 is hovering +124 points “high” above the smooth valuation line:

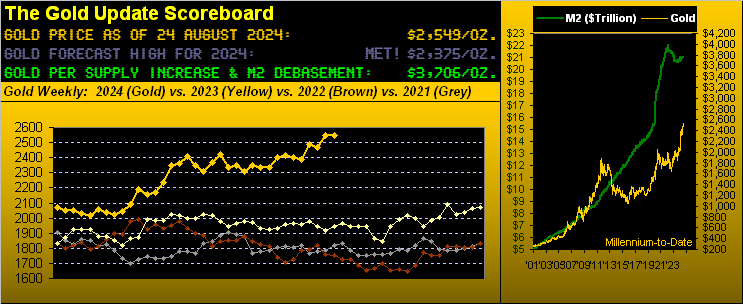

‘Course as we regularly remind — courtesy of the “Keeping One’s Eyes on the Prize Dept.” — per the opening Gold Scoreboard we’ve the current price of 2549 a vast -31% below the yellow metal’s Dollar debasement value of 3706, (including honestly accounting for the increase in the supply of Gold itself). And given history rhetorically repeats, price in due course shall reach up to such value, nearer-term declines en route essentially as noise within Gold’s broader climb.

“Well, careful there, mmb, as price’s 46% decline from Sep 2011 to Dec 2015 can hardly be called ‘noise’…“

And, (as Squire well remembers despite such devil’s advocate aphorism), ’twas leading into those days that we repeatedly wrote of Gold having “gotten ahead of itself”, following which came price’s substantial plummet. However, today — courtesy of the “But Then Comes the Overshoot Dept.” — Gold clearly remains ever so low relative to rampant debasement, just as the S&P 500 is ever so high relative to impotent earnings. To be sure, ’tis written: “The market is never wrong, but it can be terribly misvalued”. Which for you WestPalmBeachers down there implies (assuming one is properly positioned whilst incorporating prudent cash management) means reversion is a beautiful thing.

“They won’t get that at all, mmb…“

But “they”, dear Squire, are vital to taking the other side of the trade. To which let’s segue to the trade of Gold by its weekly bars from one year ago-to-date.

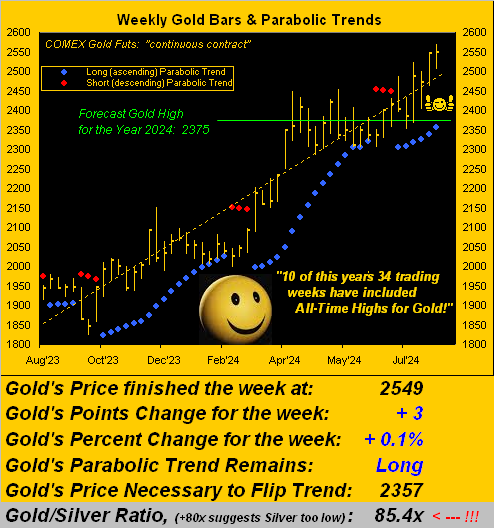

And as therein confirmed, nearly a third of this year’s 34 trading weeks have recorded Gold All-Time Highs, indeed during four of the past six. Note, too, the green line (our 2375 forecast high for this year): it nicely bisects the structural support zone constructed across the prior few months (for those of you scoring at home seeking a “buy on the dip” point). Indeed from the current All-Time High of 2570, a run down to at least 2375 would be in line with the afore-referenced table from a week ago as to price pullbacks following marginal All-Time Highs. As for the Gold/Silver ratio now 85.4x, ’tis at its lowest closing reading since this past 30 July, (albeit still well-above the century-to-date average of 68.4x). ![]() “Don’t forget the Silver…”

“Don’t forget the Silver…”![]()

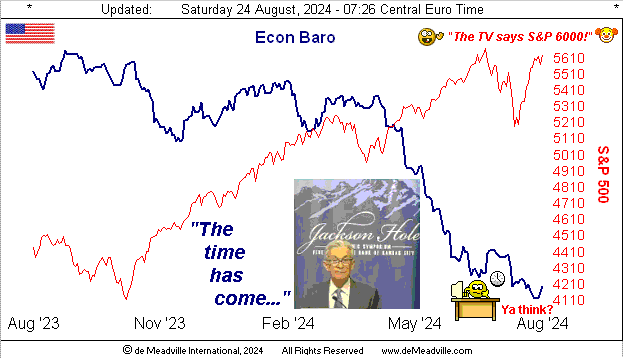

Forgettable, however, remains the Economic Barometer, although it ticked higher into week’s end on improved Home Sales, both Existing and New. Yet surprising to all who do not follow our Econ Baro, (i.e. six-figure analysts, the FinMedia, and parroting pundits) was the Conference Board’s report of “Leading Indicators” having dropped -0.6% for July, twice as poor as experts’ “expectations” for only a -0.3% demise.

But ’twas hardly a surprise to the wise who monitor the Baro, for ’tis been plainly bad, (which is why we regularly refer to said report as “Lagging” rather than “Leading”). And for the Fed (as ’tis said) “being behind the curve”, clearly that is the case. Our case for a rate cut back on 31 July did not come to pass, which lends credence to a two-pip reduction on 18 September. But then the optics would be poor for the Fed being too slow, thus we think ’twill be but one pip they’ll go. Either way, as you know, the truth remains in the Baro:

More truth be told, the S&P 500’s August rally (from the 5th’s low of 5119 to the 22nd’s high of 5643, a 14-trading day gain of +10.2%) is quite vapid of supportive MoneyFlow, as we again “X’d” (@deMeadvillePro) this past Thursday. Here below from the website is the MoneyFlow (regressed into S&P points) relative to the change in the Index itself for the past week, month and quarter. Obviously the MoneyFlow’s leading characteristic portends this rally’s staying power as unrealistic:

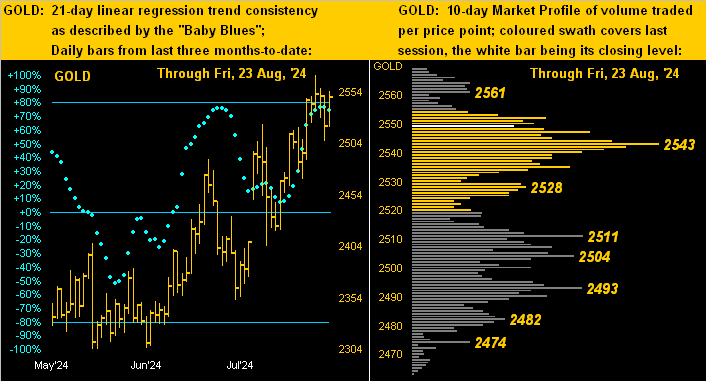

Add in the fact that the S&P is now seven trading days “textbook overbought” along with a “live” price/earnings ratio of 41.5x and The Herd is facing GERD, (a little medical lingo there). Healthy, however, is Gold, below for which we’ve the two-panel display of daily bars from three months ago-to-date on the left and 10-day Market Profile on the right. The baby blue dots of linear regression trend consistency are just now running out of puff, which coincides with the notion of near-term price pullback following this year’s marginal All-Time Highs. Still by the Profile, there’s volume trading support from 2511-to-2493, (but we’ll see…):

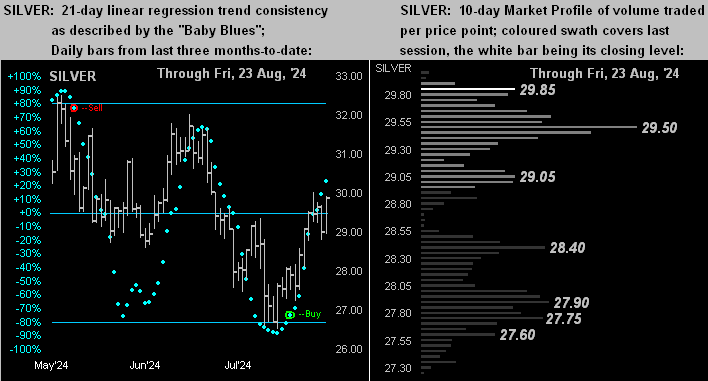

But again using the same construct for Sister Silver, the picture remains a bit different, her having been carrying on of late with Cousin Copper. Note in her daily bars (below left) the two encircled baby blue dots. You regular readers and website followers already know the drill here, but as with the passage of time we pick up new folks, here’s how the leading attribute of the “Baby Blues” works:

- When after having been above the +80% axis the “Baby Blues” confirm piercing beneath it, we view that as a “sell” signal. And instead, ’tis a “buy” signal if eclipsing up through the -80% axis.

Reprise: “Follow the Blues instead of the news, else lose yer shoes”:

Meanwhile by Silver’s Profile (above right) there’s quite a dearth of trading between 29.05 and 28.40; thus the white metal could readily slip through that zone, and certainly so should both the yellow and red metals endure some near-term decline.

In sum, Gold looks great even should anticipated decline near-term dominate. And specific to the Fed, soon after the Chair’s remarks yesterday — our instead purely watching markets’ reactions — we internally messaged this notion:

“Haven’t a clue about Powell’s remarks (didn’t listen) but all eight of the BEGOS Markets are doing well, whilst the Dollar has made a nine-month low. So … ‘guess’ is Powell gave relative assurance for an 18 September rate cut. ‘Course, they’re not really supposed to ‘tip their hand’. But a benign PCE is expected next week which would certainly lock in a rate cut.”

Thus a little deMeadville inside baseball there. Or as was recently quipped: “Ya can read deMeadville, or ya can wait for everyone else.”

“You tell ’em, mmb!

‘Tis always a gradual team effort, Squire, leading off decidedly with Gold!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro

deMeadville. Copyright Ⓒ 2010 - 2024. All Rights Reserved.