Gold is often criticized by Wall Street as kind of a useless investment.

Institutional investors prefer assets thought to contain the potential for growth, or “sprouts”. An investment has to produce a growing revenue stream – if it doesn’t grow it doesn’t compound. Gold is rejected as an investment because it doesn’t produce sprouts, meaning without a dividend or yield, the steady income and systematic growth sought after by institutional investors isn’t there.

But gold performs two jobs that fiat currencies, or any other financial innovation, cannot do; first, it acts as a safe haven in times of turmoil, second, as a store of value.

Nowadays the only people and institutions who own physical gold (bars and coins, not jewelry) are central banks and those who distrust the monetary system – people who see gold as a hedge against inflation, and/or want to own it as insurance against some calamity (e.g. banking system collapse), when getting access to cash is difficult or impossible, and paper currencies plummet in value.

Most people think such an event is so unlikely, they disregard the idea of owning gold or returning to the “barbarous relic”, as economist John Maynard Keynes referred to the gold standard in his 1924 book on monetary reform, suggesting gold had outlived its usefulness.

In reality there are many instances of how gold came to the rescue of states on the verge of collapse, and a number of frankly terrifying scenarios that could destroy the meaning and value of today’s money in a heartbeat.

Historical examples include the fall of Saigon in the 1970s, when safe passage on a departing ship was paid for with 10 to 12 “taels” (1 tael = 1.2 troy ounces) of 24-karat gold for an adult and half that for a child; Argentina, where the precious metal is turned to during economic crises, such as in 1989 when prices rose by 5,000%; Venezuela, whose collapsing currency, the bolivar, recently led to hyperinflation, shortages and social unrest, and where gold is used to buy food and everyday goods; and Zimbabwe. The poster child for hyperinflation reached peak madness in January 2009 when a 100-trillion-dollar note was printed – the largest currency denomination ever issued. People’s savings were completely wiped out, leading to food shortages and famine. Many were forced into illegal gold panning just to scrape together enough gold to barter for food. Cooking oil, soap and grain, all were exchanged for gold. “Without 0.3 grams of gold a day you would not survive. Without gold you would have died,” recounts a resident who fled Zimbabwe in 2008, quoted in Bullion Star.

Gold is also thought of as a store of value. The precious metal is proven to have held its worth over time. Investors therefore see it as a way to preserve wealth, unlike paper or “fiat” currencies which are subject to inflationary pressures and over the years, lose their value.

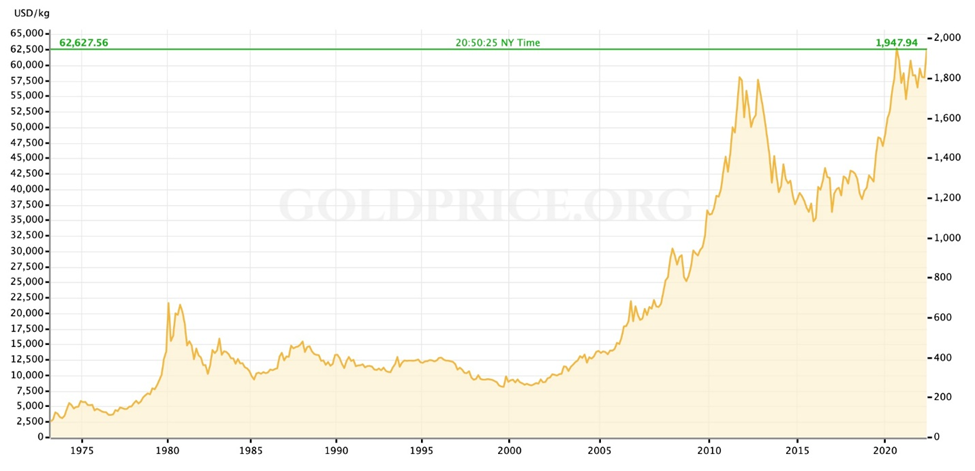

In 1913 (the year the US Federal Reserve was born) when the US dollar was a dollar, gold was US$20 an ounce. 119 years later, the dollar has lost 95% of its purchasing power and gold is hitting fresh highs of $2,051 an ounce.

Historical gold price. Source: Goldprice.org

Historical gold price. Source: Goldprice.org

Gold gives all of us something that fiat money or any other financial innovation, cannot deliver. Gold is insurance, sprout-less yes, but irreplaceable in its functions.

If anyone knows this, it’s Vladimir Putin.

The Russian Central Bank started significantly increasing its gold purchases in 2014, the year Russia was sanctioned by the United States for invading Crimea, the strategically important peninsula in southern Ukraine. The country’s gold pile is now the fifth largest in the world and valued at around $140 billion.

Clearly Putin was directing the central bank to buy gold as insurance for a future scenario, when the country might need to sell gold to support a plunging ruble.

After Russia invaded Ukraine on Feb. 24, the Russian ruble fell to a record-low 110 to the US dollar. It continued falling (rising numerically) to 150 on March 7, the day the US said it would ban Russian oil imports. While the ruble has recovered some of its lost ground, the exchange currently sits at 1USD=97.1693RUB, still well into record-low territory.

Source: XE.com

Source: XE.com

The question on a lot of people’s minds, is whether Putin and his circle of savants can access Russia’s gold reserves to help skirt Western sanctions and thereby stave off a recession? What options are available to the nation that has fast become a global pariah?

To answer this question, we first look at the effect Western sanctions are having on the Russian economy.

Two days after the invasion, the US, Canada and European allies agreed to disconnect a handful of Russian banks from SWIFT, the Society for Worldwide Interbank Financial Telecommunication.

The affected banks are Bank Otkritie, Novikombank, Promsvyazbank, Bank Rossiya, Sovcombank and VEB. Being cut off from the global messaging system for banks and other financial institutions, means that individuals and companies using those banks will have difficulty borrowing money or investing money across national borders, receiving cash for exports and paying for imports. As Time put it, “access to the system is all but necessary for conducting business overseas.”

Couldn’t Russia use alternative means? Well, yes. The problem is they are far smaller than SWIFT, used by over 11,000 financial institutions which send around 38 million messages daily. After the 2014 Ukraine crisis the Bank of Russia created its own financial messaging system but it only has about 400 users. China’s CIPS system has about three times the FMS’s users, but SWIFT has nearly 10 times as many users as CIPS. Also, China may be reluctant to welcome sanctioned banks lest it jeopardize its use of SWIFT, the Washington Post pointed out. Executing transactions over phone or fax, or by using credit/ debit cards, are outdated technologies that can’t scale up to Russia’s needs.

So for now, kicking Russia out of SWIFT is proving to be an effective economic weapon.

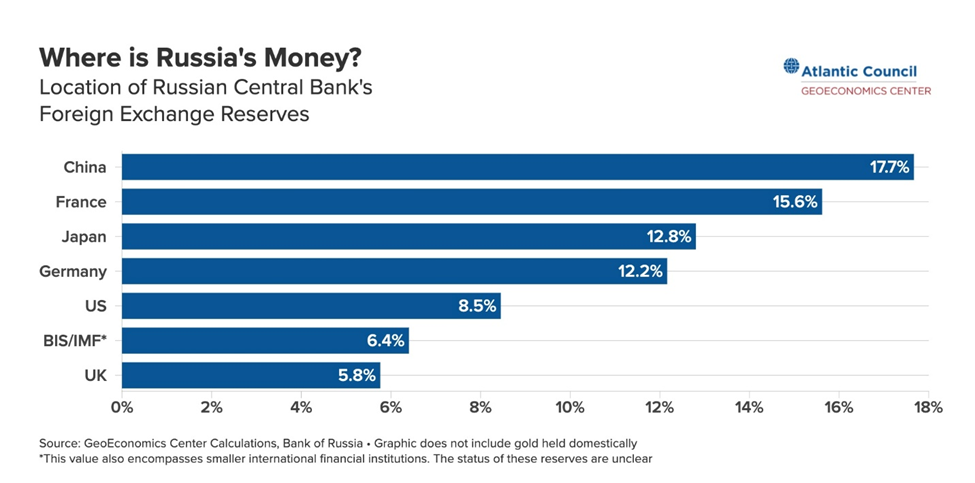

The bigger hammer came down the first week of March, when the United States and Europe sanctioned the Central Bank of Russia (CBR). By freezing the bank’s assets in their jurisdictions, Western allies hoped to deprive Russia of its $630 billion stockpile in reserves.

As of March 13, about $300B, nearly half of the gold and forex reserves held by the CBR, had been frozen, according to the Post.

Source: Atlantic Council

Source: Atlantic Council

Apparently Russia’s central bank, unlike the US Federal Reserve, has never leant out more than what it had backed up in foreign exchange reserves. Now, to ensure it has enough dollars to lend to the banking system, the CRB is forcing exporters to convert 80% of their revenue into rubles, limiting non-residents’ ability to withdraw capital, and the ability of Russians to take cash across the border. The Finance Ministry has also reportedly introduced a “capital amnesty” allowing residents with savings abroad to bring them back to Russia with few questions asked about taxes or criminal activity.

If Russia is barred from using SWIFT and from accessing its foreign exchange reserves — a major limitation on a government’s ability to control the value of its currency — what are its other options?

Some have said now is the time for the Kremlin to turn to cryptocurrencies like bitcoin. However, while ordinary Russians will likely find some relief from a plunging ruble and Western sanctions by adding to their crypto wallets, we don’t expect the same to be true on a macroeconomic scale.

The founder of Binance, a cryptocurrency exchange, was quoted in Fortune March 6 saying that “crypto is too small for Russia.”

“If we look at the crypto adoption today, there is probably about 3% of the global population with some kind of crypto exposure (i.e., owning some crypto),” Changpeng Zhao said. “Of those, most only have a small percentage of their net worth in crypto… There is probably only less than 0.3% of the global net worth in crypto today. “This percentage applies equally to Russia.”

Moreover, the use of blockchain, which is publicly accessible, makes it too traceable for the likes of the Kremlin trying to skate around economic sanctions. On Feb. 28 Binance announced it would not process transactions by sanctioned Russian individuals or entities.

Source: Google

Source: Google

That brings us to gold.

One would think that an unprovoked attack on a neighboring nation, followed by a swift, pun intended, excommunication from the international financial system, sanctions on big Russian companies and oligarchs, and a freezing of its foreign exchange reserves, would be the ideal conditions for an autocrat like Putin to “get gold”. This was obviously his intent, having built up the CRB’s gold accumulation to the fifth largest in the world.

What Putin didn’t bank on was the coalescing of international support for Ukraine and the symmetry of opposition against him.

Bloomberg noted on March 6 that Sanctions forbid US, UK and EU institutions from doing business with Russia’s central bank. Traders and banks are wary of buying the country’s bullion indirectly or using other currencies out of fear of reputational damage or falling foul of penalties. And senators in Washington want secondary sanctions on anyone buying or selling Russian gold.

Indeed a bipartisan group of senators is working with the Treasury Department to prevent Russia from liquidating its giant bullion stash, according to Fox News potentially blocking one of the Kremlin’s last methods for circumventing punishing financial sanctions.

The legislation, which could pass as soon as this week, would impose secondary sanctions on any US entities knowingly buying or selling Russian gold.

There has also been resistance from two of the largest commodities exchanges to deal with gold from Russia. Earlier this month the London Bullion Market Association and the CME Group suspended six Russian gold refineries from their accredited lists, amounting to a ban on new Russian bars entering the key London and US markets.

Still, there are ways to get around such restrictions, both legal and illegal. Never one to follow the rule of law, it’s likely that Putin will take advantage of whatever loophole he can find.

One option is to sell gold domestically to buy rubles. If Russia does this at a fixed price, the same way the United States did when it was under the gold standard (1 gold oz = US$35), rubles would be convertible to gold, and vice versa, amounting to an internal gold standard.

If this seems far-fetched, consider the sources: US multinational investment bank Citigroup and Switzerland-based Credit Suisse both mentioned it in the above-cited Bloomberg article:

“If things get worse, you could basically re-anchor to a pile of gold,” Credit Suisse Group AG strategist Zoltan Pozsar said on Bloomberg’s Odd Lots podcast. “You need an anchor in situations like this.”

To me that sounds an awful lot like a gold standard. If Russia were to take it a step further and peg its currency to gold, it would instantly stop the free-floating ruble’s slide in foreign exchange markets. Again, if this seems out of left field, the idea surfaced during the last Russia-Ukraine war in 2014. At that time, CNBC quoted Alasdair MacLeod, the head of research at online bullion exchange GoldMoney Foundation, stating,

“It was (and still is) in Russia’s power to adopt a gold standard. There is no doubt that Russia and China, plus the other Eurasian states in their sphere of influence are all accumulating gold and the indications are they see it as central to replacing the U.S. dollar for cross border trade.”

Arguably little has changed, eight years later.

The extent to which China can, and will, help Russia out of its current economic troubles is beyond the scope of this article. Suffice to say, even before the invasion, the two countries were cozying up through a “no limits” strategic partnership they said was intended to counter Western influence.

As for who would buy Russian gold, China is the obvious answer. The country has increased its gold holdings significantly in recent years, adding nearly 900 tons between 2009 and 2021. Beijing, one observer writes, may be keen on adding to those holdings, fearing it may face Russia-style sanctions in the future for its own foreign policy actions. Third, buying on the shadow market would give China leverage to demand a below-market price for for the metal, which is quite expensive presently. Finally, with a 2600-mile land border between the two countries, shipping gold from Russia to China in exchange for cash, goods, or services would be relatively easy — and difficult to track.

Other possible gold-trading partners include countries that have been sanctioned by the United States and want to avoid future sanctions, such as Turkey, Iran and Venezuela. It’s a known fact that gold bars were flown aboard charter planes from Venezuela to various destinations including the UAE and Turkey, where they were exchanged for euros, then doled out to Venezuelan banks.

Criminal groups are another potential buyer of Russian gold, which could be transported and sold in places like Uganda or Dubai where the above-mentioned source says thriving illicit gold markets are used by criminals and kleptocrats to launder money.

Conclusion

Western sanctions on Russia’s central bank have proven the vulnerability of any country holding cash in its foreign exchange reserves. Bitcoin is a fad that has no real value, in fact it’s worse than cash, it only exists on a computer screen. Gold performs two jobs that fiat currencies, or any other financial innovation, cannot do; first, it acts as a safe haven in times of turmoil, second, as a store of value.

Russia hasn’t yet reached the point of having to liquidate its gold reserves or setting up a gold standard but the fact that we are even talking about the “barbarous relic” this way, to me speaks volumes about the continued importance of gold in a crisis.

When the proverbial shit hits the fan, when cash is trash and bills need paying, imports priced in US dollars must be bought, where do people like Putin and Venezuela’s Maduro turn? They turn to gold.

Of course it’s not only desperate dictators that have a hankering for the precious metal at the present time. Banks are suddenly buying bullion like it’s going out of style. According to a March 18 column by Peter Schiff, ‘Banks are restocking gold at fastest pace in years.’

Schiff, a gold bug, states “This is the largest inflow since October 2020 and we are only halfway through March!” before coming to the conclusion that “The Comex gold market has been flashing warning signs since early January. This continues to be the case. The latest influx of metal further supports the notion that banks are preparing for higher delivery volume and potentially higher prices.”

Tying into the gold bull narrative is the inflationary dynamic at play throughout most of the world’s developed economies, that has prompted the US Federal Reserve to “go hostile” with a series of planned rate hikes that could bring the overnight lending rate to 3.25% by the end of this year.

Fed Chair Jerome Powell’s 11th hour conversion from fiscal dove to hawk is almost certain to crash the stock market, pushing investors out of stocks and bonds and back into bullion.

Recall the last time the Fed tried to hike interest rates, from 2015-18, it only got to 2% before the markets tanked and the central bank was forced to re-instate quantitative easing.

At that time inflation wasn’t a problem. Now it’s running at double digits, if we go by the Producer Price Index. Gold is a tried and true hedge against inflation, the enemy of investors expecting a yield.

We also have a war that is keeping commodity prices high, militaries re-arming, record amounts of sovereign debt, negative real interest rates — all swirling into what we see as the perfect storm for gold.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.