Let's begin with this apologetic correction: we've oft-quipped that Federal Reserve Chair(man) Powell shall come to the aid of former FedChair now U.S. Secretary of the Treasury Janet "Old Yeller" Yellen upon her depository's default. Wrong we were. To quote the Chair(man) from his testimony this past Wednesday to the House Financial Services Committee:

"...No one should assume that the Fed can protect the economy from the non-payment of the government’s bills, let alone a debt default..."

Sorry Mr. Chair(man).

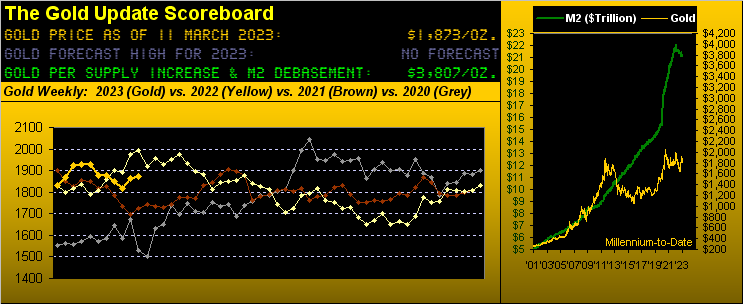

Thus were the magic words leading Gold to ultimately persevere after initially being spooked this past Tuesday during the Chair(man)'s testimony to the Senate Banking Committee. Specifically with Gold having settled a week ago at 1863, it took quite an interest-rate-hawkish "Powell Pounding" to as low as 1813 through the traditionally-tagged two-day "Humphrey-Hawkins Testimony". But by week's end, Gold settled yesterday (Friday) at 1873, the 1851-1798 support zone have again survived a key test.

Here 'tis graphically per Gold's weekly bars from one year ago-to-date, the current red-dotted parabolic Short trend now four weeks in duration, even as price resiliently perseveres past Powell (with a boost from the first bank gone bad):

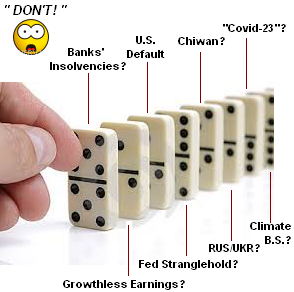

Still, although the Fed rather immaterially continues to shrink the U.S. Money Supply (M2 basis from the 18 April 2022 peak of $22.1 trillion down to now $21.1 trillion), by Dollar debasement Gold today at 1873 is but 49% of our (conservatively) realistic Scoreboard value at 3807. But debasement alone is not the only Gold positive given our upgraded -- dare we say even more ominous -- state of the dominos:

The leftmost domino is of course all the FinMedia rave at present. And to be sure, whilst likely buoying Gold a bit more, banking liquidity (or lack thereof) has begun to weigh on the stock market. However: any real "fear" such that we saw from 2008 into 2009 has yet to appear as portrayed per the website's S&P 500 MoneyFlow page. For be it by the weekly, monthly or quarterly measure, the S&P's MoneyFlow suggests the Index itself "ought be" as much as +300 points higher than the current 3862 level.

'Course with the S&P's live price/earnings ratio at 40.5x, the Index "ought be" well lower by at least -1000 points, (that's being kind). Which is why we're already on record (per our 28 January missive) for the S&P to trade sub-3000 as we watch this year unfold. "Got Gold?"

As to that bank having in a heartbeat gone into receivership over in Silly Con Valley, we shan't dwell on it given all the media coverage other than to ask "Who's Next?" --[The Who, '71]. But: we muse over a bank unable to monetize its deposits as a mere microcosm of the StateSide Money Supply (again $21.1 trillion) alone being inadequate to monetize the market capitalization of the S&P 500 ($33.7 trillion per Friday's settle). Which means (as we've previously explained for you WestPalmBeachers down there) that if all S&P 500 constituents' shares were sold, some 50% of those invested would receive $0 (zero).

Thus with respect to next equities crash, you regular readers well know our dubbing it to be the "Look Ma! No Earnings!" crash. But in reviewing the above dominos, at the end of the day, one might more comprehensively dub it the "Look Ma! No Money!" crash.

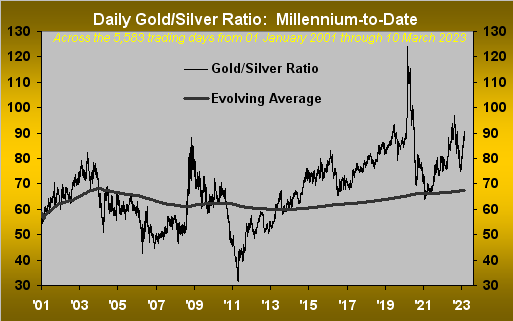

Again regarding Gold, yes its net change for the past week was a rather muted +0.5%, albeit the gain from the intra-week low was +3.3%. However, dear ol' Sister Silver continues to lack pace, the Gold/Silver ratio now topping 90x for the first time since last 09 September. And at the request of a most-valued Gold Update charter reader from a-way back in 2009, here we've the millennium-to-date Gold/Silver ratio by the day along with its ever-evolving average:

So for that ratio (now 90.9x) to revert to its evolving average (at 67.4x) -- given there's nothing fundamental at all for Gold to fall -- the price of Silver "need rise" from its present 20.61 level to 27.79, which for those of you scoring at home would be a gain of +26%. (Or if you trade the Silver Futures for which the initial margin/contract is $9,350, such 7-point gain at $5,000/point = +$35,000, i.e. a return on margin of 374% ... just an observation). "Got Silver?"

As to aforementioned FedChair(man) Powell, he wasn't the past week's only presenter to Congress. One Mark Zandi of Moody's testified that: "...A default would be a catastrophic blow to the already fragile economy..." which CNN then embellished with "A breach of the US debt ceiling risks sparking a 2008-style economic catastrophe that wipes out millions of jobs and sets America back for generations..." The good news here is at least ~finally~ that over which Gold analysts have cautioned for years is actually getting a modicum of mainstream notice.

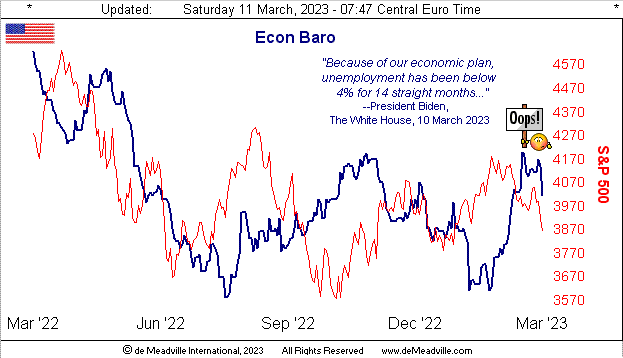

So is inflation: a wee patisserie here just increased the price of our morning café crème from €1.90 to €2.50 ... that's a +32% nudge. There goes the budget. And here goes the StateSide economy:

To put this past week's plunge into perspective, even as three metrics showed improvement (ADP Employment, Wholesale Inventories and Consumer Credit), eight were worse (yes, Joe, the Unemployment Rate, Non-farm Payrolls, Hourly Earnings, the Average Workweek, Initial Jobless Claims, the Trade Deficit, Factory Orders and -- if she still has one -- Yellen's Treasury Budget). And the squeeze looks to continue with a return to +50 basis-point FedFunds' rate increments per the upcoming Federal Open Market Committee's 22 March Policy Statement, (a move to which we first alluded in our 04 February missive).

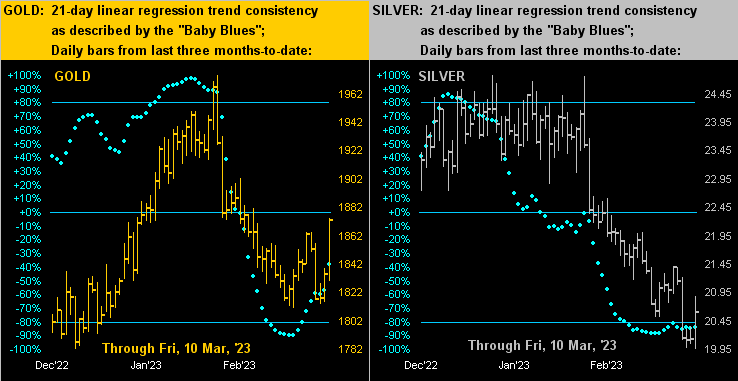

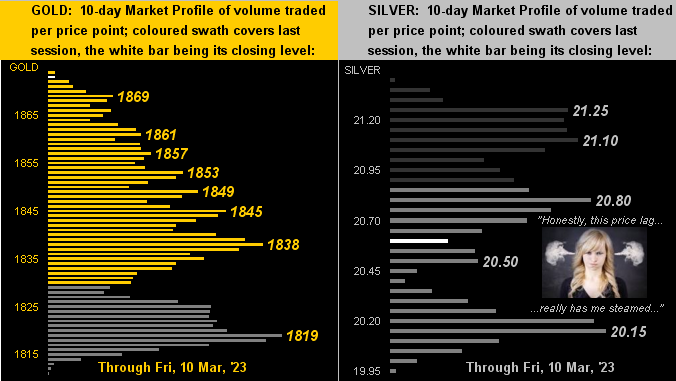

Further for Gold, its post-Powell + bank receivership response rightly squeezed the Shorts as we go to our two-panel graphic of the yellow metal's daily bars across the past three months on the left and those for the white metal on the right. And with reference again to the Gold/Silver ratio, here you clearly can see Gold getting the better bid over Silver:

Too, reinforcing that displayed a week ago in turning to the precious metals' 10-day Market Profiles, Gold (below left) remains atop its stack, whereas Sister Silver (below right) stays mid-pack:

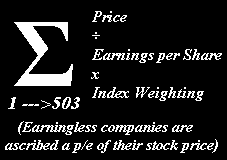

We'll wrap it for the week with this from the "Blatant Dishonesty Dept." Herein we regularly harp upon the excessively high (understatement) price/earnings ratio for the S&P 500, (as noted now 40.5x using "trailing twelve month earnings"). But if you do an internet search for same, the response is only 21.3x. How can that be? We thus decided to see. And per a highly-visible website (which we shan't credit to avoid embarrassing it) comes its S&P P/E calculation: "The sum of all the stock prices divided by the sum of all the earnings per share."

Heinously Erroneous! In fact, we ran that very calculation and came up with an immaterially different 22.0x. 'Course, there are two gross errors in doing that:

■ No.1 --> of the Index's 503 constituents, 41 of them are earnings-less; but because they're included in the erroneous calculation, that in turn materially dumbs down the P/E. If you ain't earning money, your P/E ratio is infinity, (which inclusively would make the entire P/E of the S&P infinity). That error is thus avoidable by assigning the price of each earnings-less stock as its P/E (conservatively giving it $1/share, but in reality stating that you're paying $X for something that earns nothing).

■ No.2 --> the erroneous calculation also assigns equal weight to all 503 constituents. In other words the earnings generated by Apple (AAPL) -- the market cap for which today is $2.4 Trillion -- is given the same weighting as the earnings generated by Lumen Technologies (LUMN) the market cap for which today is $2.8 Billion, i.e. a tiny 0.1% (one-tenth of one percent) that of AAPL. (Note: LUMN which is earnings-less is being booted from the "500" to the "600" effective 20 March).

Thus the bottom line formula as we on occasion display remains The Truth:

Now persevere and go get some more Truth: go get some Gold and Silver!

Cheers!

...m...