STORY AT A GLANCE – week ending November 27:

- Gold prices made a significant low during November or December in 8 of the last ten years. Gold prices are low and over-sold as of Nov. 27.

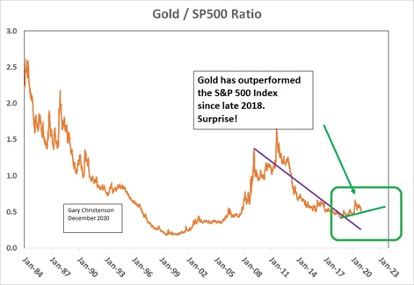

- The gold to S&P 500 ratio shows gold is inexpensive compared to the S&P over four decades of history.

- Gold and silver price lows are due now—which means between mid-November and late December. Now, or soon.

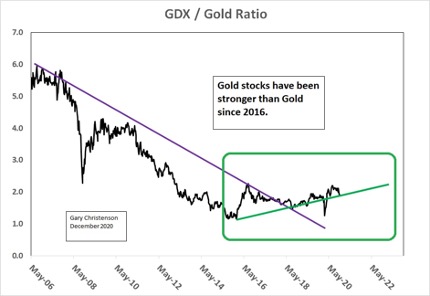

- The GDX to gold price ratio bottomed in 2016. Expect gold to rally and gold stocks to rise faster in the coming years.

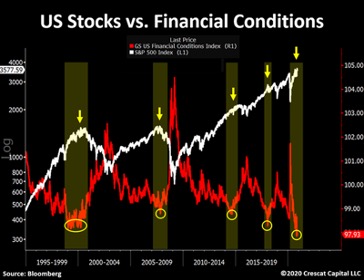

- Stocks are making new highs. Craziness in politics and monetary policy are “off the charts.” Beware the consequences of both.

‘Tis the season for:

- Election fraud—every fourth year, regardless of who is mismanaging government and elections.

- Stock market euphoria—the Dow hit 30,000.

- Political nonsense – never ends.

- Central bank “printing.” Their season runs from January 1 through December 31 of every year. Global CB creation of currency units exceeds $28 trillion.

- Gold market selloffs. The gold market is crushed almost every year at this time.

- It is a time for “Ho, Ho, Ho” by the fiat currency and massive debt advocates because, once again, they have beaten down gold prices.

- Fiat currencies are celebrated. Gold is disparaged.

The events are predictable. Let’s explore:

Election fraud: It happens during every Presidential election. The people counting the votes are more important than the actual votes. Dead people have been voting for decades. If the Powers-That-Be wanted it different, then voting could be honest. As it is…

Stock Market Euphoria: Print many $trillions from “thin air” and shove it into the stock market. Bingo – the market makes new highs—a Santa Claus rally. No mystery here. Eventually those extra $trillions boost prices for gold, silver, crude oil, housing, and food. Then politicians and central bankers will blame speculators, Russians, Chinese, or the other political party for their mistakes and corruption.

Gold Market Selloffs: Examine the chart of weekly gold prices over a decade. Note the green ovals around significant lows near the end of each calendar year, except for 2012, which does not fit the pattern.

SO WHAT?

- Because gold prices show a reliable pattern of year-end lows, the recent weakness in gold prices (down $90+ this week) is consistent with the past ten years. Higher prices lie ahead, after the price crash is complete. It is a paper market, so deeper lows are always possible.

- The lows for the past ten years average 345 days into each calendar year – about December 10th.

- Gold and silver price lows are due now—which means between mid-November and late December.

- The recent year-end lows for 2018 and 2019 occurred in mid-November. Gold prices in 2020 have fallen hard since their all-time high in early August. Gold fell under $1,780 on November 27 and silver fell below $22.50. Maybe this week saw the low, maybe not.

THIS GUARANTEES NOTHING! Oh dear!

Why? The paper markets determine gold prices. It’s easy to sell a few $billion in paper gold, crush prices on COMEX, and buy paper contracts back for a huge paper profit. No real gold exchange occurs. Fake money creates fake prices.

Our managed news services are biased. The media do not appreciate gold. But we’ve suffered through this for decades.

As Richard Russell once said, “Where are cycles when you need them?” Cycles and patterns are helpful, but they do NOT guarantee price action.

Prices for metals are erratic in our crazy and manipulated global economy.

CRAZINESS: Global financial policies and political events are crazier than usual. Consider:

a) Portuguese 10-year bonds yield less than 0.0%. Why would an investor buy those bonds unless they expected the ECB to bail them out? Front running central banks can be profitable.

b) Two California churches are now “family friendly strip clubs” since California banned church services, but not strip clubs. COVID craziness struck many blows upon good sense and rational thinking.

c) The California Governor expects everyone to wear a mask. If eating, the Governor expects his subjects to wear a mask between bites. The rules may not apply to him.

d) New York state forced nursing homes to accept COVID patients, even though the highest risk people are old, such as those in nursing homes. Why?

e) Global central banks created over $28 trillion in “funny money.” Yes, it distorted stock and bond markets.

f) The Fed’s balance sheet exceeds $7 trillion in “printing press currency.” Wealth of billionaires increased during 2020 when over $3 trillion was “printed.” However, Chairman Powell claims Fed policies do NOT encourage wealth inequality.

g) Over $17 trillion in global bonds yield less than 0.0%. Crazy?

h) Nominated for Time Magazine’s person of the year: Dr. Fauci, Andrew Cuomo, and AOC. Strange!

i) Millions of American families may be evicted in January. Unemployment is high. The U.S. economy, small businesses, and millions of people are in deep financial trouble, but the DOW hit 30,000 and the S&P 500 Index reached a new all-time high in November. The stock market does NOT reflect economic conditions in middle-America.

j) COVID deaths are real, some of them. But: New Study Exposes Alleged Accounting Error Regarding COVID Deaths.

Line in Dallas for food handouts… while stocks hit all-time highs.

SO WHY BOTHER?

- Because cycles are helpful. As the chart shows, gold prices often bottom in November or December.

- Cycle lows are confirmed by other analysis, such as ratios.

- Don’t expect guarantees and “sure things” in markets. The guarantees in life are death, taxes, government nonsense, and increasing debt.

- Government nonsense and increasing debt assure rising gold prices. Fractional reserve banking, central bank monetization, helicopter money, MMT, insane debt levels, and “funny money” assure us that fiat currencies will devalue, and gold prices will rise.

SHOW ME THOSE RATIOS:

The DOW and S&P500 Index hit highs in late November. Gold reached a high months ago in August. Total market cap is too high. Financial conditions indicate a top. How high? What do the ratios show?

You can see:

- The ratio has been much higher than on November 27 (0.49). Gold prices could rise, and the ratio could triple.

- Surprise. Gold has been stronger than the S&P 500 Index for two years. Stocks receive the headlines, but gold rallied more.

- The trend for the ratio has been up for two years, since September 2018.

- Expect another rally in the ratio, like that of 2001 – 2011.

The GDX is a gold stock ETF. Examine the ratio of GDX to gold prices since 2006 – the beginning of data for GDX.

You can see:

- The ratio bottomed in December 2016 and has risen since then.

- The ratio broke ABOVE its downtrend line from 2006.

- Expect the ratio to rise for years. Gold stocks will rise more rapidly than the price of gold.

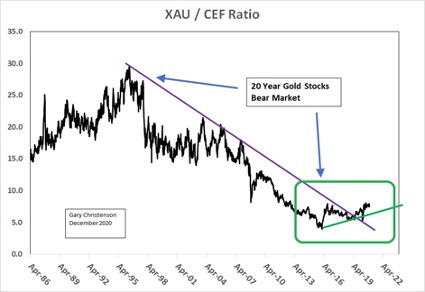

The XAU is an index of gold and silver stocks. CEF is a fund that buys gold and silver bullion. The ratio shows a longer-term view of gold and silver stocks versus the price of bullion.

You can see:

- The ratio topped in mid-1996 and fell until 2016, a 20-year bear market in gold and silver stocks when compared to the underlying price of bullion.

- The ratio bottomed in November 2016 and has risen since then.

- Expect gold and silver stocks to rise faster than gold bullion for several years.

Read:

Alasdair Macleod: “Global Inflation Watch”

“This article posits that fiat currencies are on the path to hyperinflation…”

CONCLUSIONS:

- In California, politicians apparently believe the COVID virus is communicable in churches, but not strip clubs or riots.

- In Europe, many bonds yield less than 0.0% interest. If we lived in a world where currency devaluation and default risk were important, those bonds should yield more. Central banks distort markets.

- Gold prices often reach important lows in November or December. Examples include 2011, 2013, 2014, 2015, 2016, 2017, 2019, and 2020. Silver prices often fall to lows at the same times.

- Ratios show that gold and silver are undervalued. History suggests gold prices are inexpensive compared to the S&P 500 Index (above), total National Debt (not shown), and M2 (not shown).

- Strange times, central bank distortions in the market, insane levels of debt, massive unemployment, small business bankruptcies, and political and monetary desperation do not bode well for the American economy. Stock prices sell at “nosebleed” levels, while the paper markets hammered gold and silver prices since August. Expect a huge rally in gold and silver prices, soon.

- In 1971 a U.S. dollar was worth 1/40th ounce of gold. Today a dollar is worth 1/1800th ounce of gold. Given the borrow and spend mentality of our “leaders,” the value of the dollar could be 1/10000th ounce of gold in a few years.

- Stay safe, don’t believe much of what our politicians and central bankers proclaim, and protect your assets and retirements with gold and silver.

Miles Franklin will convert paper and digital dollars into real money—gold and silver bullion. Call 1-800-822-8080 and protect your savings from the inevitable devaluations created by central bankers and politicians.

Gary Christenson