After a roller coaster last week, both the metals and mining stocks have recovered bit and have ben consolidating this week. We have yet to resume the uptrend in metal prices which may mean another correction ahead or they may stay in a trading range until the next catalyst such as the U.S. elections, announcement of the next stimulus package, etc. In the very-short term we could break either way and if we go lower it will represent yet another great buying opportunity.

Be Sure to sign up for the free email list at Goldseeker.com.

$AEM, $BNKR.CN, $ELY.V, $EXK, $FSX.V, $GPG.V, $KGC, $LIO.V, $NUAG.TO, $PAAS, $RSLV.V, $ELEF.TO, $SSVR.CN,

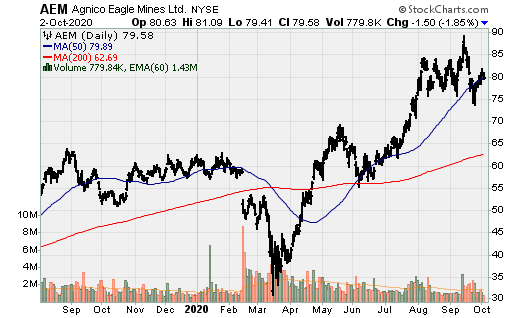

Agnico-Eagle: Announced exploration joint venture in Colombia with Newmont Mining. he 50-50 Joint Venture, which will be operated by Agnico Eagle, will explore the Anza project and seek other prospective gold targets of district-scale potential in Colombia. The Anza project is a gold exploration project, comprising exploration contracts and applications totaling approximately 200 km2 located in the Mid-Cauca belt in Colombia. The project is 50 km west of Medellin and 60 km south from Zijin Mining's Buritica operation.

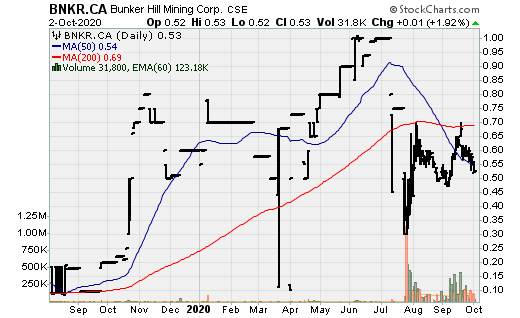

Bunker Hill Mining: Announced maiden resource estimate. A maiden inferred resource of 9Mt containing 11m oz. Ag, 0.9b lbs. Zn, and 0.4b lbs. Pb. The company commenced its first high-grade silver focused exploration campaign at its Bunker Hill Mine located in Idaho’s Silver Valley, USA. The exploration campaign is being supported by the enhanced geological understanding gained following the recently completed digitization and 3D modeling of historic geological data which confirmed numerous high-grade silver exploration targets. This first high-grade silver exploration program will consist of 4,570 meters (15,000 feet) of diamond drilling from surface and underground focused on targets in the upper levels of the mine located in close proximity to existing infrastructure.

Ely Gold Royalties: Announced it agreed to purchase a 1% NSR royalty (Watershed) on the Cote gold project in Ontario, Canada. It will acquire this royalty from Santana Resources. The royalty covers 46 claims surrounding the Cote gold project. Part of the Watershed claims are currently part of the mine plan per the November 2018 feasibility study (FS). In exchange for the royalty, Ely Gold will remit total consideration of $3m ($2.5m in cash and 1m Ely Gold warrants; valued at $500k).

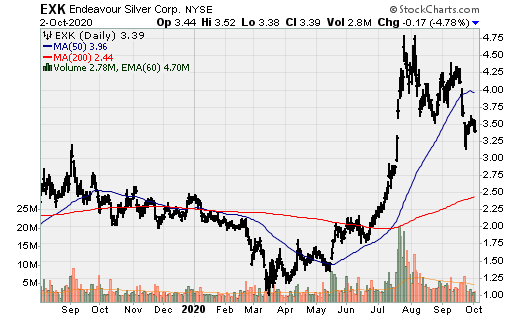

Endeavour Silver: The company continues to dilute shareholders as it announced an ATM (at the market) offering up to $60m.

Fosterville South Exploration: Reported long interval of high-grade gold assay from core drilling program at Golden Mountain. Highlights include 9m @ 10.2 g/t Au and 4.8m @ 4.8 g/t Au, 3.5m @ 4.8 g/t Au, 2.7m @ 6.9 g/t Au, 9m @ 3 g/t Au.

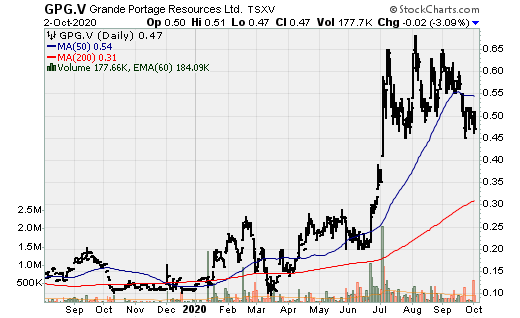

Grand Portage Resources: Announced an excellent drill hole: 2.71m @ 52.34 g/t Au at its Herbert Gold Project in Alaska. Other drill results include:

- 8.05m @ 5.72 g/t au

- 1.46m @ 23.80

- 2.38m @ 11.47 g/t Au

- 1.62m @ 15.27 g/t Au

- 2.92m @ 2.60 g/t Au

- 1.40m @ 17.29 g/t Au

Great Bear Resources: Drilled wide shallow gold intervals at LP fault: 63.6m @ 3.22 g/t Au and 39.80m @ 4.61 g/t Au in the same drill hole. CEO, Chris Taylor made the following comment: “These results continue to demonstrate the exceptional grade potential and predictability of the LP Fault's near surface bulk tonnage gold mineralization. Drill hole BR-166 intersected two wide zones of higher-grade gold mineralization, which combined averaged 3.76 g/t over a total of 103.4 meters at a vertical depth of 95 - 210 meters.”

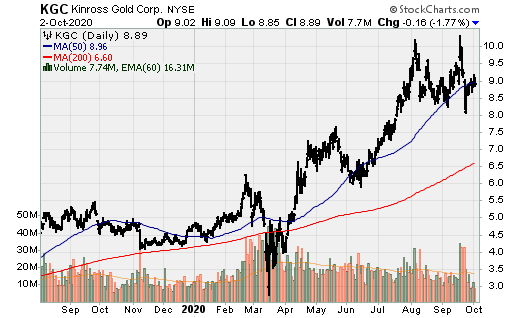

Kinross Gold: Will acquire a 70% interest in the Peak Gold project in Alaska. The project will leverage the Company’s Fort Knox mill and expected to add to production and cash flow profile in top-tier jurisdiction. Kinross entered into agreements to acquire the 70% interest from Royal Gold for total cash consideration of $93.7 million. Kinross will have broad authority to construct and operate the Peak Gold project, with Contango retaining a 30% non-operating minority interest.

The Peak Gold project is a relatively high-grade deposit with a large estimated resource base that is expected to commence production in 2024 as a low-cost, open-pit mine. The project, which is located approximately 250 miles southeast of the Company’s Fort Knox mine, is a low-risk “tuck-in” to supplement Kinross’ existing Alaska operation. Kinross plans to process Peak Gold ore at Fort Knox and utilize the existing mill and infrastructure to benefit both the project and the mine.

Highlights of the acquisition:

- Adds another high-grade, low-cost development project to Kinross’ portfolio.

- Expect to commence production at the open pit project in 2024, with total production of approximately 1 million Au eq. oz. over 4.5 years at average mining grades of approximately 6 g/t.

- Preliminary all-in sustaining costs estimated to be in the range of $750 per Au eq. oz. and initial project capital expenditures in the range of $110 million.

- Expect to strengthen Kinross’ medium-term production and cash flow profile.

- Numerous exploration targets within Peak Gold’s 675k-acre land package to potentially increase mine life.

- Lower initial capital investment due to processing ore at the Fort Knox mill.

- This adds to Kinross growth profile, supplementing growth from the Tasiast 24k expansion, the Chulbatkan development project, La Coipa & Lobo Marte restarts. Kinross has one of, if not, the most robust near- and medium-term growth profile among its peer group (those which produce 2m oz. Au or more).

Lion One: Announced updated PEA for the starter mine at Tuvatu. the mineral resource estimate used in the PEA is from 2018 and does not include any new drilling completed by the Company in its 2019 - 2020 drill programs. Furthermore, the potential development model set out in the PEA is confined to the current mineral resource inside the permitted mine lease area (SML 62) and does not reflect the expanded Project area following the grant of the adjoining Navilawa Caldera tenement (SPL 1512) in 2019. Highlights include:

- Initial capital costs: $67m

- Initial Mine Life: 4.15yrs

- Average head grade: 8.6 g/t Au

- Average annual production: 78k oz. Au

- Cash costs, AISC, and AIC + initial capital costs: $503/oz., $586/oz., and $788/oz.

- IRR & NPV5% @ $1,800/oz. Au and $2,000/oz. Au: 74.50% + $203m, 85% + $243m.

New Pacific Metals: Extends broad areas of silver mineralization at its Silverstrike project in Bolivia. Highlights of the assay results received to date:

- Valley Zone (Channel Chip): 1.50m @ 689 g/t Ag + 0.63% Pb and 1.1m @ 1,100 g/t Au + 0.61% (Underground).

- North Top (Channel Chip): 2.0m @ 696 g/t Au, 12.25% Pb, and 0.14% Zn (Surface Outcrop).

- Tarafaya (Channel Chip): 1.80m @ 909 g/t Ag, 3.68% Pb, and 0.12% Cu (Surface Outcrop).

- South Top (Channel Chip): 1.50m @ 906 g/t Ag (Surface Outcrop), (Mine Dump Grab): 1,185 g/t Ag, 10.55% Pb, 1.15% Cu (Surface Mine Dump).

- CP Zone (Channel Chip): 2.0m @ 1,665 g.t Ag, 1.42% Cu (Underground), 2m @ 1,865 g/t Ag (Surface Outcrop), 888 g/t Ag, 3.41% Cu (Surface Mine Dump).

- West Top (Channel Chip): 0.9m @ 960 g/t Ag; 2m @ 457 g/t Ag (Surface Mine Dump).

- Breccia Zone (Channel Chip, Mine Dump Grab): 1.1m @ 54 g/t Ag, 5.64% Pb, 19.50% Zn (Surface Outcrop), 713 g/t Ag, 7.66% Pb, 4.50% Zn (Surface Mine Dump).

- San Luis Mine (Channel Chip, Mine Dump Grab): 1.1m @ 178 g/t Ag (Underground), 504 g/t Ag, 10.60% Pb, 0.81% Cu (Surface Mine Dump).

- Lourdes Ines Mine (Mine Dump Grab): 1,675 g/t Ag, 18.35% Pb, 2.03% Pb (Surface Mine Dump).

- Turini Zone (Mine Dump Grab): 3,220 g/t Ag, 51.18% Pb, 14.95% Zn, 1.76% Cu (Surface Mine Dump).

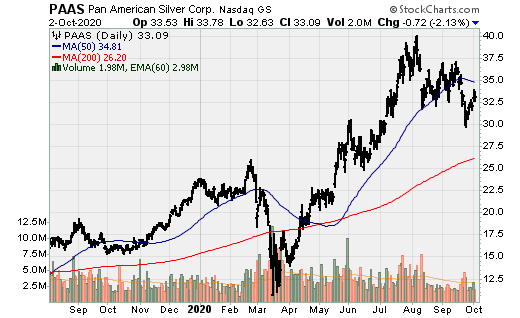

Pan-American Silver: Announce the restart of Huaron and Morococha operations in Peru. These were the last of Pan-American’s operations to restart. This will obviously hit Q3 production and cash flow but the material rise in the silver price in Q3 will more than offset some lost production, in addition to higher average realized gold prices.

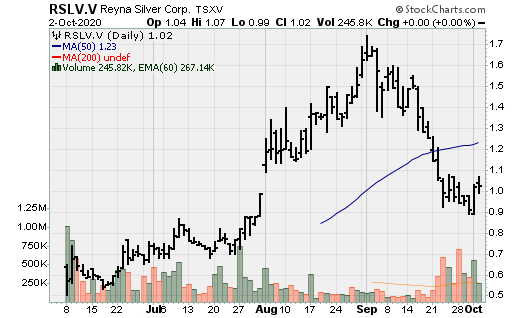

Reyna Silver: Reyna expands Mexican footprint with the acquisition of the La Reyna Project in Chihuahua, Mexico. La Reyna is located 90 km from Reyna Silver’s flagship Guigui project and encompasses two former high-grade silver mines; La Reyna and La Princesa. The property has not been drilled. Reyna is run by smart individuals including Dr. Peter Megaw as Chief Technical Advisor, so they must see something in this land package. The company’s primary focus will remain Guigui, but this does provide additional optionality to the company.

Roxgold: Reports 6m @ 77.2 g/t Au in near-surface drilling at 55 zone, Yaramoko mine complex. Other near-surface highlights include:

- 6m @ 49.5 g/t Au

- 11m @ 10.1 g/t Au

- 4m @ 16.2 g/t Au

- 2m @ 29.5 g/t Au

- 6m @ 23.8 g/t Au

- 3m 2 11.3 g/t Au

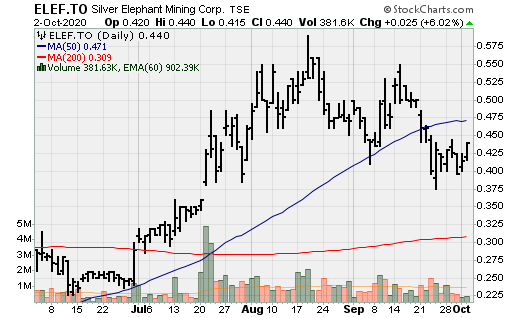

Silver Elephant: Sunawayo returned assays up to 477 g/t Ag + 20% Pb; all 48 collected samples from 4 areas returned anomalous assayed grades. all of the initial forty-eight chip and grab samples collected from surface outcrops and adits at its Sunawayo silver project returned anomalous Ag-Pb assayed values. Ten of the assayed samples contain either over 100g/t silver or 10% lead or both.

Summa Silver: Makes high-grade discovery at its Hughes property, Tonopah Nevada. The highlight hole is 2.50m @ 3,760 g/t AgEq (1,762 g/t Ag and 19.99 g/t Au). Other notable holes include:

- 0.8m @ 1,870 g/t Ag and 5.53 g/t Au

- 2.3m @ 805 g/t Ag and 3.77 g/t Au

- 0.2m @ 2,370 g/t Ag and 22.6 g/t Au

- 0.2m @ 625 g/t Ag and 7.04 g/t Au