The gold miners’ stocks are surging back, amplifying their metal’s gains in a strong mean-reversion rally. That is shifting sentiment back towards bullish, a big change after this contrarian sector was hammered to exceedingly-oversold lows. Despite gold stocks’ recent surge, their young upleg likely has a long ways to run yet. Gold’s own outlook remains very strong, and its miners’ stocks will leverage its upside like usual.

The GDX VanEck Gold Miners ETF is this sector’s leading benchmark and trading vehicle, and it has had quite a run lately. Between late September to early December, it blasted 37.4% higher regaining its 200-day moving average. That leveraged gold’s parallel 11.1% mean-reversion rebound by a strong 3.4x! The major gold stocks dominating GDX usually amplify material gold uplegs and corrections by 2x to 3x.

The smaller fundamentally-superior mid-tier and junior gold miners I specialize in fared even better. Our newsletter trading books are full of such great stocks, and recent trades’ unrealized gains were running as high as 74.6% mid-week! We aggressively bought incredible bargains in the months surrounding GDX’s brutal 2.5-year secular low in late September. The gold stocks were left for dead in something of a false panic.

I wrote a whole essay on that false gold-stock panic published the trading day before GDX bottomed at $21.87. This sector hadn’t traded at lower prices since immediately after March 2020’s ugly pandemic-lockdown stock panic. Remember fear was off the charts then before lockdowns’ impact on the economy was understood. In just over a single month, the flagship S&P 500 benchmark stock index plummeted 33.9%!

GDX getting sucked into that maelstrom was reasonable, but there was no justification for gold stocks to revisit such extremes in late September 2022. At those lows I warned gold stocks had “been slammed to extreme lows in recent months on a false premise. Traders assume gold’s parallel plunge must be fundamentally-righteous. But that was driven by enormous gold-futures selling on anomalous market events.”

Therefore “As these unsustainable extremes inevitably reverse hard, the battered gold stocks will soar.” The rationale was simple. Speculators’ gold-futures positioning had grown exceedingly bearish, leaving their selling firepower exhausted. That was fueled by the US dollar shooting parabolic in response to the Fed’s most extreme tightening ever. Specs only had room for major mean-reversion buying from there.

I concluded then when everyone hated gold stocks “As all that reverses, gold will soar launching gold stocks way higher.” That is exactly what started since late September, with specs buying to cover an enormous 61.5k gold-futures short contracts! That’s the equivalent of 191.2 metric tons of gold, a lot of buying in just nine weeks. That directly blasted gold 11.1% higher at best, driving GDX’s big 37.4% surge.

These young gold and gold-stock uplegs ought to be only getting started. One of the core principles of contrarian trading is proportional mean reversions out of extremes. The lower prices are hammered, the more popular fear that generates, the greater the subsequent mean-reversion rebounds and overshoots. In late September gold was also crushed to a deep 2.5-year secular low, March 2020 stock-panic levels.

Out of such unsustainable technical and sentimental extremes, gold soared 40.0% higher over the next 4.6 months. The major gold stocks of GDX skyrocketed 134.1% in about the same 4.8-month span! That made for strong upside leverage to gold of 3.4x. Interestingly that is exactly what we’ve seen since those last unsustainable lows in late September 2022. Gold and gold stocks have a long ways to mean revert yet.

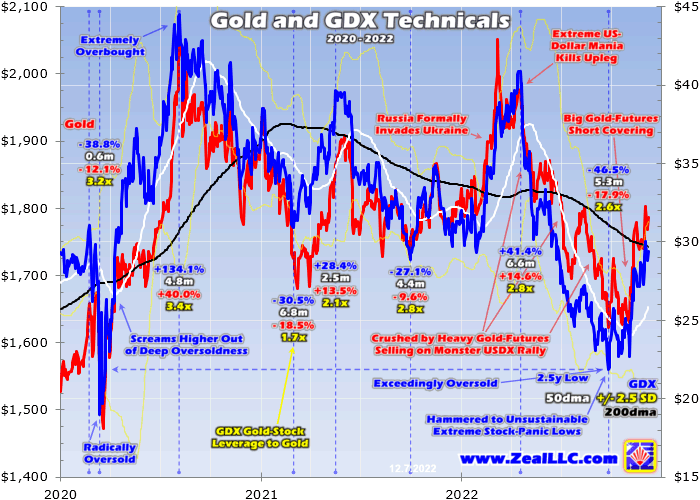

This chart superimposes GDX and its various technical lines over gold during the past several years. All gold stocks’ gains during uplegs and losses during corrections are labeled, along with the parallel gold moves driving them. Those gold uplegs and corrections may be offset from gold stocks’ buy a few trading days, as toppings and bottomings don’t always match. GDX’s leverage to gold during each big swing is noted.

After that powerful mean-reversion-overshoot upleg out of March 2020’s stock-panic extremes, both gold and gold stocks were extremely overbought. A major correction was due, and came to pass followed by a bottoming consolidation. The precious-metals sector started climbing again in late January 2022, despite an increasingly-hawkish Fed and a month before Russia invaded Ukraine. That young upleg was looking solid.

By mid-April this year, GDX had powered 41.4% higher over 6.6 months on gold’s 14.6% gains in roughly that same span. That 2.8x upside leverage was good, near the upper end of major gold stocks’ usual 2x-to-3x range. Then the bottom fell out as the US dollar started soaring on the Fed’s extreme jawboning, rate hikes, and quantitative-tightening monetary destruction. That culminated in late September’s panic lows.

Excluding its earlier Russia-invading-Ukraine geopolitical spike, gold plunged 17.9% in 5.5 months on massive gold-futures selling. Speculators aggressively dumped longs and flooded into shorts with the benchmark US Dollar Index blasting an unbelievable 14.3% higher during that short span! GDX plummeted 46.5% in sympathy, amplifying gold’s downside by a normal 2.6x. Mid-2022 certainly proved miserable.

I wrote plenty of essays analyzing that carnage in real-time as it unfolded. All gold-stock speculators and investors need to follow specs’ gold-futures trading, as the extreme leverage inherent in it often bullies around the gold price. My most-recent work on this thread was a mid-October essay on all that crazy gold-futures puking stalling. That will get you up to speed if you ostriched through gold’s major selloff.

A late October essay dived into why the euphoric dollar was vexing gold this year. That extreme dollar rally on extreme Fed tightening left that US Dollar Index as extremely overbought as gold was extremely oversold, necessitating its own mean-reversion-overshoot plunge. Indeed in the last 2.2 months as gold surged 11.1%, the USDX plummeted 8.4%! The Fed’s ability to shock traders with hawkish surprises was over.

In yet another essay in early November, I explained in depth why the Fed’s dollar/gold shock was ending. After a monster 375 basis points of rate hikes in just 7.6 months, the Fed’s federal-funds rate was nearing its terminal levels. With the lion’s share of that ultra-aggressive hiking cycle already done, the Fed would have to soon moderate its rate hikes. Last week the Fed chair signaled a smaller 50bp hike in mid-December.

Along with that recent streak of huge 75bp hikes, the Fed is starting to destroy some of the vast money it conjured into existence after March 2020’s pandemic-lockdown stock panic. In just 25.5 months between then and mid-April 2022, this central bank foolishly injected $4,807b of new fiat dollars into the economy. That ballooned the global US dollar supply by a crazy 115.6%, more than doubling it in just a couple years!

That extreme fourth quantitative-easing campaign has just started to be unwound since June, with the Fed selling $337b of Treasuries and mortgage-backed securities. While that’s sizable, so far this QT2 has only reversed less than 1/14th of that gargantuan QE4 money printing! With the Fed promising $95b per month of monetary destruction and already falling well behind, there are no more bigger-QT surprises coming.

So after four monster 75bp rate hikes in a row and the biggest QT ever attempted by far, top Fed officials have expended their potential to keep hawkishly shocking markets. The result of that is clear in the past couple months, the overbought US dollar is plunging while oversold gold is surging. Those trends ought to continue as the smaller Fed rate hikes coming will increasingly be seen by traders as a major dovish pivot.

That extreme US-dollar anomaly in mid-2022 was the only reason gold plunged, dragging down the gold stocks with it. But all that is rapidly unwinding as the last couple months’ price action on all these fronts proved. Gold is casting off the Fed-goosed dollar’s tyranny, finally starting to reflect its own super-bullish fundamentals. As gold continues powering higher on those, the gold stocks will continue amplifying its gains.

The World Gold Council collects the best-available global gold supply-and-demand data, which it then publishes quarterly in its fantastic must-read Gold Demand Trends reports. The latest iteration is current to Q3’22. The end of that coincided with gold’s deep stock-panic-grade $1,623 low, leaving this metal down a hefty 9.1% year-to-date exiting Q3. That futures-selling-driven anomaly masked strong fundamentals.

During the first nine months of this year, total global gold demand climbed 3.0% year-over-year to 3,553 metric tons. That exceeded total mine-supply growth rising 2.0% YoY to 2,686t. Jewelry demand in this nine-month span grew a healthy 5.2% YoY to 1,589t, investment demand surged a strong 26.4% YoY to 889t despite mid-2022’s big gold selloff, and central-bank buying blasted 61.9% higher YoY to hit 673t!

That investment category is the big wildcard in overall gold demand, dominating the yellow metal’s price trends. Investors in turn are very sensitive to those very trends, only flocking to gold when it exhibits nice upside momentum to chase. That was sure lacking between mid-April to late September, so investors were apathetic at best. But with gold off to the races since, investors will increasingly return accelerating its gains.

The raging inflation unleashed by the Fed’s extreme money printing in recent years is super-bullish for gold investment demand. The more investors suffer inflationary predations on their capital’s purchasing power, the longer high inflation persists, the more they will diversify some of their stock-heavy portfolios into gold. Gold has a millennia-old track record of being the ultimate inflation hedge during currency debasements.

Though this year’s extreme US dollar rally temporarily derailed gold, we are suffering the worst inflation super-spike since the 1970s. Over the past twelve months, even the lowballed headline Consumer Price Index has averaged staggering 8.0% year-over-year jumps! As legendary American economist Milton Friedman proved back in the early 1960s, “Inflation is always and everywhere a monetary phenomenon.”

While the Fed can bluster all it wants with aggressive rate hikes, the root cause of higher prices remains relatively-more money competing for and bidding up the prices of relatively-less goods and services. Fully 13/14ths of the Fed’s epic QE4 monetary deluge remains in the system. And even if the Fed can hit its $95b-per-month QT2 target, it would take 47 more months to fully unwind QE4 or 24 to even half reverse it!

That almost guarantees at least another couple years of big inflation. While the headline CPI prints could moderate on higher base effects, general prices will keep rising on balance. As investors suffer more and more of this in their lives, they will increasingly remember gold unleashing huge new investment demand. That certainly happened during those last similar inflation super-spikes dominating the 1970s markets.

From June 1972 to December 1974, headline year-over-year US Consumer Price Index inflation soared from 2.7% to 12.3%. During that 30-month span, conservative monthly-average gold prices blasted up an amazing 196.6%! After that serious inflation wave passed, another one soon followed. From November 1976 to March 1980, the YoY CPI prints skyrocketed from 4.9% to 14.8%. Gold was a moonshot in that span.

Over that 40-month inflation super-spike, gold shot parabolic with a stupendous 322.4% gain in monthly-average-price terms from trough to peak CPI! As the world’s aboveground gold supply is way bigger now than during the 1970s, gold probably won’t nearly triple or more than quadruple again in this first inflation super-spike since then. But surely it ought to at least double with red-hot inflation raging out of control.

Today’s inflation super-spike rapidly started accelerating in April 2021, when the CPI surged hotter first exceeding 4% YoY price hikes. That month gold averaged $1,761 and GDX averaged $35.07. If gold doubles from there, it would exceed $3,500 before this next mighty bull run gives up its ghost! And GDX ought to stay true to history amplifying gold’s gains by 2x to 3x, meaning it should quadruple to sextuple.

That implies GDX peaking somewhere between $140 to $210, radically higher than last week’s $30! From mid-week levels, that would make for stupendous 377% to 616% gains in the major gold stocks. And the fundamentally-superior mid-tiers and juniors will do much better outperforming larger peers like usual. There’s certainly no other stock-market sector with such huge upside potential in coming years.

So gold stocks surging back in recent months is likely only the beginning of a temporarily-delayed mighty inflation-super-spike-fueled bull. Contrarians buying in early before gold powers high enough for long enough for everyone to figure this out stand to multiply their wealth earning fortunes. Despite gold stocks’ mounting gains since late September, those are merely the tip of the iceberg of what is probably coming.

If you regularly enjoy my essays, please support our hard work! For decades we’ve published popular weekly and monthly newsletters focused on contrarian speculation and investment. These essays wouldn’t exist without that revenue. Our newsletters draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks.

That holistic integrated contrarian approach has proven very successful, yielding massive realized gains during gold uplegs like this overdue next major one. We extensively research gold and silver miners to find cheap fundamentally-superior mid-tiers and juniors with outsized upside potential as gold powers higher. Our trading books are full of them already starting to soar. Subscribe today and get smarter and richer!

The bottom line is gold stocks are surging back, mean reverting out of recent extreme stock-panic-grade lows. They are nicely amplifying gold’s parallel upleg, which has been fueled by big gold-futures short covering. With the Fed out of room to keep shocking markets with its extreme tightening campaigns, the parabolic US dollar has reversed hard. So gold-futures speculators are unwinding their super-bearish bets.

These recent sharp gold and gold-stock gains are only the beginning. Gold’s fundamentals remain strong despite mid-2022’s sharp selloff. And investment demand will only grow in coming years as high inflation persists. That’s not going away until major central banks destroy the majority of recent years’ extreme money printing. As long as gold powers higher on balance, the gold stocks will leverage its gains like usual.

Adam Hamilton, CPA

December 9, 2022

Copyright 2000 - 2022 Zeal LLC (www.ZealLLC.com)