Strengths

- The best performing precious metal for the week was platinum, up 4.93%. Barrick Gold’s earnings exceeded estimates as higher metal prices blunted the impact of rising costs and lower output for the world’s second-largest bullion producer. The company reported adjusted profit of 29 cents a share for the second quarter, compared with the 26-cent average estimate among Bloomberg analysts. It was Barrick’s eighth straight earnings beat. During the quarter, the company produced 1.04 million ounces of gold at a cash cost of $729 per ounce.

- Karora Resources reported earnings per share (EPS) of $0.10 per share, ahead of consensus of $0.08 per share. EPS was helped by the strong sales and production numbers during the quarter of 29,800 ounces and 30,400 ounces, respectively. Cash costs of $874 per ounce were marginally better than consensus of $887 per ounce.

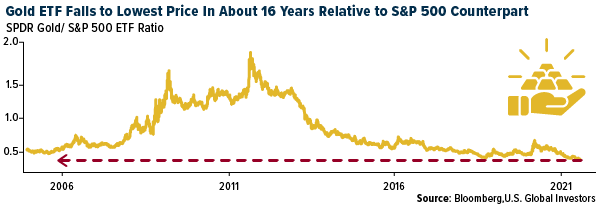

- Gold’s status as a precious metal is belied by its performance relative to U.S. stocks. Comparing the SPDR Gold Shares and SPDR S&P 500 exchange-traded funds shows as much. Monday’s ratio between the gold and stock ETFs was the lowest since September 2005, according to data compiled by Bloomberg. The ratio was down 44% from a March 2020 peak and off 78% from a record set 10 years ago this month.

Weaknesses

- The worst performing precious metal for the week was silver, down 2.93% on little specific news largely following gold’s drop on Monday. Pan American Silver reported EPS of 22 cents versus a 34-cent consensus, primarily due to lower-than-expected production and inventory build-up of $38 million. Silver production of 4.5 million ounces was down 2% quarter to quarter and 8% lower than consensus. Gold production of 142,000 ounces. was up 3% but 4% lower than consensus.

- U.S. gold futures traded modestly lower last week, however a sudden burst of selling on Sunday of gold futures contracts sent gold prices plunging to as low as $1,677 an ounce. The plunge was obvious manipulation of the price by the bullion banks, creating 20,000 contracts out of thin air and then forcing the sale when markets are largely closed; you expect to get the worst price. Together with Friday's post-payroll plunge, this has been the biggest two-day drop in gold (in dollar terms) since the March 2020 crash.

- Gold headed for a second straight weekly loss amid concerns that the Federal Reserve may soon curb its massive monetary stimulus. The durability of the global economic recovery has dimmed the appeal of the haven asset in recent weeks as some Fed officials signaled that they’re ready to discuss softening ultra-loose monetary policy. U.S. data on Thursday added to signs of rising inflation pressures and a strengthening labor market. Ten-year benchmark Treasury yields have climbed this week, curbing the appeal of non-interest paying bullion, but eased slightly on Friday. The dollar inched lower. Gold has slid this month -- despite the spread of the Delta variant of COVID-19 clouding the global economic outlook -- and has now given up most of its gains from a rally in April and May.

Opportunities

- Jerry Braakam, CIO of First American Trust, is concerned that stagflation – rising prices and falling incomes – may be in the cards. Such an environment should benefit sectors with the highest degree of pricing power -- “energy, materials, even some consumer durables, if they can pass on higher costs to consumers, which they’re trying to do,” he said. “P/E multiples would likely compress if this became sustainable and thus highly valued stocks would be most vulnerable and cheaper ones less so.” With the rising inflation of the 1970s, gold shot up and gold stocks significantly outperformed the broader markets.

- Metal and mining equities could have a 40% upside from current levels over the next 6-9 months, Citi says, assuming the duration and magnitude of the current rally is like past cycles. The history of mining cycles shows that pullbacks in commodities and equities in the 12–18-month period from trough are followed by price acceleration.

- SilverCrest Metals provided a construction update for the Las Chispas property. Overall construction is 33% complete, ahead of the scheduled 28%. Management remains comfortable with the $138 million initial capex estimate with the fixed price plant construction contract and efficiencies limiting the impact of inflation. Detailed engineering is 90% complete.

Threats

- Jackson Hole is gold’s biggest risk factor, with gold already dropping below $1,700 after Friday’s payrolls beat highlighted the potential that policy makers will shift from spurring growth toward curbing inflation.

- The world’s second-largest bullion producer, Barrick Gold, sees the U.S. as its “big challenge” with regards to COVID-19 vaccinations for its workers, CEO Mark Bristow said in an interview with Bloomberg TV. Vaccination rates among Barrick employees in Nevada are about 25%.

- Demand for platinum group metals (PGMs) is facing decline due to the growth of battery electric vehicles. Conventional cars with internal combustion engines use three PGMs – platinum, palladium, and rhodium – in their catalysts to limit emissions. Electric vehicles do not use catalysts. Bloomberg NEF estimates that demand for PGMs from autos will peak around 2024 and fall 59% by 2040. Platinum may not be down and out though as fuel cell-powered vehicles do use platinum as a catalyst to convert hydrogen to energy.