Strengths

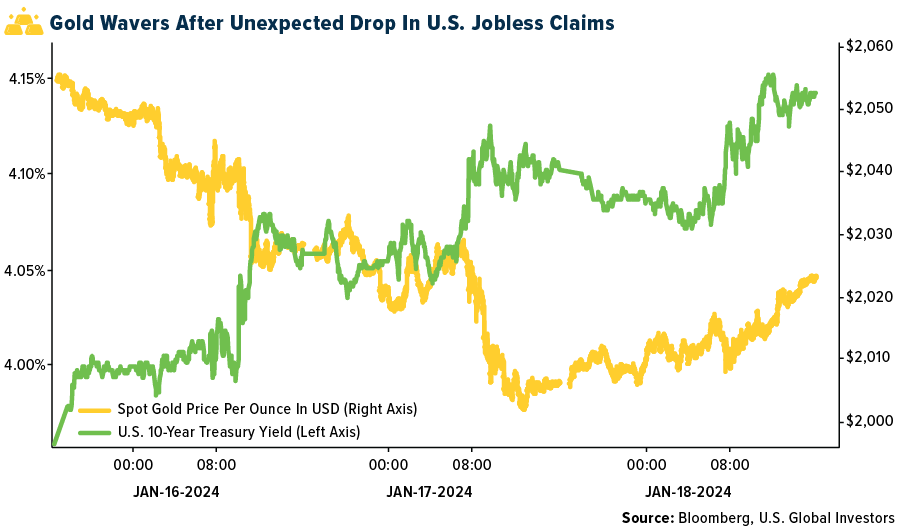

- The best-performing precious metal was gold, but still down 1.01%. Gold was only up by 0.09% last week yet still appears to have support above $2,000. However, the metal slipped after the dollar reached a one-month high and on increasing signs that global central banks may have to delay the timing of interest-rate cuts.

- According to Bank of America, Eldorado Gold reported fourth-quarter production results which were (surprisingly) stronger-than-expected, beating Bloomberg and Visible Alpha (VA) consensus by 6% and 2% respectively. Production was up a sizable 18% quarter-over-quarter (QoQ) also. Eldorado was one of the best performers for the week, gaining more than 3.5%

- According to Canaccord, Wesdome Gold had a strong finish to 2023 production-wise, reporting fourth-quarter gold production that beat consensus by 17%. Full-year 2023 production was slightly above the midpoint of the guidance range. Wesdome’s share price gained almost 1.75% for the week.

Weaknesses

- The worst performing precious metal for the week was palladium, down 2.81%. Palladium is still about $45 per ounce more expensive than platinum. According to Canaccord, Silvercorp Metals’ production of silver and lead were below their estimates, while gold and zinc were in line. On a silver equivalent basis, production and sales were 16% below their estimate. Lower production was driven by lower grades at the Ying mining complex, due to mine sequencing, resulting in a share price decrease of more than 5.75%

- De Beers made one of the steepest cuts to its diamond prices in years, as the world’s top producer tries to revive gem sales after the market ground to a halt. The industry almost came to a complete standstill in the second half of 2023 as the two biggest miners all but stopped supplies in a desperate attempt to stem a collapse in prices. While those efforts helped the market to pick up a bit, it is unclear how much appetite trade buyers currently have. To improve demand, De Beers cut prices by about 10% across the board at its first sale of this year.

- According to Bank of America, Pan American Silver PAAS reported Q4 silver production of 4.8Moz, 16% below Bloomberg consensus at 5.7Moz, and 16% below Visible Alpha (VA) consensus at 5.8Moz. Gold production of 267.8koz was 3% above Bloomberg consensus at 259.3koz, and 2% above Visible Alpha consensus of 263.5koz but sentiment was negative on results with their share price dropping more than 12.5% for the week.

Opportunities

- Acquisitions may be picking up. According to Scotia, Alamos Gold announced it has entered into a definitive agreement to acquire the issued and outstanding shares of Orford Mining Corporation, a $10 million small-cap exploration company. The acquisition seeks to consolidate Alamos’ existing 27.5% ownership of Orford shares through which the Company will add the highly prospective Qiqavik Gold Project, located in Quebec, Canada. Alamos took plenty of time to finally put the trigger after their first toehold purchase four and half year ago illustrating how patient Alamos was to not make a bad acquisition. Unfortunate outcome for the Orford shareholders in terms of current price levels.

- Angus Gold reported on Friday that Wesdome Gold Mine agreed to make a strategic investment in the company to purchase 10.6% of the company’s common shares and with the included warrants, Wesdome can go up to a 15% stake in the company. While Angus Gold is off the radar for many investors, it is noteworthy some of the executives and board members at Probe Gold, with solid reputations, have significant ownership interest in Angus Gold.

- Bluestone Resources was up 90% after the company announced Guatemala's Ministry of Environment and Natural Resources (MARN) approved the environmental permit

amendment for the Cerro Blanco gold project to change the mining method from the existing permitted underground development to surface mining development.

Threats

- The value of rough lab-grown diamond imports increased by 22% YoY and 117% MoM, coming in above their three-year high and showing similar restocking trends as the rough stone market. However, polished lab-grown exports were in line with their 3-year average and fell by 19% YoY (-23% YoY), pointing to a slightly better dynamic versus polished stones.

- The speculation about rate cuts is happening as soon as March is too soon as the 2% inflation target has not been reached, European Central Bank (ECB) Governing Council member Joachim Nagel said on a panel at the World Economic Forum (WEF) in Davos. Earlier, his ECB colleague, Robert Holzmann, said that reductions in borrowing costs were not assured this year, given lingering inflation and geopolitical risks.

- According to Canaccord, Evolution Mining gold production of 161,000 ounces missed Visible Alpha consensus of 185,000, with the miss largely driven by lower production at Red Lake due to an ore pass issue at Cochenour that has now been resolved. Group cash costs of A$1,618 per ounce were due to lower sales rather than higher costs. Most analysts cut their future price target for Evolution Mining post the production miss and their share price fell nearly 17.5% for the week.