Strengths

- The best performing precious metal for the week was platinum, up 4.47% as Impala Platinum reported weaker production for the quarter. Rough diamond prices have continued their ascent, unphased by the deteriorating consumer sentiment, with Anglo American reporting realized rough prices of US$213 per carat for the first half of 2022. Although eroding disposable incomes usually catch up with diamond markets, supply disruptions from Russia have kept rough diamond customers on-edge. Anglo American has been successfully favoring “value over volume” and diamond profits have exceeded consensus estimates for the first half of the year.

- Torex Gold reported strong second quarter 2022 results this week. The company announced adjusted earnings of $0.66 per share, materially beating the consensus estimate of $0.50 per share. Pre-reported production of 123,000 ounces of silver was up approximately 10% over first-quarter output. “Our strong production, combined with ongoing discipline in cost containment, resulted in robust revenue, operating cash flow and free cash flow generation this quarter,” Torex President and CEO Jody Kuzenko said.

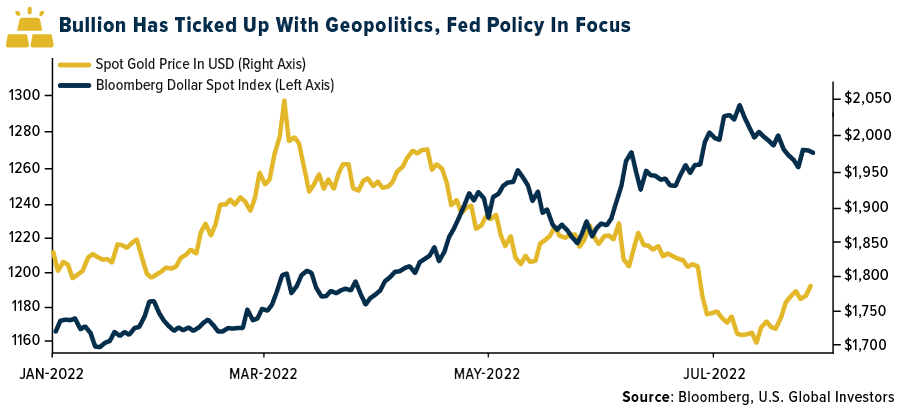

- Gold extended gains later in the week, reports Bloomberg, as geopolitical tensions between the U.S. and China persisted, boosting haven demand. Bullion is hovering near a four-week high as the fallout from U.S. House Speaker Nancy Pelosi’s visit to Taiwan keeps markets on edge, the article explains. The Bloomberg Dollar Spot Index was little changed after slipping earlier on Thursday.

Weaknesses

- The worst performing precious metal for the week was silver, down 1.79% and ending a two-week run with the strong jobs report on Friday. Dundee Precious Metals reported second quarter results after pre-reporting consolidated gold production of 72,900 ounces and copper production of 8.8 million pounds. Adjusted earnings per share (EPS) of $0.17 missed consensus of $0.21.

- Eldorado Gold also reported second quarter operating and financial results after pre-reporting production of 113,500 ounces. Overall, the quarter came with higher costs, resulting in a miss to consensus expectations. Production guidance of 460-490,000 ounces was maintained, with the company now expecting production in the lower half of the guidance range. Gold production, however, did see an increase of 22% from the first quarter of 2021, driven by strong production and mine development in Lamaque.

- South Africa’s Royal Bafokeng Platinum reported weaker-than-expected first half of the year results, as highlighted in the company’s recent trading statement. The company reported a 58.1% fall in half-year profit, hurt by lower metal prices and higher mining costs, writes Kitco News. Its headline earnings per share, the main profit measure in South Africa, fell to 7.67 rand in the six months to June 30, from 18.32 rand.

Opportunities

- AngloGold Ashanti was one of the stronger gold stocks on Friday after announcing they were considering selling some of their smaller assets to shift their focus to larger lower-cost operations. Attaining scale is a challenge in the gold industry. Some companies chose to grow faster through acquisitions of known assets as exploration results can be unpredictable. AngloGold had previously de-risked by selling off their South African assets but leadership at the senior level has had a reboot over the past year and we now appear to be seeing some of their strategy beginning to unfold. Management noted that those projects capable of producing 300,000 ounce per year were more their target and those projects that could maybe achieve 120,000 ounces per year were best left in the hand of a smaller company to exploit.

- Mineros SA, a long-time dividend paying gold stock, currently sporting an indicated yield of 9.92%, reported its most recent quarterly gold production of 74,062 ounces, a 10% increase from the same quarter in 2021. The company also announced that it remains on track for annual guidance. Mineros listed on the Toronto Stock Exchange in late 2021. With the latest financials filed, Mineros traded at a price-to-earnings (P/E) ratio of 4.93 and its current return on invested capital is 10.90%.

- According to the Royal Bank of Canada (RBC), Centerra Gold announced the closing of the agreement with the Kyrgyz government regarding the transfer of Kumtor. They continue to see this agreement as removing a significant overhang for Centerra shares and increasing management's flexibility in terms of funding growth post-2024 (along with potential additional cash return, either via a buyback or higher dividends).

Threats

- JPMorgan retains an elevated concern about recessionary impacts on downstream automobile customers and light vehicle production, and therefore potential downside risks to palladium prices in the second half of 2022 and into 2023. However, upbeat commentary from global original equipment manufacturers (OEMs) so far during the second quarter mitigates some of the bank’s near-term concerns pointing to improving second half volumes underpinned by robust pent-up demand and exceptionally low vehicle inventory globally. JPMorgan thinks it is premature to turn bullish on the outlook for palladium, given risks to autos in a recession scenario.

- Royal Gold’s most recent stream, Cortez, is amongst the highest caliber assets across the entire gold sector by both scale and duration (1.1 million ounces of production at bottom quartile costs). It is in one of the best jurisdictions globally and maintains high value in a royalty market where precious metals investable opportunities are scarce. Nonetheless, the transaction is also the largest value paid for a royalty and there is material dilution to Royal Gold.

- SSR Mining had a significant EPS beat that was driven by tax accounting. EBITDA (earnings before interest, taxes, depreciation and amortization) was toward the bottom end of the consensus range despite higher sales volumes and revenue, versus consensus, as costs were also higher. Consolidated production guidance is unchanged, but management has made material upward revisions to its cost guidance for the year.