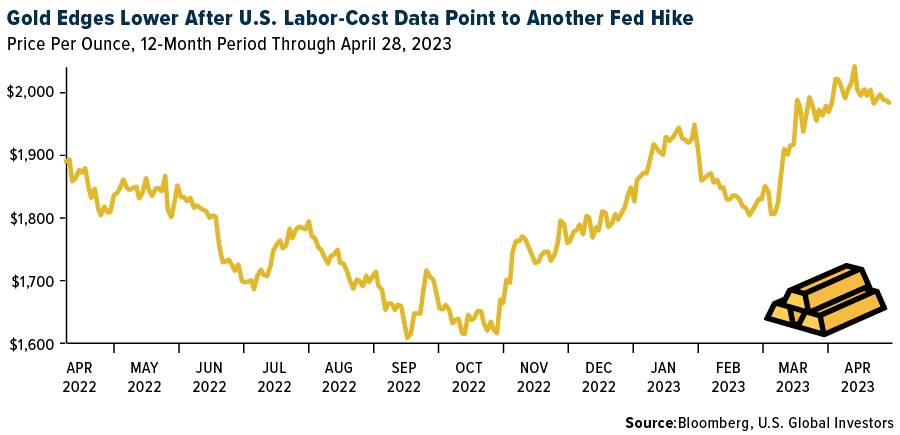

This week gold futures closed the week at $1998.10, up $7.60 per ounce, or 0.38%. Gold stocks, as measured by the NYSE Arca Gold Miners Index, ended the week lower by 0.44%. The S&P/TSX Venture Index came in off 0.13%. The U.S. Trade-Weighted Dollar fell 0.19%.

Strengths

- The best-performing precious metal for the week was gold, up 0.38%. Gold prices in India have soared to the highest ever, damping the outlook for demand in the world’s second-biggest consumer. That was especially apparent during the day of Akshaya Tritiya at the weekend, which is considered one of the most auspicious times of the year to buy gold by the nation’s majority Hindu population.

- Investors are buying into platinum exchange-traded funds (ETFs) as power cuts in South Africa threaten the output of the world’s top producer. Holdings in funds backed by the metal surged by more than 117,000 ounces last week, the biggest weekly increase since March 2019, according to an initial tally by Bloomberg. That helped push platinum prices to the highest in more than a year.

- Harmony Gold was raised to equal-weight from underweight by Morgan Stanley, which noted that there are higher risks associated with this company and yet they find that balanced considering the bullish gold price forecast. Harmony finished the week up 5% on the rerating, the strongest performer in the NYSE Arca Gold Miners Index. Pan American Silver also had favorable guidance on production and cost after their bedding down their part or the Yamana acquisition.

- The worst-performing precious metal for the week was palladium, down 7.12%. Gold prices were held in check this week with the personal consumption expenditures index, excluding food and energy, rising 4.6% in March from a year earlier, far above the 2% Fed target for underlying inflation. The Fed is meeting next week to consider its options.

- Royal Gold’s 2023 guidance is for gold sales of 320-345k ounces, where midpoint targets are 9% below consensus estimates of 364k ounces. Of the 30k ounces negative variance versus consensus, approximately 10k ounces are attributable to gold production. The remaining 20k ounces negative variance is attributable to non-gold production.

- Newcrest announced relatively weak fiscal third-quarter operating results. Gold and copper production were 10% and 18% lower, respectively, than consensus, at 6% higher cash costs and 10% lower all-in sustaining costs (AISC). 2023 operating guidance was maintained and capital guidance was decreased by 24% due to lower stripping and deferral on the timing of capital spending on various projects.

Opportunities

- Since bottoming at $1,622 per ounce in September 2022, gold’s pronounced 20%+ run-up to the $2,000-per-ounce level in recent months has brought some amount of relief to an otherwise difficult market for junior explorers and developers. In spite of this relief, valuations for the group remain trading at a significant discount to producer peers, which we see as reflective of lingering fears around cost and capital inflation, along with the perceptions/realities associated with executing on project development successfully as a junior.

- RBC continues to believe explorer/developer mergers and acquisitions will remain muted in the near term. This is the result of not only depressed valuations among the producers but also a focus among these producers on maintaining financial discipline while reducing project execution risk driven by the persistent inflationary environment. Longer term, as M&A inevitably comes down, and larger producers begin to focus on growth once more, they expect one of the main emerging themes to be the acquisition of permitted, shovel-ready projects that can produce material ounces (>200k ounces) over 10+ years. A higher gold price could accelerate transactions.

- The Wall Street Journal reported that some weary Bitcoin investors are starting to chase a shiny new object – gold! Bludgeoned by the instability of the unregulated cryptocurrency markets, some investors in crypto who wanted their money independent of banks and national currencies have now turned to gold. Web searches for “crypto” and “gold” in the same query are the highest since 2018, and Google searches on “how to buy gold” have hit their highest level this month, according to Google Trends data, which covers two decades of historic searches.

Threats

- In India, unless domestic gold prices drop by 5-10%, demand from April to June will be weak and overall sales this year will be flat to negative compared with 2022, Sheth said. “You already have a washed-out January-March quarter, and the current quarter is also weighed down by high prices,” he said. Consumption was 774 tons last year, according to World Gold Council (WGC) data.

- The ongoing inflationary environment remains an overarching theme within the gold space, raising concerns among investors about the potential impact inflation will have on project economics. Companies who have entered construction are facing increased capital and operating costs, which could place them in a situation to seek additional financing at a time of high interest rates and discounted valuations.

- Illegal mining by “zama zamas,” a Zulu term that loosely translates to “take a chance” (as you are literally putting your life at risk going into old mining shafts and mining remanent gold), is up. Sibanye Stillwater noted this week that there is a “material risk” to its South African operations. In 2017, the number of illegal mining incidents the company had to deal with was 515, but with a sharp crackdown in 2018, Sibanye reduced the incidents to 92. However, the number of incidents in 2022 was 363, double the prior year’s count. They are literally having to address a new illegal mining incident every day.