Strengths

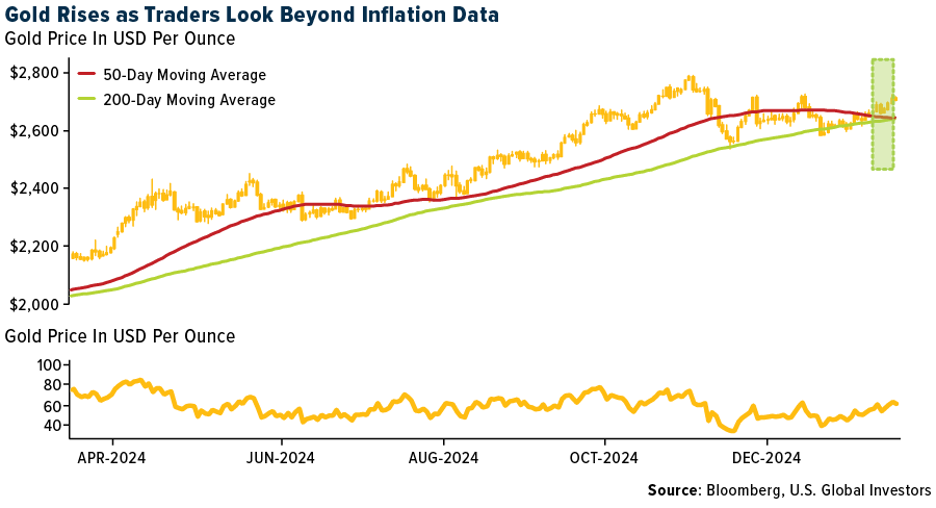

- The best performing precious metal for the week was gold, up 0.86%. Bullion traded at over $2,700 an ounce, after the consumer price index — which excludes food and energy costs — rose 0.2% following four months of gains of 0.3%. Gold climbed to the highest in a month after a surprise slowdown in U.S. inflation revived expectations for Federal Reserve rate cuts this year, reports Bloomberg.

- According to BMO, Mandalay Resources reported fourth quarter 2024 gold equivalent production of 25,000 ounces. On an annual basis, the company produced 97,000 ounces of gold, which approached the high end of its annual production guidance of 90,000-100,000 ounces. Mandalay has coproduct grades of 5% antimony that significantly enhances its importance to Western interest with China cutting of antinomy exports.

- Catalyst Metals rose over 15% this week on plans to double production on the plutonic gold belt by bringing in three mines into production for A$31 million over the next 12 to 18 months. The Plutonic East mine remains on schedule for first production in March 2025. K2 and Trident remain on track along with a 180,000-meter exploration drilling program.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.16%, on weak auto demand numbers for November and rising U.S. inventories on dealer lots. On Friday, Kazakhstan announced they would be selling about $6 billion in gold bullion per year in a bid to prop up their national currency, the tenge. Initially the gold price fell about $10 per ounce but recovered as the trading day started.

- According to Morgan Stanley, challenging demand fundamentals across the supply chain prompted major rough diamond suppliers over 2024 to cancel/delay sight sales and cut prices. January polished prices remain 16-26% lower year-over-year, according to Rapaport.

- According to Scotia, B2Gold reported Q4/24 production results of 186,000 ounces gold, 4% below their estimate of 193,000 ounces and achieving the lower end of the 800,000-870,000 ounce guidance range. According to Bloomberg, Eldorado Gold slipped after saying the Skouries project in Greece is experiencing slower-than-planned progress due to limited availability of construction workers. Management announced lower-than-expected spending in the fourth quarter for the Skouries project due to a delayed ramp up to the planned 1,300 site personnel, with about 1,050 personnel on site at year-end.

Opportunities

- Canaccord believes valuations for gold equities remain relatively attractive, particularly given the backdrop of all-time high gold prices. Gold equities are currently trading at price-to-net asset value (P/NAV) ratios of 0.64x, with an average implied gold price of US$2,165/oz—representing a 20% discount to the spot price. A reversion to historical gold-to-gold equity averages suggests potential upside of 33% and 47% for the VanEck Vectors Gold Mines ETF (GDX) and VanEck Vectors Junior Gold Miners ETF (GDXJ), respectively.

- Gold is in an interesting spot as Trump’s second term looms. Central banks are buying, while investors try to second-guess the Fed about how many rate cuts are due this year. Trump’s trade and foreign-policy agendas — when they take initial form after Jan. 20 — are likely to lead to volatility, especially for lofty stocks, according to Bloomberg.

- Gold’s biggest annual gain since 2010 will be followed by fresh record highs later this year as trade and geopolitical uncertainties help drive demand for the haven asset, UBS Group AG predicts. The metal has edged higher so far this month — trading near $2,670 an ounce — after jumping 27% in 2024. While a stronger dollar and elevated US yields will be headwinds in the first half of this year, that will be more than offset by demand for bullion as a diversifier, pushing prices to $2,850 by year-end, UBS said.

Threats

- According to Stifel, i-80 Gold amended the terms for its $65 million convertible debentures due in February 2027. Although this 15% dilutive move is a step in the right direction, the company needs a cash injection now. They model the company needing to raise $25 million this quarter with another $60 million by year-end and an additional $70 million by mid-2026 to repay the Orion debt.

- According to BMO, for 2025, Aris Mining production guidance was somewhat disappointing as Segovia’s 2025 guidance (210,000-250,000 ounces) was lower than previously disclosed. Additionally, cost estimates (AISC guidance of $1,450-1,600 per ounces) were higher than expectations.

- Barrick Gold said it is suspending mining operations in Mali after the government started removing gold from the nation’s biggest mine in the latest escalation of a months-long dispute. The world’s number two gold producer is stopping activity at the vast Loulo-Gounkoto complex, the firm said in a statement on Tuesday, according to Bloomberg.