Strengths

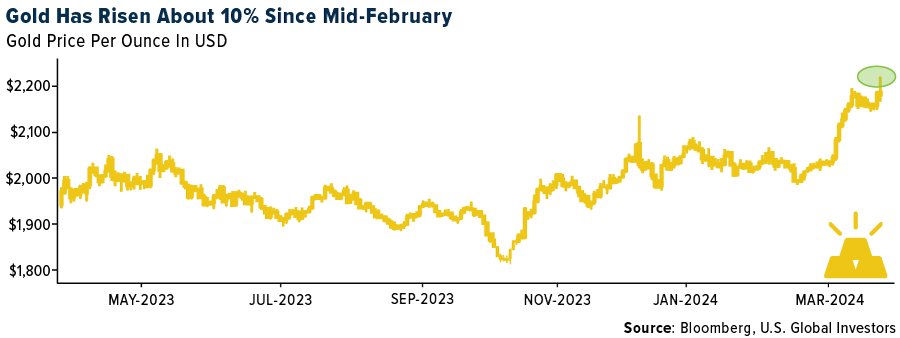

- The best performing precious metal for the week was gold, up 0.29%. According to Bloomberg, gold’s consolidation after climbing to a record high earlier this month should be positive for the metal in the longer term. Market participants will continue to focus on U.S. monetary policy and geopolitical tensions.

- Bloomberg reported this week that investors added a net $1.04 billion to State Street's SPDR Gold Shares in the latest session for which data is available, increasing the fund's assets by 1.8% to $57.8 billion, the highest level since January 2, according to data compiled by Bloomberg.

- Bank of America says physical gold demand has been strong of late, helping gold’s rally. Linked to that, precious metals refiner Heraeus notes that, “Following the typically strong gold-buying season in the first two months of the year in China due to Lunar New Year demand, March and the second quarter tend see lower consumer demand.”

Weaknesses

- The worst performing precious metal for the week was palladium, down 8.88%, despite the net-short position being cut to a 10-week low, as reported by the weekly CFTC data release. According to Bank of America, gold prices have been strong, up 18% since the October low. However, gold equities have underperformed, with key indices up far less: the Philadelphia Gold and Silver Index (XAU) is up 15%, the NYSE Arca Exchange Gold Bugs Index (HUI) is up 15%, and the S&P/TSX Global Gold Index is up 11.5%, over that same period.

- K92 Mining announced underground operations at the Kainantu Gold Mine in Papua New Guinea have been suspended following a non-industrial incident on March 10 that resulted in the death of an employee. The mill continued to process ore from existing stockpiles.

- As of Friday afternoon, Russian rescuers had still not reached their way to search for 13 miners trapped at about 400 feet underground after the Pioner mine collapsed in Amur region on Monday, Interfax reports, citing emergency services. The cause of the accident has not been announced.

Opportunities

- Bank of America reported that its gold stocks, on average, are priced in at $1,737 per ounce, well below spot at $2,156 per ounce. The highest is Triple Flag Precious Metals, pricing $2,115 per ounce, while the lowest is Centerra, pricing $1,240 per ounce.

- According to Haywood, the gold-to-silver ratio has trended higher so far this year, to 85.6, according to Friday’s closing prices, against 87.03 on January 1, the analysts wrote. “Much of this has been due to initial gold price appreciation beating silver before both took off on February 29,” they added.

- RBC noted that while gold is up 13% over the last six months, and now up 70% over five years, EV/oz valuations for the precious metals explorers and developers they track continue to trend lower, now at an average $27 per ounce, down 40% from a peak of $46 per ounce in 2023 with gold 10% lower, and well off 2020 highs of over $80 per ounce with gold at similar levels.

Threats

- The three-week string of losses in the U.S. dollar that started in the third week of February has now had all those losses recouped with the last two weeks of trading. With gold trading sideways during that lift in the value of the dollar, this may be a headwind for gold if we continue to see renewed dollar strength.

- Eight Capital Uranium reported over the weekend that Niger announced it has suspended its military agreement with the U.S. Russia’s influence in the region is growing larger. Niger is threatening an alliance with Burkina Faso and Mali (also backed by Russia).

- Research by Bank of America suggests that India, as the second-largest consumer in the gold market, could see lower demand in March and April due to the fewer auspicious wedding dates, which are associated with a higher level of gold purchases.