Strengths

- The best performing precious metal for the past week was gold, up 2.11%. The precious metal closed the week strongly on weaker-than-expected factor data combined with consumer confidence waning, which may prompt the Federal Reserve to act sooner rather than later. Bullion has largely held ground this year despite expectations being pushed back on how soon the Fed will start easing. Swaps markets suggest investors do not see much chance of a reduction in borrowing costs until June.

- According to BMO, Reunion Gold released a new resource and hosted a teach-in today. In general, the update was positive, with mineral inventory and grade both increasing. Indicated resources increased 72% compared to the June 2023 maiden resource. The company also released a maiden underground resource of 1,145K ounces.

- Endeavour Mining announced that wet commissioning is underway at its Sabodala-Massawa BIOX plant expansion with overall construction 91% complete and on budget, and that they are expecting first gold in early May 2024 (as planned). Sabodala-Massawa’s FY24 guidance forecasts production of 360,000-400,000 ounces at an all-in sustaining cost (AISC) between $750-$850 per ounce.

Weaknesses

- The worst performing precious metal for the week was palladium, down 3.78%. According to Bank of America, production widely disappointed with nine of 12 gold companies reporting guidance below Bloomberg consensus expectations. On unit costs, similarly, nine out of 12 companies reported guidance that was higher versus Bloomberg consensus expectations. Total capex was better, with only four out of 12 companies reporting higher capex than consensus. On conference calls, cost inflation remained very topical with most companies noting that they are still seeing cost inflationary pressures in certain areas (such as labor) while easing fuel costs have provided some offset.

- RBC says it expects a negative reaction from Argonaut Gold shares following 2024 guidance with higher costs and capital versus their estimates and consensus. At the Magino project in Ontario, greater dilution from selective mining of higher-grade material upfront has resulted in 5%-10% lower budgeted grades over the first few years. Throughput is guided to continue to ramp up through the first half of 2024 due to lower availability and higher costs driven by pressures related to labor and diesel.

- According to Sibanye Stillwater, platinum group metal (PGM) prices may be close to the bottom. BMO spoke to the continued challenges in the PGM environment but remained optimistic for the future, indicating that the PGM market could be nearing the end of the destocking cycle and outlook for interest rate cuts later in 2024 should help demand recovery. They are of the view that the supply response to the PGM price weakness, while possible, remains a less flexible option in the near term.

Opportunities

- Orla Mining announced it will acquire all the outstanding common shares of Contact Gold for $8.1 million, representing an implied enterprise value (EV)-to-ounces of resource of $18, compared to the average for developer companies at $89. Each holder of Contact shares will receive 0.0063 of an Orla share, for total consideration of $0.03 per share, with closing expected in the second quarter.

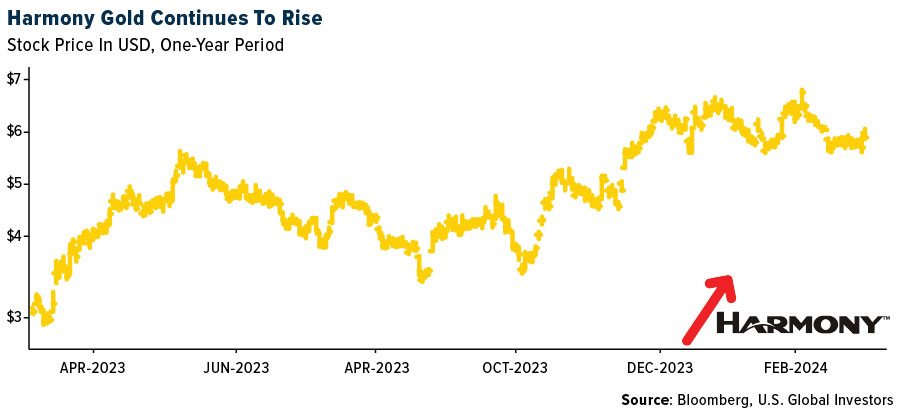

- Harmony Gold Mining said it will spend 7.9 billion rand ($410 million) to extend the life of the world’s deepest mine, bucking the trend in South Africa’s dwindling gold industry. The company acquired the Mponeng mine – east of Johannesburg – when AngloGold Ashanti sold its last remaining assets in South Africa four years ago. The project has become the star performer in Harmony’s portfolio, helping the miner triple its profit in the six months through December.

- BMO continues to be excited about the increased pace of new technology adoption among mining companies. As companies prepare for the next phases of growth, technology leaders are increasingly likely to adopt new productivity improvements such as electric vehicles, autonomous haulage, advanced process control, etc. These technologies will be available to "fast followers" as well as the first movers. Mines built to large-cap companies with financial and technical resources should have cost and efficiency advantages in the future.

Threats

- Mexico's president, Andrés Manuel López Obrador, or AMLO, recently presented a series of potential constitutional changes to the Mexican Congress, including a measure that aims to ban open pit mining in the country. This is still very early stage and part of a broader reform package, which still must be approved by Congress by a 2/3rds majority in both houses.

- Northam Platinum reported that its earnings declined 91% year-over-year The PGM industry is currently navigating significantly depressed PGM prices and high inflation, together with a raft of global geopolitical uncertainties and locally, Eskom faces load curtailment events. We have not yet seen a change in fundamentals which are likely to move the market into more positive territory, and consequently, the short-term outlook remains challenging. Northam anticipates the depressed pricing environment will continue over the next 12 to 24 months, placing significant pressure on earnings and cash generation across the PGM mining sector as reported by Bloomberg.

- According to Scotia, for SSR Mining, public comments from the Turkish government indicate that test results to date have been negative with respect to potential environmental contamination. Containment and remediation efforts are ongoing as directed by the Turkish government, with an initial focus on removing heap leach material from the Sabırlı Valley and relocating it to a permanent storage location. SSR is in the process of evaluating the estimated remediation costs and anticipates recording a remediation liability during Q1/24.