- Gold's long term price structure is pointing towards $20,000.

- 10X like the 1970's.

Silver surged to $31.55 an ounce today, May 17, 2024.

Now that the silver price surpassed the $30 mark, we anticipate a significant upward movement. This is a crucial point as we have recently seen a successful breakout from a formation that has been in place for a decade. We advise holding onto your investments with confidence and not selling. Additionally, consider acquiring physical Gold and Silver, as well as carefully selected mining equities.

- India bought more in Q1 2024 then all of 2023

- The BRICS nations are gathering, and their 'gold for oil' strategy will overthrow the dominance of the US Dollar.

- This is a significant development that requires our close attention.

- The US #SilverSqueeze, driven by platforms like Reddit and other social media, has also resurfaced.

- Staying informed about these global economic trends is crucial for making informed investment decisions.

- It's important to note that the retail market in the US, while significant, is not as dominant as that of India, China, and Russia (collectively known as BRICS ++), which account for 70% of the global market.

- But more than being 70% of the World (everything not NATO) the motivation to dethrone a rogue bully is how history always moves.

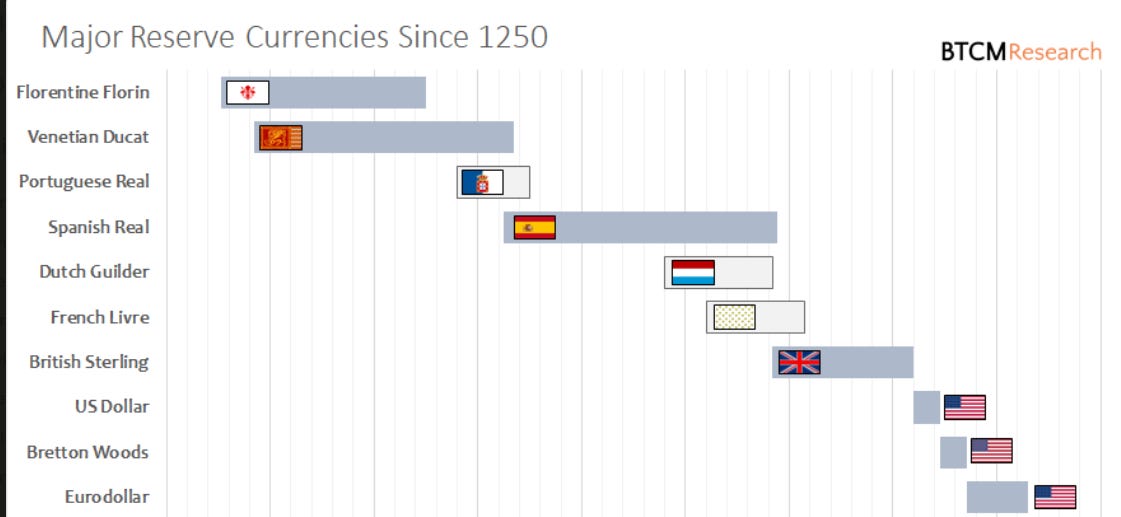

Here is a table showing the dominant reserve currencies throughout history, along with their approximate years of being the global reserve currency:

- Portugal and Spain dominated as reserve currencies during their periods of global exploration and empire building in the 15th-17th centuries.

- The Dutch guilder became a major reserve currency in the 17th century when the Dutch East India Company facilitated global trade.

- France and Britain were the dominant reserve currencies in the 18th and 19th centuries respectively, reflecting their economic power at the time.

- The British pound sterling was the primary reserve currency until after World War II when the U.S. dollar took over, aided by the establishment of the Bretton Woods system.

- The U.S. dollar has been the dominant global reserve currency since the end of World War II to the present day.

As history advances the time window of being the global reserve currency shortens mostly because the world is smaller (in terms of communication, infrastructure, internet and modes of transportation) Shorter meaning the time to travel from continent to continent has rapidly decreased.

Nations likewise can meet over zoom or plot a new currency with gold for oil on the blockchain.

Really Gold has been the Global Reserve currency this entire time because as regimes falter always due to debt, deficit spending (WAR SPENDING) and zealous colonization the people that feel isolated and subject to coercion always figure out a new system.

Though Gold (a noble metal) and Silver (the world’s most conductive metal and both on the periodic table of elements) each time step up to account for the “new system” its really the oldest system that emerges as the new solution.

I understand this is confusing, but if you look back through that chart, and even before going through the Collapse of Athens, Rome, and Persian Empire, people revert to Gold and Silver. This is because fiat currencies are issued by Governments and Governments are made up of people, and people are flawed and subject to corruption.

The US is now a rogue state comprised of politicians stealing and bombing multiple corners of the globe to smithereens (remember the military is the only thing backing the dollar and also the best way for war profiteers and their puppet politicians to continue their parasitic plans.)

They steal by printing the money (insidious inflation tax) then moving the money overseas by aggressive foreign policy. It's much easier to steal when you hide it overseas. You can even fund both sides of wars to make it even more confusing and the theft more undetectable.

So the wars:

- Feed the kleptocracy

- Alienate other nations

- Weaken the currency

- Strengthen Gold and Silver

- Gold and Silver represent a constrained monetary system which is the Opposite of the Government issued (printed) currency that erodes in purchasing power.

- This in turn means the social contract is broken.

- Workers enter into a system believing that their time, talent, labor and energy can be traded for a Government issued currency to purchase rewards valued by society including housing, food, energy, clothing, health care, education. But the broken contract means someone's life congealed (their work) is considered meaningless by the Politicians engaged in theft.

- So now The failed State has to deal with pressure from BRICS++ as well as its own citizens who awaken that their leaders have been stealing, lying, issue false media statements and the civil strife intensifies so that the regime loses legitimacy.

- Political legitimacy is defined by: can the laws on the Federal level penetrate and hold to the rank and file citizen.

- Right now the legitimacy is lost and it can never be reclaimed entirely because people begin to lose faith in ordinary institutions such as electoral college, voting registration, and vote counting.

- Even the choice of candidates is more like the Uni-party and nothing like the representative form of Government (taught in grade school textbooks)

- The more pathetic it becomes, the more you need Gold and Silver.