Recently I saw a T-shirt for sale that said, “Science Doesn’t Care What You Think.” I used a similar metaphor recently, observing how many experiments show that jumping off a cliff will send you rapidly downward. If you want to test that theory, please add me to your will first.

But it’s different when the “science” is economics. Using that kind of analysis, we would observe that jumping off a cliff works more like Wile E. Coyote did it. You might or might not fall but if you do, you can first stand there in mid-air for a minute. This is what they call “lagged effects.”

Of course, the economy is far more complex than coyotes vs. gravity. We don’t even know what all the inputs are, much less know with any certainty what they will produce. The best we can do is get in the general vicinity of correct. Oftentimes, we struggle just to get the direction right.

Yet even that is tough when economic forecasters can so easily work backwards, starting with the desired conclusion and then finding data to “prove” it. Such data is always there. It’s not even hard to find. You just have to be willing to ignore the parts that don’t fit.

Today I want to demonstrate this by first showing how the economy is in great shape and nowhere near recession. Then I’ll do the opposite, telling you why the economy is terrible and will probably get much worse in the near future. Then I’ll conclude with what may be a way to reconcile these seemingly opposite outlooks.

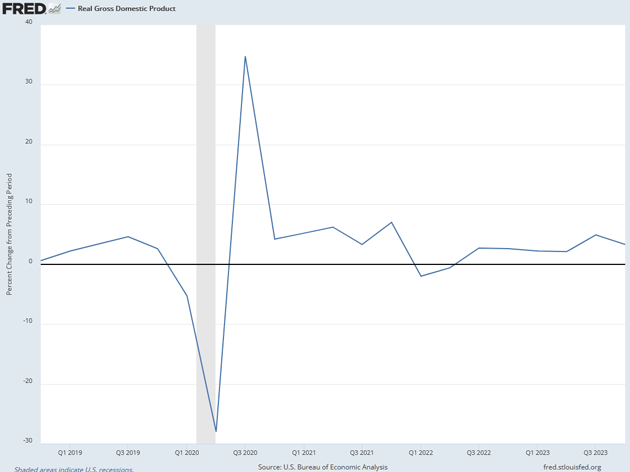

We’ll start with the good news. The US economy’s statistical vital signs are, if not healthy, at least stable. We’ll start with GDP growth. This chart shows real (i.e., inflation-adjusted) GDP growth by quarter for the last five years at a seasonally adjusted annualized rate.

Source: FRED

COVID obviously distorts 2020, with a sharp drop and then a quick recovery. But since then, GDP growth stayed positive other than that two-quarter “technical recession” in early 2022. The worst you can say here is that Q4 of 2023 was weaker than Q3. But it was still pretty good.

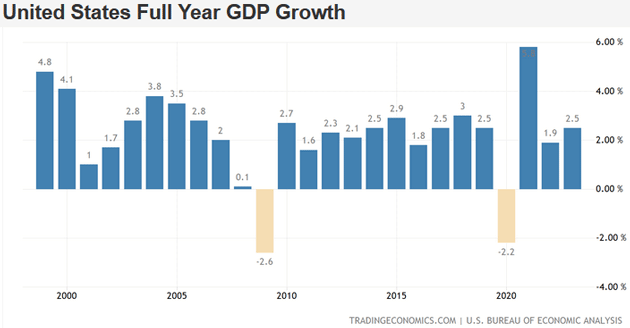

Here is a longer-term perspective, showing full-year real GDP growth for the last 25 years.

Source: Trading Economics

Here again we see the COVID effect in 2020‒2021 and the Great Recession in 2008‒2009. But otherwise, the 2.5% growth in 2023 is in the normal range compared to recent years.

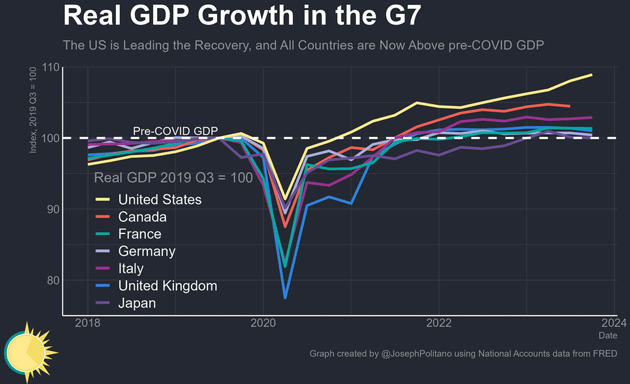

US GDP is doing well against other large economies, too. We have recovered from the pandemic far better than the other G7 countries.

Source: Joseph Politano

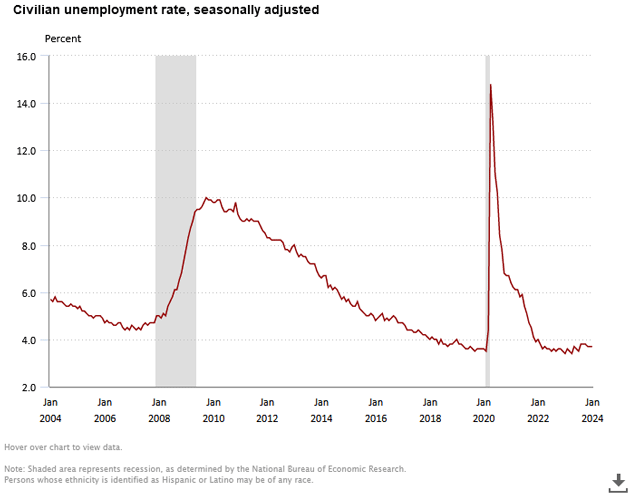

The labor market also looks healthy. The headline unemployment rate—which had already been falling for years before COVID—is roughly back where it was in 2019. The only problem here is that some employers often can’t find the help they need. They’re also having to pay higher wages, but in the big picture that’s a good problem. It puts more money in consumers’ pockets.

Source: BLS

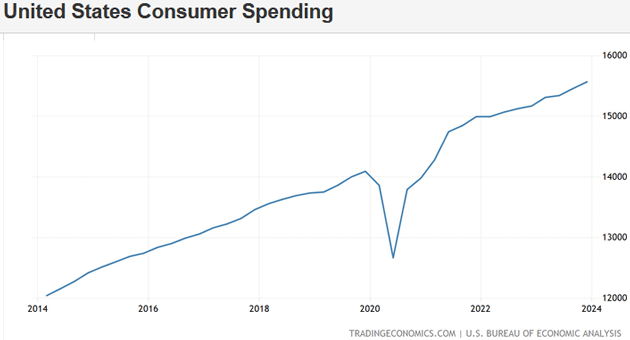

And speaking of consumer spending, it is rising again after the COVID stumble. The way we spend has changed, but the total amounts are right on trend.

Source: Trading Economics

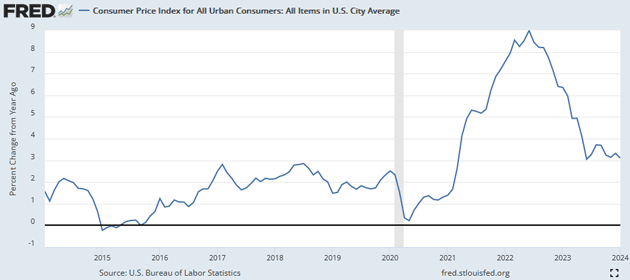

The biggest sore spot, inflation, remains a problem but a much smaller one.

Source: FRED

As of January 2020, the annual CPI change was 2.5%. As of January 2024, it was 3.1%. So it’s risen 0.6 percentage points. That’s not nothing, but it’s also not the end of the world. Yes, many items remain more expensive than they used to be, but average wages have kept pace, too.

As with your body’s vital signs—pulse, temperature, etc.—these economic vital signs may not show potentially serious chronic conditions. They don’t prove everything is well. Nonetheless, they suggest the economy isn’t in imminent danger.

You could argue this data is flawed, manipulated, or otherwise unreliable. I routinely describe those sorts of problems in my letters. But remember, too, we’re looking at data collected over many years, in all kinds of conditions, by different agencies using assorted methodologies. When it all shows generally consistent findings, data problems are a less likely explanation.

As Sigmund Freud (supposedly) said, “Sometimes a cigar is just a cigar.” The headline data makes a good case the economy is performing well. But that’s not the only case. I can make another equally convincing one in the other direction.

In writing this letter I talked to David Bahnsen, who always has a thoughtful perspective on the economy. The conflicting data puzzles him, too. He rattled through this list (off the top of his head!):

“Short-term market-watching does not get easier by attaching it to short-term economic data. For some time now pundits have been pulled in two directions at once. Manufacturing? In decline for over a year. Factory construction? Up 75% over the last year. Unemployment? Well below 4%. Labor force participation? Still dramatically lower than its pre-GFC high. Trade deficit? Down (that is good). Total global trade levels? Down (that is not good). Japan’s economy? Better in many ways. China’s economy? Worse in many ways. Housing prices? Have not collapsed at all. Housing sales volume? Totally collapsed. Housing demand? Not collapsed. Housing supply? Collapsed. Core goods inflation? Gone. Core services inflation? Not gone.

“I can go on, but this is the tale of the tape—economic data everywhere you look that is maddening to the pessimists and not quite reassuring to the optimists.”

(By the way, you should subscribe to David's Dividend Café, a brief free daily market update plus a short philosophical point. I have been reading him daily for years. David is concise and fun to read, in addition to being brilliant and on TV somewhere almost every day.)

That’s quite a list of opposing data, which I think demonstrates the dilemma. Every positive data point—including those I showed above—has a negating counterpart.

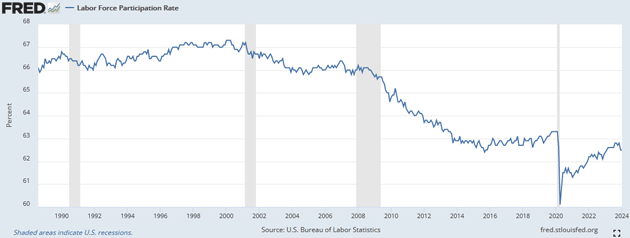

For example, I showed above how unemployment is historically low. Yet, as David mentions, the percentage of adults participating in the labor force has been dropping steadily since 2000.

Source: FRED

We know why this is happening. It’s mostly a result of a growing percentage of the population being above retirement age as the larger Boomer generation ages. Yet that explanation isn’t comforting. Limited workers mean limited GDP growth unless the average worker becomes much more productive. (AI may actually do that but not for a few more years, at least enough to show up in the data.)

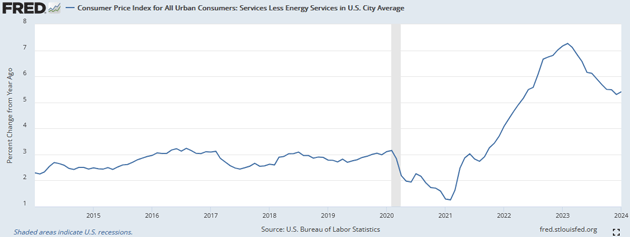

The fact that a higher percentage of the population is retired matters to inflation, too. It raises the “dependency ratio” as millions of adults stop working but continue consuming. This means each working person must carry a larger load in order to sustain GDP. It also changes the composition of demand in favor of services. So, as David notes, service inflation is rising even as overall inflation stabilizes. Here’s service inflation less energy (so this includes housing).

Source: FRED

Service inflation is off the highs but still north of 5%, and far above the pre-2020 range.

What, if anything, is going to bring down this inflation? To most people it matters a lot more than the disinflation we are seeing in goods. It’s great that furniture and clothing cost less but you can only buy so much. Rent, however, is there every month. So are food and healthcare.

It is entirely possible, if not likely, we will have an economy that is objectively good by traditional measures but in which many households don’t feel good at all. And at some point, this becomes self-fulfilling. Pessimistic people don’t spend as freely.

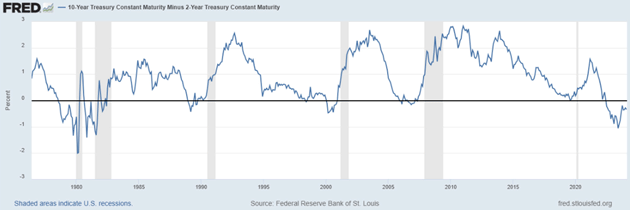

There is a lot more data that frustrates analysts. Let's look at a few examples. Perhaps the most frustrating to me personally is the inverted yield curve.

Source: FRED

The yield curve has been one of my go-to recession indicators for decades, and is one reason I expected a recession in 2023. You have to go back to the 1980s to find a yield curve more inverted, and yet we still see no recession. We can posit all sorts of reasons this is the case, but it doesn't relieve my frustration.

As I've pointed out numerous times, an inverted yield curve doesn’t cause a recession. Like a fever, it simply indicates something is wrong in the economic body. This may point to why we don’t feel so good even as data suggests the economy is generally OK.

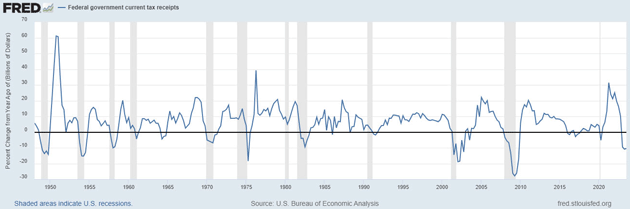

Look at this next chart. Federal tax receipts have plummeted in a way typically associated with recessions.

Source: FRED

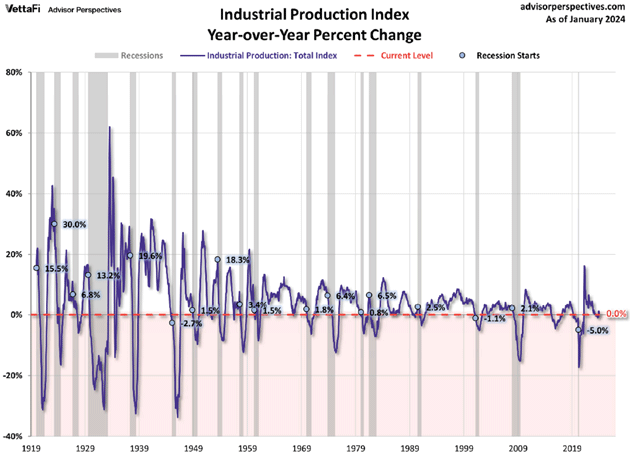

Industrial production is down, yet the economy seems to be doing fine.

Source: Advisor Perspectives

In the stock market, more stocks are down than up in the advance/decline measures. A few big names account for most of the growth while many companies see mediocre gains. But the S&P 500 index is knocking on 30% gains over the last 12 months.

Nvidia (NVDA) in particular had a mind blowing surge this week. I understand the company’s importance but is Nvidia really worth more than the entire S&P energy sector? The numbers say so with market value is now $2 trillion. Then again, Cisco in early 2000 was also overvalued.

These valuations are nowhere near normal. Quoting Bahnsen’s note today:

“Seeing a company like Palo Alto Networks get taken to the woodshed today behind declining sales and lower-than-expected cybersecurity spending in 2024 (guidance) made me wonder if we are hitting the early innings of ‘revised expectations’ for AI spending. Cisco was also down last week (but only a tad, nothing like Palo Alto was today) as they announced slower corporate technology spending. But in their case, AI-revenue guidance for 2024 was tripled from prior expectations, even as total backlogs indicated slower spending. I am not sure there is a detectable trend from some of the specific cases we have seen so far, as idiosyncratic and unique situations do not lend themselves to an economy-wide conclusion. I do know this: A company that drops -25% in stock price because they decided corporate tech orders would be -2% less than previously expected is not dealing with disappointing guidance; they are dealing with over-valuation. Period.”

Will that happen to the rest of the market? At some point, I expect the answer will be yes. But the market can stay overvalued a long time until we see a revaluation across the board. Remember that the 1990 tech bubble burst wasn’t caused by a recession.

As Peter Boockvar said on a phone call a few minutes ago, “I have never seen so many cross currents in the markets and economy as I see now.” I totally agree.

I mentioned above there might be a way to reconcile these seemingly opposite views. There’s actually more than one way. I touched on it last week in Choose Your Own Economy. It’s important and I think worth repeating.

“We should also note ‘the economy’ is a misnomer. We have a bunch of different individual economies whose condition can vary wildly. You can be doing well while the national averages say the country is in recession. Or you can lose your job and go bankrupt while ‘the economy’ is booming. It's like the old joke that says when your neighbor loses his job it's a recession. When you lose your job it's a depression.

“No forecast can accurately capture everyone’s individual experience or prospects. At best, they can describe broad tendencies. And in large countries, ‘broad’ can hide a lot of variation.”

This is incredibly important and often overlooked. Averages, by definition, don’t describe everyone. Many will be above average or below. When, for example, we observe how real wages are up since 2020, we should remember many people haven’t participated in that. Not everyone gets an inflation adjustment to their base salary. But if not, and their nominal pay hasn’t risen, their real income is actually down something like 20%. They naturally aren’t happy about it.

But even bigger things are happening. I think the business cycle itself may be changing. This pattern where the economy swings from expansion to recession to expansion again, with central bank policy heavily influencing the swings, isn’t etched in stone. Nothing says it has to continue forever.

Consider the current cycle. The conventional view is that COVID stimulus generated inflation which the Fed belatedly attacked with higher interest rates, and which it is now preparing to reverse. This “soft landing” is a great victory, in that view.

Yet it’s not clear the Fed had much to do with landing this plane so smoothly. You could argue they didn’t produce the inflation and didn’t stop it, either. The inflation came from supply disruptions and the higher interest rates did nothing because they started from such an absurdly low base.

My friend Jim Bianco posted some fascinating info on X this week. He was responding to Mark Zandi (another friend) who argues the Fed has achieved its mandate and shouldn’t wait much longer to cut rates.

Here’s Jim Bianco:

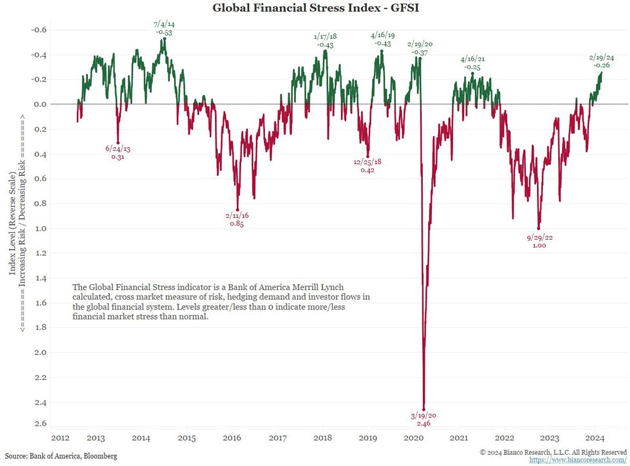

“Below is the BofA Global Financial Stress Indicator. A description is on the chart.

Source: Jim Bianco

“It just exceeded its April 2021 extreme, showing the LEAST amount of financial stress since the Pandemic (February 2020).

“If, as noted in the [Mark Zandi] repost below, the Fed ‘has all but achieved its dual mandate of a full-employment economy and low and stable inflation’ then the Fed did this with a 5.50% funds rate!

“In other words, 5.50% is NOT a stressful rate. The Global Financial Stress Indicator above says markets are enjoying the least amount of stress at any time in the last four years.

“Restated bluntly, a 5.5% funds rate is not restraining anything. So, cuts are not necessary.”

Set aside whether or not the Fed should cut rates. If Jim is right here, it means the Fed never really “tightened” in the conventional sense. They didn’t constrain economic activity enough to reduce demand. Yet inflation dropped and we have, so far, avoided recession. What is going on here?

I don’t have a good answer, except that it suggests we are now operating under different rules. We shouldn’t assume events will unfold as they did in the past. We know some things have changed, with federal debt at unprecedented levels and a demographically driven labor shortage. Add in new technologies like AI, and I think it’s possible we crossed the event horizon without even knowing it. That’s why we’re confused.

All this will grow clearer, I hope, but meanwhile I think we should avoid thinking X will always lead to Y just because it always did in the past.

“I have a feeling we’re not in Kansas anymore, Toto.”

We (Still) Want to Hear from You

A couple of letters ago I announced a change to our comments section. We’ve moved to a new platform where we are building a community of readers engaging in a never-ending conversation. You can join us at the link below.

That announcement produced a wealth of immensely valuable feedback—far more than we usually get. I suspect the increase was partly just because I reminded readers they could send me their thoughts, all of which I read carefully.

So, in case you missed it…

Click here to join our Thoughts from the Frontline community.

Mill Valley, Florida, and Thoughts

I find myself tonight in the pleasant environs of Mill Valley, California, almost in the shadow of the Golden Gate Bridge. I am here undergoing some new procedures that deal with the problems I have of getting older. Understand, my full intention is to get much older than I currently am. I just want to do it in a better fashion than my parents did.

If you are under 50, you will likely not have to deal with many of the issues that so many of us of a certain age have to work through. Biotechnology is advancing rapidly. I am under somewhat of an NDA for a certain amount of time before I can talk about this, but the minute I can, I will. Assuming everything works as we all expect. Just think of me as your personal guinea pig.

My computer and my body tell me it is after midnight in Puerto Rico, so it really is time for me to hit the send button. I hope you have a great week. I am hoping to have the opportunity this weekend to stroll through Muir Woods once again. Something about walking through a forest of majestic redwoods just soothes the soul.

Have a great week while we think about how the world is evolving. And don't forget to follow me on X!

Your fascinated by the potential of the future analyst,

|

|

John Mauldin |

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price.

Click here to learn more.