NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 47th year in the gold business

February 2021

“We live in a technological golden age but in a monetary and fiscal dark age. While physicists discover the so-called God particle, governments print and borrow by the trillions. Science and technology may hurtle forward, but money and banking race backward.” – James Grant, Grant’s Interest Rate Observer

Investor gold demand running at red hot levels

So why isn’t the price running through the roof?

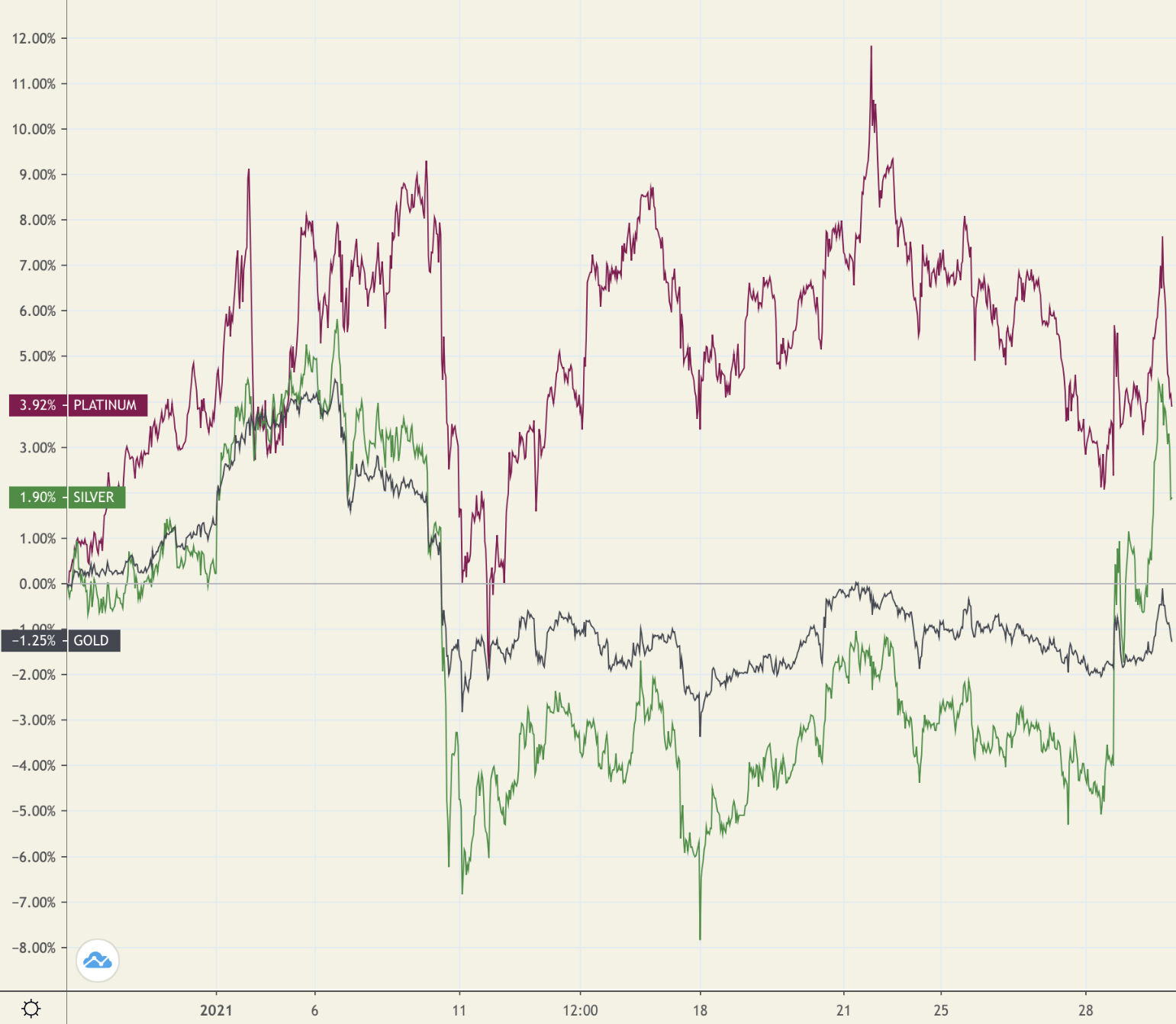

Though gold has struggled to regain the momentum so far in 2021, silver and platinum are off to solid starts. Silver was up almost 2% in January, and platinum, almost 4%. Gold, though, was down just over 1%. Demand for gold and silver coins for delivery is running red hot exacerbated by tightening supplies and delayed releases of new coinage from sovereign mints. As a result, premiums – the amount investors pay over a coin’s melt value – have begun to move higher.

Gold, silver, and platinum

(Percent gain or loss, January 2021)

Chart courtesy of TradingView.com • • • Click to enlarge

The Royal Canadian Mint is reporting a several week delay on shipping any of its 2021 product – with no concrete availability date yet announced – and the U.S. Mint has returned to allocation, reducing and limiting the number of coins being released to the dealer network on a weekly basis. The imbalance between supply and demand has already pushed wholesale premiums roughly .75% higher on gold bullion coins and approximately +2.5% on silver bullion coins since the start of the year.

At this juncture, the consensus in the industry is if gold prices remain at the lower end of their range against a backdrop of continued fiscal and monetary support from both the government and Federal Reserve, demand is likely to continue at high levels, and premium pressure unlikely to abate anytime soon. All of which raises a question we get often at USAGOLD. If demand is running so high (as it is now), why aren’t gold and silver prices going through the roof?

Analyst Craig Hemke makes a compelling argument on the price discovery mechanism in an article published recently at Seeking Alpha. “The internationally-recognized price of gold (and silver),” he writes, “is NOT based upon any sort of physical metal transaction. That’s so 1960s. Instead, the price is determined through the trading of digital derivative futures contracts in New York and unallocated forwards in London. So the only way price rises is when demand for these derivatives outstrips the supply. The big rally last summer was a period of Bank reluctance to add derivative supply, and price soared. Since then, Banks have felt more comfortable adding supply and prices have been driven consistently lower.……”

Hemke goes on to say that most of the trading that governs the gold price is implemented through computer-based trading programs that do not recognize economic fundamentals. Instead, they concentrate on day-to-day movement in notional bond yields and foreign exchange trading. Though the fundamentals make a compelling case for gold, trading algorithms, he says, “have no concept of this. So, what we’ll await in 2021 is the moment when The Machine ‘fundamentals’ switch again to our favor. And what will be the driving factor? When The Fed begins to implement Yield Curve Control.” (Ed note: We see the implementation of yield curve control, though important, as just one of several factors that could jar gold loose from its trading range.)

With prices at artificially low levels, the public is taking the opportunity to load up. The new year, though, in many respects, is just an extension of the old in terms of gold investor behavior. The World Gold Council recently reported investment demand running at record levels in 2020 and 40% higher than 2019. Germany rose to number two in the rankings for global gold coin and bullion demand behind China (where fourth-quarter demand was up 33% over last year). The United States broke into the top five for retail coin and bullion demand globally in 2020. As for 2021, the Council reports the U.S. Mint posting its best January for bullion coin sales since 1999 – despite the return to allocation.

Will the ‘Reddit Rebellion’ target silver next?

“Cooped up at home,” reports Bloomberg’s Sarah Ponczek and Claire Ballentine under the headline In 11 Hours of Pure Mania, “glued to Reddit and Stocktwits chat forums, empowered by Robinhood accounts, funded by massive government money-printing, and emboldened by a bull market that has turned reckless risk-taking into a virtue ……” Those who have studied the history of money printing know that it not only has an economic impact, it also has a psychological impact inciting uncontrolled greed, financial recklessness, and moral hazard – in short, a mania. Among the references in the Bloomberg quote, perhaps the most damning is that the current mania is funded by “massive government money printing.”

It goes without saying that GameStop is unlikely to be the only manifestation of the phenomenon. In fact, it was not long after stock trading websites put the brakes on GameStop that chat room posters began suggesting silver as the next target for the Reddit Rebellion. There is a great deal of space, however, between making a few posts and moving a market the size scope of the global silver market. Getting the lion to jump through that fiery hoop might be slightly more difficult than it would appear on the surface. Too, those hoping for a short squeeze in the silver market might be careful what they wish for. It could unleash market forces against which there is little or no defense.

Credit Bubble Bulletin’s Doug Noland had some interesting things to say along those lines in his regular missive released over this past weekend:

“Hopefully I’m wrong on this, but most will be losers. Before this is all over, many will blow up their trading accounts and exit the casino in dismay – or worse. Short squeezes always have a pyramid scheme component. It’s musical chairs, and the velocity with which squeeze stocks eventually collapse will be a shock to many. There was outrage Thursday after Robinhood and other online brokers restricted trading in a limited number of stocks. But just wait until this Bubble implodes, and there’s blood in the (Main and Wall) Streets. Trading systems were stressed this week by millions of buy orders. How will the system function under the stress of tens of millions of panicked sell orders? I’ll presume worse than March.

Things get crazy at the end of cycles. To what scale of craziness during the waning days of an epic super-cycle? From this perspective, it’s only fitting that Crowds of retail traders discover the short squeeze game – the ultimate speculation. It’s also a conspicuously late-cycle phenomenon. Indeed, ears were ringing this week from sirens blaring warnings of trouble ahead.”

Here at USAGOLD, we recommend gold and silver for long-term asset preservation purposes – not speculation. As such, we see outright ownership of physical coins and bullion as the safest and most productive option for the average investor. It is a simple, straightforward philosophy and strategy that has served us well over the years.

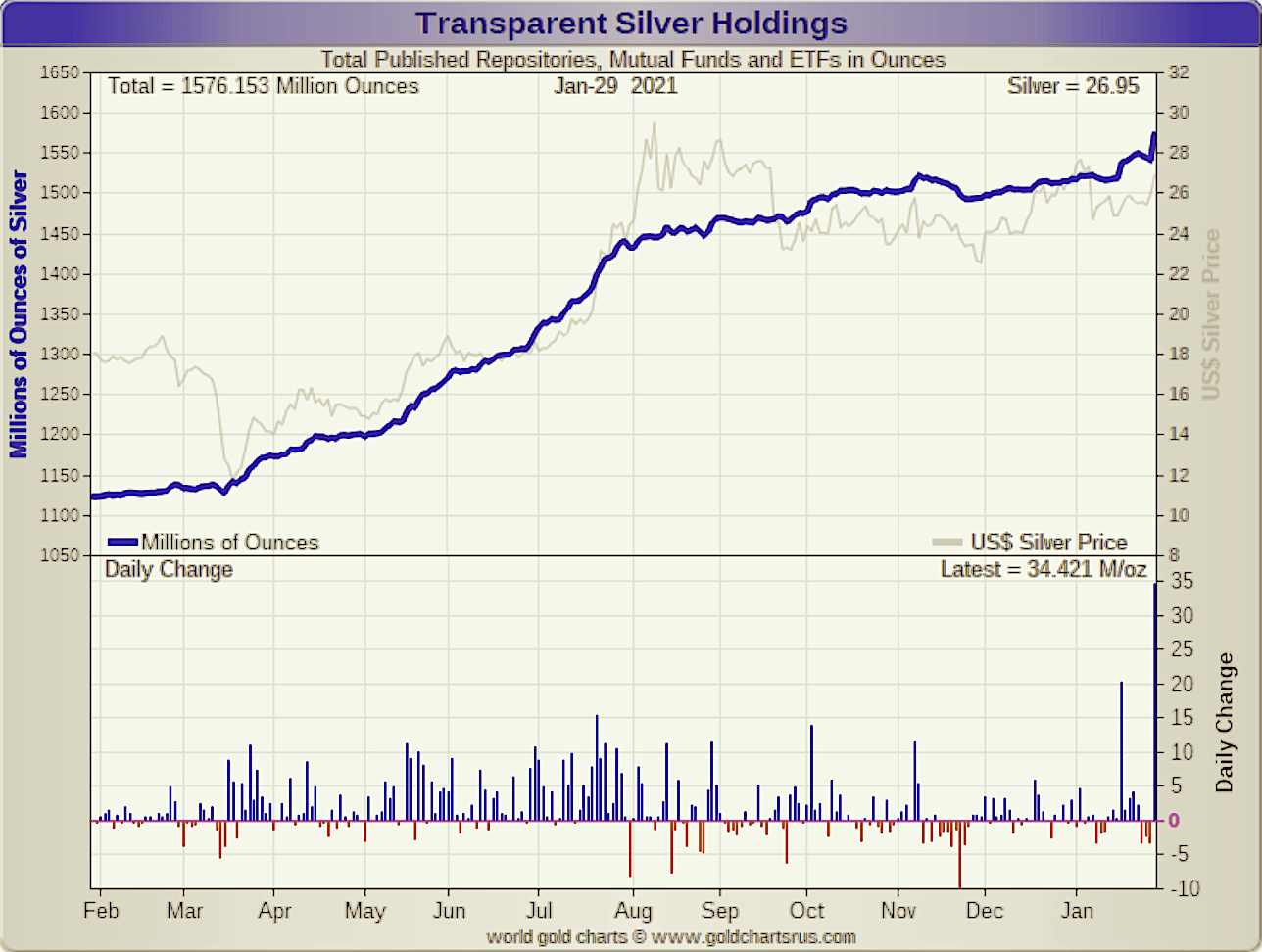

Editor’s Note: As we go to press, there are reports of very strong demand for SLV shares – the most prominent silver ETF. GoldChartsRUs reports a 34.4 million troy ounce stockpile addition for the ETF on Friday [1-29-2021]. As you can see in the chart below (which includes all repositories, mutual funds, and ETFs, including SLV), Friday’s gain is by far the largest for a single day over the past year (and, by the way, the largest since 2013 ).

Chart courtesy of GoldChartsRUs • • • Click to enlarge

‘Everyone knows they need a safe haven’

“Last March and April,” writes the Systemic Risk Council’s Paul Tucker in a piece published recently at Financial Times, “the fabric of our financial system was stretched almost beyond endurance. Only intervention from the north Atlantic central banks seems to have averted some kind of disaster triggered by markets grasping the pandemic was serious.” The most important lesson from that brush with disaster is that the financial authorities did not even bother to disclose to the public (and the investment community) just how dangerous the situation had become until months after the fact. It was labeled, you might recall, a “liquidity problem” that the Fed was addressing – no need to worry. Such circumstances argue strongly for having a hedge in place at all times just in case the wheels actually do come off.

MoneyWeek’s Merryn Somerset Webb posted a reminder of gold’s baseline portfolio role during times of market uncertainty in a separate Financial Times’ in early January. “Think of the reasons to hold gold,” she wrote. “If inflation is coming (and it probably is) you want to hold a real asset that can hedge against it — one that can’t be inflated away by relentless money creation and currency debasement.…[E]veryone knows they need a safe haven, but everyone also knows the traditional ones (government bonds) no longer offer that safe haven. That turns us to gold, the one asset that has a 3,000-year record of protecting purchasing power. No wonder the gold price is up around 40 percent since 2018. I hold a lot of gold for all these reasons.”

Concern to shift in 2021 from ‘herd immunity to herd insolvency’

Ross Norman has finished high or won the annual LBMA price forecasting contest (including last year’s) so often that one is forced to pay attention. For 2021, he sees $2025 as the average price, $1810 as the low, and $2285 as the high, he says in a recent LinkedIn post. Norman says physical demand for silver coins and bars will show “impressive gains,” reflecting ‘strong demand for safe havens in these troubled times.” For good measure, he sees $36 as the high for gold’s running partner – silver. “As in 2008,” he says, “central banks are doing whatever it takes to save the economy, but the second order consequences of the measures put in place will weigh on markets ; as such, we see concerns shift from herd immunity to herd insolvency. Financial markets remain vulnerable and we think investors will continue to see gold as the near perfect antidote. In short, the bull run that dates from mid-2018 still looks very much in place, and we see good gains ahead, albeit at a slightly slower pace.”

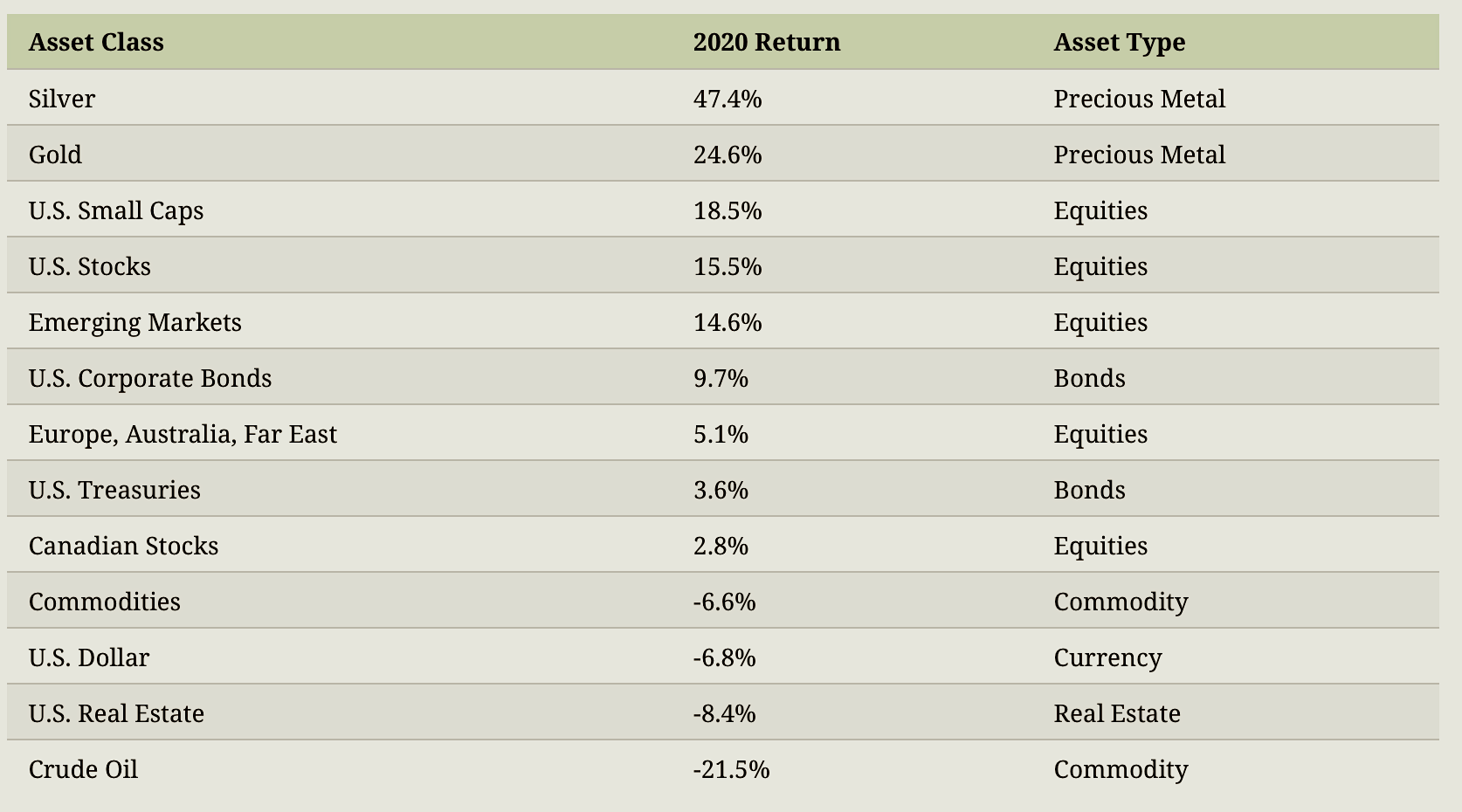

One last look at 2020 for the record

Table courtesy of Visual Capitalist • • • Click to enlarge

Final Thought

Jeremy Grantham’s ‘Waiting for the Last Dance’

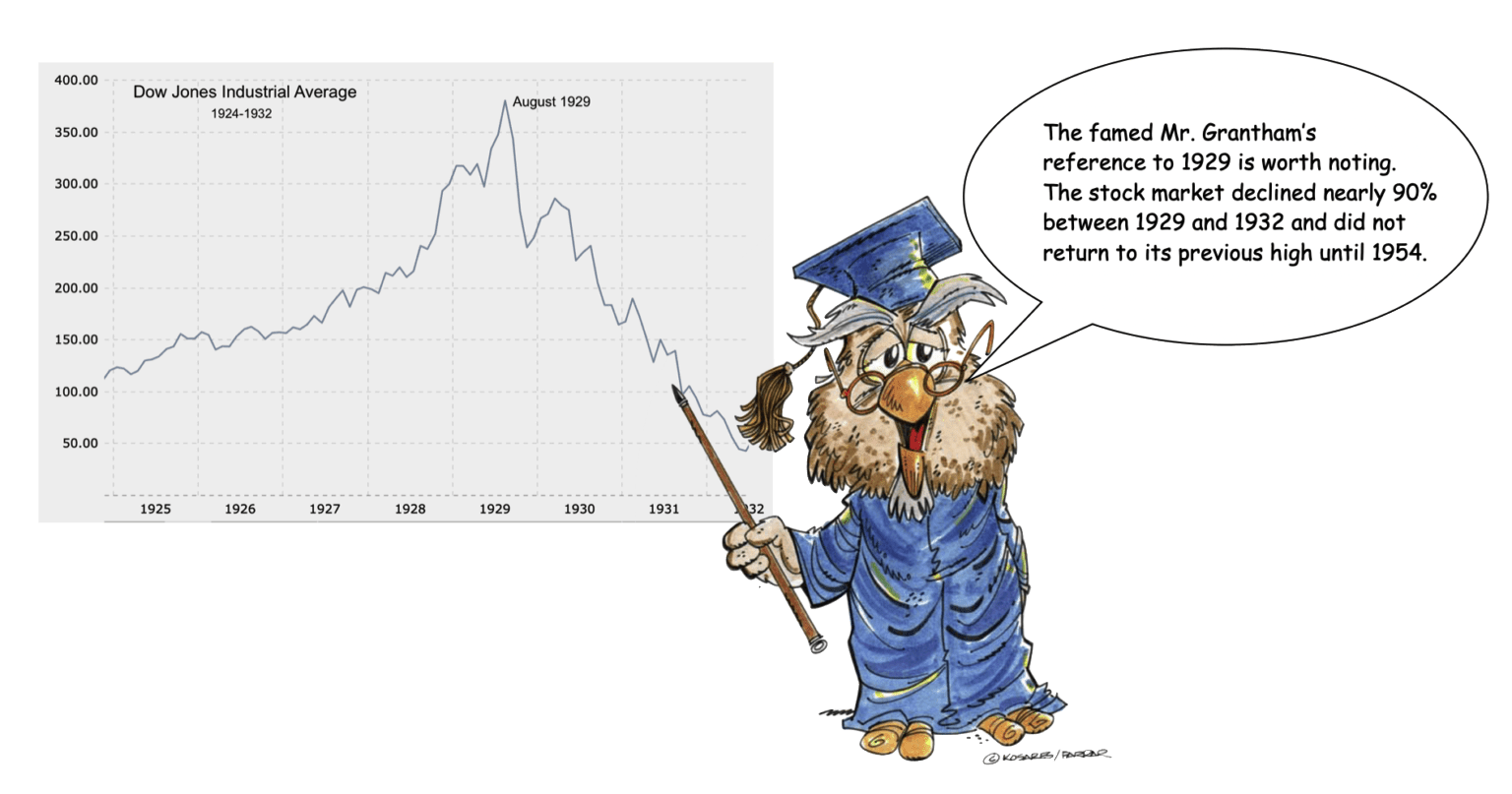

In a report titled Waiting for the Last Dance published in January, Jeremy Grantham, the legendary Wall Street analyst, says that “The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.” Grantham joins a long list of Wall Street notables predicting an unhappy end to the current stock mania.

His report has caused quite a stir in financial circles. No doubt, money managers are being asked in droves: “How do we hedge it?” One thing to keep in mind is that it’s not only the market that could break down but the brokerage firms that service it – in which case the investor in many instances is at the mercy of the web portal housing his or her accounts even if one’s advisor is able to structure some sort of derivative solution. We had an unwelcome warning on that score in recent weeks when several name online brokerage services experienced outages connected with the GameStop sensation.

The best way to hedge the system is not with more of the system’s paraphernalia but with something that stands outside it – purchased preferably far in advance of the bubble bursting. First and foremost, do not allow yourself to be grouped without hope of a better result among Seth Klarman’s boiling frogs.

Chart courtesy of Macrotrends.net • • • Click to enlarge

All rights reserved

Up-to-the-minute gold market news, opinion, and analysis as it happens.

If you appreciate NEWS & VIEWS, you might also take

an interest in our Daily Top Gold News and Opinion page.

Ready to add a safe haven to your holdings?

ORDER DESK:1-800-869-5115 x100/orderdesk@usagold.com

ONLINE ORDER DESK-24/7

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.