For many, the above headline accompanying a recent Financial Times “Big Read” will be welcome news. For others, it will serve as a warning. FT says the Biden administration’s economic program “echoes” Franklin Delano Roosevelt’s New Deal and Lyndon Johnson’s Great Society. “The passage of the [stimulus] bill in a deeply divided Congress…,” explains FT, “has a much broader significance. It cements a leftward shift in US politics and economics that has gained traction during the coronavirus crisis, affording government a far bigger role in solving problems in society than it has enjoyed in recent decades.” Part and parcel of that shift is a severe leftward tilt in Washington’s economic policy that poses a direct threat to the dollar’s longer-term value and stability in the bond market.

Even Larry Summers, a top economic advisor to President Obama and former Secretary of the Treasury under Bill Clinton, lambasted the Biden $1.9 trillion stimulus package as “the least responsible macroeconomic policy in the last 40 years” – one, he said, that could lead to inflation and accelerate to stagflation. The Jerome Powell-Janet Yellen tandem will not take kindly to this very public warning on a policy both embraced wholeheartedly – Yellen saying it is time to “go big” and Powell pushing hard for the stimulus package from the get-go. Coming from the individual many in the Democratic party see as its principal economic guru, the criticism carries a bit more sting than if it had from elsewhere. Summers also sees serious “consequences for the dollar and financial stability.”

Bloomberg reports that major financial institutions from Goldman to JPMorgan are worried about inflation, citing it as an “invisible force rocking Wall Street.” In a recently posted LinkedIn piece, Bridgewater Associates’ Ray Dalio stated flatly that “the economics of investing in bonds (and most financial assets) has become stupid … [B]ecause you are trying to store buying power, you have to take into consideration inflation. In the US, you have to wait over 500 years, and you will never get your buying power back in Europe or Japan. In fact, if you buy bonds in these countries now, you will be guaranteed to have a lot less buying power in the future. Rather than get paid less than inflation, why not instead buy stuff – any stuff – that will equal inflation or better? We see a lot of investments that we expect to do significantly better than inflation.” Of course, the ultimate “stuff” – the ultimate stores of value – are gold and silver. Most of the inflation-proofing strategies outlined by analysts in the Bloomberg report include real assets, gold, commodities, et al.

How to spot a bubble

‘Amount of leverage in U.S. equity markets now easily the highest in history.’

Cartoon courtesy of MichaelPRamirez.com

“If you want my opinion,” writes Hussman Fund’s John P. Hussman in a recent analysis, “I suspect that a near-vertical market plunge on the order of 25-35% is coming, probably quite shortly, most likely out of the blue, as in 1987, driven by nothing more than the sudden concerted effort of overextended investors to sell, and the need for a large price adjustment in order to induce scarce buyers to take the other side. As usual, no forecasts are necessary. … This dysfunctional behavior isn’t about any particular video game retailer. I suspect it’s actually about some sort of fragility or segmentation in order-flow mechanisms, possibly coupled with poorly managed derivatives exposure. As I used to teach my students, show me a financial debacle, and I’ll show you someone who had a leveraged, mismatched position that they were suddenly forced to close into an illiquid market. Though my concerns run far beyond the amount of leverage in the system, it isn’t helpful that the amount of leverage in the U.S. equity markets is now easily the highest in history.”

These days spotting the bubble is about as difficult as finding it in the Ramirez cartoon above. Hussman attacks Wall Street’s new rationalization of buying into the bubble, i.e., extreme valuations are justified by low interest rates. Those who are all-in for fear of missing out – blindly walking on air – are obviously the most vulnerable. When investing becomes a matter of faith, that faith will be tested. A solid diversification, we will add, would blunt the downside. Though investor margin debt is small compared to the leverage funds and institutions deploy in the market, it does serve as a bellwether for analysts looking for what might trigger a market crash. SentimenTrader’s Jason Goepfert recently posted a warning to his readers that at $831 billion, we are fast approaching a “year-over-year growth rate in [margin] debt – on both an absolute scale and relative to the change in stock prices – will compare with some of the most egregious extremes in 90 years.”

When paper money dies, precious metals prevail.

The lessons learned from the nightmare German hyperinflation of 1923

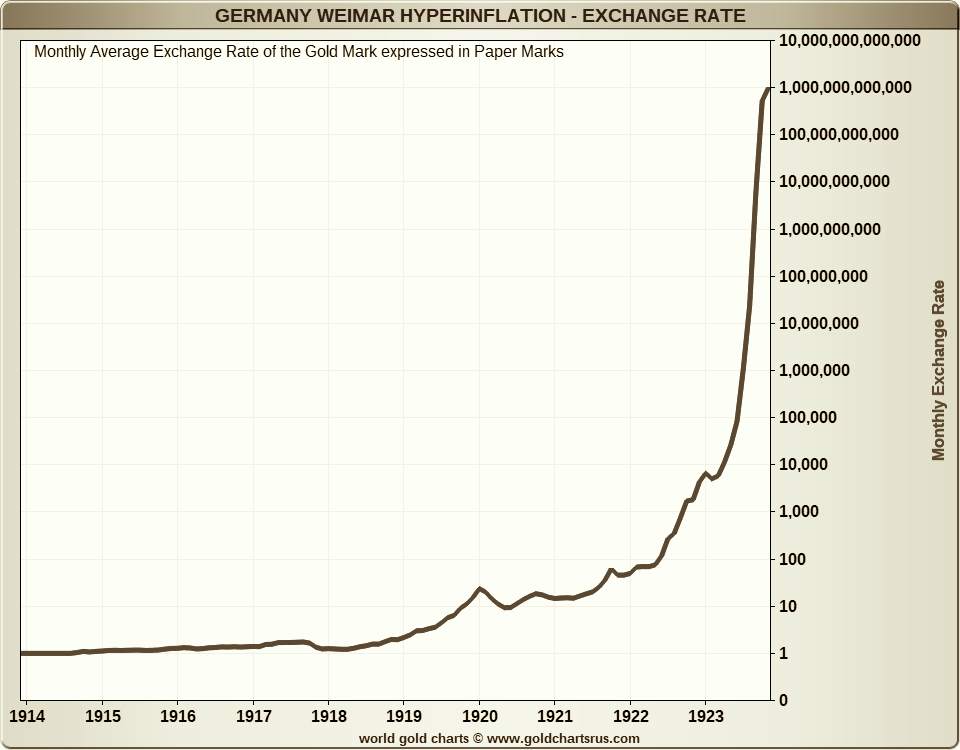

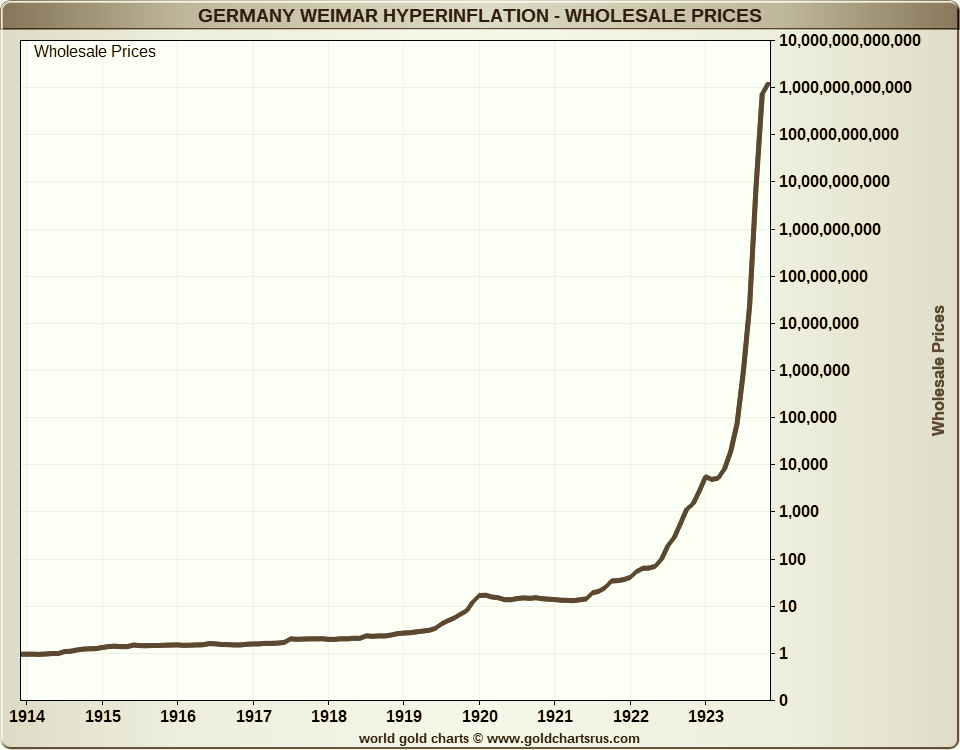

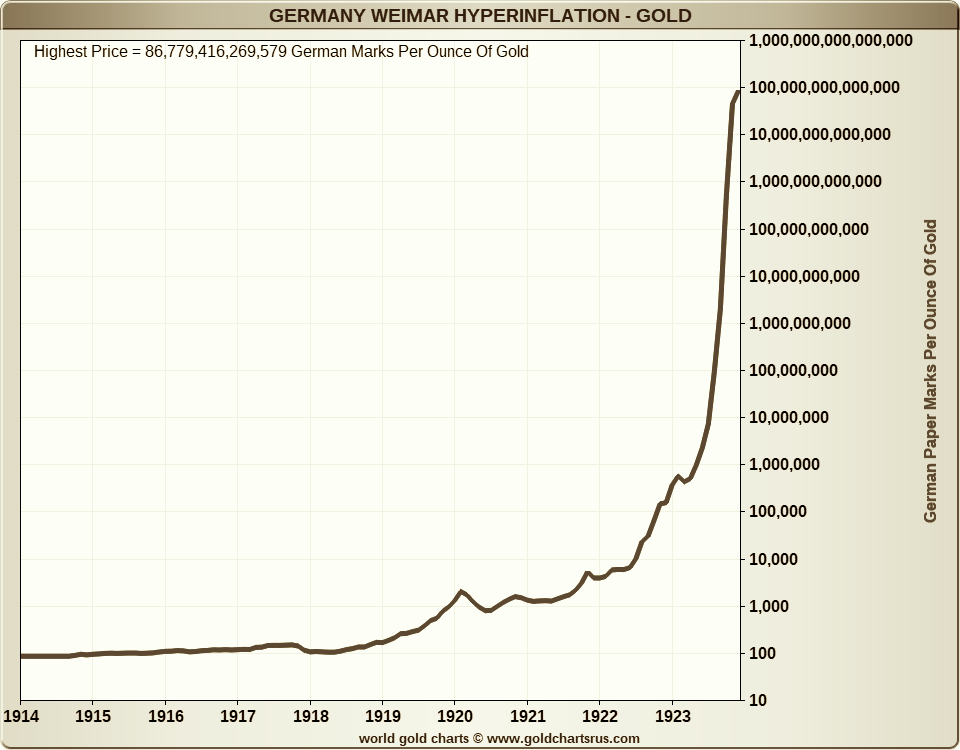

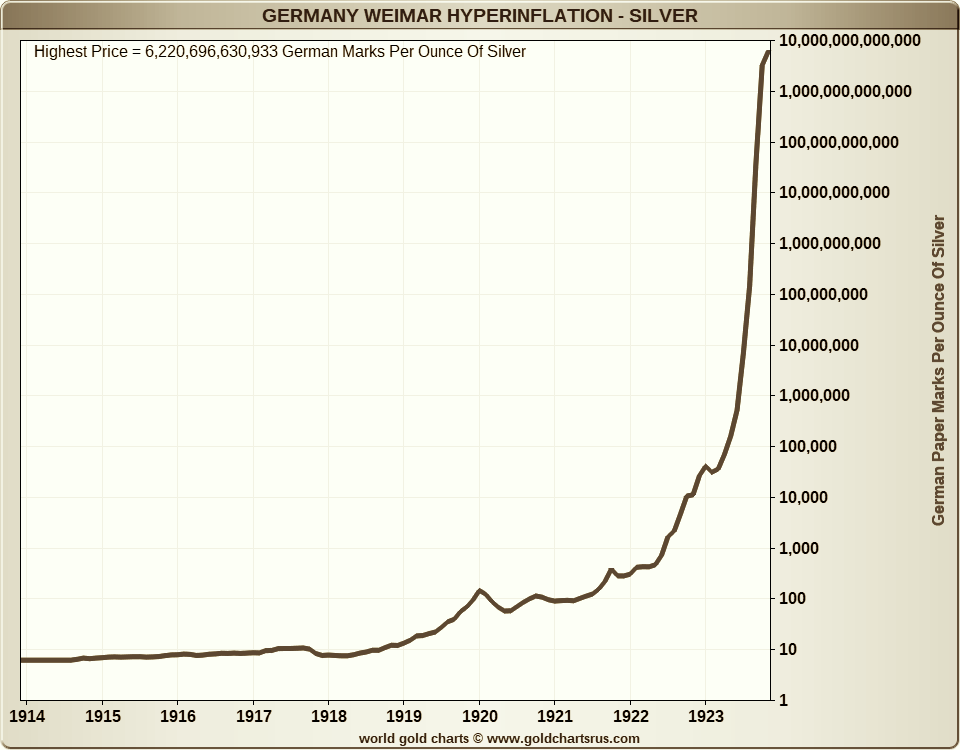

Not many investors are seriously concerned about hyperinflation in the United States at this juncture. At USAGOLD, we, too, see it as an outlier – something that could happen but not a probability. But that’s the thing about hyperinflations. Rarely does the handwriting appear unmistakably on the wall. Not many were worried about hyperinflation in Germany in 1923 when it struck out of the clear blue. When disaster did strike, however, it came with a vengeance. Prices shot up in 1921. Then just as quickly – within the space of a year – they ran out of control. By 1923, an individual’s life savings could not purchase a cup of coffee. We ran into the following charts researching another matter at the GoldChartsRUs website. The one unsettling aspect they all have in common is their verticality – an indication of how quickly and conclusively the inflationary catastrophe swept through the German economy.

The first and second charts reflect the severe debasement of the German mark at the time. The third and fourth show how gold and silver performed as a hedge. In effect, what could have been purchased with an ounce of gold or silver before the debacle, could have been purchased at any time as it worsened and finally when it ended a few years later. Few, as stated above, predict an inflationary disaster on the level of the Weimar Republic. Still, it is good to know that by preparing for the lesser version of inflation, one prepares for the nastier versions as well.

Charts courtesy of GoldChartsRUs • • • Click to enlarge

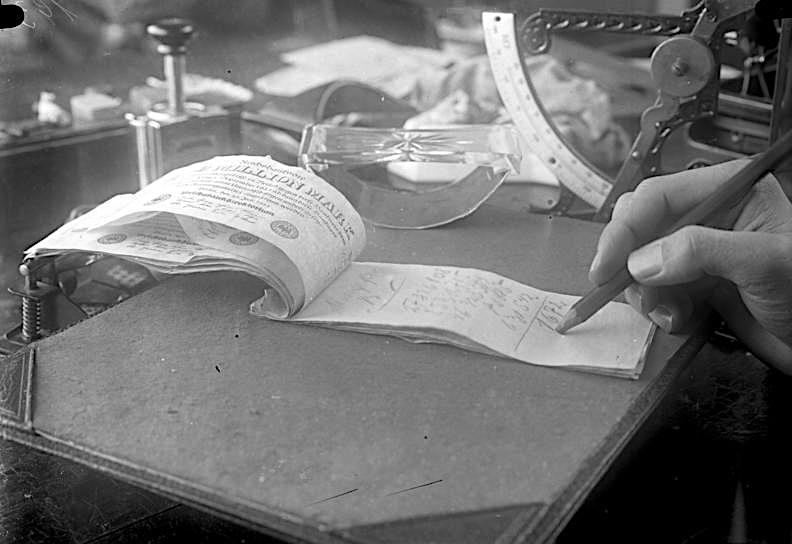

Image (top): Paper German marks converted to notepad, 1920s Weimar Republic. Attribution/ Bundesarchiv, Bild 102-00193 / CC-BY-SA 3.0, CC BY-SA 3.0 DE <https://creativecommons.org/licenses/by-sa/3.0/de/deed.en>, via Wikimedia Commons

China’s monetary tradition and the origins of money

“The first step in theorizing correctly about money,” writes Mises Institute‘s Joseph T. Salerno, “is to understand that the value of money, like that of commodities, is never fixed and unchanging. Chinese philosophers who published the earlier Mohist Canons (468 B.C.~376 B.C.) grasped this crucial point. They recognized that metallic money, such as the ‘knife coins’ then in wide circulation, was valued and exchanged by weight and argued that the real value of money, despite its fixed face value, was not stable but fluctuated inversely with the prices of commodities. When commodity prices were high, money was ‘light’ or its purchasing power low; when prices were low, money was ‘heavy’ or its purchasing power high. Thus, if monetary conditions were such that the nominal prices of commodities were abnormally high, the real prices of commodities were not high, but rather money was ‘light’ or depreciated.”

According to Salerno, much of what we understand about sound money was first explored in ancient China, where metallic coinage was first introduced in the 12th century BC or earlier. Salerno’s article serves as an interesting introduction to Chinese monetary theory and philosophy. We recall that China was also the first country to experiment with paper money as an alternative to coins made from precious metals. As might be expected, those experiments led to several instances of runaway inflation.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Does the deployment of helicopter money not entail some meaningful risk of the loss of confidence in a currency that is, after all, undefined, uncollateralized and infinitely replicable at exactly zero cost? Might trust be shattered by the visible act of infusing the government with invisible monetary pixels and by the subsequent exchange of those images for real goods and services? . . . To us, it is the great question. Pondering it, as we say, we are bearish on the money of overextended governments. We are bullish on the alternatives enumerated in the Periodic table. It would be nice to know when the rest of the world will come around to the gold-friendly view that central bankers have lost their marbles. We have no such timetable. The road to confetti is long and winding.” – James Grant, Grant’s Interest Rate Observer

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

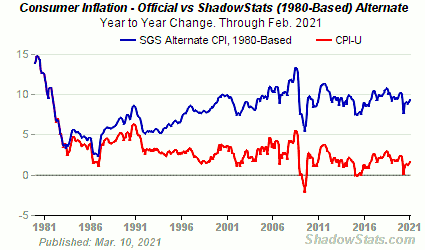

What if the 1980s rendition of the inflation rate were used

to determine real yields on Treasury paper?

Chart courtesy of ShadowStats.com

There has been so much analysis published on the link between the bond market yields and the price of gold that it seems almost superfluous to include a section on it in our monthly newsletter. Then again, a good many of our readers would think us remiss if we failed to address it. Too often, analysts talk about yields and yields alone as the primary influence on gold prices when in reality, the culprit or benefactor (depending upon the market’s direction) is the real rate of return on government paper.

So rather than going over familiar ground, we thought it might be a bit more interesting to explore what the real rate of return might be on the 10-year Treasury if Shadow Stats’ rendition of the inflation rate were taken into account. ShadowStats tracks alternative data series to official statistics. Above is its rendition of the inflation rate if calculated using the methodology in place during the 1980s. As you can see, the inflation rate would be running near 10% using that measure of consumer prices.

If you were to plug that data into the current chart for the 10-year inflation-indexed security – now at .5% – the current real yield would be roughly a negative 10%. If that were the market perception, the governing psychology in money markets would be much different than it is now. The chairman of the Federal Reserve, in turn, would not be talking about driving the inflation rate over 2% to kick-start the economy, but 10% instead – once again, a much different psychological framework than the one under which the markets are operating at present.

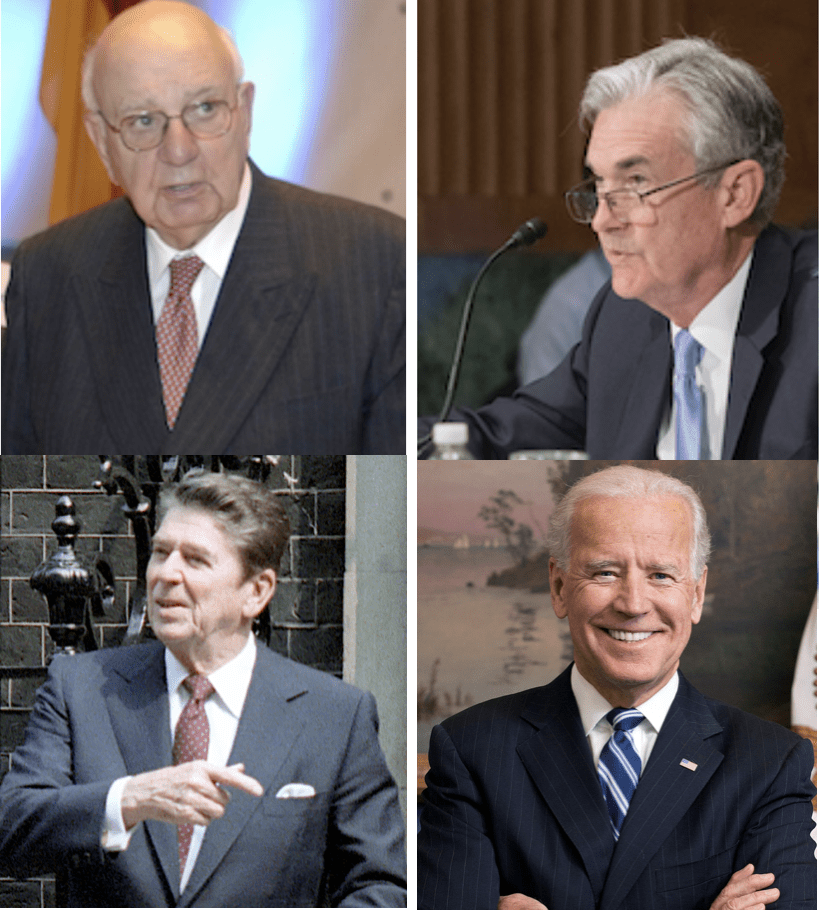

Is monetary policy regime change upon us?

“Let’s make a big assumption. We really are in the process of not only a great shift toward reflation, but toward a new inflationary regime. What is this like, how can we tell, and what does the future hold?” – John Authers, Bloomberg, The Inflation Regime Change Is Already Upon Us

We have noted previously that as the current government/central bank policy mix is fully deployed, it might turn out that what the Reagan-Volcker team was to disinflation the Biden-Powell team might be to inflation. Authers explores that possibility in the essay linked above. In the process, he offers a few deep insights like this one from Alex Lennard of Ruffer LLP. “Volcker said he was going to tame inflation, unemployment be damned. Now it’s the other way around. I don’t think people have quite realized that you’ve had this huge change in the mandate of policymakers.”

“Inflation has no date of beginning. Inflation is the cancer of modern civilization, the leukemia of planning and hope; as with all cancers, no one can say when it begins or how fast it may spread. It is a disease of money, and when money goes, order goes with it. Inflation comes when a government has made too many promises it cannot keep and papers over the shortfall with currency which, ultimately, becomes confetti — and faith is lost.” – Theodore H. White, historian-political journalist, “America in Search of Itself” (1982) As quoted by Authers

Final Thought

What does bitcoin have in common with the ancient stone money of Yap?

“That does not render bitcoin invalid or the blockchain useless,” writes Gillian Tett in a recent Financial Times editorial. “After all, the mainstream currencies on which our lives depend rely on sometimes tenuous social norms as well. One way to frame the contest between bitcoin and fiat currency is thus as a battle of norms — and of distributed versus hierarchical trust.” Tett, perhaps inadvertently, makes a point a good many gold enthusiasts will embrace. Bitcoin is more readily comparable to fiat currencies than gold – as its value rests completely in the faith that it will not be printed without restriction.

Therein lies bitcoin’s ultimate weakness as a store of value. Who’s to say that any number of copycat cryptocurrencies won’t invade the space and undermine bitcoin’s value? )In fact, a good many already have with varying degrees of success.) Who’s to say that some enterprising software geek doesn’t find a way into the blockchain and begins producing bitcoin willy-nilly? (Which is what happened, by the way, to yap stone money. [More]) Tett ends her essay with some advice for Elon Musk – a new and ardent supporter of bitcoin: “Perhaps Musk’s next trip should be to Micronesia, where those now-useless stone circles still litter the landscape as a sign of what happens when norms and patterns of trust change.” To get to the heart of what Tett – an anthropologist as well as a first-rate journalist – means by that statement, you will need to read her essay in its entirety at the link above. In Musk’s defense, he also expressed an interest in Tesla building its gold reserves.

Ready to begin or add to your precious metals holdings?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/orderdesk@usagold.com

ORDER GOLD & SILVER ONLINE 24-7

Disclaimer – Opinions expressed on the USAGOLD.com website do not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. USAGOLD, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such, USAGOLD does not warrant or guarantee the accuracy, timeliness, or completeness of the information found here. The views and opinions expressed at USAGOLD are those of the authors and do not necessarily reflect the official policy or position of USAGOLD. Any content provided by our bloggers or authors is solely their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.

Michael J. Kosares is the founder of USAGOLD, author of The ABCs of Gold Investing – How To Protect and Build Your Wealth With Gold [Three Editions], and the firm’s publications editor.