“Our Gold High for ’25“

A little cheer to start the new year: “We’re Number One!”

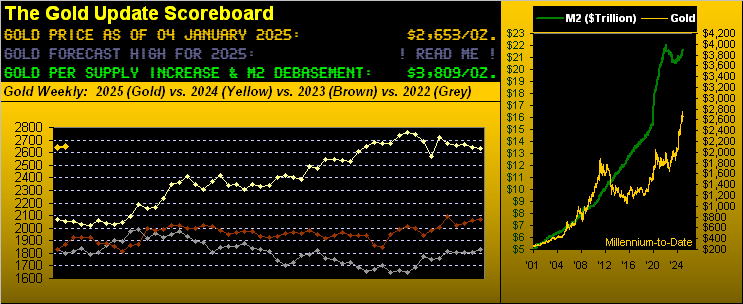

Yes, across the 2024 BEGOS Markets’ spectrum, the year’s best performer was Gold’s +27.4% increase. ‘Course, for the math-challenged FinMedia, all the talk has instead been over the S&P 500’s +23.3% gain. ‘Tis the quintessential example of “Money talks, Wealth whispers”. (Got Gold?)

On to 2025. And as ’tis been absolutely eons since we’ve had a pop quiz in The Gold Update, let’s begin the year with one. Ready?

- What was the last year wherein Gold netted a yearly gain for a third consecutive time?

If (without looking it up) you answered “2012” you’ve earned a Gold Star.

Moreover, through this century-to-date’s 24 completed years, Gold netted yearly gains 12 consecutive times from 2001 through 2012.

Since then however, such streak has succumbed to becoming “herky-jerky” (technical term). Following those 12 consecutive up years, Gold then netted:

- Three consecutive yearly losses from 2013 through 2015;

- Two gains for 2016 and 2017;

- A loss in 2018;

- Two gains for 2019 and 2020;

- Two losses in 2021 and 2022;

- Two gains for 2023 and 2024.

Thus if such “herky-jerky” pattern of these past 12 years continues, Gold shall suffer a net loss for this year 2025 … but we don’t think so. Rather, for the first time since 2012, we look to Gold’s recording a third consecutive net yearly gain.

Despite the FinMedia’s disinclination to highlight Gold, from our purview it continues to quietly be gaining a wee degree of (pardon the yucky woke word) “awareness”. To the extent that Gold ownership is increasing is a reflection of its price having risen, certainly so across the past two years.

Still, trying to estimate the percentage of Gold owned by various entities yields quite a large standard deviation. Pro-Gold bugs push that a mere 0.5% of individuals carry exposure to the yellow metal; AI (“Assembled Inaccuracy”) puts portfolio exposure up toward 10%; and (hat-tip The World Gold Council) private individuals own more Gold than do governments and banks combined.

Regardless — and with specificity to the debasement of currency as the ultimate driver of valuation — Gold’s price trend clearly is up.

“So let’s get to it, mmb: what’s Gold’s high gonna be for this year?”

First, Squire, as acknowledged above, Gold could put in a down year. Should StateSide inflation — which as you regular readers know — remain above the Federal Reserve’s +2% target, interest rate decreases then morph back into increases. In turn, the Dollar becomes more attractive still, and both the horrifically overvalued S&P 500 and Gold (at least initially) descend. Naturally, inflation inevitably works back into Gold’s favour. But such negative scenario is quite real — one might even say “anticipated” amongst the currency bunch — given the Dollar’s increase throughout Q4 of last year. Indeed for 2024 per our the BEGOS Markets’ Standings, the Dollar Index netted an annual gain of +7.1% … but Gold (which as you know plays no currency favourites) went up anyway.

Still, at the end of the day, we expect Gold’s positives to will out, and certainly so the creation of more dough. To repeat that herein penned just a week ago: “And the month’s Main Event commences 14 January upon U.S. Secretary of the Treasury Janet ‘Old Yeller’ Yellen begging for dough upon which to draw to pay obligations on the nation’s debt.” Whoopsie.

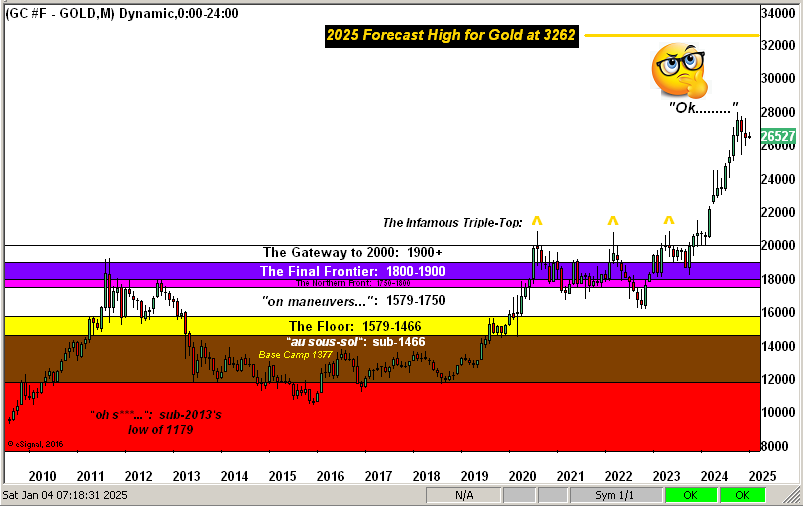

As to Gold’s high in ’25: recall a year ago our opening missive was entitled “Gold – We Conservatively Forecast 2375 for 2024’s High“ … and such forecast turned out to indeed be “conservative”, price rather swiftly arriving at the 2375 target on 09 April en route to the current All-Time High of 2802 on 30 October. For 2025, we’re a bit more “aggressive” especially having just acknowledged Gold could put in a down year.

However, given our perspective that ’twill be an up year, in establishing a forecast Gold high, we employed the quantitative aspects used to present the website’s “Market Ranges” page, in this case to solve for Gold’s “expected yearly trading range”. We like this approach as it supports maintaining prudent cash management, (the most important element of trading).

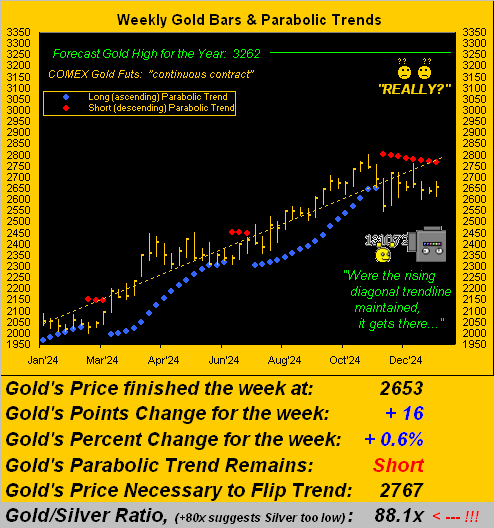

Now obviously we don’t expect Gold to go straight up; however we do see the low coming before the high. Recall from recent missives that Gold is currently in a weekly parabolic Short trend, which — given other negative technicals — we’ve mused price perhaps tapping the upper 2400s near-term. And applying the “expected yearly trading range” method, the year’s low approximates that area at 2507. Then would follow the ascent to its forecast high of …  … 3262. ‘Tis thus basically a +30% run from low-to-high as 2025 unfolds. For now, Gold yesterday (Friday) through the first two trading days of the year settled at 2653. Achieving our 3262 level may seem a very long row to hoe, but with 250 trading days remaining in 2025, there’s time.

… 3262. ‘Tis thus basically a +30% run from low-to-high as 2025 unfolds. For now, Gold yesterday (Friday) through the first two trading days of the year settled at 2653. Achieving our 3262 level may seem a very long row to hoe, but with 250 trading days remaining in 2025, there’s time.

In the meantime, let’s go to Gold’s aforementioned weekly parabolic Short trend, the rightmost red dots now eight weeks in duration. Yet at present, the positively sloping dashed trendline is on pace to reach 3262 within the year, albeit obviously such trend can rotate to negative:

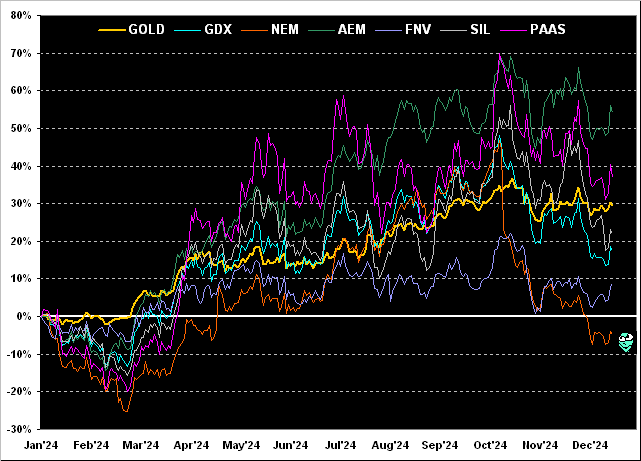

Now it being month-end, indeed year-end plus two trading days, let’s bring up the percentage tracks of Gold and key of its equities’ brethren from one year ago-to-date. Therein we see at best Agnico Eagle Mines (AEM) +54%, followed by Pan American Silver (PAAS) +37%, Gold itself +29%, the Global X Silver Miners exchange-traded fund (SIL) +22%, the VanEck Vectors Gold Miners exchange-traded fund (GDX) +18%, Franco-Nevada (FNV) +9%, and Newmont (NEM) actually -5% given the company’s increased production costs:

Producing a rather sideways swath since September is the Economic Barometer, even as the S&P 500 on balance manically runs up and away from it. This past week’s light set of Econ Baro metrics included for December an improved Institute for Supply Management Manufacturing Index, but a drop in the month’s Chicago Purchasing Managers’ Index. Too came a better November reading for Pending Home Sales, but a zero growth pace for the month’s Construction Spending. Put it all together — and economically — ’tis “Happy Blah Year, America!”

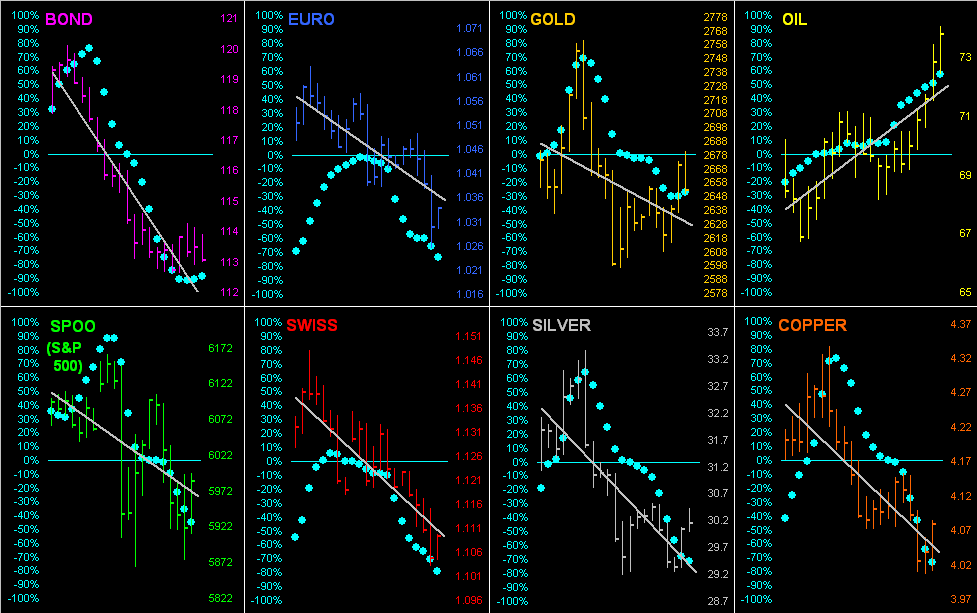

To which we earlier alluded, the Dollar’s been on a three-month up run. And you know the drill: as the Dollar is getting the substantive bid, everything else (save for Oil) is in a skid. By the following graphic we go ’round the horn for all eight BEGOS Markets with their daily bars from one month ago-to-date. Thus with the exception of Oil, the seven other components all are sporting negative grey regression trendlines, the baby blue dots depicting the day-to-day consistency of those respective trends. (Pssst: are you still in the stock market? Just askin’…) Here’s the graphic:

Turning to the 10-day Market Profiles for the precious metals, both Gold on the left and Silver on the right have moved above their respective mid-points. Gold’s most dominant trading support price by volume is 2630, whilst for Silver ’tis 30.00:

And toward wrapping 2025’s first piece, here we’ve Gold’s monthly bars across the past 15 years. Were Gold’s “Infamous Triple Top” to permanently hold, preceding stratified layers basically become obsolete. ‘Course a -50% Gold correction would plop price back into the 1300s.

“Oh really, mmb, c’mon man…”

To be sure, Squire, hardly do we anticipate such demise from here. Yet historically, Gold has suffered through some serious spills. More recently was price’s -23% decline from August 2020 into November 2022; precedent to that was the -46% tumble from September 2011 into December 2015; and of course, too, was Gold’s -68% fall from the skies running January 1980 into June 1982. But we shan’t lose any sleep over such, especially should 3262 be in this year’s balance:

So there’s our Gold forecast high for ’25: 3262. And honestly it may be “A Bridge Too Far” –[United Artists, ’77]. But again per our premise of Gold gaining a third consecutive up year and as guided by the “expected yearly trading range”, 3262 seems a reasonable target from a prudent cash management perspective.

Indeed hardly do we have much negative concern over Gold. Per the opening Gold Scoreboard’s valuation level of 3809, Gold is looking ever so attractively fine given inevitably price has so much more to climb.

But when it comes to the stock market as measured by the S&P 500, we remain significantly concerned (understatement). Remember old “Fritz” Hollings’ (D-SC) famous line from back in his time? “There’s too much consumin‘ goin’ on out there!” To peruse today’s FinMedia one might instead say “There’s too much euphoria goin’ on out there!” We read (paraphrasingly) that: “The S&P’s the place to be!” “Without AI you cannot be!” “Trump to put Bitcoin in orbital spree!” Oh gee.

Today finds the S&P 500’s “live” price/earnings ratio at 46.8x, at least double any historical rationale; the Index’s market cap is $52.4T for which the supportive liquid money supply is “only” $21.7T. (For you WestPalmBeachers down there, that means you sell your stock, but you might not get the money). Oh gee.

AI seems to have given up on trying correctly quote the price of Gold; you may recall our asking AI what the price was three different times during the course of last year, the response in each attempt being wrong by $100s; today rather than quote a price, it simply says that “it is best to check a financial news website.” Oh gee.

Dear old Bitcoin in round numbers essentially is 90% mined and trading at $100k/coin. Consensus is ’twill reach $250k/coin this year. “The Trumpster” is purportedly bidding (on behalf of the insolvent USA — remember “Old Yeller” needs money by mid-month) for one million coins, i.e. $100 billion-worth, which actually is not that much money given ’tis roughly what the federal government spends per week. But will you be offering to the nation your Bitcoin, and at what ask? Oh gee.

So with 3262 potentially in the year’s balance, can you imagine not being with Gold? Oh gee!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro