The leading gold holders are some of the world’s most powerful nations, such as the US, Germany, Italy and France; they are keeping 60% of their foreign reserves as gold. This is a testament to the significance of gold in the central banking system.

Central banks bought 399 tonnes of gold in the third quarter, by far the most ever in a single quarterly period. According to the World Gold Council, they added another 31t of gold to official reserves in October, putting central bank holdings at their highest level since 1974.

Data compiled by the World Gold Council shows demand outstripping any annual amount in the past 55 years, with China and Russian being the largest accumulators of the precious metal in 2022 (Financial Times, Dec. 28, 2022).

The question I ask myself is, why do central banks keep adding to their massive hoards of gold bullion?

The easiest answer would be that last year the America and it’s Western alliance emasculated the Russian central bank (ROB) of its foreign currency reserves with little more than the stroke of a pen.

Western governments froze $300bn of Russia’s foreign currency through sanctions, forcing governments across the globe to ask themselves why have so much exposure when the US and, it’s allies, can confiscate them at any time?

Arguably, the gold buying is an indication that some nations want to diversify their foreign exchange reserves away from the US dollar.

Could the purchases also be a sign that China is moving to launch a gold-backed central bank digital currency? (CBDC) to compete with, and perhaps even one day, supplant, the US dollar?

Central bank digital currencies

Lately there has been a lot of talk about a coming cashless society.

The coming cashless society and gold

According to Barclays Bank, in the UK, 88.6% of eligible payments made in 2020 were contactless. But here’s the rub. While 90% of adults living in high-income countries have bank accounts, only 45% in medium-income countries have them, and in low-income countries, people with bank accounts number just over 20% of the population.

Despite this banking participation disparity, central bank digital currencies are coming.

China has started large-scale trials of the “e-yuan”. European officials want to launch a digital euro by 2025. And America’s Federal Reserve is studying whether to follow suit.

The first step was taken last August, when the Fed announced an instant payment system called FedNow, scheduled to be launched between May and June, 2023.

Additionally, the New York Fed recently launched a 12-week pilot program with several commercial banks to test the feasibility of a CBDC in the US. The program will use digital tokens to represent bank deposits.

The Bahamas has already put its version, the “sand dollar”, into circulation. Ghana, Jamaica and Nigeria are also on board. The Reserve Bank of India intends to plan pilot launches of an e-rupee.

In China, an estimated 140 million people have already begun using the new digital yuan, which accounts for nearly $10 billion worth of transactions. (New York Public Radio, Dec. 9, 2022)

A total of nine countries have fully launched their CBDCs, while central banks in more than 80 countries either have, or are in the process of gearing, their monetary systems in that direction.

Central Banks consider DCs as a check against the growth of cryptocurrencies, which operate outside the traditional banking system.

A CBDC is simply a digital form of money issued by a central authority. According to LinkedIn, The Bank of International Settlements defines CBDC as a digital payment instrument

denominated in the national unit account that is a direct liability of the central bank. In other words, the central bank is responsible for the CBDC that is issued and not the private sector that we all have to come to learn and see, based on the traditional banking system.

Pros and cons

The Economist reports the following benefits of CBDCs: “Cashless transactions make for faster, more reliable payments and are less susceptible to counterfeiting and issuing digital cash is cheaper than minting coins. Officials also have an easier time monitoring how digital money is used, making it harder to fund criminal activities. In poorer countries, central banks hope that digital currencies will bring unbanked citizens into the financial system, boosting economic development.”

A CBDC could use mobile wallets to make cash injections more direct — for example, quickly sending money to residents of a region struck by a natural disaster.

Central banks also don’t want to leave billions of transactions in the hands of internet payment platform operators. A cryptocurrency is not legal tender, and transactions are verified, and records are not maintained, by a centralized authority. It’s also an issue of financial inclusion for millions of people who can’t afford to use the conventional banking system or don’t have internet access. (IMF, ‘Taking Digital Currencies Offline’, September 2022)

If a CBDC is implemented, the central bank will have access to all transactions, as well as being capable of freezing accounts, like the Canadian Liberal government did during the 2022 trucker convoy protests. A CBDC will also give governments the power to determine how much a person can spend, establish expiration dates for deposits, and even penalize people who saved money, writes Andre Marques in ‘Digital Currency: The Fed Moves Toward Monetary Totalitarianism’.

The Bank of England has also admitted that a digital pound could be “programmable“, meaning that the government could potentially add mechanisms to prevent people from spending their own money on things the state disapproves.

This has led to concerns that Western governments could implement a system akin to the social credit score in Communist China, which has already been used to blacklist millions of citizens from travelling, including those who dissented against the authoritarian rule of Chairman Xi Jinping. (Breitbart, Dec. 11, 2022)

Each country will likely issue their own digital currency. However a global digital currency is a little tricker – there would have to be a way to measure value.

For many of the world’s currencies, a US dollar peg serves this purpose, however as the sections below prove, the USD is losing its cache amid rampant de-dollarization and a loss of confidence in US political institutions.

For hundreds of years prior to the fiat currency era, a country’s money was backed by gold, and while a return to the gold standard isn’t likely, we see growing evidence of a Chinese central bank digital currency backed by gold coming to the forefront of international finance.

Shanghai Cooperation Council

According to The Cradle columnist Pepe Escobar, The nine permanent SCO [Shanghai Cooperation Council] members now represent 40 percent of the world’s population. One of their key decisions in Samarkand [Uzbekistan, site of the 2022 SCO Summit] was to increase bilateral trade, and overall trade, in their own currencies.

The importance of this cannot be underestimated: 40% of the world’s population is no longer interested in conducting trade using US dollars! Notice also from the paragraph below, that at least six SCO members are headed up by governments that have been, or are currently, the target of US sanctions. China and Russia, of course, are America’s main economic and military rivals.

(The SCO currently comprises eight Member States (China, India, Kazakhstan, Kyrgyzstan, Russia, Pakistan, Tajikistan and Uzbekistan), four Observer States interested in acceding to full membership (Afghanistan, Belarus, Iran, and Mongolia) and six “Dialogue Partners” (Armenia, Azerbaijan, Cambodia, Nepal, Sri Lanka and Turkey). In 2021, the decision was made to start the accession process of Iran to the SCO as a full member, and Egypt, Qatar as well as Saudi Arabia became dialogue partners.

Since its inception in 2001, the SCO has mainly focused on regional security issues, its fight against regional terrorism, ethnic separatism and religious extremism. To date, the SCO’s priorities also include regional development. (United Nations)

Shanghai Gold Exchange

With SCO members recently agreeing to conduct trade outside the US dollar system (remember, most commodities are priced in dollars), Middle Eastern countries snubbing the United States by pricing their oil sales to China in yuan, and existing currency swaps between China and Russia worth tens of billions of dollars, it is worth considering how the growing global CBDC movement could manifest itself. Will gold have a role to play in backing central bank digital currencies? And will China’s super-sized position in international trade (it is now the second-largest economy behind the United States) mean that its currency, the yuan, becomes the medium of exchange among non-Western nations who are growing increasingly reluctant to use the US dollar?

The answer to both questions appears to be “yes”. For the past several years, China has taken steps to internationalize the yuan and make it investable through the purchase and sale of gold bullion.

In 2008, the China Banking Regulatory Commission issued permits allowing Chinese commercial banks to trade gold futures on the Shanghai Future Exchange. Six years later, the Shanghai Gold Exchange launched a gold-trading platform with 11 yuan-denominated gold contracts. Importantly, the platform is located in the city’s free-trade zone, making it open to foreign investors.

In 2016, the Chinese government announced a new contract on the SGE to set a benchmark price for gold bullion. Eighteen banks and bullion traders were chosen as initial market makers, including 10 Chinese lenders, Standard Chartered Bank, Australia and New Zealand Banking Group and six domestic and international bullion traders. The benchmark was designed to compete with the centuries-old London gold fix, and to give buyers in Asia more power over the bullion trade (Marketswiki.com).

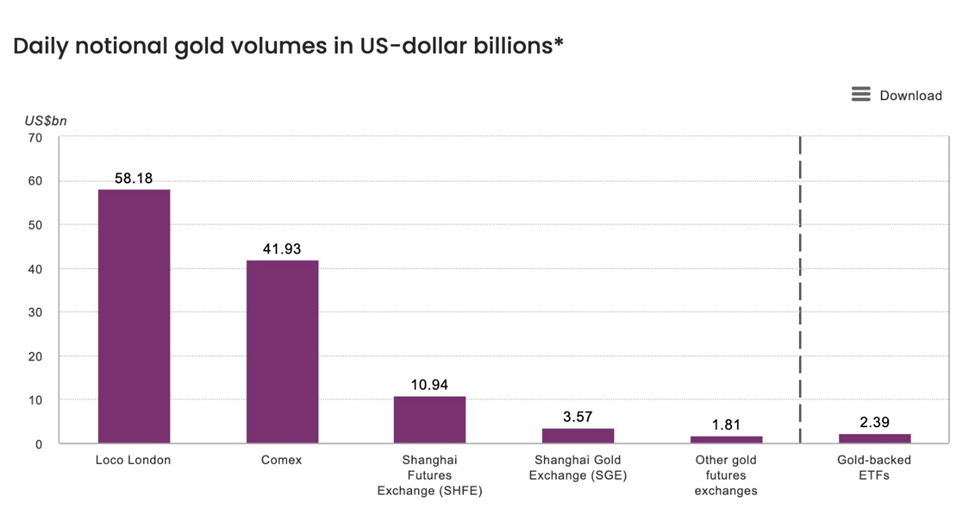

The World Gold Council says the establishment of the Shanghai Gold Exchange in 2002 cemented China’s role as a price-setter (for buyers in Asia). The move was also to help internationalize the yuan and to broaden international participation in the Chinese market. The SGE is currently the world’s largest purely physical spot gold exchange, although it is still dwarfed by the daily volumes of gold exchanged on the LME in London and the Comex in New York, as the chart below shows.

Source: World Gold Council

Source: World Gold Council

When you consider that China and India have long been among the world’s top buyers of physical gold (and silver), and that throughout the past year, Asian buyers have been sopping up gold while Western buyers dump the precious metal, it makes total sense that a Chinese digital currency would be backed either fully or partially by gold.

West to East gold migration

This idea is buttressed by the amount of gold that is flowing into Asia.

According to data from the CME Group and the London Bullion Market Association, more than 527 tons of gold bullion moved from vaults in New York and London — the two biggest Western gold markets — between end of April and mid-October.

In August Chinese gold imports hit a four-year high, with net imports via Hong Kong at 68.2 tonnes, compared with 48.7 in July.

Bloomberg via USAGold reports Rising rates that make gold less attractive as an investment mean that large volumes of metal are being drawn out of vaults in financial centers like New York and heading east to meet demand in Shanghai’s gold market or Istanbul’s Grand Bazaar.

A Bloomberg chart from the above link, shows Asia has net-imported gold from the West since April. China brought in the most at 160 tons followed by India’s 80 tons, Turkey’s 62, Thailand’s 38 and Saudi Arabia’s 20. By contrast, 136 tons flowed out of the United States, followed by Australia (34), Canada (33), South Africa (32) and the UK (15).

Recall from earlier, central banks bought 399 tonnes of gold in Q3 2022, by far the most ever in a quarterly period. Another 31t of gold was added to official reserves in October, putting central bank holdings at their highest level since 1974. Data compiled by the World Gold Council shows demand outstripping any annual amount in the past 55 years.

De-dollarization

On top of massive gold-buying by central banks, we also have the gradual diminishment of the US dollar and many countries’ need for it.

In the 1960s, French politician Valéry d’Estaing complained that the United States enjoyed an “exorbitant privilege” due to the dollar’s status as the world’s reserve currency. His point was well taken.

The US dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks.

Because of the dollar’s position, the US can borrow money cheaply, American companies can conveniently transact business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and the United States insulated from the conflict. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency i.e. through foreign purchases of US Treasury bills.

Lately though, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

Russia and China have both made moves to de-dollarize and set up new platforms for banking transactions outside of SWIFT that skirt US sanctions. The two nations share the same strategy of diversifying their foreign exchange reserves, encouraging more transactions in their own currencies, and reforming the global currency system through the IMF.

In 2014 after Russia annexed Crimea, there were calls to cut Russia off from SWIFT. In response the Kremlin developed its own financial communications platform, SPFS. In December 2021, SPFS had 38 participants from nine countries. As of March, 2022, the system had 399 users. Russia is currently negotiating with China to join SPFS.

China has also developed an alternative to SWIFT, in 2015 launching the Cross-Border Interbank Payment System (CPS) to help internationalize the yuan.

Without taking action to reverse this trend, Washington will see its global standing weaken.

Since 2018, the Bank of Russia has substantially reduced the share of dollars in its foreign exchange reserves, through purchases of gold, euros and yuan. As of March, 2022, Russia was the fourth largest holder of gold bullion, behind the US at no. 1, Germany, Italy and France. The country’s gold holdings have tripled since the first Russo-Ukraine war in 2014, and are estimated at around 20% of the BoR’s total reserves.

China and Russia have drastically reduced dollar usage in conducting trade. In 2015 about 90% of transactions used the dollar. After the trade war between the US and China broke out, the figure by 2019 had dropped to 51%.

Bilateral currency swaps between Russia’s and China’s central banks helped Russia to bypass US sanctions in 2014, leveled against Moscow for its invasion of Crimea. A three-year currency swap worth $24.5 billion enabled each country to access the other’s currency without having to buy it on the foreign exchange market (i.e. involving dollars).

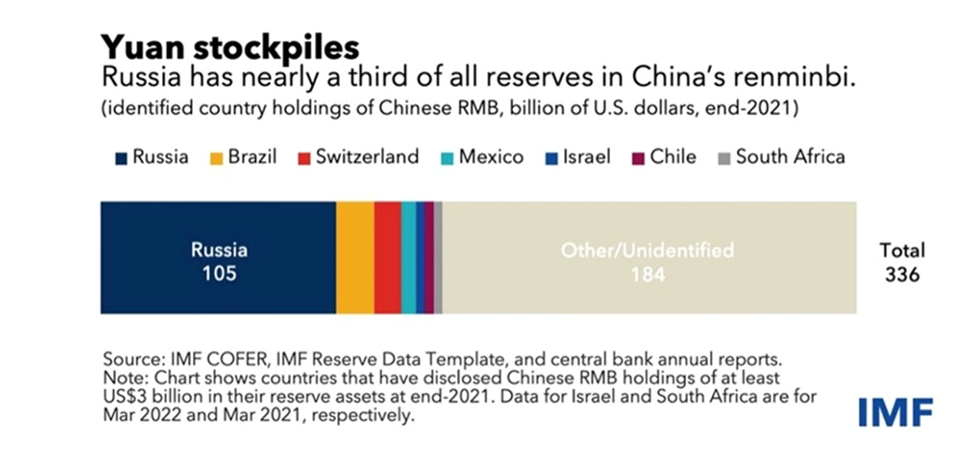

The Bank of Russia in early 2019 purchased $44 billion worth of Chinese yuan, tripling its share of Russia’s foreign exchange reserves from 5 to 15%. Russia’s yuan holdings are about 10 times the global average; it currently has nearly a third of all reserves in China’s renminbi/ yuan.

Major Russian energy companies including Gazprom and Rosneft have stopped using the US dollar, with the euro now the primary vehicle of trade between Russia and China. At the end of 2020 more than 83% of Russian exports to China were settled in euros.

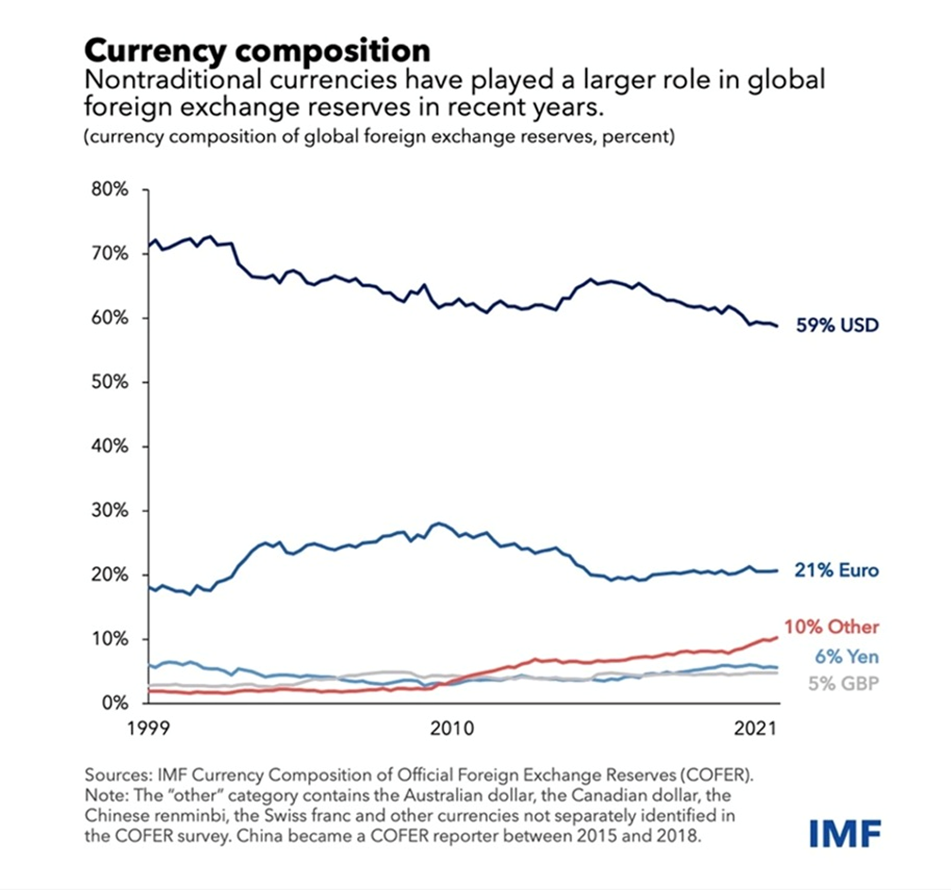

The latest numbers from the IMF show the dollar’s portion of total foreign exchange reserves has fallen. From $7.093 trillion in the third quarter of 2021, claims in US dollars have slipped to $6.441T in Q3, 2022 (in fairness, total foreign exchange reserves in all currencies have also dropped, from $12.8T in Q3 2021 to $11.5T in Q3 2022)

Source: IMF

Source: IMF

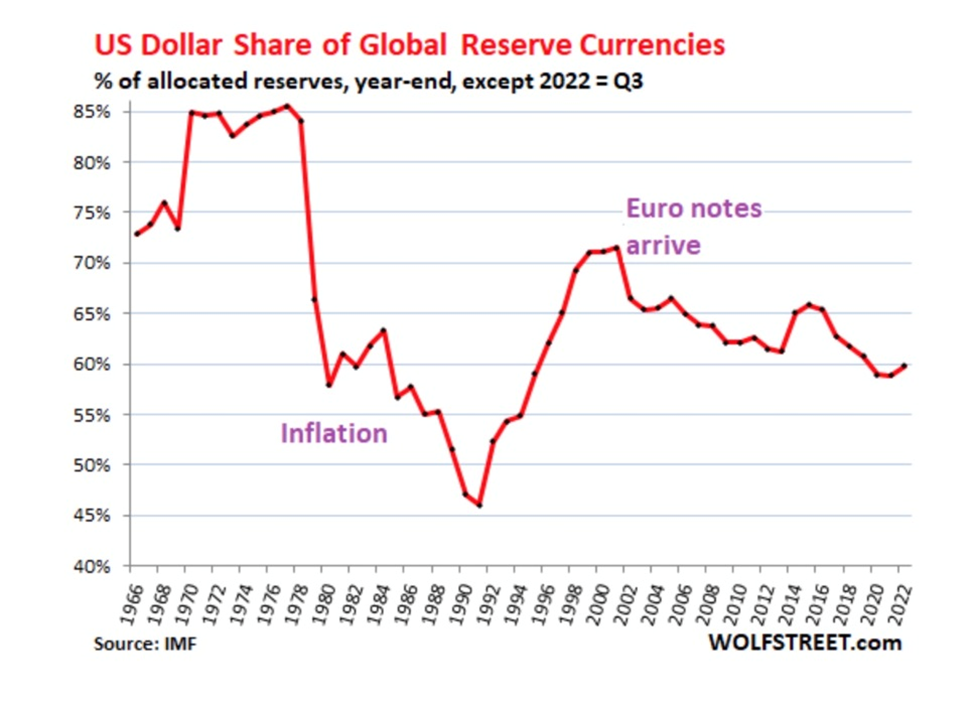

Wolf Street recently reported on the trend, stating that in 2002, the dollar’s share of foreign exchange reserves was 66.5%; 20 years later, its share has fallen to 59.8%.

Author Wolf Richter points out that in the early 1970s, 85% of global exchange reserves were in dollars. But over the next 15 years, the share plunged by nearly half, driven by an explosion of inflation that scared the wits out of holders of USD-denominated assets. One of the reasons why the Fed is now serious about cracking down on inflation is to avoid another dollar-fiasco like that:

Source: Wolf Street

Source: Wolf Street

As countries move away from holding the dollar and using it for conducting trade, they are also shunning the purchase of US government debt.

Bloomberg reported on Oct. 10 that the biggest players in the $23.2 trillion US Treasury market are in retreat:

From Japanese pensions and life insurers to foreign governments and US commercial banks, where once they were lining up to get their hands on US government debt, most have now stepped away.

Central bank buying represents the largest reduction in demand for US Treasuries.

Japan in September intervened to support its currency for the first time since 1998, raising speculation the country may need to actually start selling its hoard of Treasuries to further prop up the yen.

Because Japan is the largest foreign holder of US Treasuries, if that were to happen en masse, it would result in a marked decline in the value of the US dollar. Already we see Japan backing off.

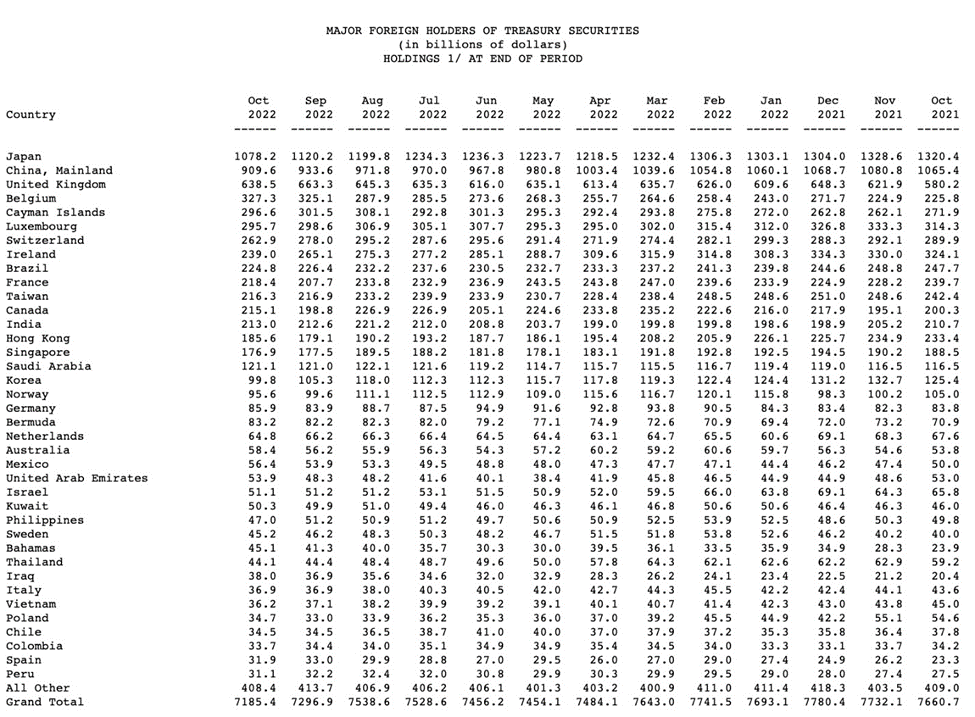

The table below shows Japan reducing its Treasury securities from $1.320 trillion in October, 2021, to 1.078T in October, 2022. China’s Treasury pile has also been winnowed, from $1.065T to $909.6B during the same period.

Source: Department of the Treasury/ Federal Reserve Board, Dec. 15, 2022

Source: Department of the Treasury/ Federal Reserve Board, Dec. 15, 2022

Commercial banks are also bailing on T-bills, with demand from them dissipating as Fed tightening drains reserves out of the financial system.

Combine de-dollarization and the relatively sudden freeze in the purchase of US Treasuries, with robust gold-buying by central banks, and we get the following evidence of a linkage:

“As de-globalisation accelerates, the non-G-10 nations are expected to ‘re-commoditize’ and ramp up gold holdings,” said Nicky Shiels, head of strategy at MKS PAMP SA, in a Dec. 7 Bloomberg piece. The article also notes The PBOC’s purchases may be part of a plan to diversify its reserves away from the dollar, said Giovanni Staunovo, an analyst at UBS Group AG.

The Financial Times, meanwhile, states:

[I]n February 2022, the last time CBR published its statistical data, gold accounted for 20.9 per cent. It has reduced its holdings of US Treasuries to only $2bn from more than $150bn in 2012, while increasing gold reserves by more than 1,350 tonnes worth almost $80bn at current prices, according to Julius Baer, a Swiss private bank.

While the US dollar was strong for most of last year due to rising interest rates, since November the buck has been in retreat, as traders slashed long-dollar positions, and investors piled into riskier assets following a cooling of US inflation data that helped temper expectations for the Federal Reserve to maintain its pace of interest rate increases.

As the US Dollar Index chart below shows, DXY has fallen from around 114 at the end of September 2022, to the current 105.13.

Source: MarketWatch

Source: MarketWatch

Loss of confidence in the US

Aside from macroeconomic factors, faith in the US dollar, especially among foreign investors, is sure to be knocked by the current shenanigans in Washington regarding the start-up of a new session of Congress.

For those who haven’t been following the news, the House of Representatives which after last November’s election became Republican-controlled, has rejected Kevin McCarthy as Speaker of the House 10 times now.

McCarthy, who has served as the top House Republican since 2019, secured only 201 votes of the 218 needed.

The roughly 20 “MAGA” (Trump-supporting) Republicans, refused to back a candidate they deem as ideologically unreliable, despite Trump’s call for party unity and to accept McCarthy as the Republican nominee for House Speaker.

The former president has said he’ll run again in 2024, and he has vowed to split with the GOP and form his own political party, taking up to 30 million far-right supporters with him.

Reuters notes, The internal struggle underscores the challenges the party could face over the next two years, heading into the 2024 presidential election…

[T]he leadership standoff raised questions about whether the House will be able to meet basic obligations such as funding government operations, let alone advance other policy priorities ahead of the 2024 presidential election.

The split on the Republican right if it continues to fester, will almost certainly affect the electability of the Grand Old Party, and play into the hands of Democrats, who just rammed through a $1.7 trillion omnibus bill rich with left-leaning “pork”.

The 4,155-page document outlines how government operations will be funded through Sept 2023. Among the list of many “woke priorities”, are $1.2 million earmarked for LGBTQIA+ Pride Centers, $3 million for the American LGBTQ+ Museum in New York City, and $856,000 for the “LGBT Center” in New York.

As an example of the cynicism currently underpinning US politics, President Biden is now meeting with the Senate Minority Leader Mitch McConnell in his home state of Kentucky, supposedly to discuss bipartisan initiatives. In fact all the Democrats really want to do is stall any legislation coming from the Republican-controlled House (the same priority the Republicans had when the Democrats controlled it), and the only reason McConnell is meeting with Biden, is because Biden bought him with electric-vehicle subsidies.

(from an Oct. 19 article in the Louisville Courier Journal: The U.S. Department of Energy will award two grants totaling nearly $500 million to Ascend Elements, a sustainable battery material production plant in Hopkinsville, President Joe Biden announced Wednesday.)

It all points to another four years of gridlock between the US legislative branches of government, and between two parties with no desire to work together unless their constituencies are paid off like McConnell’s.

Foreign investors watching the horror show unfold will undoubtedly be keeping a close eye on the value of their US dollar-denominated assets as the chaos in Washington chips away at the dollar’s exorbitant privilege.

Conclusion

De-dollarization, the non-buying of US debt, the weaponization of the USD, out-of-control currency creation through ridiculous pork-barrell spending, and debasement of the dollar all lead me to one conclusion:

The Fed will arguably be forced into unwinding its tight monetary policy, becoming more dovish in the first quarter, as the central bank is confronted by evidence of a collapse in consumer spending, and a downward-spiraling US economy.

The signs of a faltering economy are everywhere. They include continued high inflation, especially food and energy, that is not reflected in the Fed’s preferred inflation index, the core PCE; rising inflation expectations; dissipating consumer confidence; an imminent collapse in consumer spending, notwithstanding the “Black Friday” bounce; a plunging PMI and an inverted yield curve.

I see the Fed reducing its rate hikes to 25 basis points before the end of the first quarter and pausing by the middle of the year. A reversal could follow shortly thereafter.

Several countries, including the UK, China and the US, are moving towards central bank digital currencies. Critics point to the inherent danger of a system that could usher in the “globalist” vision of a cashless society in which all transactions are traceable by government.

I suggest an even bigger downside to CBDCs is their lack of backing by something physical, on which they can be valued. Fiat currencies and CBDCs are supported by nothing but trust — trust that politicians have shown time after time they do not deserve.

Consider: an important feature of cash payments is their indifference to power outages or internet network coverage.

You can now be controlled by simply cutting off the supply of digital money, which really isn’t money at all in the traditional sense. It’s more like a voucher system.

The idea that cryptocurrencies can have value is ludicrous; anyone can make a crypto. Even if you have zero technical know-how, you could hire someone on Fiverr to make a cryptocurrency for less than $20.

As of November 2022, there were 21,844 cryptocurrencies in existence. However, not all of them are active or valuable. Discounting many “dead” cryptos leaves only around 9,314 active cryptocurrencies. The number more than doubled from 2021 to 2022. At the end of 2021, the market was adding about 1,000 new cryptocurrencies every month. (Exploding Topics, Nov. 22, 2022)

Of course, CBDCs are not cryptocurrencies, but they suffer the same downside in that there is no means of valuing them without a hard asset. China appears to be the first nation to realize this and is rushing to accumulate as much gold as it can. The country is “officially” the fifth largest gold holder but since it rarely makes public its purchases, who knows how much gold Beijing really holds. The Shanghai Cooperation Council has decided to trade bilaterally in their own currencies. This means 40% of the world’s population is no longer interested in conducting trade using US dollars! Over the past year, physical gold has moved West to East, with much of the trading being done on the Shanghai Gold Exchange. A lot less gold is traded on the SGE than in London or on the Comex, but China now sets the price of gold in Asia.

Admittedly, I’m speculating when I say that China is planning on using its gold reserves to back its digital currency, the e-yuan, in whole or in part. But consider everything else — the de-dollarization, the lack of Treasury buying, China’s currency swaps with Russia, and payments for Middle Eastern oil in yuan. The launch of the gold-backed e-yuan may still be a year or two away, but we believe this is what’s happening.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.