Today we continue our study of the historical cycles suggesting a major crisis is in our near-term (5‒8 years) future. We don’t know the precise timing or nature of the crisis, but the patterns indicate one is coming and could be severe.

As with many therapeutic programs, the first step is admitting you have a problem. The good news is we have some time to think, reflect, and position ourselves to weather the coming storm, and with some luck, compromise and cooperation among leaders may even mitigate the problems.

So far, we’ve looked at Neil Howe’s Fourth Turning, a theory based on generational archetypes, and George Friedman’s idea of overlapping institutional and socioeconomic cycles. Both point to climactic events happening in the years around 2030. Today we turn to Peter Turchin, whose new book End Times uses more scientific tools to arrive at similar conclusions.

All three visionaries—an overused word but I think appropriate here—have their own ideologies and presuppositions. I know Neil and George quite well and am getting to know Turchin. (Full confession: While reading Turchin’s book I noticed what seemed to me a subtle left-leaning bias. Then I thought about Neil Howe’s book, and realized he has a right-leaning bias, which I didn't notice at the time because I agreed with it. What would be surprising is no bias in talking about these fairly controversial ideas. In any event, both Howe’s and Turchin’s evidence massively overwhelms any bias.)

I think all three authors succeed in setting their own preferences aside, analyzing through their own informed lenses what they think will happen rather than promoting ideas of what should happen. I highly recommend all three books. Reading them may be the motivation you need to start preparing for what lies ahead.

Before we look at Turchin, let me share some general thoughts. I always pay close attention to reader feedback (thank you!) and this series is generating a lot of it.

A number of readers are justifiably skeptical about historical cycles and models in general. I’ve often had similar thoughts about various economic and financial cycles (the Kondratiev Wave comes to mind).

The first and correct criticism is, I think, a misunderstanding of what the authors are trying to do. These forecasts by Howe, Friedman, and Turchin (and my own) are neither precise nor specifically predictive. No one is claiming to be Nostradamus here. We don’t know the future and many different things can happen. The possibilities are endless. What would another pandemic look like? Or a reproducible Fountain of Youth (perhaps closer than you think)? I am sure if you and I sit down together we can come up with a dozen different major events which could dramatically reshape the future.

But as I read these books, I saw patterns coinciding with my own observations of the world around us, admittedly viewed from a different lens of economic cycles. Does anyone really feel like we aren't moving toward some kind of crisis in our culture, economy, and politics? That’s an even harder position to defend.

The value of these ideas is not that they tell us exactly what will happen, but the insight they give us into what might happen. I see them as signposts on the way to what all indicate will be a better period after the crisis. Our goal is to get there as intact as we can. Their work and thoughts can help us plan and be more aware of what will shape the future.

It’s also important that these multiple viewpoints, from greatly different disciplines, seemingly coincide in the same time period with the same endpoint of crisis. And in their own individual analyses, they realistically—if uncomfortably—describe where we are today. Their reasons coincide with what we all generally expect: growing problems and the potential for a crisis.

Here in Puerto Rico, we pay attention to hurricane warnings. Sometimes it is a problem and sometimes it's not, but only the foolish fail to prepare on the assumption it is real.

In these books, we have multiple sources giving us the equivalent of a category 5 hurricane warning. I think we should pay attention.

Peter Turchin has a different perspective than Howe or Friedman. First, he was born and grew up in the Soviet Union, giving him personal experience with a culture and politics quite unlike what we know in the West. He doesn’t have to imagine what radical change is like. He has seen it. It of course produces a personal bias or understanding of history, but it is one that I find informative. My youth in West Texas helped form my own biases, but far closer to the norm than Turchin’s.

More important, Turchin is a scientist, a PhD-holding biologist and emeritus professor at the University of Connecticut. It was actually his study of insect populations that led him to patterns of human history. Why does a certain species of beetle, for instance, appear in a particular place, thrive for a while, and then almost disappear? Often it relates to the resources available in that place and how they are distributed among the insect population.

Turchin noticed something similar in human history. Societies emerge, thrive, and disappear to be replaced by something else. There’s a rhythm which repeats often enough to be considered a cycle. Turchin began collecting data to quantify this pattern, with the help of an increasingly large and diversly educated team which ultimately led to what he calls “cliodynamics,” an attempt to apply mathematical models to the development of human societies. Quoting [throughout this letter and in general I use backets […] to indicate I am inserting an idea or clarification into their words]:

“I began to consider how the same complexity science approach [on insect population] could be brought to the study of human societies, both in the past and today. A quarter of a century later, my colleagues in this endeavor and I have built out a flourishing field known as cliodynamics, (from Clio, the name of the Greek mythological muse of history, and dynamics, the science of change).

“We discovered that there are important recurring patterns, which can be observed throughout the sweep of human history over the past 10,000 years. Remarkably, despite the myriad of differences, complex human societies, at base and on some abstract level, are organized according to the same general principles. For skeptics and those simply curious, I have included a more detailed general account of cliodynamics in an appendix at the end of this book [which is fascinating].

“From the beginning, my colleagues and I in this new field focused on cycles of political integration and disintegration, particularly on state formation and state collapse. This is the area where our field’s findings are arguably the most robust—and arguably the most disturbing. It became clear to us through quantitative historical analysis that complex societies everywhere are affected by recurrent and, to a certain degree, predictable waves of political instability, brought about by the same basic set of forces, operating across the thousands of years of human history. It dawned on me some years ago that, assuming the pattern held, we were heading into the teeth of another storm.

“To put it somewhat wonkily, when a state, such as the United States, has stagnating or declining real wages (wages in inflation-adjusted dollars), a growing gap between rich and poor, overproduction of young graduates with advanced degrees, declining public trust, and exploding public debt, these seemingly disparate social indicators are actually related to each other dynamically. Historically, such developments have served as leading indicators of looming political instability. In the United States, all of these factors started to take an ominous turn in the 1970s. The data pointed to the years around 2020 when the confluence of these trends was expected to trigger a spike in political instability. And here we are.”

Regular readers know I am highly skeptical of models in general, particularly economic models. They tend to work until they don’t. This is usually because the economy changed in some important way. Turchin’s models are somewhat less prone to that flaw because their roots are in human nature which (sometimes sadly) has been quite stable for multiple millennia. Our species, while superior in many ways, is in certain respects predictably weak and foolish.

In 1979, Kahneman and Tversky created the foundations for the current analysis of behavioral economics. One of their conclusions was that humans are irrational [at least in their economic behavior], but the point is that they are predictably irrational. Turchin, et al., highlight yet another way in which human beings are sociologically predictable. Same song, different verse.

Turchin noticed societies always seem to split into elites and commoners. You might call the second group peasants or workers. In earlier ages they included serfs or even slaves. Today’s middle and lower classes have lives immeasurably better than serfs and peasants of the past, but nonetheless there is a difference between them and what passes as elites today. Whatever the label, upper and lower classes develop.

What makes one an elite? Two things: wealth and education, which are foundational to the power equation. These are the keys to a more comfortable life, so of course everyone seeks to achieve them. But not right away; in a society’s early development, the common people are generally satisfied—enough so that they produce many children. Their numbers grow and eventually resources become scarcer.

The scarce resources then get more expensive, to the benefit of the elites who own them. They become even more wealthy, and their numbers also grow. This “elite overproduction” is the beginning of the crisis. It spawns competition among elites who feel entitled to the advantages of their class. Inevitably some lose, falling down the scale while the top of the pyramid grows ever more elusive and distant. Some are radicalized into what Turchin calls “counter-elites” who oppose the ruling elites.

Meanwhile, with the elites consuming more and more economic resources, the commoner class becomes “immiserated,” unable to advance no matter how hard it works. Note this is relative. While a poor class person in the developed world may be immeasurably better off than the poor in Africa or Asia, they don't compare their situation to poverty abroad but to the wealth that surrounds them. At this stage, they often see little opportunity to acquire their own wealth or at least advancement.

This unstable situation can persist for a long time, not unlike the financial system “sandpile” metaphor I’ve described. In this case, the sandpile collapse is triggered when a split develops within the elite class, giving the counter-elites and immiserated commoners an opportunity to exploit. Crisis follows, then the cycle starts again. This whole process tends to repeat every 50 years or so.

(If all that sounds a bit too neat, please read the book. I just compressed several chapters into a few paragraphs. Turchin describes it all in detail and gives many fascinating historic examples.)

The economic heart of this process is what Turchin calls the “wealth pump.” That’s the mechanism by which elites gain increasing control of assets while wages and wealth decline for everyone else. Understanding this is key to everything else, and particularly how the process is playing out right now in the United States.

Here, I’ll let Turchin speak for himself. This excerpt comes from chapter 8 of his book. (While this chapter is a summary, I think it is the most important. You should at least read it, and then maybe go back and look at the data that he builds his case on.)

“The wealth pump has a major effect not only on the commoner compartment (causing immiseration) but also on the elite compartment. Elite numbers change as a result of demography (the difference between birth and death rates), but this is a relatively unimportant factor for us because demographic rates between the elites and the commoners are not that different in the United States… The more important process is social mobility: the upward movement of commoners into the elite compartment and the downward movement of elites into the commoner compartment. And whether net mobility is upward depends on the wealth pump.

“The mechanism here is simple. When corporate officers [or entrepreneurs] keep increases in worker wages slower than the growth of the company's revenues, they can use the surplus to give themselves higher salaries, more lucrative stock options, and so on. The CEO of such a company, upon retirement with a ‘golden parachute,’ becomes a new centimillionaire or even billionaire…

“This dynamic can also operate in reverse. When worker wages increase faster than GDP per capita (that is, when relative wages grow), the creation of new super rich is choked off. Some exceptional individuals continue to create new fortunes, but their numbers are few. The old wealth, meanwhile, is slowly dissipated as a result of bankruptcy, inflation, and division of property among multiple heirs. Under such conditions, the size of the superwealthy class gradually shrinks.

“But such a gradual, gentle decline assumes that the social system maintains its stability. Analysis of historical cases indicates that the much more frequent scenario of downward social mobility, which eliminates elite overproduction, is associated with periods of high sociopolitical instability, the ‘ages of discord.’ In such cases, downward mobility is rapid and typically associated with violence.

“Political instability and internal warfare prune elite numbers in a variety of ways. Some elite individuals are simply killed in civil wars or by way of assassination. Others may be dispossessed of their elite status when their faction loses in a civil war. Finally, general conditions of violence and lack of success discourage many ‘surplus’ elite aspirants from continuing their pursuit of elite status which leads to acceptance of downward mobility.

“Thus, the heart of the MPF model [Turchin’s mathematical tool to analyze all this—JM] is the relative wage and the wealth pump that it powers. When the relative wage declines it leads to both immiseration and elite overproduction. Both, as we now know, are the most important drivers of social and political instability.”

This sounds hauntingly like 2020s America, but Turchin shows this process repeating itself many times in different civilizations. It is not unique to us. But that isn’t encouraging because it rarely ends well and often ends violently.

Let’s check his data. Turchin mentions a specific way to measure this process, what he calls “relative wages” or wages relative to GDP. He uses GDP as a rough proxy for wealth.

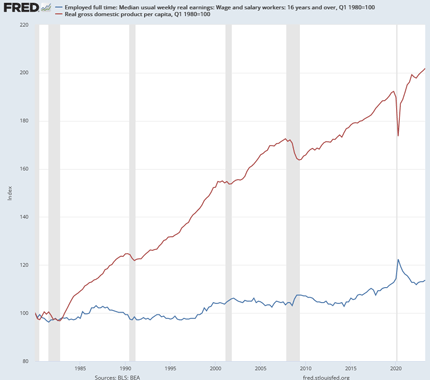

In the chart below the red line is GDP per capita (accounting for population growth and immigration). The blue line is median weekly earnings for full-time workers over age 16. Both are indexed so their 1980 level equals 100.

Source: FRED

As of mid-2023, per capita GDP had risen to 201.8 and wages were up to 113.7. GDP grew approximately seven times faster than wages. And note these are median wages, not average, so half the workers saw even less wage growth. This is what “immiseration” looks like.

Why start with 1980, you ask? Turchin sees that year as the previous cycle low. In his view, that’s when the elite class turned away from what had been relative generosity for the 50 prior years since the Great Depression. And we are now approaching 43 years into the next phase, hence the expectation of crisis soon.

From Turchin’s perspective, relative wages are key. If we are to avoid the worst-case outcomes, that gap between GDP and job earnings must start shrinking. Wages are indeed rising, especially at the lower end, but not nearly enough to close the gap anytime soon. Falling GDP would help but also create other, likely even more severe, problems. A few years of flat GDP might do the same thing, but we probably don’t have that time. Elite overproduction is out of control.

Remember, elites aren’t just the wealthy. The category also includes educated people, of which we have created many more in recent decades by making college degrees more widely accessible. We also created an expectation that these degrees would open the door to better lives. Yet the door stayed shut for many, and some of them aren’t at all happy about it. And especially with the massive student loans they used to chase the dream of rising into a high-paying job they felt they were promised if they only got that degree!

A US problem? Not at all. This is happening all over the world, though not everywhere. I am particularly thinking of China, where unemployment among young people is a minimum of 20%. Their parents sacrificed to send them to schools to get the right degrees, but in a slowing economy, those opportunities just don’t exist. Xi Jinping, with what sounds like a tone deaf ear, told them to be willing to go to the country to take a job. He asks them to help “revitalize” the countryside, which means take lower wages with less chance for promotion and improvement. Not what those parents and students thought they were signing up for. Sound familiar?

Turchin goes on to describe the conditions that lead to crisis outcomes. The good news is we are not yet beyond hope. There are ways we can avoid the worst, but certain groups will have to make some hard choices.

I’ll tell you more about that part next week.

Shane and I will fly to London and play tourist and see friends. She is fascinated with all things Anne Boleyn, so we are going to see Hever Castle (which locals tell me is fun) and other sites before taking the Chunnel to Paris mid-week, to again play tourist and see friends culminating in Charles Gave’s 80th birthday party on Saturday the 9th. Then she will return to Puerto Rico, and I will go to Dallas for a few days to meet with my partners and see friends (see the theme here?).

I have noticed a pattern on my recent travels: I don't exercise and come back home stiff and somewhat weaker, needing my gym. I'm going to have to avoid that on future trips.

I have been intending to write this series on various approaches to cycles for some time. I thought I pretty much knew where I was going. It turns out the deep dive raised all sorts of new ideas and insights. I find myself wanting to go deeper as it is a key part of the critical question of our times, what I've been calling The Great Reset. But I’ve also begun to see it is much deeper than that. This is a critical topic for our longer-term planning.

I note that historically almost all periods of crisis are preceded by massive denial among the intelligentsia, even the market participants who are supposedly laser-focused on the real world. They miss it perhaps because they don’t expect anything that could be so extraordinarily out of their personal comfort zones. That's why there is generally so much time between each of these crisis periods. The memory fades and a new generation faces the same problems without a personal understanding of the consequences.

We may be the first generation to actually have some warning. It remains to be seen how many of us will take heed, and even more important, whether we as a culture can learn from history and mitigate the often severe outcomes. Stay tuned…

It is time to hit the send button. I wish you and yours a great week and remind you that at the end of our lives, none of us will regret spending more time with our friends and families. And don’t forget to follow me on X!

Your West Texas country boy not feeling like an elite analyst,

|

|

John Mauldin |

P.S. If you like my letters, you’ll love reading Over My Shoulder with serious economic analysis from my global network, at a surprisingly affordable price.

Click here to learn more.