Read the full report on SilverSeek.com

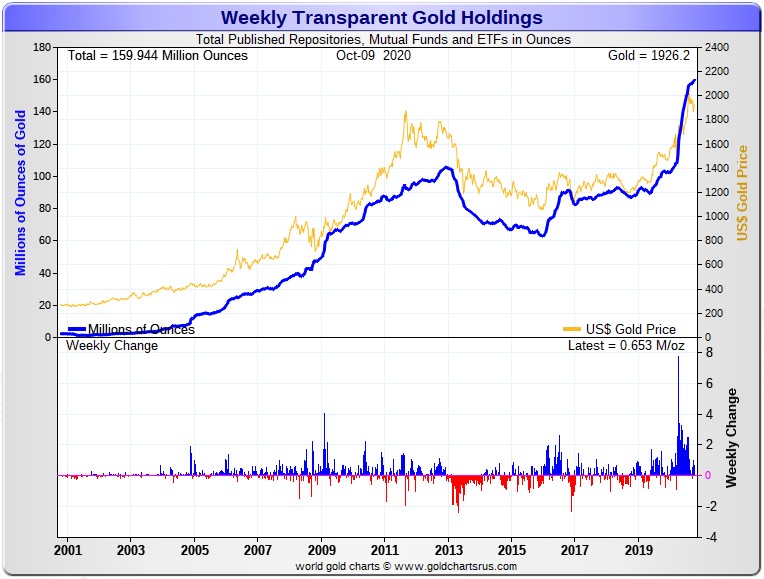

Here are the usual 20-year charts from Nick that show the total amount of physical gold and silver in all known mutual funds, depositories and ETFs as of the close of business on Friday.

During the week just past, there was a net 780,000 troy ounces of gold added. The number on the chart below shows only 653,000 troy ounces, but the COMEX warehouse stocks in gold and silver for Thursday didn't show up on his website for whatever reason, so I had to add in the net 127,000 troy ounces added on Thursday [posted above] manually. Click to enlarge.

|

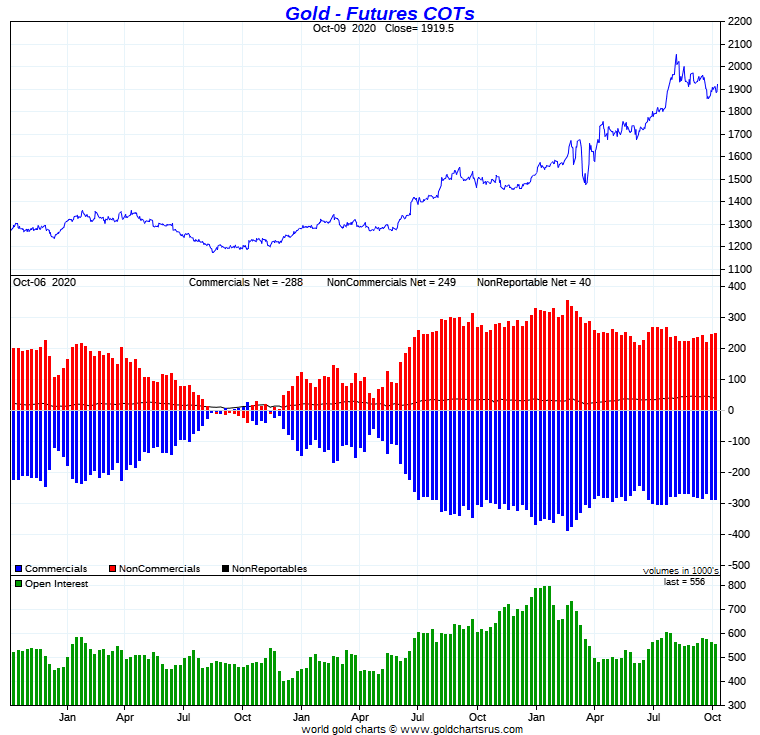

In gold, the commercial net short position increased by a scant 2,290 contracts...229,000 troy ounces, which is mostly a rounding error in the grand scheme of things.

They arrived at that number by decreasing their long position by 9,256 contracts -- and also reduced their short position by 6,966 contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Like in silver, the Managed Money traders did very little, decreasing their net long position by a paltry 240 contracts. And also like in silver, the big action was with the other two categories.

The 'Other Reportables' increased their net long position to yet a new record high, this week by a chunky 4,688 contracts. The 'Nonreportable'/small traders went in the opposite direction...decreasing their net long position by 2,638 contracts.

Doing the math: 240 plus 4,688 minus 2,638 equals 2,290 COMEX contracts...the change in the commercial net short position.

The commercial net short position in gold now sits at 28.85 million troy ounces, up from the 28.62 million troy ounces they were short in last week's COT Report.

The Big 8 traders are net short 23.83 million troy ounces of gold, or 82.6 percent of the commercial net short position. Last week at this time, the Big were net short 24.24 million troy ounces, so they cut their short position by about 4,100 COMEX contracts, or 410,000 troy ounces of gold during this past reporting week...which is really nothing at all.

Ted said that there didn't appear to be any change in JPMorgan's position in the COMEX futures market in gold...which remains market neutral.

Here's Nick's 3-year COT chart for gold, updated with Friday's data -- and there's not a lot to see here, either. Click to enlarge.

|

|

Like in silver, the Big 8 are still trapped on the short side, at least on paper -- and it remains to be seen if any or all of this gold that's been brought into the COMEX depositories over the last six months is about to be used to extinguish it. Maybe that's what these big deliveries in gold are all about, at least in part. And from a futures market perspective, the set-up in gold is very bullish as well.

But the stand-out feature of these two reports is the ever-increasing long positions being put on by the traders in the 'Other Reportables' category -- and Ted has been right to ask..."Who are those guys?" We'll find out in due course, I'm sure.