As a general rule, the most successful man in life is the man who has the best information

Slow recovery from virus unlikely to impede strong demand for metals

Daily coronavirus cases may be down in the United States, but that is no reason to be complacent, especially given that cold and flu season is only a few weeks away, says the nation’s top doctor.

In a roundtable discussion Thursday at Harvard Medical School, Dr. Anthony Fauci warned that “we need to hunker down and get through this fall and winter, because it’s not going to be easy.” He compared the pandemic to the early days of HIV in terms of how quickly it escalated, and how it might continue to escalate, if current trends of low mask-wearing and social distancing continue. “We've been through this before,” he said. “Don't ever, ever underestimate the potential of the pandemic. And don't try and look at the rosy side of things.”

On Friday Dr. Fauci went against President Trump, who in a White House news briefing Thursday told MSNBC’s Andrea Mitchell, “I really do believe we’re rounding the corner,” referring to new cases having declined substantially since July.

According to data from John Hopkins University, over the past seven days the country has reported an average 35,200 cases per day, which is 12% lower than a week ago, and around half compared to 70,000 cases per day peak in late July.

“I’m sorry, but I have to disagree with that because if you look at the thing that you just mentioned, the statistics, Andrea, they’re disturbing,” he said. “We’re plateauing at around 40,000 cases a day and the deaths are around 1,000.”

Regarding the latest hot spot, the MidWest, and the looming threat of another covid-19 wave, like what’s happening right now in France and Spain, Dr. Fauci warned, “it’s really quite frankly depressing to see that because you know what's ahead.”

Tepid global growth

What does lie ahead? As smart investors, always keeping an eye on the horizon, we need to know. In this article, we sum up the world’s condition, especially as it relates to metals demand. What we find is a mixed bag, of good and bad news.

A recent survey published by NPR found that low-income minority households experienced the most financial hardship during the virus-induced recession. No surprise there. “Racialized” individuals (the new media buzzword) ie. blacks, Latinos, Middle Eastern immigrants, etc., are far more likely to be living in multi-family housing, and working jobs where they are unable to tele-commute.

The study showed a majority of low-income minority households had their savings wiped out, compared to white households and others with incomes over $100,000, which managed to escape financial calamity. The recent expiration of $600 weekly stimulus checks, affecting tens of millions of Americans, has exacerbated the situation. As Zero Hedge notes, With the economic recovery stalling and the labor market deteriorating, much of the financial distress, due to the virus pandemic, has been exerted onto the working poor.

If anything the coronavirus crisis has exposed the widening gulf between the rich and the poor in the land of the free, home of the brave. As Zero Hedge points out, On one end of the spectrum you've got affluent borrowers locking in record-low rates, while mortgage originations reached a record $1.1 trillion in the second quarter as rates on 30-year mortgages dipped below 3% for the first time in history in July, according to Bloomberg.

At the other end of the spectrum, mortgage delinquencies are up 450% from pre-pandemic levels, with around 2.25 million mortgages at least 90 days late in July - the most since the credit crisis, according to Black Knight, Inc.

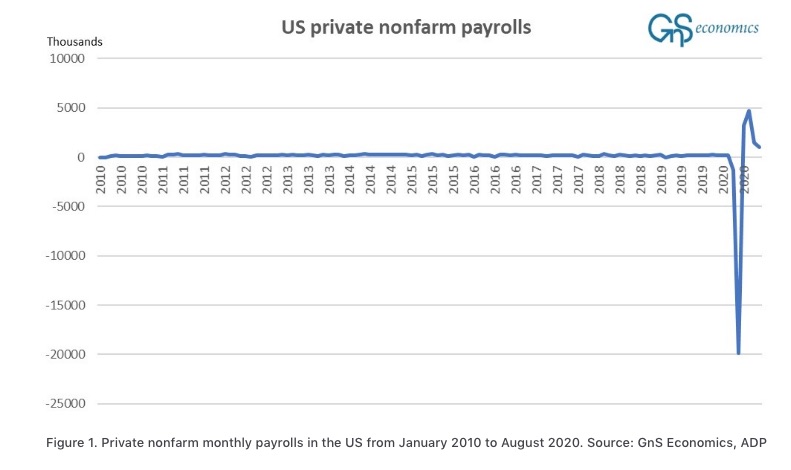

Recovery in the US is hobbled by persistent unemployment. Jobless claims last week were worse than expected, at 884,000 first-time filing compared to an anticipated 850,000. The total of those claiming benefits through government assistance programs rose to 29.6 million through Aug. 22. Nonfarm payrolls declined by some 22 million at the onset of the crisis, and about half those jobs have been recovered, CNBC reported. Large corporate bankruptcies saw their largest-ever increase in August, making notable improvements in employment unlikely.

The Trump Administration’s trade war with China, meanwhile, is doing little to swing Trump’s base, and undecided voters, to his casus belli. According to research from the Federal Bank of New York, quoted in the South China Morning Post, nearly all the costs of higher import duties were borne by US firms and consumers.

Moreover, despite taking a hard line on China, including bans on Huawei, TikTok and WeChat, recommendations to delist US-listed Chinese companies, and threats to cancel trade talks, 60% of respondents in the latest Gallup poll disapproved of the President’s handling of US-China relations, according to the Hong Kong-based newspaper.

Beyond the United States, countries that initially recovered from the pandemic, by lifting lockdowns, are now facing a long period of modest expansion, meaning it will likely take many months, if not years, for the global economy to bounce back to pre-pandemic levels.

For example, the UK economy grew 6.6% in July from June, and is projected to gain 15% in the third quarter, but output is still 11.7% lower than February. Economists predict it will take until 2022 for the British economy, which suffered the worst decline among rich countries during the second quarter, to recuperate. It also won’t be until 2022 that the US economy recovers, economists say, following a 9.1% contraction in the three months to June, even though the economy is on track to expand 7% in Q3 and 1.25% in Q4.

In the eurozone, industrial sentiment has collapsed, while in China, even growing at 4-5%, industrial production is expected to take until the end of the year before it reaches the level it was before the pandemic. Chinese retail sales haven’t recovered as expected, and actually declined in July. Problems in China’s overleveraged banking sector could impede its recovery.

The global economy contracted for a second straight quarter in Q3. Across the Group of 20 leading economies, the 3.4% decline in output during the first quarter, was the largest since records began in 1998, while the steep second-quarter drop was without precedent since the end of World War Two.

The Wall Street Journal quotes Gilles Moëc, chief economist at the Axa insurance company, saying, “As long as the major economies do not need to get into generalized lockdown, the economy should continue to mend, but cannot sustain the spectacular rebound seen upon reopening businesses a few months ago. The hard part starts now.”

Of course, the scope and speed of recovery is directly tied to the coronavirus, for which hundreds of pharmaceutical companies are racing to develop a vaccine. IMF Chief Kristalina Georgieva this week said that a full recovery is unlikely without a vaccine, and warned that the global economic crisis is “far from over.”

Brazil and the United States have topped the covid-19 charts for months, but India just knocked Brazil off its number 2 position. According to CTV News, India’s 90,802 cases added Monday pushed its total past Brazil with 4.2 million cases, putting the country behind only the United States, where over 6 million people have been infected.

India’s economy shrank faster than any other nation, nearly 24% in the second quarter, following a harsh lockdown in March. CTV states, When Prime Minister Narendra Modi ordered 1.4 billion Indians to stay indoors, the whole economy shut down within four hours. Millions lost their jobs instantly and tens of thousands of migrant workers, out of money and fearing starvation, poured out of cities and headed back to villages. The unprecedented migration not only hollowed out India's economy but also spread the virus to the far reaches of the country.

Stimulus failure

Even before the coronavirus crisis, central banks throughout the world were slashing interest rates to kickstart faltering economic growth. With covid, the floodgates were opened to colossal levels of fiscal and economic stimulus, in the form of government spending and asset purchases by central banks, the latter meant to inject liquidity into flatlining economies.

However growth, and demand, haven’t kept up with the torrent of “digital” money being created, ie. money-printing.

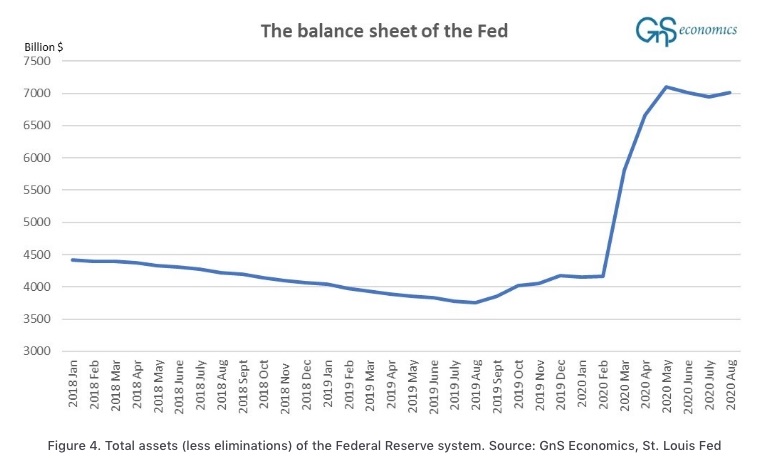

The U.S. government has flooded over $2 trillion into the economy and the budget deficit is expected to top $3.3 trillion in 2020, the largest deficit as a percentage of GDP since 1945. The balance sheet of the Federal Reserve has also exploded from little over $4 trillion to over $7 trillion in just a few months (see Figure 4). There is just one word for such unprecedented actions: desperation.

Stimulus in China has also broken records. By the end of July,’ the aggregate financing to the real economy’ had reached an astonishing $3.3 trillion, easily topping the previous record of $2 trillion set in 2019. In an economy that is already extremely indebted, this is, naturally, completely unsustainable.

There is, quite simply, no real economic recovery coming. On the contrary, we are heading deeper into the crisis.

Lower for longer

“Lower for longer” is the US Federal Reserve’s new mantra for the economy which continues to struggle under the weight of the pandemic. This, of course, refers to its policy of low interest rates; the federal funds rate currently floats within a range of 0% to 0.25%.

While the Fed normally targets 2% inflation as a way of keeping the economy in the Goldilocks zone of “not too hot, not too cold,” the central bank recently said it will allow inflation to run hotter, (>2%) to support the labor market and the broader economy. This effectively means the Fed is less inclined to hike interest rates when unemployment falls, so long as inflation does not creep up as well.

In August the cost of US goods and services rose sharply, for the third month in a row.

If inflation goes, say, above 3%, yet interest rates remain near zero, that would create bullish conditions for gold - negative real rates (interest rates minus inflation). When US Treasury bond yields turn negative, investors typically rotate their funds out of bonds, into gold.

Precious metals bull

Indeed gold and silver have been on a tear since mid-March. The factors behind the surges of both metals are worrisome covid-19 infections, geopolitical concerns especially US-China tensions over trade and the South China Sea, inflation expectations on the back of (seemingly) unlimited monetary stimulus, and low interest rates worldwide.

Bullion prices have climbed 25% year to date, as investors choose gold as a safe haven amid widespread economic uncertainty created by the pandemic. They believe gold will hold its value better than other assets such as stocks and bonds.

Silver in July gained an astonishing 35%, its best performance since 1979, as investors sought shelter from pandemic turmoil and low or negative interest rates, while industrial demand for the metal recovered in some parts of the world.

Soaring debt

Gold is also being helped by skyrocketing US debt levels, as the federal government scrambles to spend its way out of the pandemic. In a previous article we established the strong correlation between gold prices and a country’s debt to GDP ratio.

Earlier this month the Congressional Budget Office said federal debt held by the public is projected to exceed 100% of GDP, for the first time since World War Two (in 1946, US debt to GDP was 106%, after years of financing military operations to end the war).

Put simply, that means for every dollar of output, the United States goes $1 in debt, putting the country in the same dubious league as Japan, Italy and Greece - nations with debt loads that exceed their economies.

Recently Alan Greenspan pointed the budget deficit as one of his biggest problems with the US economy. Through July, the federal government’s spending imbalance totaled $2.45 trillion, an amount the former Fed Chair said was “getting out of hand.” “We are if anything underestimating the size of the budget deficits that are down the road,” he told CNBC’s “Squawk on the Street,” referring to ballooning entitlement spending like Social Security, Medicaid and Medicare, due to “the extraordinary increase in the size of the retirement area.”

Copper

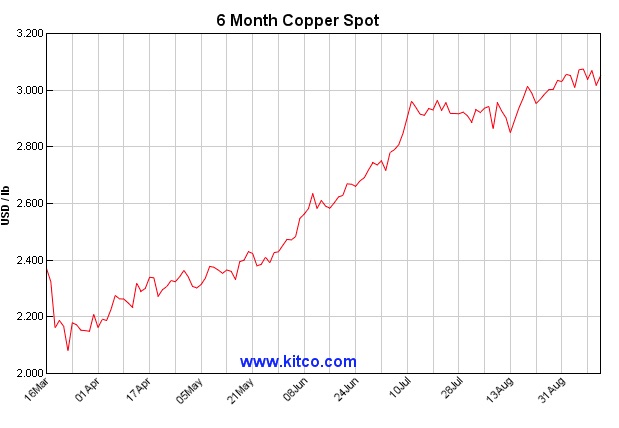

Certain industrial metals, despite lower demand, have done quite well in the new covid-19 normal. Tight supply and strong demand from China have elevated copper prices above $3.00 a pound for the first time since 2018. The country’s total unwrought copper imports this year climbed 38%, to 4.27 million tonnes.

Physical purchases have been supplemented by futures buying. According to Reuters, positioning on the CME’s copper contract is the most bullish since the second quarter of 2018, with money managers lifting their collective bets on higher prices. In the week to Sept. 1, net longs rose by 6,783 contracts to a fresh two-year high of 69,783.

On the supply side, Chilean state-owned Codelco, the largest copper miner in the world, lost 4.4% of its production in July, as the coronavirus forced the company to scale back staffing, slow projects and turn off a smelter.

As we have reported, without new capital investments, Commodities Research Unit (CRU) predicts mine production will drop from the current 20 million tonnes to below 12Mt by 2034, leading to a supply shortfall of more than 15Mt. Over 200 copper mines are expected to run out of ore before 2035, with not enough new mines in the pipeline to take their place.

Covid-related mine closures, albeit temporary, are ringing alarm bells throughout the copper market and bidding up prices, as investors fret over whether the industry can meet demand, especially now that China, which consumes 51% of the world’s copper, appears to be back on its feet.

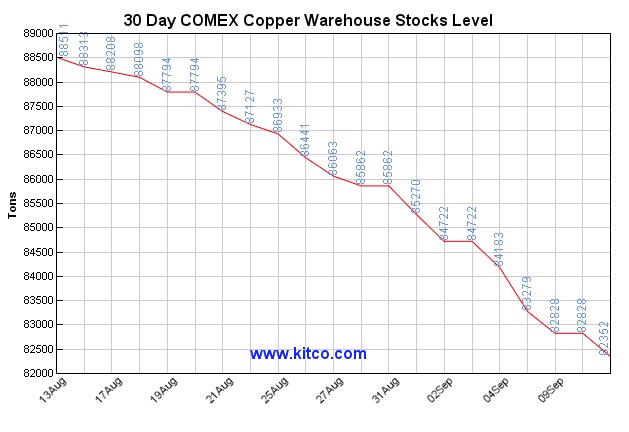

Earlier this month Bloomberg wrote that The global copper market could be on the cusp of a historic supply squeeze as Chinese demand runs red hot and exchange inventories plunge to their lowest levels in more than a decade.

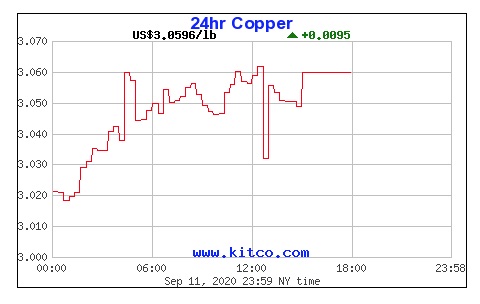

On Friday, red metal prices rallied to $3.05/lb, on predictions that Chinese scrap metal imports could fall by half, forcing the country to increase its shipments of concentrate and unwrought copper.

Iron ore

China also consumes vast quantities of iron ore, required for producing steel. The country’s demand for the steelmaking commodity has driven 2020 price gains to over 40%. According to Fastmarkets MB, benchmark 62% Fe fines imported to northern China surged to $129.92 per tonne on Sept. 3 - the highest level since 2014. The country’s recovery from the pandemic is reflected in a healthy Purchasing Managers Index, with the Caixin manufacturing PMI index rising to 53.1 in August, compared to 52.8 in July. A reading above 50 indicates economic expansion.

Zinc

Another key industrial metal, zinc, has benefited from strong Chinese metals demand. While prices fell 17.3% during the first quarter owing to pandemic-related uncertainty, prices have since recovered, with three-month zinc averaging $2,121 per tonne over the first eight months of the year. In fact Fitch’s country risk and research division recently revised its forecast for 2020 up from US$2,100 a tonne, to $2,200/t, driven by Chinese demand.

US dollar woes

Pushing the commodities complex higher is a weak US dollar. Since its mid-March high, the greenback has fallen 10%, reversing almost half of the appreciation of the last decade, in only a few months. The chief culprit has been the US Federal Reserve’s low interest rate policy, which has cut the demand for dollars flowing to safe havens like US government bonds.

Geopolitical tensions

Along with a low dollar, near zero interest rates and forecasts for rising inflation, gold prices are also driven by economic and political crises, and we are currently in no shortage of these.

Recently we reported on the “new Cold War” heating up between the US and China. We have written extensively on the escalating tensions in the South China Sea, where China holds historical claims despite international treaties to the contrary (ie. the UN Convention on the Law of the Sea). Ongoing maneuvers in the waters off its southern coastline demonstrate that Beijing is willing to flex its muscles in a region it sees as strategically and economically critical. China has built man-made islands and constructed port facilities, military buildings and even airstrips on them.

At the end of August, China launched four medium-range ballistic missiles into the South China Sea, amid broader military exercises by the People’s Liberation Army (PLA). A day earlier, Beijing protested a flyover by a US spy plane. The Trump administration is reportedly strengthening action against 24 companies that helped set up outposts in the region.

The United States supplies weapons to Taiwan despite not having diplomatic relations with the island and its government. China sees Taiwan as a breakaway territory that must be re-united with the Chinese Mainland; its independence is not recognized by Beijing. A forced reunification would almost certainly cause a war between China and the US; the Americans would never allow Taiwan, a key tentacle of US influence in that part of the world, to be overtaken by the Chinese. Yet there are increasing calls from China to end Taiwan’s independence by the 100th anniversary of the Chinese Communist Party in July, 2021.

On Wednesday and Thursday, Chinese military aircraft entered Taiwan’s air defense identification zone, prompting Taiwan to scramble fighter jets, according to an Al Jazeera report.

Meanwhile China is cozying up to Russia, as it has done on numerous occasions historically. This time the rapprochement comes in the form of “Caucus 2020”, joint war games in southern Russia which will run in late September.

Infrastructure spending

One of the most compelling arguments for higher metals prices is a global infrastructure push, that could not only replace dangerously aging bridges, roads, sewers and the like, but put millions of people to work in high-paying jobs. Infrastructure spending may even be the much-needed panacea to the coronavirus.

As we have discussed, in the US there are two directions a national infrastructure program could take. One is spearheaded by Joe Biden, the Democrats’ nominee to take on Trump in the November presidential election. Biden recently announced a $2 trillion climate plan, seeking to boost clean energy and rebuild infrastructure.

Trump also has infrastructure on his mind, but it would likely be more black and grey than green, focusing on road & bridge replacement, new water/ sewer infrastructure, public buildings, etc., with some funds set aside for 5G wireless infrastructure and rural broadband.

The European Commission has released a €1.85 trillion recovery plan focusing on “EU Green Deal” initiatives aimed at reaching the eurozone’s net emissions by 2050 target.

Beijing earlier this year kicked off a widely anticipated program focused on “new infrastructure” and “new urbanization”. The plan is expected to generate $2 trillion in investment over the next five years, targeting high-tech infrastructure, including 5G, artificial intelligence, and the industrial “Internet of Things” (IoT).

Chinese stockpiling

While on the subject of Chinese infrastructure spending, we recently reported on the fact that Beijing is apparently hoarding copper and other raw materials.

In July, surges in Chinese imports of copper and iron ore kicked up prices of those metals to multi-year highs. Why is China stockpiling commodities? One possibility is that Beijing is preparing for war.

Obviously we can’t say for sure, given China’s opaque statistics, but we suggest a good chunk of the materials are going into bulking up the Chinese military, in particular its navy patrolling the South China Sea.

China began building up its military in the mid-1990s, with the goal of keeping its enemies at bay in the waters off the Chinese coast.

Long seen to be inferior to the powerful US Navy, including the Japan-based 7th Fleet, in just over two decades the People’s Liberation Army has amassed one of the largest navies in the world. According to an in-depth Reuters feature on the Chinese military buildup,

China now rules the waves in what it calls the San Hai, or “Three Seas”: the South China Sea, East China Sea and Yellow Sea. In these waters, the United States and its allies avoid provoking the Chinese navy.

This increased Chinese firepower at sea - complemented by a missile force that in some areas now outclasses America’s - has changed the game in the Pacific. The expanding naval force is central to President Xi Jinping’s bold bid to make China the preeminent military power in the region. In raw numbers, the PLA navy now has the world’s biggest fleet.

Another intriguing possibility is that China is using up its US dollar reserves, as a way of accelerating a shift to the yuan, cultivating monopolies, or exerting pressure on foreign governments.

Michael Every of Robabank suggests this in a recent column that ran in Zero Hedge. Every points out that China has announced plans to boost its strategic commodities reserves to assuage anxiety over energy and food security. Starting in 2021, officials say the country is expected to make “mammoth” purchases of crude, strategic materials and farm goods, to avoid a repeat of this year’s supply disruptions owing to covid-19, or a deterioration of trade relations with the US.

Actually, those in the know know that this has already been happening across the board for some time: China has been swallowing up raw materials and strategic goods far in advance of what the economy needs right now. That means the drop in other imports --which are still down y/y overall even including this commodity surge-- is even larger. (And why aren’t FX reserves rising even as the trade surplus soars…? Mmmm.)

What possible disruption could be on the horizon that would require China to have a large enough buffer of all conceivable inputs --in remote inland areas to boot-- that it needs to use up its precious USD reserves in a bulk splurge now?

“Geopolitics”, as we say euphemistically? That hardly suggests the benign, sunny uplands that ECB is going to try to sell today, with its eyes firmly on its own shoes, RBA-style.

It can’t be on *imminent* concerns of the US acting on China’s USD access because all these purchases will presumably still be made in those precious USD, even in vast size,… right? Or is the idea with THAT much buying, a shift to CNY can be accelerated? For commodity sellers, that’s something to consider. So is that this would be a multi-year bull-run – and then a very sharp stop.

Indeed, theoretically China would no longer have to worry about not having enough of X, or Y, or Z; and it could simply stop buying from industry/country X, or Y, or Z for a year or two if prices were too high,….and watch them collapse,…until prices were again amenable, or the asset was for sale, or the relevant government ‘came to its senses’ on foreign policy.

Conclusion

As smart resource investors, we want to be invested in metals, and companies, that are at the leading edge of a trend. At AOTH we see gold, silver and copper as THE best metals to own right now, considering the multi-trillion-dollar infrastructure programs being promised by the two presidential candidates, the European Union and China.

Palladium companies are good to own too, considering that palladium prices, like gold prices, have held up well during the pandemic.

As palladium continues its multi-year run, amid supply constraints, new sources of palladium are needed to meet demand for gas-powered auto-catalysts, in conventional and hybrid vehicles and thereby help achieve stricter air quality standards.

At the moment inflation isn’t a problem, but if multi-trillion-dollar infrastructure programs come to pass, they will be hugely inflationary. The rise in food prices and gas prices in the US may just be the precursor of what’s to come, when the printing presses start churning out dollars like never before - far surpassing the quantitative easing programs that followed the financial crisis.

Inflation is good for gold and silver. Ditto for debt. The debt to GDP ratio is a reliable indicator of gold prices. The ratio is certain to go higher, as more money is printed, expanding the Fed’s balance sheet, while economic growth continues to be pinned down by the pandemic.

Fiscal and monetary stimulus will have to rise, just to keep people fed, housed and from taking to the streets; to pay for the big infrastructure spend planned after the election; and regular spending priorities. It will all be inflationary - great for silver and gold.

Interest rates are likely to stay low for at least the next couple of years. Indeed with a debt to GDP ratio over 100%, the government cannot afford to let interest rates rise to high – the interest payable on the debt would quickly become unmanageable. Low interest rates and rising inflation results in negative real rates – a sure-fire catalyst for gold (and silver).

Meanwhile, silver and copper are on an upward trajectory and will continue to do well under a Biden or Trump infrastructure push. Clearly, copper with all its green energy applications will be more in demand under Biden’s plan. Same with silver due to its application in solar panels (millions of them under Biden).

It is remarkable to see a bullish case for all three metals, no matter who clinches the presidency in November. Owning gold, silver and copper, or better yet, the companies that are exploring for them and offer the best leverage against rising prices, is my investing strategy going forward.

Richard (Rick) Mills

aheadoftheherd.com