Summary

-Quick background on Newmont Corporation and Newcrest Mining.

-Fundamentally speaking - What’s the deal? Rumors?

-Technical Elliott Wave view of Newmont and Newcrest.

Contributed by Mark Malinowski, produced with Avi Gilburt

Who are these companies?

Let's start out with a dose of pure honesty. Newmont (NYSE:NEM) is a giant. In fact, it's a giant-diversified octopus of a corporation with operations on four continents. In the first quarter of 2023, it produced 1.27 million gold ounces and 288K GEOs (gold equivalent ounces) combining its production of copper, silver, lead, and zinc. There's a reason that Newmont is the single largest component of the GDX ETF. At just over $33B (USD), it's the major player in precious metals mining. That level of cash flow from gold production and Newmont's diversity in operations does create opportunities to grow, but this expansion frequently does not move the needle in terms of the larger company goals.

Newcrest Mining (OTCPK:NCMGF) is a well-known Australia-based miner that has been in operation since 1966 and has a market capitalization of $15.8B (USD). They have operations in Australia and Papua New Guinea, plus joint venture advanced-stage projects with Harmony Gold (HMY) and Greatland Gold (OTCPK:GRLGF). Newcrest recently expanded into Canada through an asset purchase and joint venture at two British Columbia locations in 2019 (Red Chris Mine (70-30 JV with Imperial Metals (III/IPMLF) and 2021 (BruceJack - Tier 1 Mine 100% owed). Newcrest reported production of 510K ounces of gold and 31 kilotons of copper in the first quarter of 2023.

We are not ones to "pound the table," but let's pause for a moment to look at All In Sustaining Costs (measured in USD per oz - AISC). As of this writing, gold is consolidating just under the $2,000 (USD) region and the industry average AISCs at $1,270 (USD) per ounce in 2022. The companies with average efficiency are operating at very healthy profit margins. Newcrest is in a different weight class though, with the most recent quarter operating at a lithe and quick $1,012 (USD) per ounce.

Fundamentally speaking - What's the deal?

Newmont has publicly stated they are offering shareholders 0.4 Newmont share per 1 Newcrest share plus a franked special dividend of up to $1.10 (USD) per share. The bid represents a significant premium to the market cap of Newcrest. As per Newcrest's April 27, 2023, quarterly report, "Newcrest granted Newmont exclusive due diligence following revised non-binding indicative proposal in April 2023 to acquire 100% of the issued shares of Newcrest."

Both these companies pay a reasonable dividend, in USD:

NEM = 0.40 USD per quarter

NCMGF = 0.2235 ASD semi-annually

On the proposed deal:

Positives:

The offer does not increase the debt of Newmont, as it's an all-share deal. Newcrest is almost 33% more efficient in terms of its AISC, expanding production in Australia and Canada (stable operating environments)

Negatives:

Expensive for Newmont shareholders from a pure production per enterprise value perspective. The market sentiment has been negative on Newmont for some time, given their slip to a losing quarter and lower production rates.

Newmont is a large multinational company with consistent cash flow due to its diverse operation, and like many large multinationals, it can be difficult to grow from a large base where different parts of the business are vying for the same dollars. It also becomes increasingly difficult to grow when you look around and see costs increasing at a significant rate. In addition, the value of producers is a function of what assets they have accumulated. As they "harvest" assets, they need to replace them, either by proving out existing mines' expansion capability or buying new ones.

Inflation has definitely driven up the two major costs for an operating mine, employee wages, and energy, as can be seen in both companies' quarterly reports.

Buying a low-cost producer, like Newcrest, that is undervalued, is often a much better way to expand and grow.

Rumors:

Word on the street is that Newmont also is deploying their best and brightest with their checkbook to assess some smaller players like Osino Resources (OSI:CA) on the TSX. Osino is in the development stages for a gold mine in Namibia. This would give Newmont more diversity and add Namibia as a country that has a long history of diamond and other mining within its borders. The only other larger player with a gold-producing operation in Namibia according to our research is B2Gold (BTG).

Why is this important?

Often when the market is viewing a company in the most negative light, that's the time to start to accumulate a position. Especially one that's as oversold as NEM is as of this article.

Lyn says that for mining companies while management decisions are important, the direction of gold is also of key importance.

"I view gold as building a pretty good long-term base ever since it began consolidating in mid-2020. The Fed's ongoing tightening is putting some pressure on it, but that can only go on for so long, and so as we look out in the years ahead, I think gold is rather well-positioned for an upside breakout. Higher interest rates by the Fed can slow down private sector lending, but increases interest on public debt and therefore increases fiscal deficits, which are a source of new money creation. The 2020s decade is likely to be defined by varying levels of fiscal-driven inflation, and if this starts to be seen by market participants as a longer-term problem, then gold is likely to be among the major beneficiaries." - Lyn Alden

Zac added that, "We share a longer-term bullish outlook on gold, seeing the 2022 lows as a significant bottom and the recent consolidation as part of a swing that should continue toward 2300s and potentially even 2500s after holding another consolidation."

What do we look for in a setup?

We like companies with strong balance sheets and strong operations in safe operating environments, like Canada, Australia, and the US. The stability in government and regulatory requirements creates clear conditions for investment decisions. Newmont will be increasing their holdings in Canada and Australia with the currently planned acquisitions and is doing it in a way that doesn't increase their debt.

Technical analysis:

As Zac has said, "This sector is closely tied to the movement of the metals and all are heavily based on investor sentiment making sharp and emphatic turns from extremes of fear and greed."

The technical view of these companies is slightly different, mostly due to their time in operation, but what is the same is the application of Elliott Wave Theory in combination with Fibonacci ratios as a lens to look at investor sentiment. By using this lens (which we teach to our members at EWT), we can find ways to increase probabilities of success and identify where/when a misalignment is occurring, using these mathematical methods. This method was coined "Fibonacci Pinball" by Avi Gilburt and is, in our opinion, the best tool for placing these extremes in context to larger trends in the price pattern and laying out clear parameters of support, resistance, and price targets.

Newmont - A Different Bird

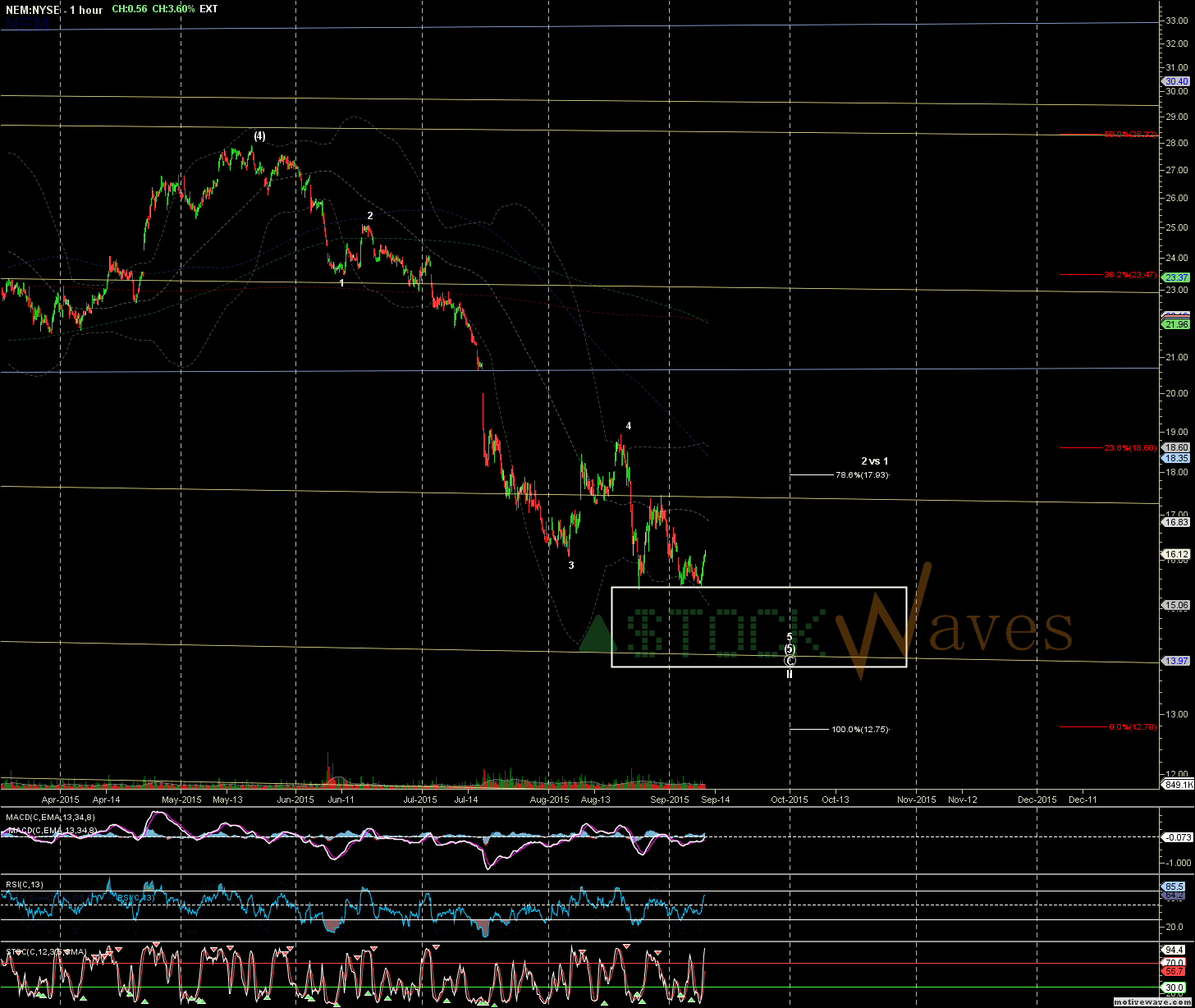

Looking into history and the humble beginnings of analyst Zac Mannes, he was calling for a bottom in 2015 in NEM and, along with Avi, shared that he was going to be buying gold miners like Barrick at $7 and Newmont at $15.

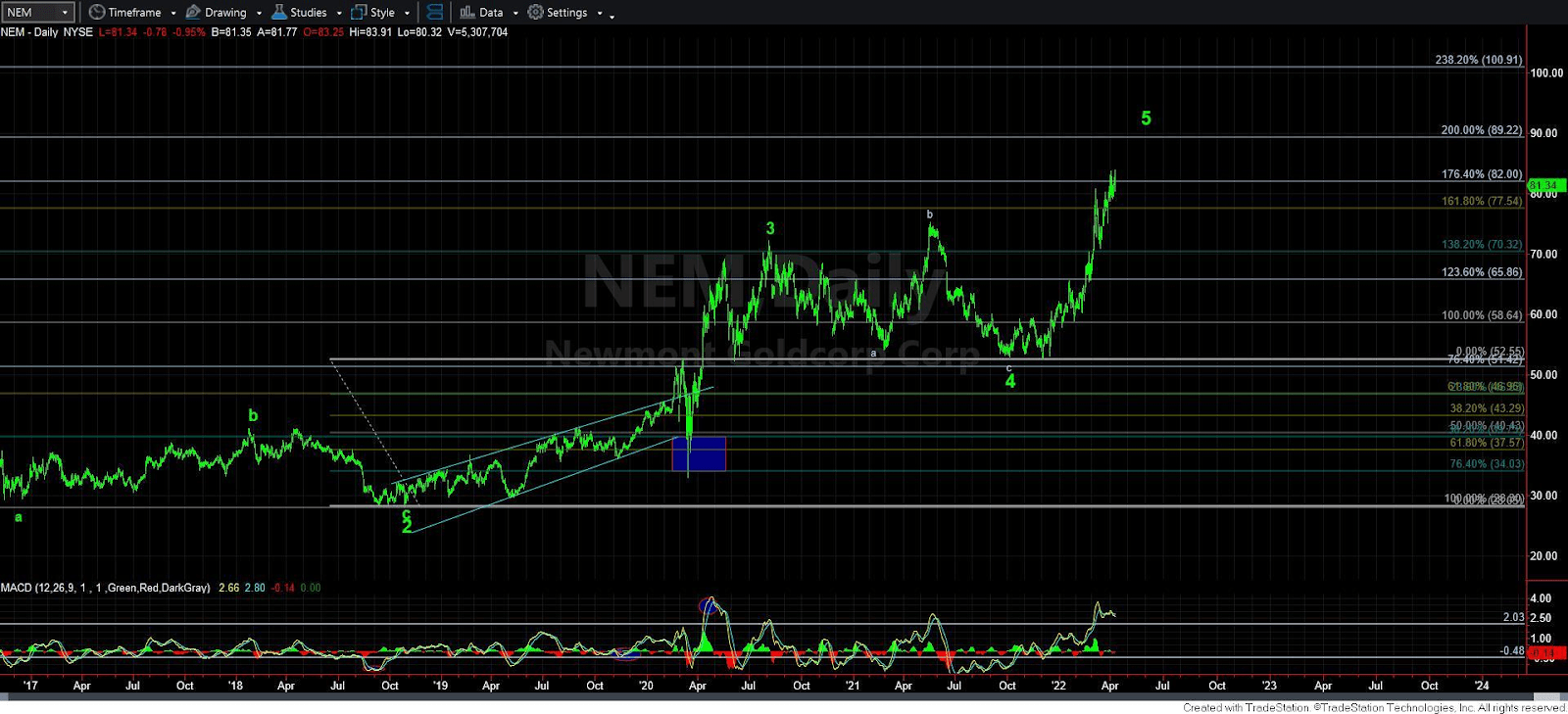

Fast-forward through seven years and many, many updates to mid-April 2022 when Avi advised his subscribers that he was counting NEM as complete to the upside in 5 waves into the 80-plus USD target and was expecting a significant pullback.

Whether just heading higher in more of a corrective bounce or the start of something more long-term bullish, we would prefer to see Newmont hold a higher low from November, right here in this $40 region.

Newcrest - Thunder from Down Under

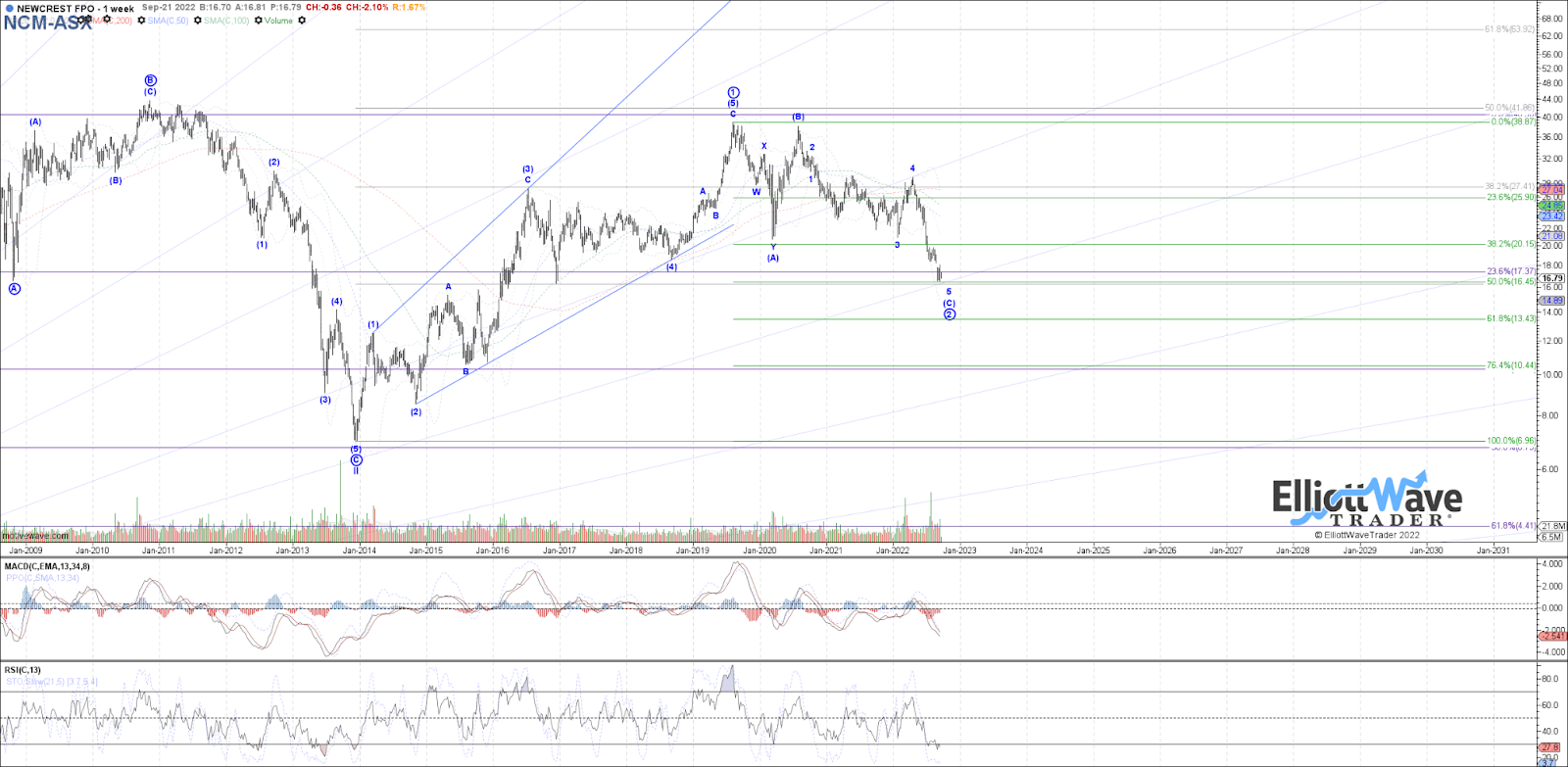

With many mining companies being Australian and Canadian listed, the best place to chart them is where the most shares are traded. Sometimes this is the US listing, other times, it's the home exchange, which in this case is in Australian dollars on the AXS.

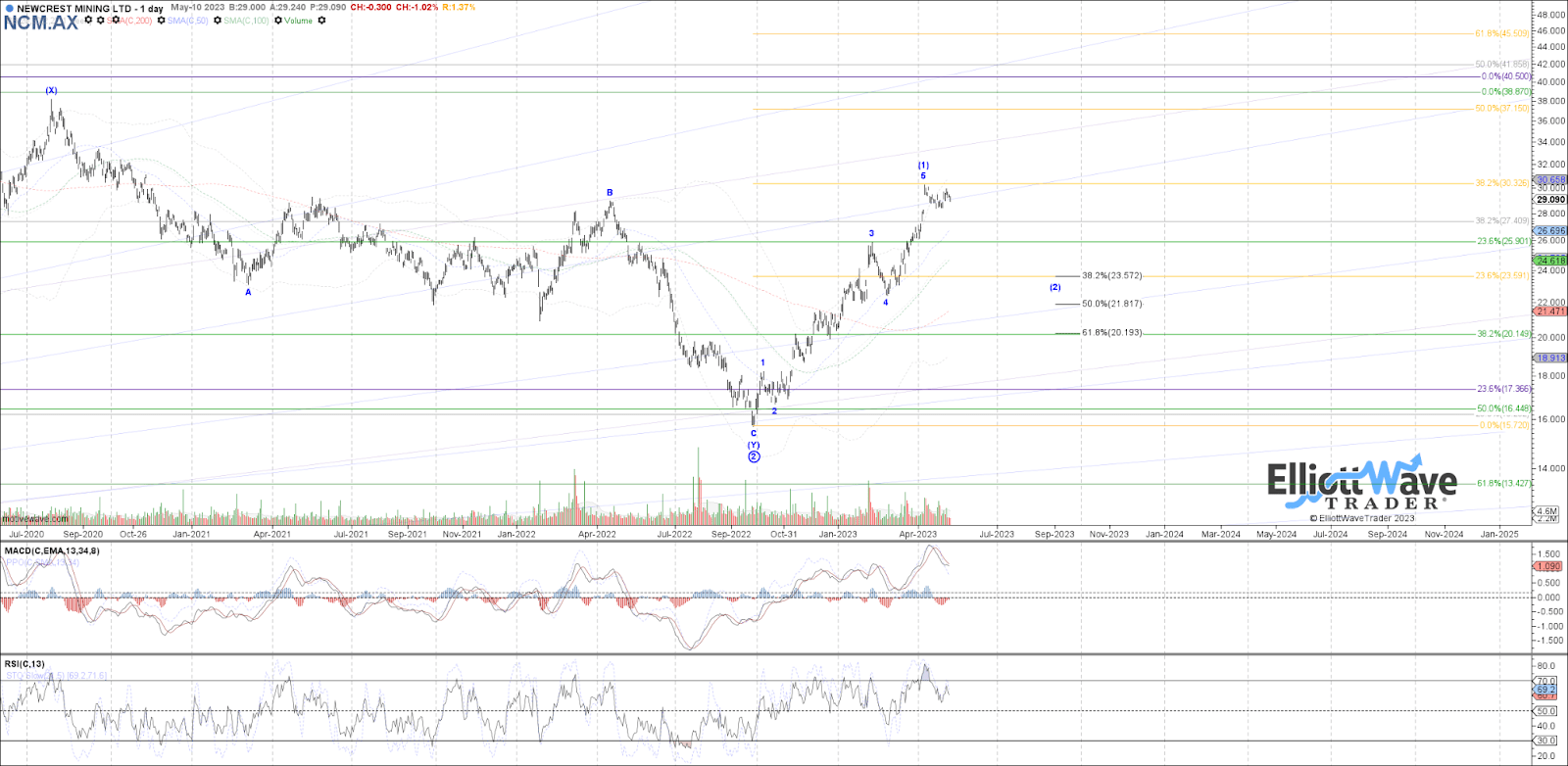

Compared with Newmont, this has been a very solid performer since Garrett posted this chart for members on Sept. 21, 2022.

Even completing 5 up to the desired 38.2 extension target within four pennies!

We're on the lookout for a pullback in three waves. While we don't have any insight into whether or not this merger will go ahead or not, we see positive setups taking shape over the next few months for both of these companies and many more in the Metals and Mining space.

We see the price of gold and silver significantly higher over the next two years, and as Avi Gilburt, the Market Pinball Wizard, posted a public target for Gold on Jan. 17, 2023, this aligns well with the increased profit potential for these two growing companies over the next few years.

Longer term, there's a very bullish view of metals in the coming years. But how should one take advantage of that opportunity?

In our Metals, Miners & Agriculture service on ElliottWaveTrader.net, we provide similar Wave Setups to those in our Stock Waves service. Here we highlight high probability good Risk:Reward setups on charts displaying clean subwaves in good Elliott Wave patterns and specify Support, Invalidation, Resistance, and Target levels. These are not specific entries or exits, but they're posted as the charts are entering or turning up from actionable support zones.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

NEM - Primary Analysis - Jun-02 1511 PM (4 hour)