Before you read the following quote from a Fed employee, you had better set your coffee, beer or wine down so you don’t spray all over the carpet or the person next to you. This is how dense the Fed is when it comes to learning from its own mistakes after it first tried quantitative tightening (QT) in late 2017-2019 and failed miserably:

The principle lesson was that we can do QT. It had never been done in the size that the Fed was trying at the end of 2017, we accomplished that goal, we ran down the balance sheet successfully – you know, you had some volatility towards the end, but by and large it was a very successful program.

The truth is the Fed fell far short of its stated QT goal and had to hit the brakes and eventually even reverse course back to QE. So, it did not accomplish that goal. That’s an outright lie or bald-faced stupidity. Aside from that crash of the stock market in the final quarter of 2018 that was only averted as it entered a bear market because the Fed rushed in to say it would be backing off its planned interest hikes and its stated goal for quantitative tightening much sooner than it had originally indicated … and aside from that massive repo crisis I referred to as the “Repocalypse” in the latter half of 2019 … it went splendidly well.

Well, until the Repocalypse hit because they did’t slam on the breaks hard enough nor reverse quickly enough. So, aside from the fact that the only way the Fed was able to stop the Repocalypse was to pivot right back to “not-QE” that really was QE and finally to full-on QE that they admitted was QE, it went great. It was as Yellen promised, as boring as watching paint dry on on your red house on a day when a rainstorm comes along before it is dry and washes the paint down the street in a river of red.

It went so well that they immediately pumped the QE back up far higher than it was before in order to rapidly start the next cycle in the spring of 2020.

Lesson learned!

Except not.

It’s hard to imagine, after seeing just how horribly bad QT went in that first go-around, that the Fed actually thought it could expand its balance sheet almost twice as high as it was back then and then do QT at an even faster pace! As I’ve written for years, the Fed clearly has no end game … other than the end of our financial system.

Who’s in charge of destroying small banks?

I’m pretty sure our economy could be better managed (especially given that economies should not be managed by central planners in the first place) by Captain Kangaroo than the likes of Treasurer Janet Yellen. Of course, now that I think about it, Janet Yellen with her modified bowl cut looks like she could be Captain Kangagroo’s fraternal twin:

Now that Yellen, Powell, Biden & Co. have cobbled together their midnight deal to save all depositors, even those with hundreds of millions in the bank, but only so long as they are invested in the Federal Reserve’s favorite megabanks — the ones they call “systemically important” — you can expect a huge rush of all of the cherry accounts at community and regional banks into the top banks of Wall Street plus Wells Fargo of San Francisco and Bank of America in Charlotte.

Do you think those running those major banks were not aware of this coming windfall as they participated in crafting the program?

Here, again, in case you missed it in my last article, is Senator Lankford of Oklahoma informing Treasurer Yellen (who looks a bit like an opossum caught in the headlights of truth) about the damage he is already hearing about from the Treasury’s new, free, preferred-bank, deposit-insurance program: (I think you’ll have to admit it sounds almost apocalyptic.)

Here is the snippet: pic.twitter.com/85iBeXC0Wn

— Seidler (@SeidlerCorp) March 17, 2023

It’s frightening to hear Lankford explain in stark terms what he is already hearing about a flight of capital from small banks to the Fed’s preferred big banksters because of this new program. The smaller banks are bound to be drained of their best accounts in this scenario. Let’s call this program vampire FDIC because it will almost certainly drain the life blood out of small banks until their faces turn gray and shrivel. It could literally transpire in a week.

Bonds away!

That new, free deposit-insurance program that only applies at the big-boy banks is separate from the Fed’s new, covert, QE-financed bond-buying program in which the Fed promises to hose up as many tired old bonds as banks of any size want to use for collateral on a one-year loan at low interest if they need to raise money to stop a run on their bank. I would predict that program is about to get some heavy use now that Yellen’s vampire FDIC program is in place, enticing massive flows of high-quality deposits out of small-to-midsize banks.

With so many small banks unable to offer free deposit insurance to million-dollar accounts, one can imagine banks may get hit with the runs as quickly as this week unless the program is revised, given that Yellen was unable to offer any knowledge of provisions that would stem that bloody flow, other than to meagerly and pathetically say, “That certainly was not our intent.”

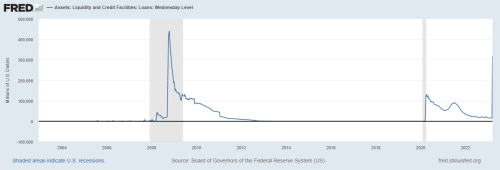

In just one week, the bond-buying program has become a torrent. The Fed’s water meter is spinning so fast it is lifting right out of the ground and hovering like a quad drone, pipes strained to the breaking point. I shared the other day a graph showing this program has already turned into the fastest round of Fed balance-sheet expansion ever known to mankind. How this is not a return to QE is hard for me to figure. If it quacks like a duck and flies like a duck, it must be a duck. Here again is that ugly picture of something that looks for all the world like emergency QE to me:

See: Straight up like a helicopter drone. Almost a year of quantitative tightening sent nearly halfway back to the Fed’s peak in one week of quantitative wheezing because banks started showing epidemic signs of their own plague of post-Covid malaise as soon as the program was made available. Because it is soaring higher every day, the graph will be notably worse by Monday.

The increase in BTFP borrowings caused the Fed balance sheet to grow by $297 billion in just one week, putting a damper in the Fed’s policy normalization program. Total assets grew to $8.6 trillion, the highest level since November 9th, 2022. This essentially reversed the past four months of quantitative tightening..

In another way of looking at it, we can also see who much bank borrowing from the Fed just shot up under the new program as well as at the Fed’s discount window compared to previous major crises:

It’s well on its way to reaching its Great Recession peak and far above the borrowing during the recession of the Covidcrisis, though that may be because so much was made available in free grants from the government back in that round. Already, we are deep in the throes of another major, systemic banking crisis.

At $318 billion, the loans extended by the Fed are at the highest level since October 2008, following the failure of Lehman Brothers….

The Fed is now faced with the dilemma of continuing their policy of raising rates and quantitative tightening to combat inflation, or of pausing to maintain stability in our financial institutions.

I’m not so sure a good part of all of that isn’t little banks cashing in their bonds to make good on the large accounts that are now, according to Lankford, fleeing to the likes of JPMorgan Chase. It’s just logic and common sense to conclude those accounts will shift to major banks quickly unless there are limiting factors Yellen simply couldn’t think of off the top of her head. Why would they take the risk of staying in uninsured accounts now that they suddenly have the option of fully government/FDIC-insured accounts at the nation’s largest banks?

Holding the perps to account

Question-and-answer time in Powell’s presser after this week’s FOMC meeting sure should be interesting! Well, it would be if I were there to ask questions, but the financial media usually just tosses Powell soft balls:

Let’s see if the present state of collapse and privileged programs and the new runs that might emerge this week because of the new programs Powell helped create don’t spice up the conversation a little.

We almost feel sorry for Jerome Powell. He got the whole world into another nice mess. And now, people turn their lonely, tired eyes to him.

First…the Fed created an outsized bubble – by holding interest rates too low for too long. People borrowed to take advantage of the low rates. Then, the Fed, effectively, “printed money” to meet the demand – particularly from the government, which was handing out trillions of dollars’ worth of ‘stimmie’ checks and PPP loans.

Anyone and everyone who could add 2 + 2 – except perhaps the Ph.Ds. who work for the Fed – knew that inflation wouldn’t be long in coming. And when it showed up, the Fed made another huge error. It judged the inflation “transitory.” No need for decisive action….

The modus operandi of the Fed is to feed money to the rich (with ultra-low lending rates) … while trying to stop anything bad from happening by backstopping the markets. But then, as debt increases, something bad always does happen … and the Fed then makes it worse by making it easier to borrow even more money….

All of this was obvious … and predictable.

Of course, if financial reporters asked tough questions, they wouldn’t get front-row seats at the Powell presser … or any seat at all at any Fed event:

Although the Bank receives numerous requests from media outlets worldwide, press attendance is also limited to a group that is selected to provide important transparency to the symposium, but yet not overwhelm or influence the proceedings.

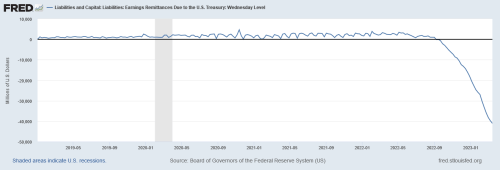

Looking at the Fed’s QT yet one more way, here is what it has done to the income the Fed used to transmit to the US government to help reduce its deficits (the above-the-line level):

The Fed doesn’t take that money below the line from the government, but what it does do is cease transferring any profits (from above the line) to the government until such time as that blue line recovers to where there are, again, above-the-line profits to transfer. This is an actual loss of revenue for the US government due to the Fed’s ineptitude.

As we wait to see Jay Powell answer for all of this (if anyone is awake enough at the presser to ask important questions), since the first Fed graph looks like QE to me, I’m going to explore in my next post that goes exclusively to Patrons what other minds that I respect have to say about this clandestine return to full-on QE. (If you’re not a Patron, you’ll just have to settle for watching reporters thank Jay Powell for the roe-on-swordfish-with-crème-fraîche refreshments at his post-FOMC meeting as well as the free pre-presser liquidation, by which I do not mean the banking kind, but the kind served in martini glasses.)

The Fed’s weakness compromises their ability to maintain control of their policy in two ways. First, as their operating losses and unrealized portfolio losses become more widely known, they risk losing the independence they require to be effective. [Because the government will get riled about its higher interest rates and lowered revenue from the Fed.] Second, they risk losing the confidence of the market in their ability to be the backstop. As we’ve seen with the banking crisis, confidence once lost is extremely difficult to win back.

Let me add a third and perhaps more important one: They risk losing control of inflation because their balance sheet and actual interest rates (regardless of what they do with policy at this weeks meeting) are running rapidly in the opposite direction of Fed policy now.

Personally, I think the Fed has done this:

It will be interesting to see how they get out of it.

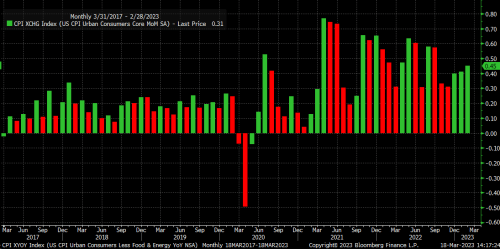

But here are their results so far:

Splatter Platter

Splatter Platter

It’s a banking pandemic now and likely a renewed inflation crisis

To put the globally systemic nature of this crash in real terms:

Credit Suisse (CS) is the first major bank, deemed too big to fail, to take up the offer of an emergency lifeline. The announcement that it will draw on emergency funds from the Swiss National Bank underlines how fragile the lender had become, as the withdrawal of deposits continued at pace and confidence seeped away. It also highlights the lightning speed of the global fallout of Silicon Valley Bank’s collapse, which has shaken the banking sector, and prompted investors spotting weaknesses in other in other institutions, to race for the exit. The $54 billion rescue wad is staunching worries about a bigger run on Credit Suisse and the repercussions for other institutions around the world exposed to its operations.

The weakest hands fold first, of course. Some, like CS, were zombie corporations, but now we are seeing zombies that are too big to fail go down. Now that the contagion from a few small and mid-sized US banks has shaken a European zombie bank to its foundation, what does this mean for the Fed’s fight against inflation? Can the Fed soldier on past the initial breakage, or will anything it does rapidly broaden the damage?

Do we even know what the current damage is? In other words, if the Fed froze in its inflation-fighting tracks right now, how many more weak and tilting dominoes in various parts of the US and the world would still fall, regardless? Currently, it looks like Switzerland’s largest bank, UBS, is swooping in like a vulture to consume CS at fire-sale pricing that is not much better than ten cents on the dollar. We may know by late Sunday or Monday as CS is holding out for a better price so far.

We also saw in the last crisis, as documented in my short chronicle of the Great Financial Crisis, that, when large banks like JPMorgan scoop up these weekend bargains, they sometimes get serious indigestion that sends them rushing to their governments for $20-billion bailouts. So, the crisis from eating the poison meat just keeps snowballing downhill as they consume things with rot they did not have TIME TO FIND OUT ABOUT IT.

Are we now going to scream toward hyperinflation as some have been claiming every year for years? The possibility is certainly there, but there are other factors to be considered, as I will lay out in my Patron Post. Hyperinflation is far from a slam-dunk at this point (for the reasons I’ll give in that next article), but it is increasingly something to be concerned about and watchful for, as I will be in other future articles.

Some of the big names in the gold peddling world always say hyperinflation is coming soon. I can think of one in particular who has preached hyperinflation every month for as long as I’ve been writing this blog. He could be on the way to finally being right, and he will certainly claim he was when it finally happens, even though he has been wrong for years and years on that score.

I’m waiting, on the other hand, to predict it until I’m sure it will be right. Throughout all of those years when the Fed’s QE was pouring in new money like Niagara Falls, I did not predict any inflation above the Fed’s target … and we did not get any inflation above that target. Then, over two years ago, I put out my first high-inflation watch before any consumer inflation rose even a whisper above 2%. When inflation first started nudging above 2% and the Fed promised it would be “transitory,” I claimed it would become red-hot like it was in the 70s and 80s and enduring to the point of being very hard to stop and that stopping it would inevitably create severe damage to the economy and stock and bond markets, while inflation would create the damage for the Fed if it didn’t get it stopped.

So, you got the news in plenty of time ahead of the actual events to be forewarned, and it was not a false alarm. Now, I’m about in the same place with hyperinflation where I want to be careful to consider mitigating factors and not raise false alarms (as I have no precious metals to sell). We’re not going to experience hyperinflation for awhile, but it is time to pay closer attention to what the Fed is doing now that things are breaking and pressing the Fed back into what looks for all the world like QE to me. If the Fed’s course starts to actually create higher inflation, it will be in a real bind with its sound money mandate. As neither high inflation nor braking banks are stable money.

The Fed’s catch-22 almost certainly does mean, however, that one of my main January predictions for this year — that inflation will rise hot again — is unfolding as I write because the effectiveness of Fed policy under these bailouts that are “not bailouts” is reversing, regardless of what the Fed states policy is.

Inflation will not resolve to the level the Fed needs to see to back its key interest rate down to a neutral level…. Inflation may rise again in the first few months of the year…. I think the most likely course is that the Fed holds interest levels at about 5.5% for as long as inflation looks like it is moderating until something major breaks. At that point, it won’t pivot directly to stimulus-level rates and not to QE either, but it may bail out the thing that breaks and will lower interest to what it considers a likely neutral level. (If breakage spreads wider, all bets are off.)

“2023 Economic Predictions” (a Patron-only Post)

Now, something major has broken (three banks) and has spread wider to take out one of Europe’s largest but faultiest banks; and, as anticipated in that Patron Post, inflation has already been steadily on the rise all of this year:

Since hitting its lowest point in December, month-over-month core CPI has risen for three consecutive months and at an accelerating pace. This trend is certainly not in line with the Fed’s desired direction.

Earlier in January, I had written for all my readers,

I’m not ready to state with certainty quite yet whether another advance of inflation is coming, but there are good reasons forming again to be concerned about it, and one reason that could make inflation absolutely formidable.

“2023 Prediction: The Fed’s Inflation Fight is FAR from over!“

So, hyperinflation has not been out of the question for this year in my view, but it depends on how the Fed responds now that it sees the crisis it has created for itself (and for all of us) as well as on other factors that are not under Fed control, which I’ll be laying out for my Patrons.

In the short term, we see again the kinds of background (producer) inflation that I said in those months now far behind us would push through to new inflation. Those background pressures are starting to show in some areas again now, indicating that, inflation could edge back upward even if the Fed keeps its foot on the brakes.

And it has.

Where does the Fed go from here?

Now it will be interesting to see what Papa Powell states policy will be after the FOMC meeting this week and whether he gets any tough grilling from the press over the actual changes in the effects of his policies versus the Fed’s stated policy goals … as well as whether anyone believes him after the last two weeks of monumental Fed policy fails. Powell does, however, have a knack for getting a free pass from the entire financial media. That’s why I have to keep writing about this stuff (and I hope you’ll help me keep at it as that prospect is always in its own state of peril, this not being a particularly rewarding financial venture).

I think the Fed will NOT reverse its stated interest policy, just as I wrote back in January. Its wisest path, in light of the bind it has painted itself into, would be to do a 25-basis-point hike as everyone is expecting. If the Fed does not raise rates at all, it will signal Fed FOMC members are terrified and are pivoting on policy and have clearly given up on fighting inflation, which will raise a whole new set of growing concerns about inflation and about the Fed losing control. If they raise by a higher amount, as rising inflation was making likely until this systemic banking crisis broke out, they will trigger alarms that they are insanely and perilously oblivious to the real troubles in the banking industry right now, which could cause additional shocks that tighten liquidity in banks even more.

If they do a 25-basis-point hike, on the other hand, it will signal the original inflation fight is continuing according to plan and that the Fed is not terrified but soldiering boldly onward, and it won’t make a huge degree of difference because the markets are driving interest rates down now, regardless of policy targets. That said, you never know how a cornered animal will respond, but we’ll soon enough find out.

Interest rates will then go where they are going already anyway on their own. The very fact that bonds plummeted since the crisis broke out, with the 2YR Treasury now down 1.2% and the 10YR down about 1.6%, means the very problem banks had with not being able to sell Treasuries to stem runs without losing lots of money is now rectifying itself as plugging yields restore prices.

The trickier question is what will the Fed do with QT policy? Obviously, QE is effectively back, but will the Fed admit that and change its policy to match what its balance sheet is showing, or will the Fed craft some argument to say this is not QE because “it is temporary.” That’s about as meaningful as saying inflation was temporary over a year ago, but I suspect that is what they will try to do. The breakage has already spread wider per my one stated caveat in my January prediction, so all bets are off, as I said would be the case if breakage gets that bad. I has. Still, I think the Fed will attempt to keep its spoken and written policy where it was and pretend this is not QE.

As banks and investors swim in a whirlpool of red right now, we all wonder where the next banking crisis will pop up and what day. Tomorrow? The next? Will this week expose a flight of capital from large depositors out of community banks and into the too-big-to-fail banks that depositors can now be certain will be saved by the government and the Fed and the FDIC to the highest level of deposits? Have the rescuers just created the next run with their bumbling rescue plans?

Those possible horizons no longer seem remote or unreasonable, do they? Would it even surprise anyone if the US banking system started crumbling around Jay Powell in new runs even as the FOMC meets to discuss raising interest to fight inflation? I’ve said this the kind of corner the Fed would paint itself into.

Looking on, central banks are now caught between a rock and a hard place. They are still super-nervous about high inflation, but fresh rate hikes run the risk of prompting fresh financial instability…. Policymakers … must make the difficult decision … about whether to hike rates as planned … and keep its inflation fighting game face on or go softer to calm feverish sentiment.

If policymakers decide to ease off another big monetary policy squeeze, the initial market reaction is likely to be one of relief, but worries are then likely to bubble back up about the insidious effect of inflation and whether the price spiral risks getting out of control again.

It’s a no-win scenario, as I’ve always said the end of the Everything Bubble would be, but you are better off seeing what is coming than running blindfolded or being guided by the blind like the Fed. If you want the upcoming granular analysis on whether this is QE and what it means for inflation, please become a Patron and support the writing you have long been getting for free on this blog to keep this kind of writing coming. (And my heart-felt appreciation to those Patrons, past and present, who have given me some incentive to keep at it this long. Without that support, everything I’ve written on this blog would have ended four years ago. I cannot, however, continue much longer without a significant rise in support. I know I’ve said that before, but I’ve continued by pushing myself to keep at it longer because I feel it’s important, especially now that the Fed’s long recovery efforts are disintegrating all around it because it never had a workable end game for reversing its inflation-causing QE without destroying its low-interest-debt-dependent, endless-money-printing “recovery” cycles.)

Liked it? Take a second to support David Haggith on Patreon!