While the “plunge protection team” appeared to have pulled the market out of its crash last week, the Dow was down a much harder 950 points Friday morning. So, it may prove a little harder to save; but put nothing past this lunatic market or the Fed’s PPT. Stocks seem to want to fall hard right now. So do Treasury yields, where the 10YR yield is plummeting.

“Sinking Treasury yields signal growing jitters about ‘everything’ ahead of Friday jobs report,”

says the headline, though I’m not running headlines today because this is now the day for writing Deeper Dives so that, thanks to my permissive audience, I can actually take weekends off—better for the long-term duration of this publication. However, some things you cannot help but write about, so I’m presenting this first part of this Deeper Dive for everyone because of how critical the news is in keeping with the event’s I’ve laid out for this year.

Thursday’s plunge in yields is the result of “everything” going on in the economy right now, including a relatively weak manufacturing report from the Institute for Supply Management and initial jobless-benefit claims that came in higher than expected, according to Tom Graff, chief investment officer at Baltimore-based Facet, which oversees about $2.5 billion in assets.

And that was written Thursday before yields nose-dived parabolically downward Friday.

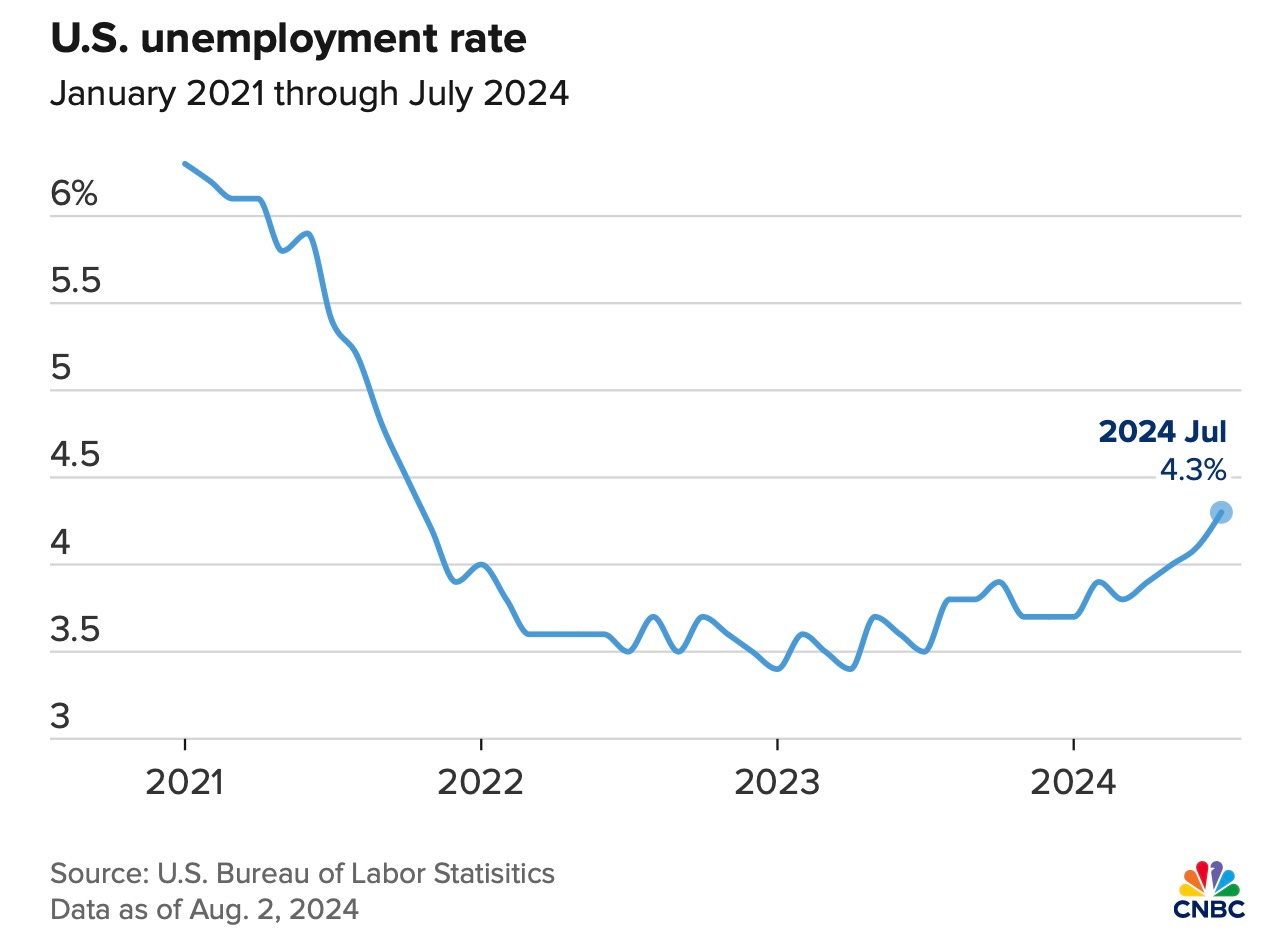

What was the big news Friday? That we went decisively above the Maginot Line of the Sahm Rule that marks the start of a recession every time. Continuing unemployment went from 4.1% (where the line sat) to 4.3%. There’s no turning back with a head fake now, Baby! We’ve more than just touched the bar. We’ve cleared it completely.

Friday’s jobs report was worse than others this week. At 114,000 new jobs, it was far below the 150,000 that are needed each week just to keep unemployment from changing and was far below expectations by our leading economists, who were around a small-growth level of 185,000 in their estimates. As usual, of course, the June numbers got revised down, too, now that no one cares about June. Standard operating procedure for the Biden Admin., so we can expect this week’s nasty numbers to get revised down next month, too.

“Normally,” in today’s market, one would expect this bad news to be good news because it would help cement the Fed into a rate cut in September. (“Normally” has to be in quotes because in a truly normal world, the market would never hope for bad news, but in a Fed-engineered world it means more engineering is on the way.) However, the jobs report went below the Goldilocks level of unscary, marginally bad that the market hopes for routinely in our modern world of economics into the outright bearish world of “Maybe the economy is falling apart worse than we thought.”

The labor market had been a pillar of economic strength but has recently shown some trouble signs, and the July payrolls increase was well below the average of 215,000 over the past 12 months. (CNBC)

Of course, this metric, I’ve promised for a couple of years or more would put in its turn way late in the game because of how broken by Covid lockdowns the labor market (and hence standards for the metrics) became. So, a turn now, means we’re already deeper into this recession than the Fed knows. The labor market was, after all, NEVER tight during this cycle due to scorching growth in jobs. It was tight due to death, sickness, or failure to show up of the labor force—i.e., a hugely diminished labor force, which everyone knew about and could see in the stats right before their eyes, but no one was thinking about in terms of what those numbers really meant about the new meaning of “labor tightness.”

“Temperatures might be hot around the country, but there’s no summer heatwave for the job market,” said Becky Frankiewicz, president of the ManpowerGroup employment agency. “With across-the-board cooling, we have lost most of the gains we saw from the first quarter of the year.”

Whoa! All the gains of the year flushed in one report, when all the other reports were treated as slightly positive. Well, you see, that is where the constant downward revisions a quarter or two after the initial reports come in. None of those gains turned out to be what people thought they were once they were revised down (when no one was looking). And that is how you get to a situation where a single bad report and a single revision down of the previous month can wipe out all the gains from the bygone part of the year.

Here is what the latest leap in the unemployment rate looks like:

A turn like that, historically, always goes parabolic and straight into recession when the Sahm Rule kicks in, which puts the line for that parabolic turn right at 4.1%, so we just cleared it. You can already see the sudden steepening, after two years of trundling sideways right in a range-bound fashion, with the present and latest leg of the journey. The curve will now start rising faster than the other side fell because that is what it always does when it passes the Sahm Rule level for any particular cycle.

Though markets on Wednesday cheered indications from the Fed that an interest rate cut could come as soon as September, that quickly turned to trepidation when economic data Thursday showed an unexpected jump in filings for unemployment benefits and a further weakening of the manufacturing sector.

That triggered the worst sell-off of the year on Wall Street and renewed fears that the Fed may be waiting too long to start cutting interest rates.

I guarantee you the Fed has waited too long to cut interest in terms of saving us from recession with a soft landing because I’ve said all along it will too long. Labor gauges would report in too late, and the Fed would be held to higher rates too long due to the massive inflation it created (by funding the absolutely massive Trump and Biden bailouts) and now has to fight. It boxed itself into this corner of the fighting arena.

To be precise about Sahm’s Rule, CNBC spells it out:

The rise in the unemployment rate brings into play the so-called Sahm Rule, which states that the economy IS in recession when the three-month average of the jobless level is half a percentage point higher than the 12-month low. In this case, the unemployment rate was 3.5% in July 2023 before it began its gradual ascent. The three-month unemployment rate average moved up to 4.13%.

The italicized and capitalized emphasis there is mine, but the wording is CNBC’s. Once we cross this line, the economy IS in recession, not heading to recession. Still, a lot of dumb economists don’t get it because they refuse to take off their rose-colored glasses:

“The latest snapshot of the labor market is consistent with a slowdown, not necessarily a recession,” said Jeffrey Roach, chief economist at LPL Financial. “However, early warning signs suggest further weakness.”

These are the same guys who never told you a recession was coming (so they’d hate to admit to one now) and who played along with the Fed’s fantasy of a soft landing. You can believe them, or you can believe the few people who keep telling you the truth about what is coming.

They are no different than their overlords in darkness:

Fed Chair Jerome Powell on Wednesday expressed confidence about the “solid” economy and said easing inflation data is raising confidence that the central bank can cut soon.

I have soundly challenged his view on that all week, while reporting faithfully what he actually said.

Deeper Darker truths to dive into

And now I have other truth to tell. It’s time to dive deep into the commercial real-estate crisis that is significantly damaging banks and other financial institutions because we are now deep into the year that I said would be extremely bad for CRE (on the basis that I reported a couple of years ago that fully 30% of CRE bonds have to be paid off or refinanced this year. That has now stacked up to the major trouble I’ve said we’ll face, which is far bigger than the meager jobs reports to date.

It’s a whole different kettle of stinking, rotting fish the Fed has boiled up with its profligate monetary policies that it is now cooking to death with the Fed’s raised interest rates and massive bond roll-offs that are driving up the cost of refinancing for major real-estate firms and with their banks and other financiers at a time when very few investors seriously want to own commercial real estate that has vacancy signs and plywood over the lower windows.

This part of the Fed’s everything bubble is not even impacted by what is happening in jobs, though it will undoubtedly add to the impact in jobs as people involved in CRE, especially in the institutions that finance CRE, are sent out onto the boarded sidewalks to pan-handle for new jobs—their old line of real-estate work now becoming completely irrelevant. Of course, their skills are transferable to other kinds of finance, but other kinds of finance are not likely to be hiring during the recession that is already happening as retail also shuts down on a major scale.

The Sahm Rule confirms my statements that the US is already in a stealth recession. Lying “real” GDP, due to electioneering on top of the usual cookery the federal government does to make itself look good via “seasonal adjustments” means that recession may not ever be declared to have started at this juncture; but the fact that we are in one is confirmed anyway by Sahm’s Rule, as well as by the sharp declines in new jobs we are now seeing, and the recessionary drops in production reported all year to regional reserve banks and reported again by major manufacturing metrics last week. It’s all there; so, you can trust the Biden government, or you can trust everything else you are now seeing.

I wanted everyone to know that it is fully fact that we are now in recession by the one gauge that has a Sterling reputation for precise accuracy.

Paying subscribers (link in bio below) can go on from here to read all about the truly massive problem that has developed in commercial real estate and banking, which others are under-reporting, even though it will become the major news of the Fed’s next new troubles. I reward those who help me stay at this with a following special report on the true and already disastrous state of CRE.