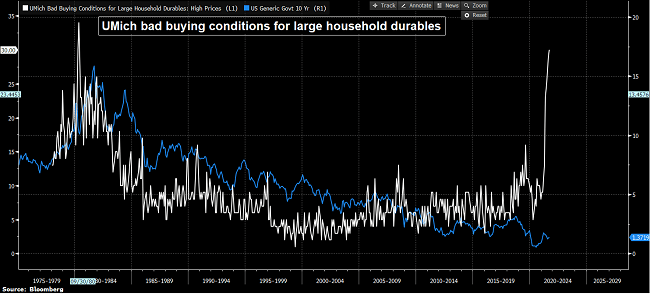

“There was a complete rout of net favorable views of buying conditions: household durables fell to the lowest level since 1980, vehicles fell to the lowest level since 1974, and homes to the lowest level since 1982. These record drops were all due to complaints about high prices: homes had the highest negative ratings of home prices ever recorded, vehicles had the most negative price references since 1974 (in response to the first oil embargo), and durables had the worst price rating since 1980.” – Richard Curtain, director of the U of Michigan Consumer Sentiment Survey

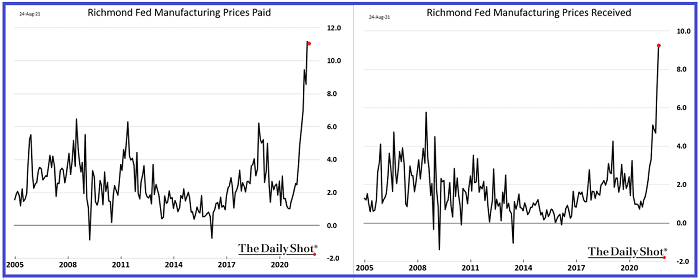

The graphic above does a great job of conveying the non-transitory nature of price inflation – price inflation resulting from the substantial and continuous devaluation of the dollar from the Fed’s money printing and the Government’s debt issuance. The graphs show prices paid and received for manufacturing companies in DC, Virginia, North/South Carolina, Maryland and Virginia. The price inflation at the production level will show up at the retail level over the next 3-6 months. This in turn will cause a further slowdown in consumer spending.

The graphic above shows consumer perception of the buying conditions for large household durables from the UMich consumer sentiment survey released Friday. The view is that the conditions are the worst since 1980. The reason is price inflation. Average household incomes are not even coming close to keeping up with price inflation. This is especially true for retired households dependent on Social Security. This is going to reverberate through the entire economy and cause a severe economic contraction – a contraction that will be masked in the headline numbers by price inflation.

When adjusted for inflation and annualized, the cost of food is higher than nearly anytime in the past six decades, according to United Nations Food and Agriculture Organization data. Alastair Smith, senior teaching fellow in global sustainable development at Warwick University in the United Kingdom, recently noted: “Food is more expensive today than it has been for the vast majority of modern recorded history.” In the U.S. instead of raising prices many food processors are making packages smaller.

“Price Inflation” is a product of currency devaluation from money printing in excess of systemic wealth output. By the time end user prices are rising, the currency devaluation has already taken place. The Fed is printing money and devaluing the currency on a weekly basis, the currency devaluation “nuclear bomb” was dropped in March 2020 when the Fed printed $3 trillion to bail out the banks and to continue funding Government spending without causing a big spike-up in interest rates. As long as the Fed continues to print more money, inflation is unequivocally non-transitory. In fact, the price inflation we’re seeing now is in the early stages of a much larger escalation.

This is not going to end well. Eventually price inflation is going to sink the economy as households are forced for budgetary considerations to stop spending money anything other than absolute essentials. And the ESG movement is going to send price of energy to Pluto and beyond.

At some point, as was experienced in a similar set-up with the German stock market in November 1923, the money printing and resultant price inflation will undermine the stock market. As legendary investor, Jeremy Grantham, recently commented: “I believe this event will be recorded as one of the great bubbles of financial history,” Grantham wrote, “right along with the South Sea bubble, 1929, and 2000.”

**************************

Most of the above commentary is from the September 19th issue of the Short Seller’s Journal. Recently subscribers who played the recommendations have made small fortunes on ideas like Toll Brothers (TOL), Microstrategy (MSTR) and Penn Gaming (PENN), among others. The learn more about this newsletter, follow this link: SHORT SELLER’S JOURNAL