While there will be all sorts of economic and geopolitical headlines in the days ahead, two events that will drive precious metals stand out. The first will be the conclusion of the January FOMC meeting on Wednesday. The second will be the release of the January U.S. jobs report on Friday. If COMEX gold and silver can successfully navigate both, the possibility of a February rally will grow.

First of all, it's not just those two events that will impact precious metal prices. There will also be the updated manufacturing and service sector PMIs as well as the latest updates on productivity and unit labor costs. However, the most important scheduled events are the FOMC meeting on Wednesday and the U.S. jobs data on Friday.

Let's start with Wednesday's FOMC statement and Powell press conference. The consensus expectation is for another fed funds rate hike, but this one should "only" be 25 basis points. This is my forecast, too, as a 25-basis-point hike in January was what Powell himself told us to expect at his post-FOMC press conference back in September.

When you watch all of this unfold on Wednesday, expect volatility in both directions between the 2:00 pm EST release of the FOMC statement and the 2:30 pm EST start of Powell's press conference. From there, watch prices during the press conference. Usually, it's not only important to hear what Powell has to say, it's also important to hear how he says it. The past few FOMC meetings have brought rallies in the precious metals as Powell's words have seemed "dovish". Will he seem that way again on Wednesday?

But then, come Friday, we get that next update on the U.S. jobs market. This data might serve to completely reverse the direction of the price action coming out of Wednesday. What will it show and how will it impact the COMEX precious metals? Let's take a stab at that.

As you may know, these U.S. "jobs reports" are, in actuality, nothing but statistical guesswork and modeling. Of course they are! How could a collection of bureaucrats and bean counters accurately measure the total job growth for a month via a report that is issued just three days after the month ended?

As such, there are several factors included in this monthly guesswork. One of those factors is called the Birth-Death Adjustment. And what is that? See this from the Bureau of Labor Statistics website:

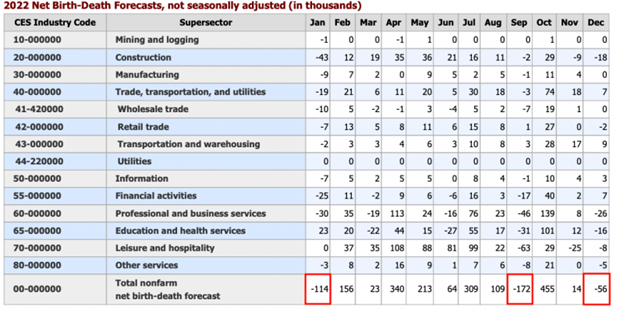

In short, each month the BLS will add or subtract "jobs" to/from their estimated total based upon the historical average of NET business growth that month. Often this results in an addition to the "jobs" total, but there are a few months per year where this adjustment is actually negative...and January is one of those months.

Below is a chart taken from the BLS website. Listed are the birth-death adjustments that were applied to the jobs data in each month of 2022. What do you see?

You should note that there were three months in 2022 where the birth-death adjustment was negative, and one of those months was January. Since they are mostly historical averages, the numbers tend to follow the same pattern every year. So what will this Friday's "jobs number" be IF the starting point in calculating the total is a six-figure net loss of "jobs" due to the business birth-death model?

Putting it back together, a bullish case for continued gains in COMEX gold likely involves:

- Powell seeming "dovish" while taking a wait-and-see approach regarding any future fed funds rate hikes;

- A U.S. jobs number that comes in "less than expectations", fueling the idea that the U.S. economy is demonstrably slowing and that rate CUTS will be the Fed policy going forward.

In summary, it's going to be a very interesting week. Pay attention, watch the headlines, and expect volatility. However, if COMEX gold can exit the week with a green candle, the chances of extending its 2023 rally into February will grow and another stab at the $2000/ounce level will become likely.