During real monetary crises, do you think citizens should want gold or bitcoin? Of course, bitcoin advocates are always preaching how BTC is the money of freedom that serves citizens best during crises and that physical gold is fool’s gold when compared to bitcoin. For example, Mark Cuban, among others, is among the community of crypto HODLers that sincerely believe that ownership of BTC will serve citizens better than gold during real economic and monetary crises. Cuban has flat out stated multiple times that “bitcoin is better than gold”. On the other hand, the majority of members of the “only gold is sound money” community has always stated that gold performs best during true economic and monetary crisis.

When the Venezuelan Bolivar (VEB) hyperinflated into nothingness and the Venezuelan Bolivar Fuerte (VEF) replaced it at a rate of 1VEF to 1000 VEB, a client of mine informed me that my guidance to change all VEB into gold before this massive devaluation literally saved his financial life and all of his savings from imploding into nothingness. When crises manifest, this is when owning gold is a non-negotiable. But of course one must have the foresight to own gold before the crisis manifests. And back then, one could not have argued that BTC still would have been the better investment because the first BTC had not yet been minted so there was no opportunity for BTC to save any Venezuelans from having their savings ground into dust.

With that said, let’s fast forward to today and investigate how gold has functioned under another economic crisis, the Sri Lankan crisis. Has gold helped Sri Lankan citizens hedge against a collapsing LKR (Sri Lanka rupee) or would HODLing bitcoin have served them better, as we have heard argued so often by the bitcoin community? Sri Lanka’s collapsing economy, in which staples which we take for granted, like food and electricity, have become scarce resources, has led to the IMF to swoop in like vultures and offer $600M in loans to “save” Sri Lanka. Of course, anyone that understands the IMF modus operandus understands that such loans are always structured exploitatively to guarantee default of interest rate payments that trigger punitive clauses that will subjugate Sri Lankan citizens under the thumb of global banker control for decades.

Thus, Sri Lanka presents the perfect case study of economic catastrophe that all Bitcoin advocates claim are the conditions under which Bitcoin will thrive to save all citizens and ensure their economic freedom. So, let’s take a closer look at the “Bitcoin is the money of freedom” narrative to see how well it functioned in ensuring the freedom of food deprived, utility starved Sri Lankan citizens this year. By the way, to understand how resources we take for granted, like running electricity at all times, may be taken away from citizens of even first world, industrialized nations, make sure you read this article if you have not already done so, for it may just save you from misery in the next few years.

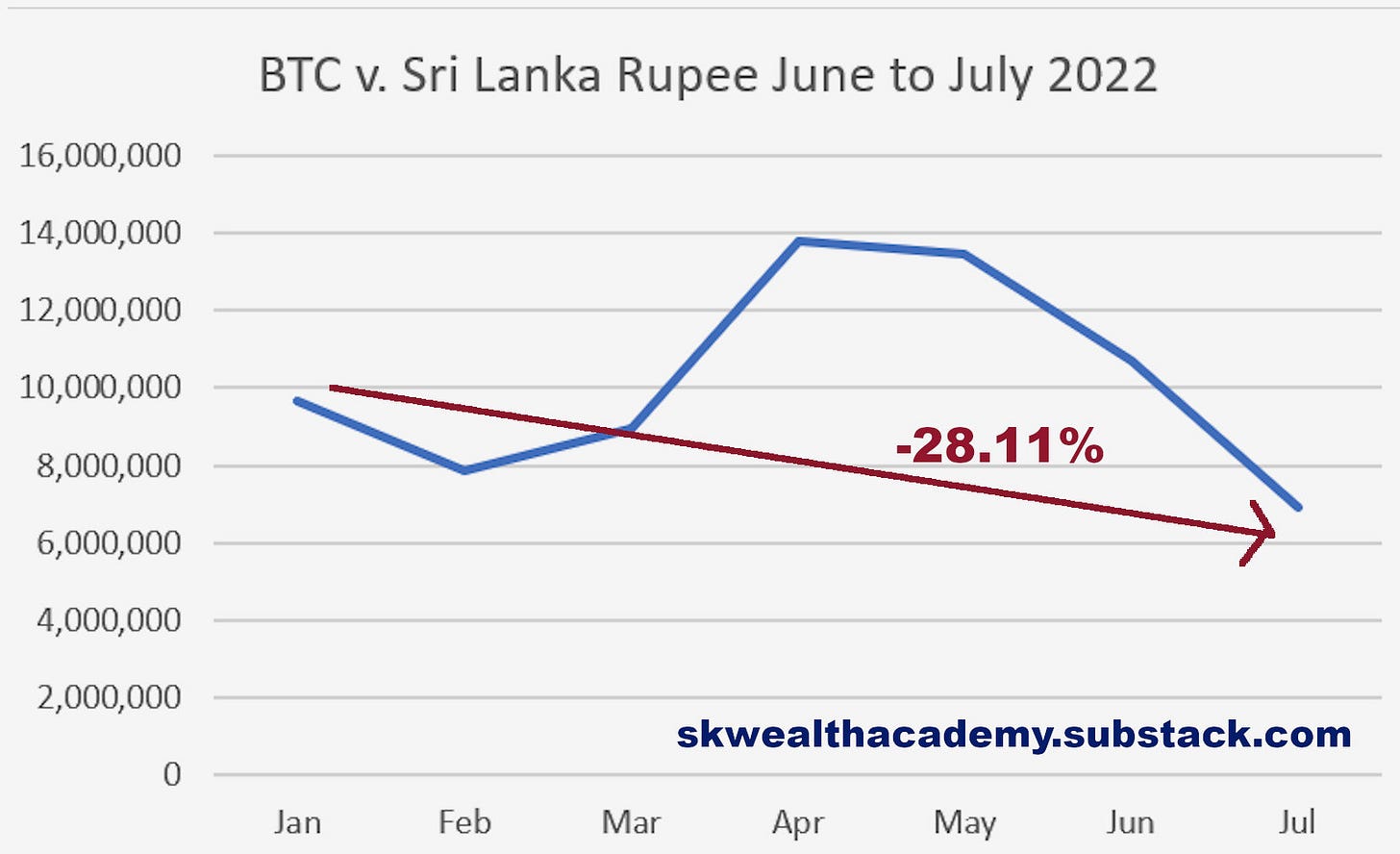

And speaking of misery, we can clearly observe that BTC has performed miserably this year against the LKR (Sri Lanka Rupee), even amidst a 56.4% inflation rate that gave bitcoin quite a boost in price when priced in LKR due to the soaring LKR USD exchange rate. However, just to break even in retention of purchasing power in 2022, BTC would have needed a 56%+ price appreciation when priced in the Sri Lanka rupee this year. Instead, it’s cratered in LKR price by 28.11% since 1 January 2022. Factor in the 56.4% LKR inflation, and for all Sri Lankan citizens that chose to HODL their saving in BTC this year, the purchasing power of their savings, in the midst of crisis when they needed preservation of their savings the most, has cratered by a boggling 68.66%.

For example, for someone holding 3,500,000 rupees in BTC on 1 January (roughly US$100,000 at today’s LKR/USD exchange rate), factoring in the 28.11% decline in LKR denominated bitcoin prices, this amount has now shrunk to a nominal amount of 2,516,150 rupees. Then, to determine the purchasing power of this nominal amount, after factoring in a 56.4% LKR inflation rate and multiplying 2,516,000 * 0.436, this final calculation yields a mere 1,097,041 LRK of purchasing power today from a 1 January 2022 3,500,000 LRK purchase of BTC. Of course, the mathematical calculation I performed is a rough calculation, because I simply used the June 2022 annualized inflation rate of the Sri Lanka Rupee (LKR) instead of utilizing the average YTD inflation rate in this calculation, but this calculation still provides a fair exposition of how BTC ownership not only would have provided zero protection against cratering LKR purchasing power during this economic crisis, but also of how HODLing bitcoin would have been a much worse decision than simply choosing to hold imploding LKRs.

But of course, according to the narratives of the BTC community, all money has cratered due to inflation this year, right? After all, holding BTC priced in Sri Lanka rupees only led to a 68.66% decline in purchasing power whereas holding BTC in USD in America would have led to an effective decline in purchasing power of about 65.14% this year (a 58.5% decline in nominal price along with a real inflation rate of about 16% in the US produces the 65.14% decline in purchasing power figure). Thus, in a collapsing economy with a near hyperinflating domestic currency, the loss of purchasing power was just about the same as it was in the US in terms of holding BTC amidst a much less severe inflation rate. Is that not great? And if “bitcoin is better than gold”, then when we investigate how possession of gold would have preserved purchasing power in Sri Lanka, we should come to the determination that such foolish choices would lead to a decline of purchasing power decline of one’s savings in the 70% to 80% range, right?

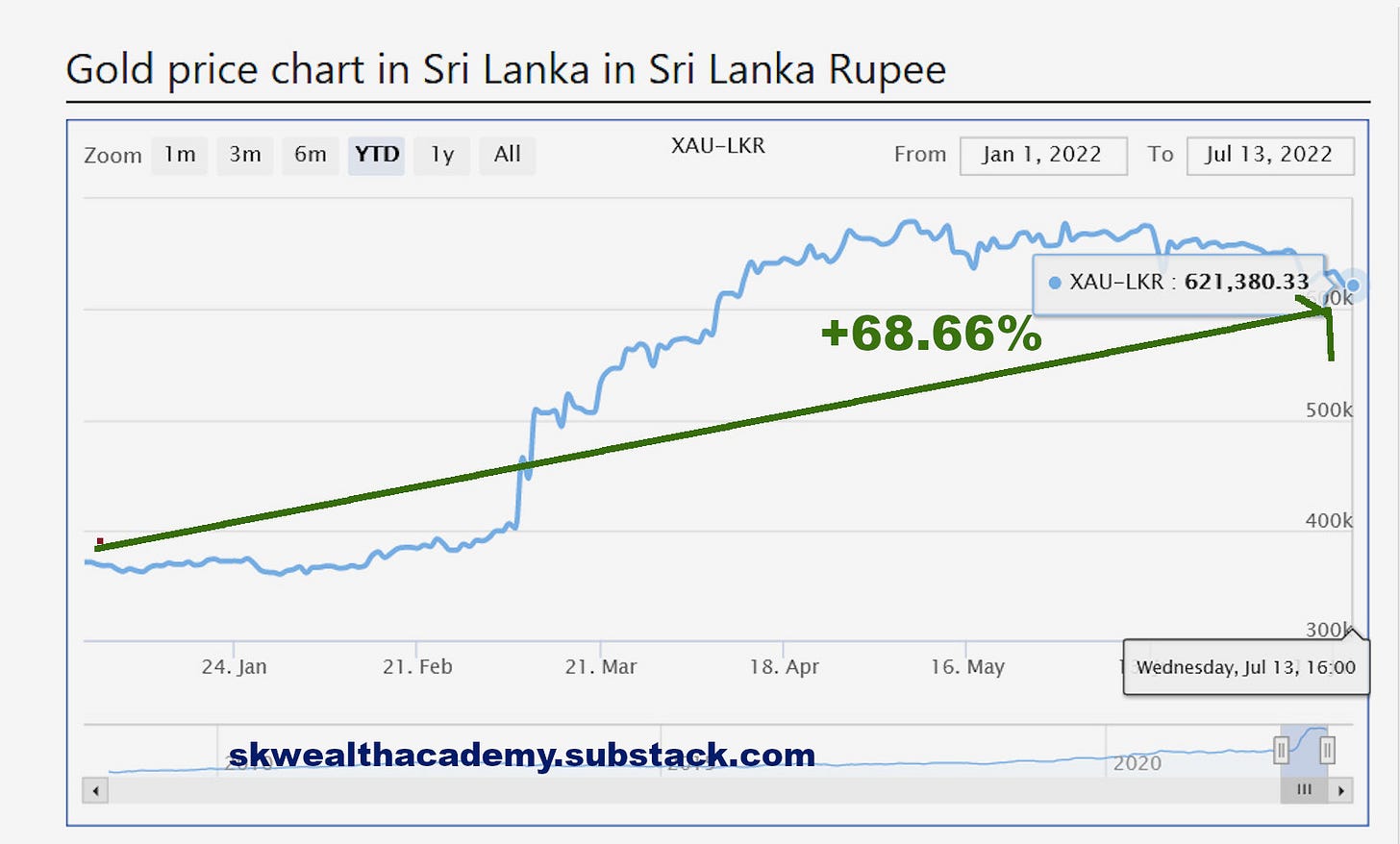

If we look at the chart below, had a Sri Lankan citizen purchased 3,500,000 LKR of gold instead of BTC at the start of this year, with the LKR gold price skyrocketing 67.5% from 370,972.59 LKR per ounce on 1 Jan 2022 to 621,380.33 LKR per ounce today, this 3,500,000 LKR purchase of gold at the start of the year would be worth 5,862,500 LKR today. In reality, this calculation understimates how gold would have preserved wealth, because I always advocate purchase of physical gold only and physical gold prices have soared in LKR rupees even more than 68.66% since the start of the year, so using the increase in spot prices is somewhat of a disservice to exposing the true value of holding physical gold.

Because the MIB complex has trained us all to wrongly think of every global asset only in terms of USD price (oil, gold, corn, rice, phosphates, coffee, etc), most of us believe gold is performing poorly in all nations when it simply is performing weakly in USD prices. Of course, this is not the case. To compare apples to apples, as I executed in the BTC example above, I must factor in the soaring 56.4% LKR inflation rate to determine the real purchasing power of the 5,862,500 LKR derived from the 3,500,000 LKR purchase of gold. Thus, when I multiply 5,862,500 LKR by 43.6%, I arrive at a purchasing power of 2,556.050 LKR. Though not ideal, the 2,556,000 LKR of purchasing power yielded by purchasing gold is still far preferable, and nearly a 2.3X better yield in purchasing power, than the resultant 1,097,041 LKR produced with the same 3,500,000 purchase of bitcoin.

Clearly, holding gold was a far better choice than HODLing bitcoin for all Sri Lankans this year, during an economic and monetary crisis. In the long run, I still highly believe that gold will serve as the far better store of value than BTC during such crises despite Mark Cuban’s declarations that bitcoin not only is “better than gold” but that “gold is also dead”. I certainly hope no Sri Lankan citizens were foolish enough to follow Mark Cuban’s gold v. bitcoin advice this year, as gold has been the clear-cut winner over bitcoin in Sri Lanka in providing preservation of wealth. Furthermore, though so many of those that dwell inside the echo chambers of the BTC and ETH communities perpetually pitch BTC and ETH as a better “store of value” than gold simply due to their massive price appreciation since inception, one cannot honestly compare 14 years of cryptocurrency history to more than five thousands of years of history in which gold has served as money and a store of value. Such an argument is intellectually dead from the start.

And quite frankly, I could produce a dozen more charts comparing gold’s store of value to BTC’s store of value this year in a dozen other nations with collapsing fiat currencies like Lebanon, Ukraine, Indonesia, and so on, and in every instance, gold would trump bitcoin as the clear runaway champ in being the better store of value. Though I’m sure bitcoin advocates will argue that I’m cherry picking the time period of comparison as many other periods exist during which BTC price performance has significantly trumped that of gold, for those that argue this, they are missing my point.

A better store of value does not mean one that provides greater price appreciation. A better store of value means a consistent track record of wealth preservation over centuries and not decades. Neither bitcoin, ether or even any stablecoin has been around long enough to prove that it can serve as a stable store of value without 50% to 70% drops in price as a regular occurrence. One thing is for certain, and that is if gold had dropped 72% from its 8 November price of $1,828 an ounce, and were trading at barely more than $500 an ounce right now, as has happened with bitcoin and ether, there would be thousands more in the cryptocommunity besides just Mark Cuban declaring gold as “dead”.

Conclusion

Gold is not dead, even if Mark Cuban says it is. All such a declaration accomplishes is to endear Cuban to the MIB (Military Industrial Banking) complex. Frankly, I don’t know why anyone would listen to Mark Cuban when it comes to the gold v. bitcoin argument. Last year, his touting of a defi coin called Titan that went from $64 to zero in just a few hours motivated me to create a Cryptocurrency Risk PSA (public service announcement) so investors would stop listening to the loudest voices in the industry that have consistently touted scams over and over again. Hopefully, those that watched my PSA never parked any money or cryptocurrencies on the Voyager exchange as Cuban was again, one of the loudest voices to tout the highly risky Voyager crypto exchange as “close to risk free as you’re going to get in the crypto universe.” Everyone that parked their cryptocurrencies on the Voyager exchange were unsecured creditors of Voyager and Voyager offered ridiculous APRs up to 12% to encourage people to park their crypto on their exchange.

It is a self-evident truth in the finance industry that 10% to 12% interest rates cannot be offered in an operational platform that is “close to risk free.” For anyone with the slightest understanding of finance markets, simply understanding this miniscule amount about Voyager, in addition to my PSA to not trust Mark Cuban in the future, should have been adequate to identify Cuban’s endorsement of Voyager as “close to risk free” as (1) a deliberate lie to scam people; or (2) a false statement made out of ignorance, which is just as bad as (1). In any event, Mark Cuban, as the promoter of two of the biggest scams in the crypto industry, is a massive hypocrite as he has at times, displayed self-righteous anger after identifying scams pitched to him on Shark Tank. After Voyager declared bankruptcy last week, it appears as if all of Voyager’s customers are going to flat out lose most, if not all of their cryptocurrency stored on the Voyager exchange.

The point of this article is that nothing trumps gold ownership during times of real monetary crisis. This has proven to be the case in Zimbabwe, when vendors would only accept gold and US dollars as payment for essential necessities. This has proven to be the case in Venezuela when the VEB hyperinflated into worthlessness. And this is proving to be the case right now in Sri Lanka. Furthermore, as the mass media has been priming us all for rolling blackouts in our near future due to utility shortages caused by Russian economic sanctions (but in reality due to a much greater threat I’ve discussed here on my substack platform), digital money cannot be the relied upon form of currency during economic or even political crises. My point is not that speculation in BTC and ETH did not lead to great riches in the past. Obviously for those smart enough to cash out this past November, it did.

For example, when BTC prices were $20,000 in November 2020 and $29,000 in July 2021, I issued buy opinions for BTC on my patreon platform and BTC prices respectively tripled and more than doubled after I issued these buy opinions. However, I believe those days of quick riches are over, and many people that acted on my buy opinions but never acted on my sell opinion at $66,000 this last November consequently lost all their paper profits. Because I will only issue buy opinions on BTC when the analytical metrics I use inform me that it is a low-risk, high-reward proposition, the truth of the matter is that moving forward, I may never issue another buy opinion on BTC. Moving forward, I firmly believe that holding gold as an asset will trump BTC and ETH ownership in proving to be a better store of value in every fiat currency crisis that manifests for the next decade. Furthermore, in a few days, I’ll post definitive proof in a subscriber only post, that explains why analysts that refuse to ascribe BTC’s largest price movements to price manipulation should never be trusted.

Disclaimer: All information published on this platform reflects the opinions of the author J. Kim and does not qualify as investment advice. Full disclaimer can be found on our “About” page.