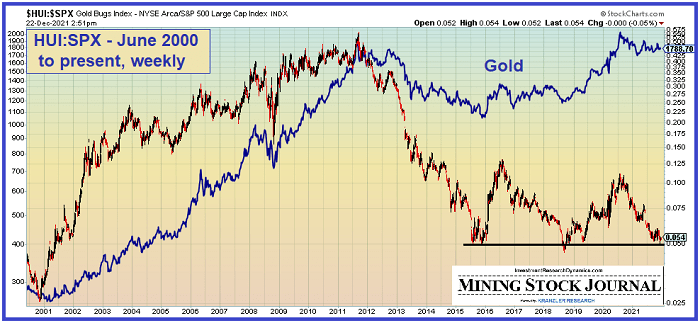

The chart above is the HUI to SPX ratio (GDX was not around until 2006) vs the price of gold on a weekly basis going back to mid-2000. It shows that the mining stocks are extraordinarily undervalued relative to the S&P 500 and gold. If reversion to the mean kicks in, either the mining stocks will experience a rally in order for that ratio to “catch up” to the price of gold. Or the price of gold is going to get demolished.

Given the fundamental back-drop supporting much higher gold prices, it’s a high probability proposition that the mining stocks, at some point, will experience a big move higher and will outperform the rest of the stock market.

Wall Street Silver invited me back on its podcast to discuss why the Fed’s current monetary policy will prime the pump for a big move in gold, silver and the mining stocks in 2022: