The Federal Reserve’s interest-rate pause, due to successfully lowering inflation, and apparently coming, subsequent pivot to reducing interest rates, is good news for commodities.

Lower rates will cause the dollar to fall and commodity prices to rise. When positive real interest rates, which favor bond investors, turn negative, it will especially lift gold and silver prices.

The case for gold revolves around three main factors: an increasingly dovish Fed monetary policy; unsustainably high debt, fueled by excessive government spending; and central bank buying.

Many investors in December placed a bet on bullion when they figured the Fed was planning to lower interest rates in 2024. Spot gold hit a new record-high $2,135 an ounce on Dec. 3.

We’ve seen how sensitive the market is to monetary policy.

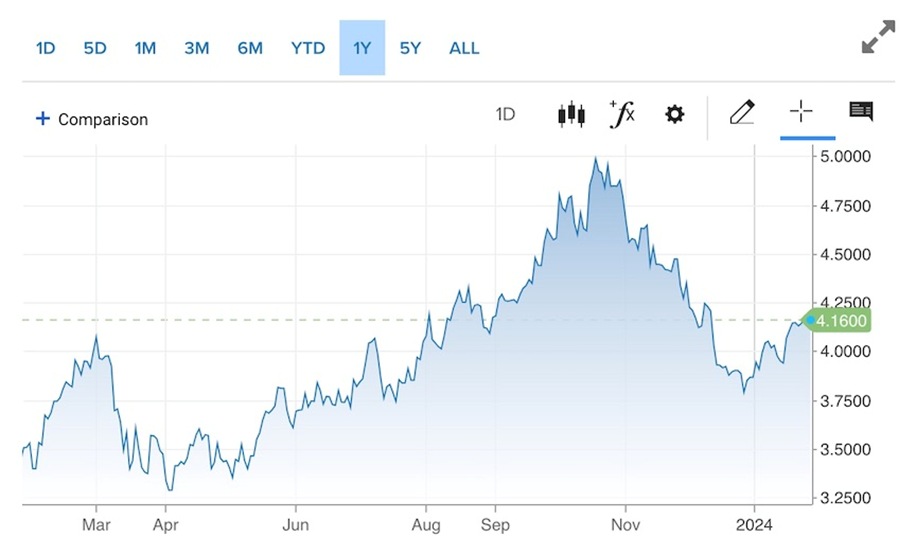

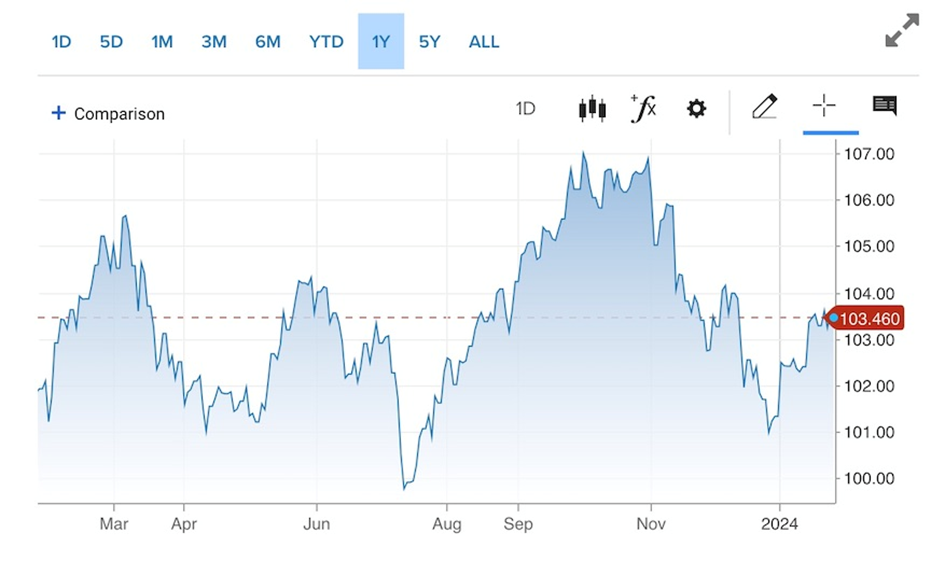

Just the suggestion of coming rate cuts pushed gold to lofty heights. The Fed’s messaging also caused bond yields and the dollar to fall. The benchmark 10-year Treasury slipped from 5% in November to 3.9% around Christmas-time. The US dollar index DXY dropped from 106.88 on Nov. 23 to 101.71, a reduction of 5%.

However, as we argued in Gold not yet, copper will retest $4, gold is not going much higher until the dollar starts weakening (the US dollar index DXY is still well above 100), and we have negative real rates. With core PCE inflation currently at 2.9% and the yield on the US 10-year Treasury at 4.1%, real rates are currently +1.2%.

1-year 10-year Treasury yield. Source: CNBC

1-year 10-year Treasury yield. Source: CNBC

1-year DXY. Source: CNBC

1-year DXY. Source: CNBC

It turns out gold’s record-high was only temporary. Within a week, it was back under $2,000.

Meanwhile, the market’s reaction to statements that the Fed is not going to pivot as early as everyone thought, strengthened the dollar and bond yields. It is surprising to see gold trading mostly above $2,000 so far this year, since the precious metal usually moves in the opposite direction as these two variables.

Source: Kitco

Source: Kitco

My thinking on what’s happened so far, is the Fed knew that it needed to hammer rates hard for a short period of time, because historically, this tactic works. What it didn’t want to do was go too slow, because when this happens a recession usually follows.

So far everything we at AOTH said would happen — i.e. that the Fed would stop raising rates in 2023, and that there would be no hard landing/ no recession — is coming true.

On Friday, Jan. 26, the release of the personal consumption expenditures (PCE) price index strengthened the argument that the Fed will want to reduce rates later this year.

On a six-month annualized basis, core PCE was below the Fed’s 2% target in December for a second straight month, at 1.9%.

This is terrific news. The Fed deserves credit for achieving its goal of taming inflation, and it did so quickly, reducing economic activity and lowering prices without causing a recession. We’re talking about the biggest and fastest increase in interest rates in a generation.

Yet in spite of the rate hikes, the US economy appears to be firing on all cylinders.

Bloomberg reports that US consumer spending in December posted its biggest back-to-back increase in nearly a year, likely fueled by a strong advance in wages and salaries.

Friday’s report showed spending last month was driven by outlays for durable goods like recreational goods and vehicles, which climbed 1.1%, the most in nearly a year, although spending on services slowed.

Separate data out Thursday said economic growth trounced forecasts, with US GDP advancing 3.3% in the last quarter of 2023.

“Evidence continues to pile up that the Fed has met its inflation goal, which will make it harder for officials to hold off on cutting rates until midyear,” Bloomberg quoted an economist with LH Meyer/Monetary Policy Analytics.

“The stage is set for the Fed to take steps toward cutting rates and tapering the pace of Quantitative Tightening (QT) in coming months. We expect the Fed to begin lowering the federal funds rate target range in March as it attempts to stick a soft landing,” Bloomberg Economics agreed.

The article also said that “many forecasters still see the economy dodging a recession” and that “traders maintained bets on about a 50% chance that the Fed will start cutting rates in March.”

At AOTH, we agree with the former but are not so sure about the latter.

We’re pretty certain that, because the Fed has managed to avoid a recession so far, and with the economy continuing to do well, a period of back to back months of negative economic growth, signaling a recession, is unlikely to occur in 2024.

Fed officials have been cautious about declaring victory on inflation, and now that they have paused rate hikes, are in a “wait and see” mode. They want to see a sustained period of cooling inflation below their 2% target before lowering borrowing costs.

To me, this means a minimum of five months of continued lower inflation. The PCE data just came in, so the Fed definitely will not, imo, lower rates at its January 30-31 meeting.

The March Fed meeting is the one where some people think they announce the first rate reduction, we also think they announce a quarter point reduction. Remember on a six-month annualized basis, core PCE was below the Fed’s 2% target in December for a second straight month, at 1.9%.

The 1.9% core PCE figures were for November/ December, so almost five months will have transpired by the time of the March 19-20 FOMC (Federal Open Market Committee) meeting.

In my view, a half-point cut would imply a sense of urgency that the Fed has gone too far — that the economy is in trouble and needs a jump-start. A more gradual set of three quarter-point decreases this year, would say everything is on track. If they do not raise in March it will certainly be at the next meeting, if inflation data shows continued cooling. Just my opinion.

Let’s play devil’s advocate and ask the question: If inflation is coming down, why would the Fed want to lower interest rates? There are several good reasons.

First, around $13 trillion in government debt is about to roll over at much higher interest rates. Second, there is a lot of spending coming down the pipeline that will have to paid for through borrowing and issuing debt (Treasury bills) at higher rates. In other words, the government can’t afford higher interest rates for much longer. Also it is an election year, consumer spending has to continue because consumers spending makes up 70% of the US economy. Consumers need debt payment relief to keep spending as wages and salaries soar.

“Americans splurged in December, powered by an accompanying rise in incomes, in the latest signal of economic strength, even as they saved less, the Commerce Department’s Bureau of Economic Analysis showed on Friday.

Personal consumption expenditures, or PCE, went up by nearly $134 billion, a 0.7 percent increase, in December. Meanwhile, personal incomes also jumped by $60 billion but at a much slower pace of 0.3 percent.

The data suggested that consumers were making up the difference by dipping into their savings, which went down to $767 billion last month from November’s $850 billion. The personal savings rate—personal savings as a proportion of disposable income—fell to 3.7 percent, the lowest it’s been in a year.

Stronger spending is being driven partly by falls in the saving rate, which is now at a 12-month low. A rebound in the saving rate is a downside risk to the outlook later this year,” Michael Pearce, lead U.S. economist at Oxford Economics, said in a note shared with Newsweek.” Americans Are Spending More, Saving Less

(Of course, they could always raise taxes, or stop spending, but in an election year? Ain’t gonna happen.)

According to Politico, the Pentagon estimates the military buildup in the Middle East since Hamas attacked Israel will cost $1.6 billion — money that it doesn’t have because lawmakers can’t pass a budget.

This includes the cost of sending additional warships, fighter jets and equipment to the region, but does not include the cost of missiles the US has expended striking Houthi positions in Yemen, or knocking out drones and missiles in the Red Sea.

It’s estimated that over a full year, the cost of the military surge could reach $2.2 billion.

Again, this is money the government doesn’t have and will either have to print, which is inflationary, or borrow, at high interest rates.

Fun facts:

- Interest costs nearly doubled over the past three years, from $345 billion in 2020 to $659 billion in 2023.

- Interest is now the fourth-largest government program, behind only Social Security, Medicare, and defense.

- The federal government in 2023 spent more on net interest than it did all spending on children, and it also spent more on interest than most major programs including Medicaid, veterans’ programs, food and nutrition programs, and education.

Interest payments over fiscal year 2024 will be just over $1 trillion, according to Blomberg.

US federal government net tax revenue for fiscal year 2024 is budgeted $5.04 trillion.

How long before interest payments on the debt exceeds revenues?

Conclusion

Now that the Fed has paused its rate-hiking cycle, the question is when does the organization pivot, i.e., start lowering rates? And secondly, what does this mean for commodities and precious metals?

We already know what will happen when monetary easing (lowering rates) begins, because we had a “dry run” in December: the dollar falls, bond yields drop, and gold (and silver) goes up.

The debt ceiling deal just reached is only temporary, there is pressure to spend much more on the military, and this is after military aid to Ukraine, Taiwan and Israel and border expenditures the Biden administration will have to make to avoid losing seats to Republicans in the November election and consumers have to keep spending to kick the debt can down the road one more time. It’s not a question of if interest rates are coming down, but when.

There’s been a lot of messaging from the Fed over the last two months, regarding if or when rates will fall. We can forget about all this “Fed-speak” and focus on the actual numbers that were released on Friday.

Inflation has come down, yet the economy is doing well. Really well. The data is setting the stage for the first 25% rate cut to happen in March.

Remember, we do not believe two months of data makes a trend. We need to wait at least three more months, at least five in total, so that the Fed is more certain that its tight monetary policy has worked and that inflation is licked.

When the Fed cuts rates the dollar will weaken, causing commodity prices (and precious metals) across the board to rise.

That’s why we at AOTH are positioning ourselves now, by purchasing inexpensive, beaten-down shares of junior resource companies, that historically have offered the best leverage to rising metal prices.