The Captain’s weekly US dollar index chart.

The Captain’s weekly US dollar index chart.

Analysis:

We continue to work on a very large wave B bearish triangle, and within that triangle, all of wave ^c^ ended at the 114.75 high.

We are falling in wave ^d^.

Within wave c, we completed wave (i) at 106.78 and wave (ii) at 109.75. It looks like wave (iii) ended at the 97.68 low, and we are now working on the assumption that wave (iv) is becoming a bearish triangle with the internal wave count as described in our Daily Posts.

After our bearish wave (iv) triangle ends, we expect a very sharp thrust lower in wave (v).

Active Positions: Short, risking to 104.00!

Silver:

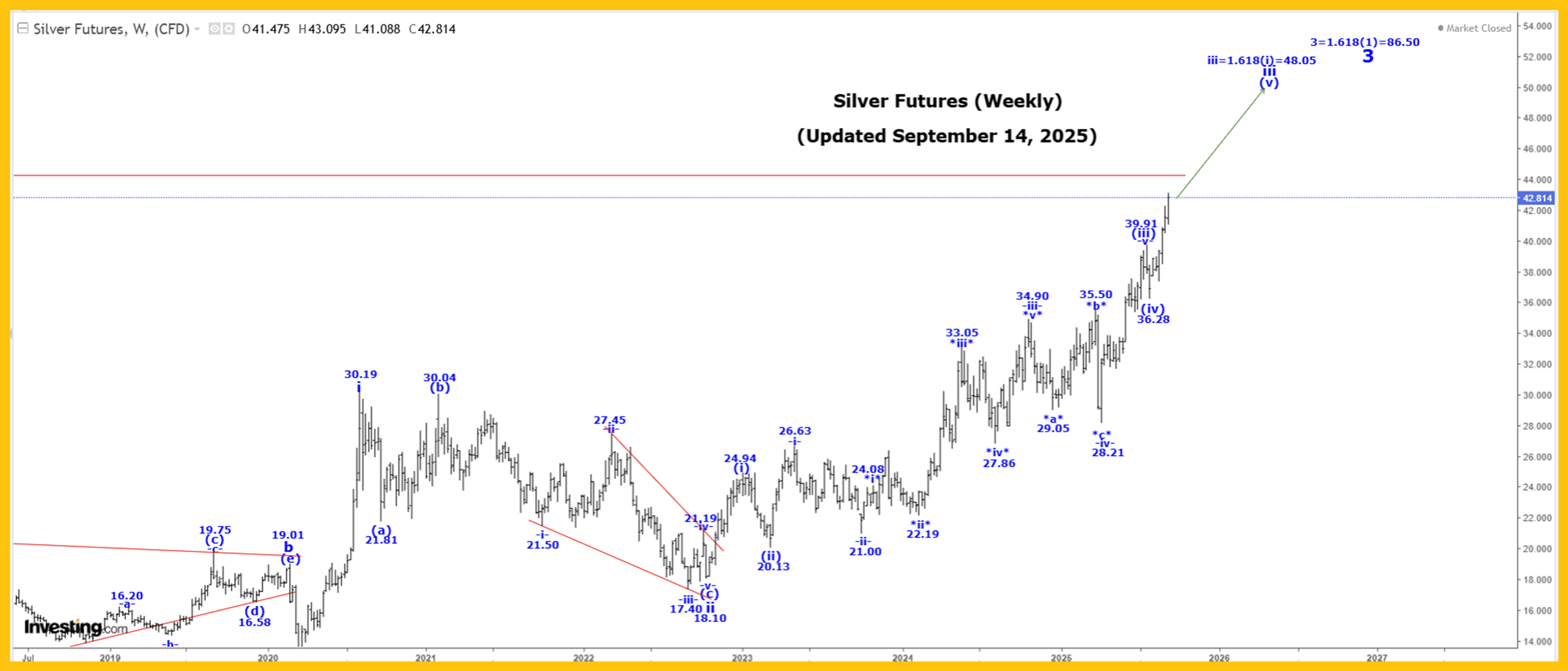

The Captain’s weekly silver chart.

Analysis:

We are moving higher in wave 3, as shown on our Weekly Silver Chart. Within wave 3, we completed wave i at 29.91 and wave ii at 18.01, and we are now continuing to move higher in a subdividing wave iii.

Our current projected endpoint for wave iii is:

iii = 1.618(i) = 48.05

After wave ^iii^ ends, we expect a wave ^iv^ correction that retraces between 23.6 to 38.2% of the entire wave ^iii^ rally.

Longer term, our initial projection for the end of wave 3 is:

3 = 1.618(1) = 86.50!

In the very long term, we completed all of wave III at 49.00 in 1980 and all of wave IV at 3.55 in 1993. We are now working on wave V, and within wave V we have the following count;

1 = 49.82;

2 = 11.64;

3 = First projection is 86.50.

Active Positions: Long with puts as a stop!

Gold:

The Captain’s monthly gold chart.

The Captain’s monthly gold chart.

The Captain’s daily gold chart.

The Captain’s daily gold chart.

Analysis:

Last week, for the first time in years, we updated our long-term gold count, starting from the 35.20 low made back in 1971, and here is our revised ultra-bullish count, which suggests we are moving higher in a multi-decade impulsive fashion, which currently remains incomplete, as follows:

Wave 1 = 1920.80.

2 = 1046.20.

3:

i = 2073.40.

ii = 1614.40.

iii:

(i) = 2073.30.

(ii) = 1810.10.

(iii):

-i- = 2790.40.

-ii- = 2539.90.

-iii- = 3500.30.

-iv- = 3280.60.

-v- is still underway, to complete wave (iii).

Projections for the end of wave (iii) are:

(iii) = 4.236(i) = 3753.00.

(iii) = 6.25(i) = 4678.20.

We should still be moving higher in wave -v- of (iii), but as a minimum, we should be heading to at least the 3700.00/3800.00 level, before it stops, but perhaps much higher if wave (iii) extends, as noted above.

After wave (iii) ends, we expect a wave (iv) correction that retraces between 23.6 to 38.2% of the entire wave (iii) rally.

A projection for the end of wave iii is:

iii = 4.236i = 5965.60.

Projections for the end of wave 3 are:

3 = 2.618(1) = 5936.00.

3 = 4.236(1) = 9033.60!

Trading Recommendation: Go long gold. Use puts as stops.

Active Positions: Long gold futures with size from $1080, with puts as our stops!

Thank-you,

Captain Ewave & Cre