The biggest eye-opener for us through the first four trading days of 2024 — a year in which we’ve called for Gold 2375 — is the Dollar’s sudden resilience. Oh to be sure: the FinMedia buzz is focused on whether or not the Federal Open Market Committee shall vote to cut its Bank’s Funds Rate come their 20 March Policy Statement, (somewhat shunning that first scheduled for 31 January).

But in seeing the Dollar take flight to start this year — indeed recovering a 10-day losing streak in just the first two days of 2024 — along with the Bond’s fresh demise as yields rise, might renewed inflation be taking first prize? In other words: what if the Fed instead tightens … surprise!

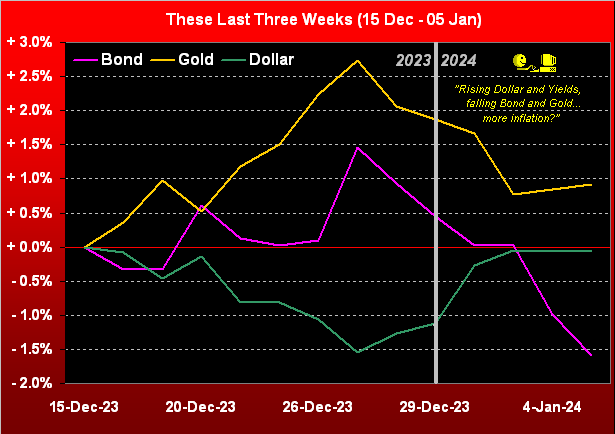

Graphically below, ’tis not that noticeable, let alone overwhelming. But right of the vertical line in commencing 2024, clearly the concerted move is out of the Bond (i.e. yields on the increase) and into the Dollar in what may be deemed as a pro-inflation play, with Gold entangled by conventional wisdom as a “sell”:

Hardly is renewed inflation a firm forecast. Yet curiously, the Buck and the Bond appear early on as inflation anticipative; and as is our wont to say: “…the market is never wrong…”

“But as you also always say, mmb, it can be really misvalued…”

True enough, Squire, the two most glaring examples (per our honestly performed math) being the S&P 500 priced +76% above earnings valuation and Gold priced -45% below debasement valuation. As for ![]() “How long has this been going on…”

“How long has this been going on…”![]() –[Ace, ’74], the S&P’s valuation above mean and Gold’s valuation below same extend back a good dozen years. “…tick tick tick goes the means reversion clock…”

–[Ace, ’74], the S&P’s valuation above mean and Gold’s valuation below same extend back a good dozen years. “…tick tick tick goes the means reversion clock…”

But as to inflation anticipation: between now and the Fed’s end-of-January confab, StateSide there’re four key incoming data sets on inflation: the Consumer Price Index, Producer Price Index, Export/Import Prices, and the “Fed-favoured” Personal Consumption Expenditures Index. And on this side of the Pond as the year begins, we’re weathering an +8% increase in the cost of our morning café crème/croissant … ouch!

Why? Because “the club” (oh yes) says ’tis responding to price increases in what it now pays per kilo of coffee. So we decided to check: and ICE Coffee futures for March delivery have increased in the last few months by as much as +41% (10 October low to 19 December high). However, the good news for you caffeine heads out there is Dow Jones Newswires having run yesterday (Friday) with “Eurozone Inflation Rose Less Than Expected, Keeping Rate-Cut Talk on Track” in turn easing our inflative coffee cost concerns … whew!

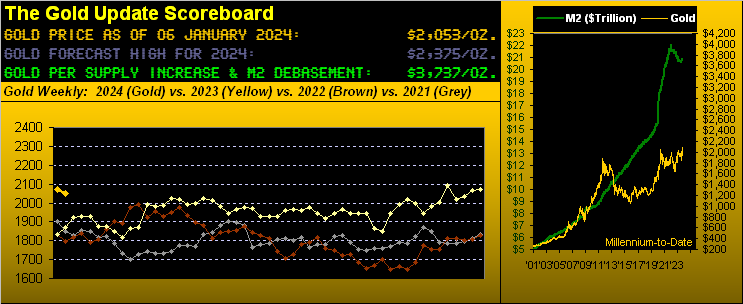

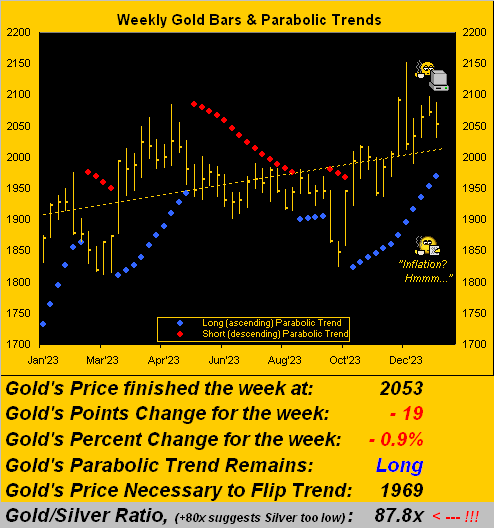

But as this is not “The Coffee Update”, let’s get on to Gold, which indeed has stumbled thus far into New Year, price having sported its first down week since that ending 08 December in settling yesterday at 2053, albeit a still comfy +84 points above the parabolic trend’s flip-to-Short level at 1969. And at the foot of this weekly bars graphic we’ve the Gold/Silver ratio now 87.8x, its highest end-of-week level since that ending last 10 March, (the century-to-date average but 67.9x):

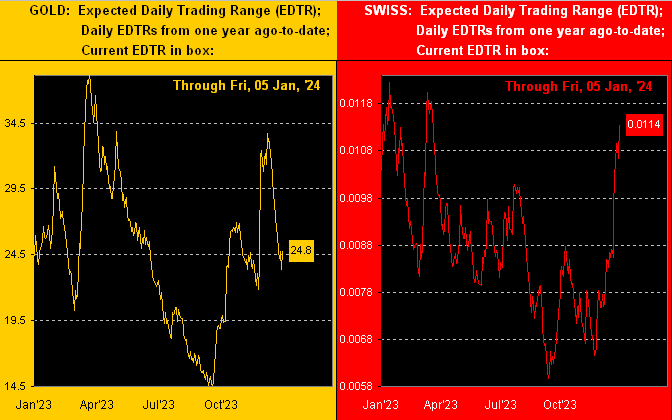

As for Gold “awareness”: if measured by trading range, ’tis not really there, even as price has been fairly firm on balance these past 14 months, (with notable thanks to the BRICS banks). Still, despite the Gold hype, a public unaware remains the stereotype. Drawing from the website, the next two-panel graphic displays Gold’s “expected daily trading range” (EDTR) from one year ago-to-date on the left, and the same for the Swiss Franc on the right. For Gold, expected range from day-to-day is as ’twas a year ago, yet waning. However for the Swissie, after a year’s worth of range doldrums, clearly of late ’tis back in play, regardless of way. So beyond banks increasing their Gold shares, it remains that no one else cares:

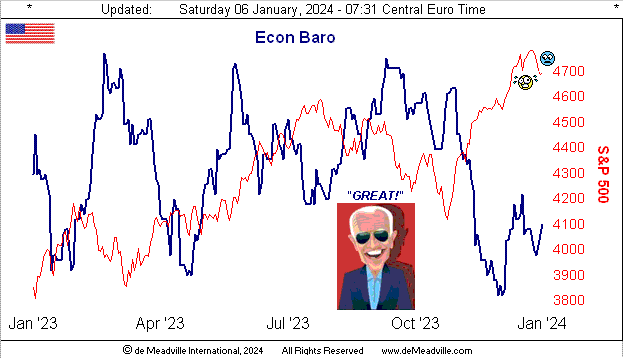

Meanwhile, looking to find its own way is the Economic Barometer, exemplified by five of the year’s first ten incoming metrics having improved period-over-period … meaning that five did not improve. Still net-net, December’s job creation and a firm upswing in November’s pace of Factory Orders were enough to bring a New Year boost to the Baro’s first week. Culling from Friday’s White House statement: “…2023 was a great year for American workers. The economy created 2.7 million new jobs … more jobs than during any year of the prior Administration…” ‘Course, not mentioned was that 2023 posted the current administration’s weakest year vis-à-vis job creation, (given 5.1 million in 2021 followed by 4.6 million in 2022). But far be it from us to rain on the President’s parade; rather, here’s the wayward Baro from one year ago-to-date along with the stratospheric S&P 500 (in red):

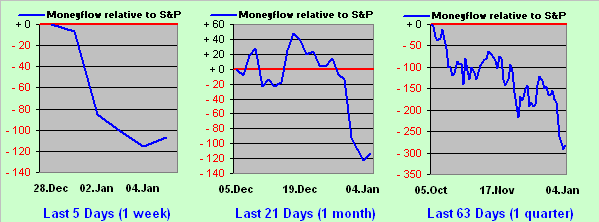

‘Course with respect to the S&P, we recall the old adage “As goes January…”, which at least early on is not boding well. Should you be following the website and/or our “X” feed (@deMeadvillePro), you already know the leading characteristics of the S&P Futures’ “Baby Blues” are suggesting still lower stock prices, certainly underscored by the negative MoneyFlow differential of late. What this next graphic illustrates is that regardless of time frame (one week, one month, or one quarter), money as regressed into S&P points is flowing out at a pace faster than the decline in the Index itself, and has provably led the decline into New Year:

“So how low would be low, mmb?“

‘Course, none of us know, Squire, and a multitude of measures can be applied. Here’s one: a full Golden Ratio retracement between the S&P’s October low of 4104 and the recent not-quite-all-time-high of 4793 would bring us to 4368, a further -7% correction from the current 4697 level. Or should Q1 Earnings Season net-net show no growth, a reversion to the original “live” price/earnings ratio of 25.4x (at its establishment in January 2013) from such current P/E of 44.7x would elicit an S&P “correction” from here of -43% down to 2669, which would put price back into its growth regression channel had COVID never occurred. Thus to tie the bow with reference to the aforementioned comment on earnings valuation (just in case you’re scoring at home), 4697 today is +76% above 2669.

Regardless of measure, the straits for the S&P 500 as a single Index remain extremely treacherous: but until the FinMedia and bullish-beyond-belief analysts own up to the overvaluation, it can remain “Game On!” for the stock market. For in today’s equities environment, earnings mean nothing … until they again do; (ref: DotComBomb 2000-2002: “We don’t need no stinkin’ earnings!” Oh really?).

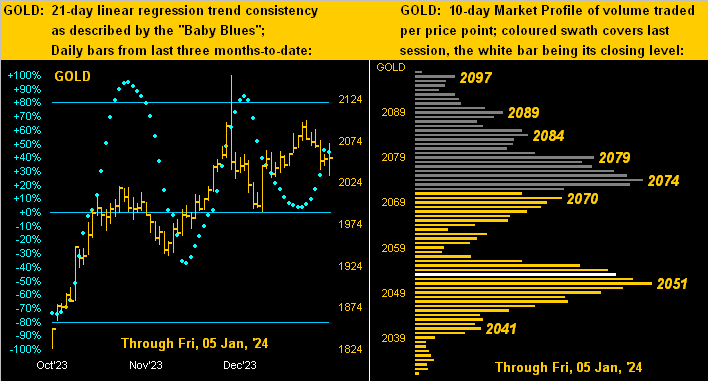

Fortunately Gold, given ’tis money, does have meaning as we next turn to the two-panel graphic of the yellow metal’s daily bars from three months ago-to-date at left and 10-day Market Profile at right. Gold’s “Baby Blues” of trend consistency have of a sudden stalled, suggesting near-term lack of puff for further price rise. And by the Profile’s labels, this 2051-2074 zone at present determines whether price can instead break higher, else first succumb to a retest of the lower 2000s:

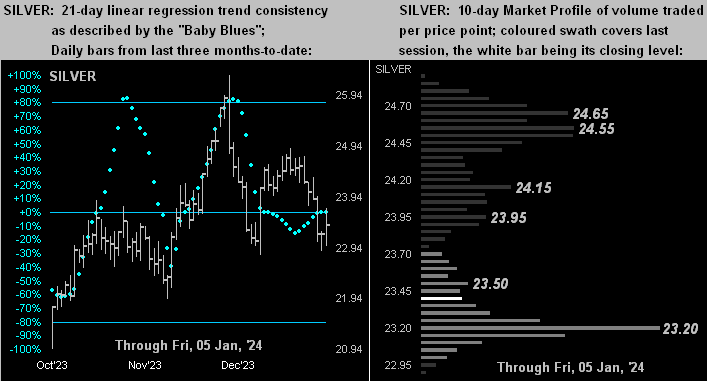

The near-term playbook looks much the same for Silver. Presently 23.39, were the white metal to slip some more, the broader 23.88 to 21.93 price structure spanning from late October into mid-November appears supportive (below left); more immediately per the Profile (below right), 23.20 appears key to hold:

We opened in musing on inflation: reporting thereto ranks significant in the first full trading week of 2024 with December’s CPI due Thursday (11 January) followed by the PPI on Friday (12 January). Shall such metrics renew the inflation scare? Or instead remain benign over which we’ve nothing to care? As a great friend and financial colleague remarked over this morning’s inflated coffee: “This is not going to be an easy year.” Indeed with valuations so out of whack, it may not be an easy several years. “Well, ya gotta buy the dip”, they say. Ok, you go first, Conway. We’ll hedge with Gold for the Long way!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on Twitter(“X”): @deMeadvillePro

deMeadville. Copyright Ⓒ 2010 - 2024. All Rights Reserved.