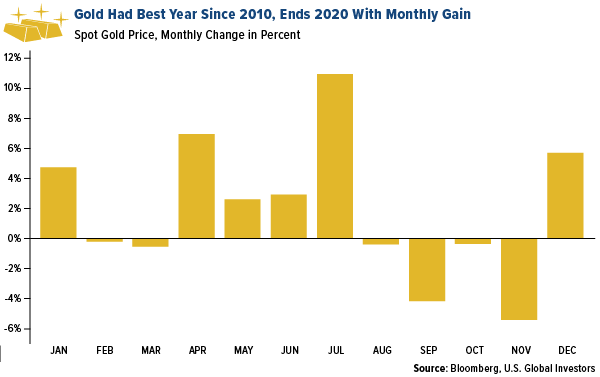

- The best performing precious metal for 2020 was silver, up 47.86% as investment demand and the outlook for more solar power improved. Gold had its biggest annual advance since 2010, up 25.11%, after a tumultuous year that included four straight months of declines before snapping back in December. Bullion hit a new record high in August above $2,000 an ounce as investors feared unprecedented stimulus by central banks globally. The yellow metal finished 2020 up, aided by the U.S dollar’s decline to the lowest since April 2018. How might gold fare in 2021? A weaker dollar and low real interest rates are likely to provide support despite the worldwide vaccine rollout. The Federal Reserve has signaled ultra-easy monetary conditions throughout the next year.

- Platinum and palladium saw gains. Palladium hit an all-time high above $2,700 an ounce and ended the year up 26.08%. Demand should continue to remain firm but the push for electric vehicles could be a headwind at some point perhaps.

- Numerous gold companies saw triple digit gains in 2020. U.S. Global Investors portfolio manager and gold expert Ralph Aldis’ top performers for 2020 include: K92 Mining, up 168.82%; GoGold Resources, up 284.21%; Calibre Mining, up 161.55%; and Metalla Royalty & Streaming Ltd, up 132.59%. Ralph predicts these precious metals companies could perform strongly in 2021: RoxGold, Revival Gold, Magna Gold and Barksdale Resources.

Weaknesses

- The worst performing precious metal for the year was platinum, still up 10.79 percent.

- 2020 saw a spike in money flowing into gold-backed ETFs, then an exodus toward the end of the year. Citigroup cut its forecast for net inflows into gold ETFs to just 800 tons for the year, 75 tons less that previously predicted, reports Bloomberg. The bank expects inflows to be 50% lower in 2020 and sees support for gold in the short term at $1,700 an ounce. The largest gold-backed ETF, the SPDR Gold Trust, had its largest monthly outflow since 2017 in November, losing over 50 tons.

- Gold demand in the world’s second-largest consuming nation was a major weakness in 2020. This year due to coronavirus and weak economic growth, India’s gold jewelry sales fell below last year’s 194 tons to the lowest quarterly numbers since 2008, according to Metals Focus. World Gold Council (WGC) data showed purchases of gold jewelry, coin and bars fell by half from a year earlier in the first nine months through September. India, which also polishes nearly 90% of the world’s rough diamonds, says exports will fall by as much as a quarter in 2020. The Gem & Jewellery Export Promotion Council says supply disruptions and lower demand from the coronavirus could push exports down as much as 25% and that the current slump is worse than that in 2008-2009.

Opportunities

- Both gold and gold equities had a banner year. The rally in bullion helped miners expand margins and generate record levels of free cash flow, allowing companies to pass on profits to shareholders already, according to Scotiabank analyst Tanya Jakusconek. Ironically, many of the gold mining stocks languished as the second half of the year wore on with gold largely trading sideways after setting a new high earlier in the year. Maybe it’s like the 1970s starting over again? Having a listen to 1970s hit “Ball of Confusion (That’s What the World Is Today)” performed by the Temptations takes a person to today in terms of the same issues that the world was facing coming out of the 1960s. The 70s was a great decade for gold, “and the band played on” as prices marched higher.

- The 2021 gold bulls are here. Credit Suisse expects another strong year for the precious metal with an average price target of $2,100 per ounce. Goldman Sachs predicts gold at $2,300 next year. The bank is clearly bullish on the metal as it purchased the Perth Mint Physical Gold ETF and renamed it the Goldman Sachs Physical Gold ETF. In a Kitco News outlook survey, 84% of respondents said they see gold over $2,000 an ounce by the end of 2021.

- Should investors look toward seniors or juniors in 2021? Ralph says “you might get more bang for your buck” with juniors or mid-tier miners. Seniors such as Barrick and Newmont have mostly flat gold production and will need to make acquisitions if they don’t find discoveries themselves, opening up opportunities for smaller players to get bought out. 2020 was largely a drought for M&A, and Ralph expects 2021 and 2022 to see more consolidation.

Threats

- A rising threat for gold, and other safe-haven assets, is the mainstream adoption of cryptocurrencies. Money has poured into Bitcoin funds and out of gold-backed funds. JPMorgan expects this trend to continue as more institutional investors take positions in cryptocurrencies. The Grayscale Bitcoin Trust has seen inflows of almost $2 billion since October, compared with outflows of $7 billion for ETFs backed by gold, according to JPMorgan. Many investors view bitcoin and cryptos as an alternative to gold as a hedge in their portfolio against equities and other currencies.

- Gold historically performs well during times of economic and geopolitical uncertainty. The yellow metal soared as COVID-19 spread and sent turmoil through global markets. The metal dropped after news of vaccine progress came out and after several vaccines were approved to fight the virus. Gold also historically moves in the opposite direction of the wider stock market. Should a global economic recovery take place in 2021, it could be a headwind for gold, although a positive for most others.

- The battle for Venezuela’s gold reserves continued in 2020. A British appeals court ruled in favor of the Venezuelan government of Nicolas Maduro, saying the legal battle over the country’s $1 billion in gold in the Bank of England vaults should be reconsidered. Bloomberg reports the appeals court reversed a lower court ruling that recognized opposition leader Juan Guaido as the interim president. This ruling gives Maduro another chance at getting his hands on the gold, which he would likely sell in order to support the struggling South American nation.