Strengths

- The best performing precious metal for the week was gold, up 2.91%. Lundin Gold reported another strong quarter with fourth-quarter production of 121,000 ounces, ahead of consensus and bringing full-year output to 476,000 ounces, above the high end of guidance of 470,000 ounce. “I am extremely happy to announce that for the second year running, Lundin Gold has beaten its production guidance,” Ron Hochstein, President and CEO, commented. “We continue to push the boundaries of what Fruta del Norte is capable of, and noteworthy improvements have been made across the board as compared to last year.”

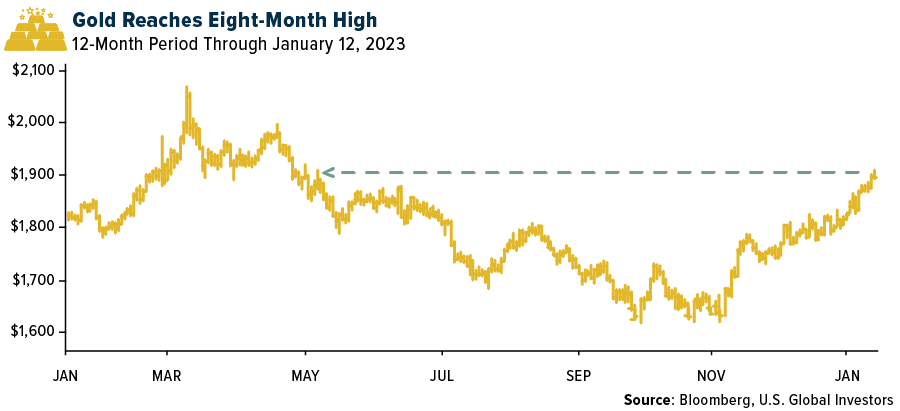

- Gold headed for a fourth weekly gain, reports Bloomberg, following data that showed U.S. inflation is cooling, buoying expectations that the Federal Reserve will rein in aggressive interest-rate hikes. Bullion notched an eight-month high on Friday, the article continues, extending a rally that started in early November on signs the Fed was becoming less hawkish.

- A survey of 13 local Russian banks last year states that Russian citizens bought 57 tonnes of gold in 2022, as they sought to safeguard their savings following the invasion of Ukraine (and also took advantage of the cancellation of the local tax on bullion buying), cites Vedomosti newspaper. The purchases represent 1.8 million troy ounces, which accounts for more than 15% of domestic output. In 2021, there were only 193,000 ounces purchased through these banks.

Weaknesses

- The worst performing precious metal for the week was platinum, down 2.65%, on little market news following three consecutive weeks of gains. Triple Flag Precious Metals reported fourth quarter GEO sales of 25,400 ounces and revenue of $43.9 million, versus consensus of 27,500 ounces and $47.8 million, respectively. For the full year 2022, GEO sales were 84,600 ounces and revenue was $151.9 million, versus consensus of 87,000 ounces and $156 million, respectively (based on actual 2022 commodity prices). The company was guiding sales toward the lower end of the 2022 guidance range of 88–92,000 GEOs.

- New Gold produced 81,000 ounces of gold and 6.9 million pounds of copper (20% below consensus). Production results were driven by higher head grades; mill throughput rates at both assets were well below consensus. That said, the company achieved the mid-point of full-year (revised) guidance.

- Victoria Gold said it produced 43,741 ounces of gold

during the fourth quarter, which ended on December 31, 2022, compared with 50,028 ounces in the third quarter. Full-year 2022 production from the Eagle Gold Mine, part of the company's 100%-owned Dublin Gulch gold property in central Yukon Territory, was 150,182 ounces. This was down from 164,222 ounces in 2021, Victoria Gold said.

Opportunities

- Royal Gold announced that it has acquired two portions of a gross smelter royalty that together cover a large area including the Cortez mine operational area and the entirety of the Fourmile development project in Nevada for $204.1 million in cash. The royalties acquired are a 0.24% gross royalty covering areas including the Pipeline and Crossroads deposits and a 0.45% gross royalty covering areas including the Cortez Hills, Goldrush, Fourmile and Robertson deposits.

- Gold may be a decent candidate for a return to bull market territory in the first half of 2023 as the positives mount. Concerns about a global slowdown, a weaker dollar, and lower real rates are burnishing bullion’s allure, as are further signs of significant buying by central banks.

- “Dr Doom” Nouriel Roubini was recently interviewed by Business Insider, and he predicts the Federal Reserve will not have the stomach to raise rates past 6% to bring inflation down to target levels due to potential recession risks. Roubini noted that gold is the best bet for investors as inflation, high debt, and extreme volatility are in store for the future economic cycle.

Threat

- Jeff Currie believes the best China reopening trade is oil. He says crude oil is heading higher to $110 by the third quarter of 2023. This could send a secondary inflation wave through the mining sector unless management considers locking in some fuel hedges while prices are relatively low. In addition, exports of Russian diesel to Europe are set to end in three weeks. Europe was getting about 50% of its diesel from Russia but lowered that to 40% by December. The diesel squeeze could potentially impact prices globally. It is likely some Russian diesel will be resold by India or China back into international markets.

- “If the market were to switch to the Fed’s path, the gold price would risk suffering a considerable setback,” Commerzbank AG analysts including Carsten Fritsch wrote in a note. Gold exchange-traded fund investors “also appear to take this view, as they are still exercising restraint with purchases despite the steep price rise,” the bank wrote.

- North America’s top mining CEOs are anticipating turbulent times ahead, reports Bloomberg. Mark Bristow, CEO of Barrick Gold, noted that he is not sure if anywhere is perfectly safe to invest in right now. This will be seen as the start of serious change – particularly in the way mines operate and are held accountable. Recently, First Quantum Minerals and Panama’s government have been in dispute on the future minimum taxation plan the government is demanding.