Strengths

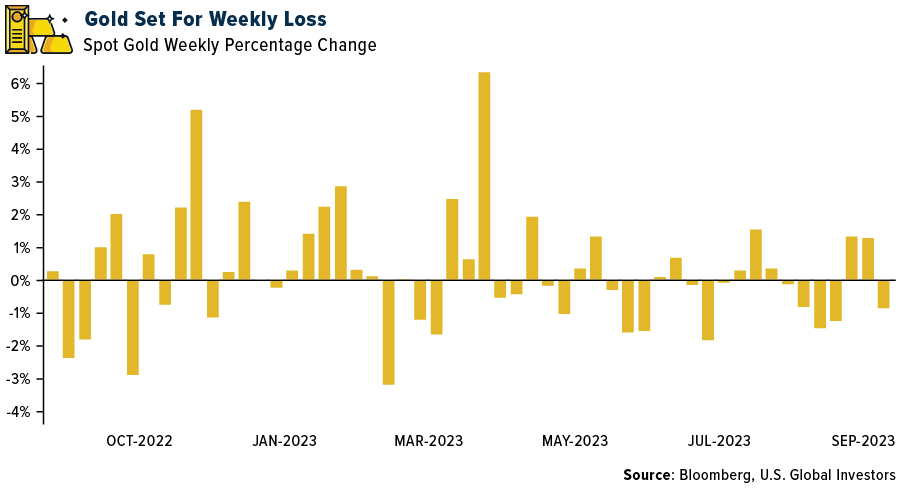

- The best performing precious metal for the week was gold, but still down 1.55%. Gold clocked a loss this week following two weeks of gains. The weakness was prompted by stronger economic data that drove the U.S. dollar and Treasury yields higher, with traders betting interest rates will remain high even if the Federal Reserve pauses its tightening cycle this month. Despite the dip, the People’s Bank of China released data showing an additional 930,000 troy ounces, or about 29 tons, to its reserves in August. This is the bank’s tenth consecutive monthly purchase as China and other countries diversify away from the U.S. dollar.

- According to Canaccord, Resolute Mining has reported a 47% increase in M&I Resources to 2.72Moz (previously 1.85Moz) and an 11% increase in total Resources to 3.53Moz (previously 3.18Moz), as a result of infill and down plunge extensions.

- Investor allocation to gold stands at its highest level in 11 years, according to an analysis by a JPMorgan strategist. Strategists led by Nikolaos Panigirtzoglou say the implied allocation to gold by non-bank investors has been led by central bank purchases.

Weaknesses

- The worst performing precious metal for the week platinum, down 7.44%, on news from the World Platinum Council that China holds more than 80% of global platinum inventories following two years of massive imports. Perhaps the imports were to secure supplies for their gasoline powered vehicles which still need platinum for pollution reduction. However, China’s EV adoption is at 17%, past the 5% adoption threshold for new car buying which typically signals the start of logarithmic adoption of EVs in a country. There could be an overhang in supply unless fuel cell production of hydrogen gains more traction in the future.

- According to RBC, Hochschild Mining’s first half 2023 EPS of -9/share was driven by an impairment charge of $60 million related to Azuca and Crespo projects ($42.3m), Aclara ($7.18m) and San Jose ($17.4m). The impairment at Azuca and Crespo was triggered by a revaluation of operating costs and capex.

- Spot palladium hit a 52-week low at $1,195.70 per troy ounce. Spot prices for palladium continue to be weak and have declined 33.3% year-to-date.

Opportunities

- According to Bank of America, with gold equities as a group having disappointed in 2023 year-to-date, the S&P Global Gold Index is down 5.3% year-to-date versus the gold price up 5.5%. Since many producers are pricing a gold price that is well below spot, while the royalty/streamers are pricing near spot, this suggests a rotation trade into the miners from the streamers might prove beneficial, particularly if gold gets a sustained lift. Scotia’s gold team recently recommended such a rotation trade too.

- Scottie Resources reported some of its first assays from the current 20,000-meter drilling program at the Blueberry Contact Zone. Encouraging results included 56.4 grams per ton (g/t) gold over 3.7 meters and 12.1 g/t gold over 3 meters. The Blueberry Contact Zone is 2km from Scottie’s 100% owned royalty free property which includes the past producing Scottie Gold Mine, 35 kilometers north of Stewart, BC, along the Granduc Road.

- Contrasting the value of hard assets versus financial assets, which have increasingly been driven by price momentum in technology stocks, a Bloomberg study shows that gold has outperformed stocks from the start to the end in each of the past three recessions. During the