Strengths

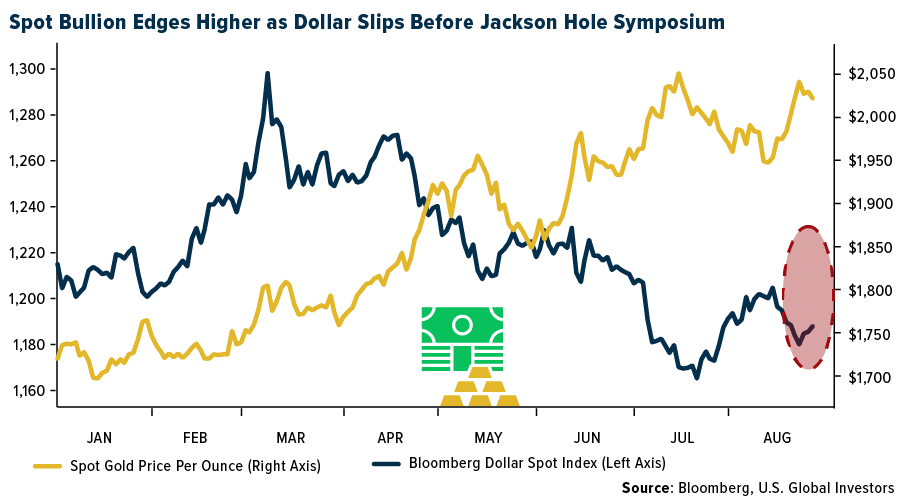

- The best performing precious metal for the week was gold, but still down 0.74%. Gold steadied after a six-day run of losses as financial markets remained on edge ahead of a pivotal annual gathering of central bankers at Jackson Hole. Bullion rose as much as 0.4% as manufacturing surveys showed France unexpectedly joining Germany in recording a decline in factory activity. A recession in the 19-member Eurozone is now more likely than not as energy costs spike following Russia’s invasion of Ukraine, according to analysts surveyed by Bloomberg. Friday’s more hawkish tone from the Fed’s Jackson Hole meeting took the edge off of a relatively good week in gold.

- Exchange-traded funds (ETFs) added 69,512 troy ounces of gold to their holdings in the last trading session, bringing this year's net purchases to 2.59 million ounces, according to Bloomberg. The purchases were equivalent to $121.4 million at the previous spot price. Total gold held by ETFs rose 2.6% this year to 100.4 million ounces.

- According to Canaccord Genuity, with a large valuation gap between the larger and smaller royalty companies (1.8x NAV average for the senior royalty companies versus 1.0x for the intermediate/juniors), the group expects more consolidation to come. The benefit here would be better diversification, scale, and lower cost of capital.

Weaknesses

- The worst performing precious metal for the week was platinum, down 3.90%, as bears put on more shorts for the week. Wheaton Precious Metals announced that it has agreed to terminate its silver stream on Glencore’s Yauliyacu mine in Peru. As compensation, Wheaton will receive an upfront cash payment of $150 million less net proceeds already received from the stream year-to-date in 2022. Management notes that the stream termination is consistent with its core principle of working with its partners, and that the company looks forward to maintaining a strong partnership with Glencore.

- Sibanye Stillwater had a weak quarter, with a 6% EBITDA/EPS miss and negative developments in its ongoing South African labor negotiation. However, the company did maintain guidance.

- Shares of Ramelius Resources slid over 7% this week after the company revealed a hit of up to $84.7 million on its full-year results to be released in one week. The gold miner announced that it would recognize an impairment in the value of its Edna May operation worth $90 million - $95 million. The impairment is being explained due to high input costs being experienced throughout the industry.

Opportunities

- One of the world’s largest platinum group metal refineries Heraeus Metals Germany GmbH & Co said output at one of its refineries will be constrained due to a supplier of a crucial chemical to the extraction process declaring force majeure. Palladium prices jumped over 5% on the news. Heraeus noted this is a short-term issue for one of its refineries in Germany, but delays could be drawn out until November 30. It is not known to what extent the chemical reagent may be restrained or whether other refineries could be impacted.

- First Majestic Silver climbed as much as 6.3%, for its biggest intraday gain since August 4, after a drilling project in Nevada returned high grades of gold. The exploration results “validate our thesis” that areas between the company’s SSX and Smith mines are favorable “for new, near-mine gold discoveries,” president and CEO Keith Neumeyer said in a press release.

- According to Raymond James, production levels generally increased in the second quarter after a weak first quarter. Gold production grew by an average of 4% and copper production by 19% quarter-over-quarter for producers under coverage. Despite higher production levels, costs remained elevated as input pricing continued to rise through the early part of the second quarter. Gold and copper cash costs increased by an average of 12% sequentially in the second quarter.

Threats

- An airstrip in a remote jungle, built by the Brazilian government to provide healthcare to the Indigenous people in the region, has been taken over by illegal miners. The miners seized the opportunity to fly in small planes with mining supplies into a region with no roads. Now that they have established their operations, they watch over the airport, controlling all traffic in and out of the landing site. If a plane approaches that they do not recognize, the miners spread fuel canisters across the runway, making it impossible for the government to land. The success of the operation has led to the illegal miners building four more nearby airstrips on the protected land of the Yanomami people, reports the New York Times.

- Russian miners are leading the push into yuan-bond issuance on the local market as international sanctions deepen the nation’s economic ties with China. Polyus PJSC, Russia’s biggest gold miner, will collect offers for 3.5 billion yuan ($511 million) of five-year bonds, at a yield of 4.2% or lower, according to people familiar with the matter who asked not to be identified because the details aren’t public.

- The panic that gripped the diamond world this year is starting to unwind as sanctioned Russian mining giant Alrosa PJSC has quietly revived exports to near pre-war levels, writes Bloomberg. Alrosa accounts for about a third of global rough-diamond supply, and the $80 billion industry was thrown into turmoil as cutters, polishers and traders hunted for ways to keep buying from Russia while their banks couldn’t or wouldn’t finance payments. The sudden shortage of stones sent diamond prices surging, the article explains, especially for the smaller and cheaper gems that Alrosa specializes in. Now, after months of paralysis when it was hit with U.S. sanctions, Alrosa is back selling more than $250 million of diamonds a month, with sales currently only about $50 to $100 million a month below pre-war levels, according to people familiar with the matter.