Strengths

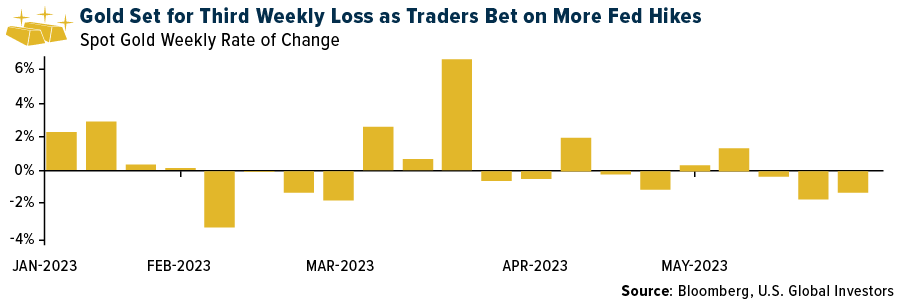

- The best-performing precious metal for the week was gold, but down 1.75%. The demand for platinum is driven by two key factors:

- 1) The increased platinum loadings needed to meet the China VI standards for heavy-duty vehicles, introduced in 2022, and the expected rebound in Chinese heavy-duty production in 2023. China accounts for 60% of global heavy-duty production.

- 2) The ongoing substitution of platinum for palladium in light-duty gasoline vehicles.

- Goldman Sachs expects a continued focus on mergers and acquisitions due to the supportive gold price environment and strong balance sheet positions. They predict potential impacts to net asset value (NAV) with the proposed implementation of the global minimum tax in 2024. Goldman Sachs continues to view the gold streaming/royalty companies as attractive business models given the elevated gold price environment and flat cost structure, underpinning 70-80% EBITDA (earnings before interest, taxes, depreciation and amortization) margins in their 2023 forecast, which is above the 40-50% EBITDA margins of gold mining peers.

- Fortuna Silver Mines Inc. reported the successful first gold pour at its Seguela Mine in Cote d'Ivoire, marking the mine's transition from commissioning to the ramp-up phase. The achievement highlights Fortuna's operational capabilities and adds a fifth operating mine to its portfolio. The company expects the Seguela Mine to contribute a substantial amount of gold production in 2023, showcasing the strength and growth potential of Fortuna's mining operation.

Weaknesses

- The worst-performing precious metal for the week was palladium, down 6.93%. Gold experienced weakness as revised U.S. data indicates a robust economy, solidifying expectations of monetary tightening. The stronger GDP growth and potential interest rate hikes diminish the appeal of non-interest-bearing gold. The ongoing U.S. debt-ceiling standoff provides limited support to gold as a haven, highlighting a weakness in its performance amidst economic strength and tightening monetary policy.

- Petra Diamonds released sales results for fiscal 2023, which showed signs of a continuously softening diamond market. Like-for-like diamond prices declined by 13%, though overall prices are still up 3% compared to the equivalent five tenders in fiscal 2022. The decline was due to extended shutdowns by certain manufacturers following recent Indian holidays that negatively impacted sales. In April 2023, India reported a nearly 39% year-over-year decline in exports of cut and polished diamonds, highlighting global challenges impacting demand from key markets like the U.S. and China. Additionally, inconsistent Russian rough diamond supply, due to global sanctions on Russian rough diamonds, also had a major impact.

- Superior Gold produced 14,400 ounces of gold in the first quarter, missing the consensus expectation of 16,400 ounces. After pre-releasing January production results of 5,942 ounces, these results suggest a notable decline in production in February and March. Cash costs of $1,969 per ounce represented a 6% drop from the fourth quarter of 2022 but was slightly above the consensus expectation of $1,871 per ounce. With a cash balance of just $3.2 million at the end of the first quarter of 2023, liquidity is a concern.

Opportunities

- Centerra Gold presents an opportunity as a deep-value stock supported by strong cash reserves and gold-in-carbon inventory, with the potential catalyst of EIA approval for the Öksüt gold mine in Turkey. Citigroup's silver price forecast of reaching $30 per unit within the next six to 12 months adds to the positive sentiment toward precious metals. JPMorgan's recommendation to increase allocations to gold aligns with the potential for a decline in stocks, offering an opportunity to position defensively and benefit from potential upside in the precious metals market.

- UBS forecasts an even tighter platinum market in 2023. Both platinum and rhodium are expected to be in a slight deficit, with investment demand likely to be a key driver of the platinum market balance. They anticipate increasing risks to near-term supply due to expected power shortages in South Africa over the winter period, potentially intensifying supply concerns against the backdrop of auto-driven demand.

- G2 Goldfields' ongoing drill program in Guyana showcases significant assay results and the discovery of a second significant zone on the OKO Project. The extended strike length and continuous mineralization at the Ghanie Zone present an opportunity for resource expansion and potential value enhancement. K92 Mining also announced high-grade drilling results from the ongoing exploration at the Kainantu Gold Mine in Papua New Guinea. The drilling showcases the discovery of high-grade mineralization, demonstrates the continuity and expansion potential of vein systems and identifies new mineralization not accounted for in the current resource estimate.

Threats

- For palladium and rhodium, 2023 could mark a return to more regular market conditions following a series of liquidity squeezes from 2019 to 2022. Several market commentators, including Metals Focus and SFA Oxford, have suggested the possibility of large surpluses in these two metals from 2024 onwards. As concerns around availability have faded, prices have trended down, and the incentive for market participants to hold additional metal has subsided.

- According to RBC, 88% of Wheaton Precious Metals’ business comes from offshore-streaming that pays no material taxes via the Cayman Islands (2022 taxes: 0%). A tax gross-up to 15% for Wheaton reduces their net asset value (NAV) valuation by 10% and their 2024/25 operating cash flow (OCF) by 10%. The impact of this change is already well understood and has been confirmed by management at various points since 2021, but it is generally not reflected within consensus forecasts and represents a risk for downward estimate revisions.

- Asante Gold Corporation has announced that Fujairah has advised of a delay in its technical due diligence process due to their consultants' inability to conduct their site visit and complete this part of its due diligence process.