Strengths

- The best-performing precious metal for the past week was platinum, up 6.68%, followed by palladium up 4.82%. China raised its gold holdings for the 17th consecutive month at record prices, while India also added to its gold holdings. China Asset Management Co. said that the secondary market price of the “Shanghai-Shenzhen-Hong Kong Gold Industry Stock Exchange-traded Open-ended Index Securities Investment Fund ETF” traded significantly higher than NAVs with a premium as high as 30% before trading was halted. This ETF of gold stocks had climbed by 40% in value in the prior four trading sessions. Investors in China are paying attention to gold and want to own the companies that own gold in the ground that can be monetized too. Western investors should be buying what China is short on, and that is gold and gold miners.

- K92 Mining announced that underground operations at the Kainantu Gold Mine in Papua New Guinea have resumed following a 28-day shutdown. The company has reiterated its 2024 operational guidance, and that the temporary suspension of underground operations will have a moderate impact on Q1 and Q2 production, according to Canaccord.

- Petra Diamonds announced that it has pinpointed a raft of operational cost-saving measures from FY2025 onwards, totaling $30 million annually, that will also likely see the reduction of plant throughput at the Finsch mine. This is on top of the $75 million capex deferrals and other cost savings of $10 million in FY2024, according to BMO.

Weaknesses

- The worst-performing precious metal for the past week was gold, but still up 0.71%. RBC expects a modest negative reaction from Dundee Precious Metals shares following the release of first quarter production results, which were slightly below their estimates and consensus. Weaker output in the quarter was driven by lower tonnage and grades at Chelopech versus their estimates, offset by stronger production at Ada Tepe with full-year guidance reiterated.

- Calibre Mining reported preliminary first quarter production results with consolidated gold output of 61.8K ounces as production came in sequentially lower compared to consensus at 67,000 ounces. Quarterly production represents approximately 21.5% of full-year guidance at mid-point and emphasizes an H2 weighted production year, according to Stifel.

- Victoria Gold slid 12%, the biggest intraday decline since October 2022, after the mining company said gold production for the first quarter was down year-over-year. Gold produced fell around 21% to 29,580 ounces in the first quarter from 37,619 ounces the year prior, according to a company statement Wednesday.

Opportunities

- Duncan MacInnes, investment director at Ruffer Investment Co., noted with China’s and other central banks, gold buying totaled more than 1,000 tons in 2022 and 2023 (with much of that led by economies with efforts to diversify away from the dollar). “What I think is really, really bullish about gold is that those ounces will be taken off the market and never come back. And that’s clearly very different to the ETFs where ultimately everyone’s a trader of it.” Last month he increased his exposure to gold and silver to roughly 8% across his two portfolios, which combined have about $3 billion under management.

- One key factor has been enthusiasm among central banks, encouraging buyers like Matthew Schwab, head of investor solutions at Quantix Commodities with $933 million under management. The firm’s long-only fund has been overweight gold since 2022, with bullion’s weighting around 30% — compared with about 15% in the Bloomberg Commodity Index. Bigger players have been moving into gold. Now that it is setting new all-time highs, this could spur retail buying if the tide shifts.

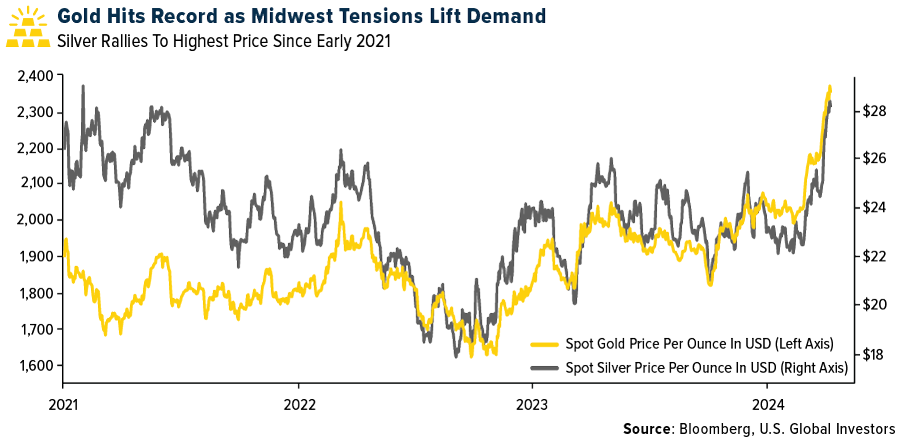

- Bank of America Technical Strategist Paul Ciana highlights a bullish pattern formation and trend line breakout, that suggests silver is positioned to catch up to gold by rallying to the 2021 highs just above $30/ounce, with additional upside potential to the 61.8% retracement at $35.23/ounce.

Threats

- Equinox Gold reports that persistent heavy rains have caused a displacement of material in two locations in the south wall of the Piaba pit at its Aurizona mine in Brazil. There were no injuries, no damage to equipment or infrastructure, and no environmental damage, according to Scotia.

- Tharisa produced 35.3K ounces of precious metals during the second quarter of 2024, which missed BMO’s estimates of 37.5K ounces. Production during the quarter was partly impacted by a minor plant shutdown.

- Westgold’s proposed acquisition of Karoro Resources is not being loved by the market. Analysts at Macquarie cut their share price by 19% on the deal, largely on the dilution from the doubling of shares outstanding. The combined company is projected to have 70% production growth over the next five years, but Macquarie noted the companies need to demonstrate some synergies from the merger. Westgold was already underappreciated by the market given its low valuation relative to its asset base.